One of the a lot more major controversies to roil the cryptocurrency industry in the final 12 months is the proposed crypto wallet rule.

On 18 December 2020, the US Economic Crimes Enforcement Community (FinCEN), component of the US Treasury, issued a Notice of Proposed Rulemaking (NPRM) that would require financial institutions, crypto exchanges, and any other dollars products and services firms to gather Know Your Client (KYC) facts on any individual transferring cryptocurrency really worth $3,000 or far more to or from a private wallet.

Searching Ahead to Meeting You at iFX EXPO Dubai May perhaps 2021 – Creating It Happen!

It brought about an quick outcry for two explanations.

To begin with, the first consultation for the NPRM was just 15 days and was scheduled to operate about the Xmas and New Yr interval when most of the environment was shutting down for the vacations. Cryptocurrency advocates smelled a rat. Typically consultations very last for at least 60 days to allow for extensive-scale representations from marketplace members.

Next, the diktat appeared created to be pushed by way of as part of the dying throes of the outgoing Trump administration. In just months, Treasury Secretary Steven Mnuchin would be deposed by the incoming Joe Biden presidency, with former Federal Reserve chair Janet Yellen lined up to switch him.

Critics quickly rounded on FinCEN expressing it would be technically unachievable for most businesses engaged in crypto solutions to comply with the ruling. Wise contracts by design and style do not comprise name or deal with info and are simply pieces of code that enact transactional facts.

In times, FinCEN claimed it experienced gained in excess of 7,500 ‘robust’ responses.

The response from Katie Haun, a previous Federal Prosecutor and Husband or wife at VC huge Andressen Horowitz (a16z), was normal of the speedy feed-back from the market.

Via Twitter, she alleged that Mnuchin was “trying to squeeze regulatory variations into the tail end of an administration with no process”, promising that a16z would obstacle the “procedurally defective…vaguely written…overbroad” ruling in court docket if it ever got close to staying imposed.

Peter van Valkenburgh, Director of research at Coin Middle, set it greatest when he characterised FinCEN’s go as an underhanded ‘midnight rule’, noting that: “The time constraints of the so-called midnight period ought to under no circumstances be an acceptable justification for imposing procedures on Us citizens and impressive American firms without the need of sufficient possibility for see and remark.

“In equivalent cases, banking institutions have been taken care of to intensive consultation and a gradual (occasionally absurdly sluggish) rulemaking approach. For instance, FinCEN has experienced a bank client because of diligence rulemaking pending and unfinished since 2014.”

Timeline of a Bungled Rule Transform

- 18 December 2020: Steven Mnuchin’s FinCEN issues wallet rule NPRM with unprecedented 15-working day consultation. Speedy backlash.

- 2 January 2021: Primary 15-day session prepared to shut

- 14 January 2021: Beneath-fireplace FinCEN announces it is extending the crypto wallet rule comment time period for 45 times

- 21 January 2021: President Biden freezes all Treasury Section rulemaking for 60 days pending a evaluate

- 22 March 2021: FinCEN regulatory ‘freeze’ scheduled to end

What the Industry Discovered from the FATF Journey Rule

In 2018 the Fiscal Motion Undertaking Force’s ‘Travel Rule’ — later on codified as ‘Recommendation 16’ — prompted a person of the first important existential crises for the industry. The Vacation Rule would endeavor to deliver cryptocurrency transactions into line with broader regulation about anti-cash laundering (AML) and KYC, exclusively calling for own information to ‘travel’ with transactions. Any person who obtained over $1,000 in cryptocurrency need to be discovered, they claimed. The tips were finalised in June 2019 and the deadline for compliance established 12 months later.

As one of the world’s most impressive intergovernmental watchdogs, when the FATF speaks, economic expert services corporations sit up and listen.

But, crypto business members argued forcefully that the Travel Rule was anathema to the way that cryptocurrency worked. Just one response by Global Digital Finance laid out the difficulty in stark phrases.

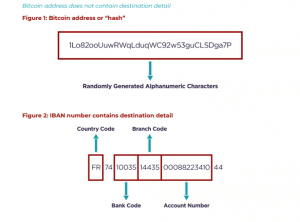

In a commentary letter to the FATF consultation back again in April 2019, GDF spelled out the difference involving Bitcoin addresses and IBAN banking codes, both of those of which are employed to mail and obtain transactions. The letter mentioned that when IBAN numbers include data about the entity that sends or receives a transaction constructed right into their code, as opposed to Bitcoin addresses which are a randomly created string of letters and quantities (alphanumerics).

