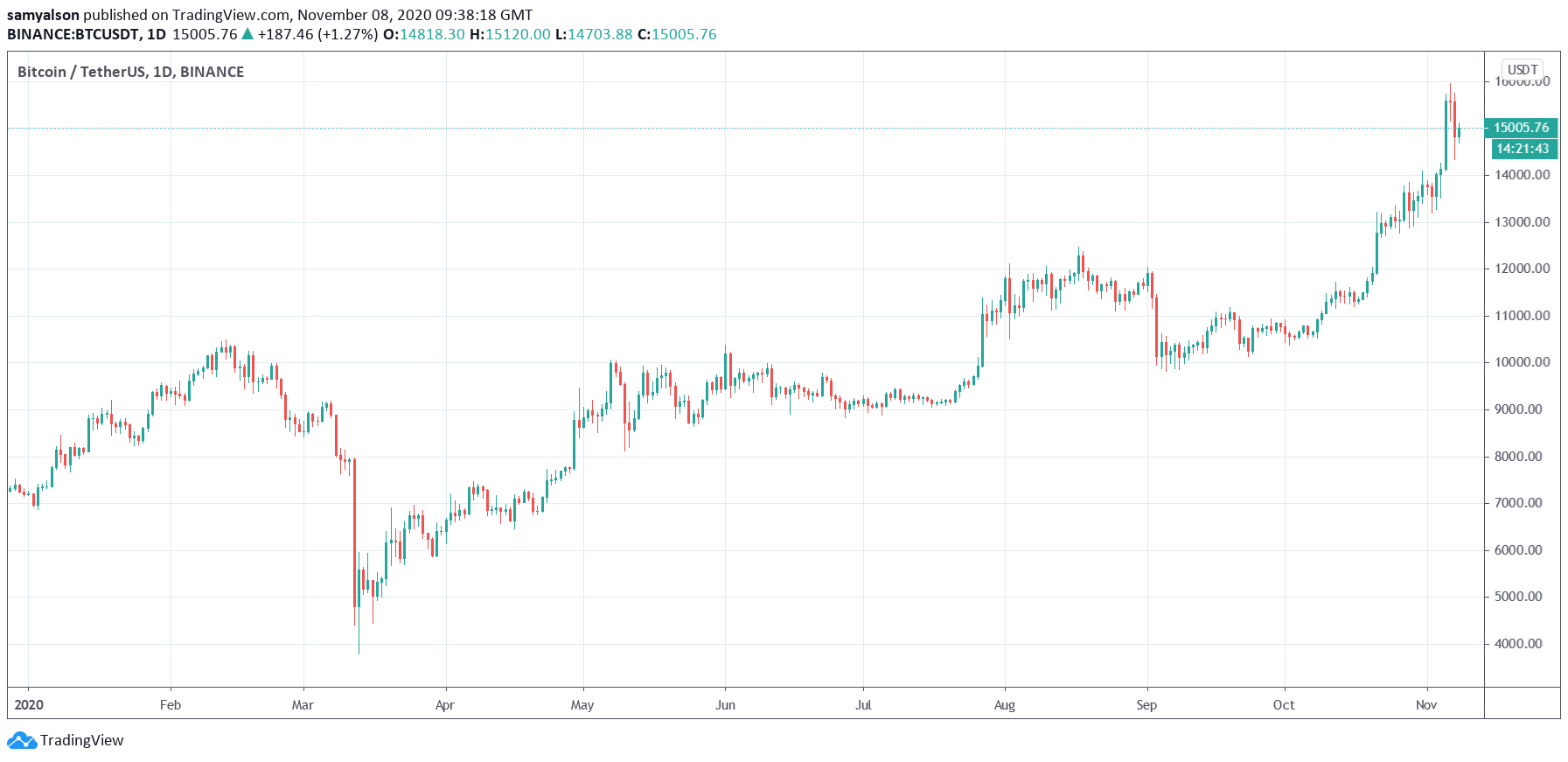

Bitcoin’s unbelievable performance around the earlier four weeks sees it achieve just shy of $16k. Even though the market has considering that regrouped for a breather, the exhibit of power from the selection 1 cryptocurrency has quite a few pondering if we are on the cusp of a big bull run.

Source: BTCUSDT on TradingView.com

The final time this occurred, coming on to 3 years back, it caught most by shock. In just 33 days, Bitcoin jumped from $5.5k to $20k.

That on your own was primarily liable for altering the narrative surrounding Bitcoin as “magical online cash.” From that stage onwards, folks had been forced to look at it a major contender in finance.

As recreation-modifying as that was, what adopted in the brutal crypto wintertime was just as meaningful. But for all of the completely wrong motives.

The crypto wintertime finally bottomed when Bitcoin experienced sunk to $3k, a calendar year after its historical all-time large. By this time, the only ones left had been the believers in what crypto was striving to accomplish.

Nevertheless, historical past displays that the very last mania phase was temporary and a extensive and drawn-out bear cycle adopted.

And with the FOMO beginning to rear its head as soon as once again, attention is turning toward Bitcoin rate targets. Can Bitcoin can exceed its all-time significant? And if so, by how considerably?

Just as essential as that is no matter whether the incoming bull phase will have the legs to print a sustained run.

To do so would herald yet another, extra significant, narrative modify about the crypto industry.

Will The Bitcoin Bull Run Diverse This Time Around?

Bitcoin’s new performance is in spite of the deteriorating macro photo. It seems like U.S. election drama, fears of financial collapse, and the on-going stress condition are powerless to convey it down.

Some would argue Bitcoin was made with this sort of circumstances in intellect. Having said that, this kind of self confidence was not as forthcoming through Black Thursday, or indeed throughout crypto winter.

All the similar, with Bitcoin seemingly on a tear at the present time, talk of a sustained golden bull run is accomplishing the rounds.

It’s extremely hard to know if that will be the case this time. But in protection of that view, it should be famous that issues are substantially far better now when compared to 2017.

The 2017 bull operate was largely the end result of speculation, and several establishments were being on the scene at that time. Now, the fundamentals and infrastructure are as potent as they have at any time been.

And with the nod of acceptance from the likes of MicroStrategy, Grayscale, and PayPal, to name but a couple of, it appears to be like as although the stars are lining up for Bitcoin to fulfill Nakamoto’s eyesight.

The coming months will expose regardless of whether a maturing sector, as well as the additional legitimacy that institutional cash delivers, have what it will take to start a sustained bull operate.

With all of these variables converging, only a fool would bet towards Bitcoin.