Previous week, analysts imagined XRP was on the verge of a substantial breakout. Towards the greenback and in opposition to Bitcoin, the major altcoin noticed an explosive breakout that reminded some of the commence of the notorious 2017/2018 pump.

But on Saturday night, just ahead of the weekly near, the asset underwent a potent fall, as did numerous other altcoins. An analyst claims that this drop verified that a macro “bearish retest” has formed on XRP’s macro chart in opposition to Bitcoin.

Connected Reading through: Crypto Tidbits: Ethereum Surges 20%, US Banking companies Can Hold BTC, DeFi Nonetheless in Vogue

Analyst: XRP Is Dealing with a 50% Fall From Bitcoin

XRP failing to surmount the horizontal resistance at 2,800 satoshis all through final week’s rally could propose the asset faces a 55% correction in opposition to Bitcoin.

That’s in accordance to a trader who predicted much of the the latest value motion in the cryptocurrency markets.

He described in a recent investigation that as extended as the asset does not reclaim the aforementioned resistance as aid, past week’s rally constitutes a “bearish retest”:

“Until proven usually, this is a bearish retest on the $XRP / $BTC chart of a range that we earlier broke down from. I am going with the assumption that $XRP has one particular closing capitulation reduced in advance of it definitely outshines #bitcoin.”

Chart of XRP's cost motion from Bitcoin in excess of the earlier couple of many years from complete-time crypto trader "Calmly" (@im_calmly on Twitter). Chart from TradingView.com

His macro cost target for XRP, assuming it doesn’t reclaim the 2,800 satoshis resistance, is 1,180 satoshis. That latter stage acted as pivotal guidance for XRP in the course of a immediate correction in late 2017.

Corroborating the bearish issue of see about XRP’s outlook is social media information.

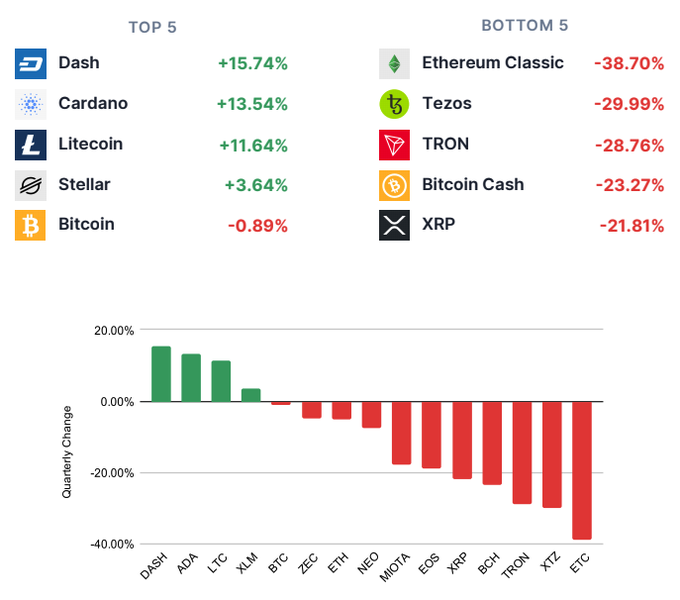

The TIE and eToro — a blockchain analytics organization and trading platform, respectively — not long ago produced an in depth report on cryptocurrency industry trends in Q2 2020.

The two corporations uncovered that in excess of the system of the next quarter, social media volumes for XRP dove irrespective of the asset’s recovery from the March lows:

“While current crypto traders turned significantly constructive about the industry, there was no mainstream euphoria surrounding crypto article-halving. 73% of cryptos saw a diminished variety of tweets in Q2.”

Facts from eToro and The TIE of the social media quantity of prime crypto belongings around Q2 2020 vs. Q1 2020

Associated Reading: Analyst Who Predicted Drop to $10,500: Bitcoin Could Plunge A further $1,500

Bitcoin Could Range, Boosting Situation For Altcoins

Analysts, although, might catch a bid as altcoins might progress to rally immediately after Bitcoin and Ethereum seemingly prepare to enter a buying and selling array. Just one trader commented on his outlook on Bitcoin volatility going ahead:

“I assume BTC and ETH just sideways now, that transfer is in all probability peak volatility of this or upcoming couple of weeks. Bidding DeFi alts right here mainly because as we sideways, aim will change once more.”

Bitazu Capital’s Mohit Sorout instructed this author in an job interview that if BItcoin volatility subsides, cash is likely to circulation to altcoins. XRP, of course, would be a beneficiary of these inflows.

Connected Looking at: Dips to $350 Are for Purchasing: Analyst Soon after Ethereum Drops 26% in 5 Minutes

Featured Image from Shutterstock Cost tags: xrpusd, xrpbtc Charts from TradingView.com XRP Could Crash 50% as Cost Undergoes Essential Rejection: Analyst