Recommended article content

The Very best Pharmaceutical Providers to Invest in Proper NowGo to short article >>

This showed the impossibility of the FATF ask for Bitcoin addresses are only not designed to elicit pinpointing information in the way that classic banking codes are. As Finance Magnates observed, efforts to acquire knowledge could in actuality motivate “P2P transfers by using non-custodial wallets, which are noticeably harder for law enforcement to track or management.” These is the legislation of unintended consequences: economic regulators’ attempts to intervene in this sophisticated program could develop an completely undesired outcome.

This showed the impossibility of the FATF ask for Bitcoin addresses are only not designed to elicit pinpointing information in the way that classic banking codes are. As Finance Magnates observed, efforts to acquire knowledge could in actuality motivate “P2P transfers by using non-custodial wallets, which are noticeably harder for law enforcement to track or management.” These is the legislation of unintended consequences: economic regulators’ attempts to intervene in this sophisticated program could develop an completely undesired outcome.

In truth, the crypto field managed to uncover a way to fulfill the FATF Vacation Rule with no breaking cryptocurrency completely.

1st came Ciphertrace which said it had established software package that would develop a validation certification to affirm transactions despatched between exchanges and wallets. At the time the company’s internet marketing lead, John Jeffries summed up the problem: “The market has stated it’s pretty much extremely hard to adhere to the Vacation Rule. The fact is it can be finished.”

Dutch multinational ING became the initially bank to put forward a alternative in June 2020, with its ‘FATF-Friendly’ protocol for tracking transfers. Custodian BitGo afterwards included guidance for the Travel Rule as a result of an prolonged API that would obtain the facts of the sender and receiver. And Coinbase — whose direct listing IPO is coming up soon — made a P2P technique for sharing person details underneath the Vacation Rule stipulations, for case in point.

And, the FATF has responded positively in kind, noting in a 25 February 2021 update [our emphasis]: “Transitioning from rules-centered supervision to possibility-centered supervision normally takes time and can be hard as the outcomes of mutual evaluations have proven.”

The FATF recognised effectively that the cryptocurrency business would like to comply with regulation: by regulation arrives certainty, shared priorities all over avoiding money laundering and terrorism funding, and an total improved practical experience for customers and investors.

The very same collaborative alternative-making have to take place when FinCEN reconvenes right after President Biden’s regulatory freeze arrives to an finish. But, it can only operate with mutual regard on each sides.

Conclusion

The image for the crypto marketplace is a great deal transformed from 2018. It is no longer mainly isolated from the mass of undertaking cash money, personal fairness, banks, and economic providers firms that deal with trillions of dollars of day by day transactions: in truth, it is inextricably intertwined. Cryptocurrency is now firmly embedded in earth banking devices — not least in latest guidelines that US financial institutions can custody crypto, and use stablecoins for payment settlement, or the point that the world’s greatest custodian bank BNY Mellon — with $41trn in AUM, no significantly less — now transferring to custody billions of dollars of crypto belongings for asset professionals, pension money and endowments globally.

It is achievable that FinCEN was not expecting the variety of overpowering backlash they acquired. It is solely achievable that they misjudged the extent to which individuals affected would object to a very last-minute piece of bait-and-swap rulemaking.

The FATF has proved that mutually-acceptable options to anti-income laundering and terrorism financing can be located: and that cliff-edge deadlines and threats are not the way to really encourage superior economic services. For illustration, the future FATF 12-thirty day period evaluate is now underway and will occur out in June 2021: suggesting that ongoing consultation with the business will now just take the sort of a yearly rolling evaluation.

New, focused organisations ended up set up in the wake of the Vacation Rule to assist fiscal services companies comply with Suggestion 16, which includes the US Travel Rule Doing work Team, which was fashioned involving 25 leading US digital asset support suppliers to get the job done on an industry-extensive resolution, and the Travel Rule Data Sharing Alliance, whose whitepaper proposes an open up-supply P2P mechanism to comply with the ruling.

That is the scale of the activity forward for the crypto wallet rule. A lot more lobbying need to goal Joe Biden’s administration and funds should be expended, each political and monetary, in pushing FinCEN to that ‘mutual evaluation’ schema that the FATF has managed to introduce.

If the sector can go away from an adversarial relationship with FinCEN and push for nearer collaboration as they did with the FATF, a option that each sides are content with is completely in just attain.

Maxim Bederov is an investor and entrepreneur.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)