Projects that start on new blockchain networks often have less competition, which makes it easier for them to get new users and money more quickly than on networks like Ethereum.

The automated market maker (AMM) Astroport has seen a lot of activity recently because more people are paying attention to the Terra ecosystem and its Terra USD (UST) stablecoin. Astroport is an example of this.

CoinGecko data shows that the price of ASTRO has jumped 194% since March 7, when it was at $1.28. On April 5, it hit a new all-time high of $4.80.

ASTRO has seen a rise in price for three reasons: more attention given to the Terra ecosystem because of the recent Bitcoin (BTC) purchases to back UST, the launch of xASTRO staking rewards, and a rise in the amount of money that is locked on the protocol.

Terra buys Bitcoin as a form of payment for UST.

Astroport could be getting a lot of attention because the Terra network is becoming more popular. The Luna Foundation Guard (LFG) is buying BTC to use as collateral to back UST, which is shining a light on the network’s decentralized finance ecosystem.

$UST with $10B+ in $BTC reserves will open a new monetary era of the Bitcoin standard.

P2P electronic cash that is easier to spend and more attractive to hold #btc

— Do Kwon (@stablekwon) March 14, 2022

When LFG added Bitcoin to its treasury, Astroport became the main AMM on the network.

The start of the xASTRO project

Another thing that helped ASTRO become more popular was the release of xASTRO staking, which allows ASTRO holders to earn more money by putting their coins in.

Staking ASTRO tokens on the protocol now pays 48.77% APY, and 0.1% of all fees on Astroport are given to ASTRO stakers. More than 65% of the available supply of ASTRO is currently being staked on the protocol, which helps push the price of ASTRO up because there is less ASTRO in circulation and more people want to buy it.

Along with a high rate of return and a share of the fees, ASTRO stakers get xASTRO in return. xASTRO is the governance token for the protocol, and it lets people who own it help make decisions about the future development of Astroport. You can get your ASTRO tokens back at any time, and there is no cool-down.

Next, see the biggest thing that will happen in the next few years The BTC whale talks about why Bitcoin was chosen for the „decentralized Forex reserve.“

Terra’s money wars and a rising TVL

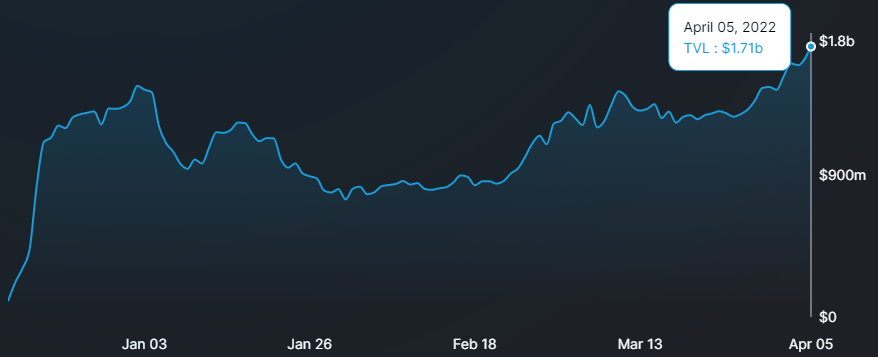

According to data from Defi Llama, the value of Astroport is now at a record-high $1.71 billion. This is because more people are paying attention to Terra and then Astroport.

Staking ASTRO tokens on the protocol now pays 48.77% APY, and 0.1% of all fees on Astroport are given to ASTRO stakers. More than 65% of the available supply of ASTRO is currently being staked on the protocol, which helps push the price of ASTRO up because there is less ASTRO in circulation and more people want to buy it.

Both ASTRO and UST have seen a rise in demand, which has led to the „Terra liquidity wars,“ which are similar to the Curve wars that took place on the Ethereum network.

DeFi protocol Retrograde is trying to be like Curve Finance, where there is a lot of competition for liquidity direction and fees. Retrograde wants to get xASTRO for the rewards and the power to change the emission rates for different Astroport pools.

If the number of protocols that want to buy xASTRO increases, more of the circulating supply of ASTRO will be locked and this will put more pressure on the price of ASTRO. This is likely to push the price up.

In this post, the author says what he thinks and doesn’t always agree with Cointelegraph.com. Every time you invest or trade, there is a chance you could lose money. You should do your own research before making a decision.