It’s been a tough earlier handful of times for Bitcoin.

Immediately after keeping $9,300 for days on conclusion, the cryptocurrency on Saturday slipped beneath $9,000. The primary cryptocurrency reached a neighborhood minimal of $8,840 on many foremost spot and margin exchanges.

Many traders had been caught off guard by this transfer to the downside.

At minimum $20 million well worth of longs on BitMEX on your own ended up liquidated in the course of this drop. This adds to the about $50 million in longs liquidated throughout the earlier several times.

BTC situation liquidation chart for BitMEX from crypto derivatives tracker Skew.com

Buyers look to be stepping in, even though, giving Bitcoin with a strengthen as it enters a crucial cost area.

Bitcoin Whale Is Stepping In

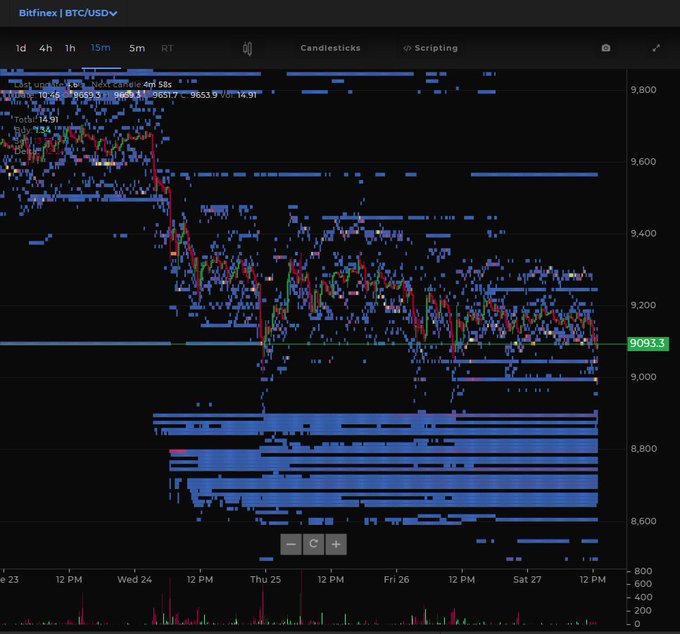

According to a crypto working day trader, Bitfinex’s order guide information exhibits that a huge customer (or prospective buyers) is stepping in. He shared the graphic below to illustrate his stage.

It shows that seemingly a one participant or little group of players have stacked Bitcoin obtain orders between $8,600 and $8,800. The orders are at these types of a measurement that the trader who shared the chart identified as the entity a “whale.”

Bitcoin price chart with get book dominance bands indicator shared by working day trader "Jonny Moe" (@Jonnymoetrades on Twitter)

Bitfinex’s get guide has a potent monitor file in predicting Bitcoin’s directionality.

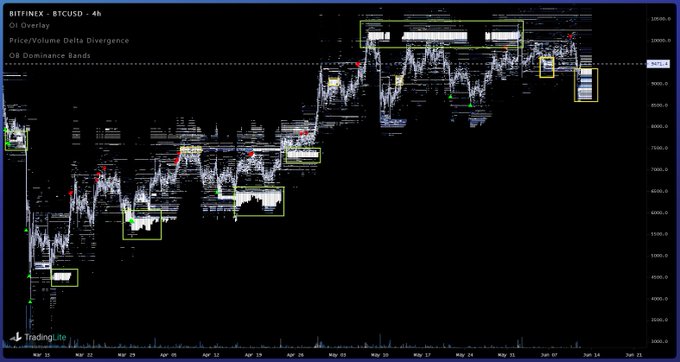

Underneath is a chart shared by one more trader, but this time with a additional macro perspective of BTC’s selling price in relation to the Bitfinex order e-book.

It displays that many of BTC’s rallies in excess of modern months were preceded by powerful purchasing assistance for each Bitfinex’s purchase books. Also, each and every leading all around $10,000 was marked by powerful promoting assist as for each the order e-book.

This historic precedent suggests that BTC may perhaps manage to bear a reduction rally.

Will Inevitably Revert to the Downside

Regardless of the order reserve knowledge, not everybody is persuaded the rally Bitcoin might see will be sustainable.

As reported by NewsBTC formerly, on-chain analyst Cole Garner observed that BTC’s up coming “big” go is most likely to be to the draw back.

He backed this sentiment by citing the inflammation offer-side stress from miners, a bearish get e-book delta on Bitfinex, and establishments getting a internet quick posture by means of the CME’s Bitcoin futures.

This confluence, Garner described, will final result in Bitcoin dropping to the $7,800-8,200 range.

1/ I am massively bullish on #Bitcoin, but I assume the upcoming massive shift is possible down.@glassnode just documented the premier $BTC transfer from miners to exchanges in over a year. pic.twitter.com/Uwj4hHveyx

— Cole Garner (@ColeGarnerBTC) June 24, 2020

There is also a bearish technological situation to be designed.

Blockroots’ founder Josh Rager mentioned past 7 days that Bitcoin losing the assist of the area about $9,000 could be adopted to a drop to $8,500. The trader extra that a shift to $8,500 could make this summertime “long” for bears, referencing the level’s significance.

“BTC’s variety is very clear. Recent assist that has been holding the earlier 3 weeks is the mid-assortment Split down here and rate likely to see $8900 followed by $8500 vary base,” Rager wrote.

Highlighted Impression from Shutterstock Cost tags: xbtusd, btcusd, btcusdt There is certainly a Bitfinex "Whale" Wanting to Get Bitcoin in the Higher-$8,000s