Why Bitcoin Rises: You’ve probably heard about Bitcoin by now. You may have heard that it has enriched certain individuals. Additionally, you may have heard that it is a new type of digital currency and that it is the future of business, or that it is a criminal enterprise that is detrimental to the environment.

The messaging is muddled and perplexing, which is partially due to the fact that no single individual controls it — much like Bitcoin, which belongs to… well, everyone.

I’d like to use this brief essay to educate the Bitcoin-curious about a few basic facts concerning the world’s most popular cryptocurrency. It is not technical, nor is it difficult to follow. It’s also not exhaustive, which is why this text is studded with links to further resources.

I am not advocating for Bitcoin as an investment, while I believe it is worthwhile to possess a small amount. I’m only attempting to dispel a few myths and assist newcomers to the Bitcoin community in quickly grasping a few fundamental principles. Hopefully, if you’re reading this with an open mind, you’ll quickly see that Bitcoin is about much more than its price.

There are babies in the bathwater

Let’s begin by clearing up a few points: Cryptocurrency is a risky and frequently unsightly world. Numerous frauds, hacks, and exploits exist. It is appealing to pathological gamblers, crooks, and stupid. Motivated reasoning and the sunk-cost fallacy maintain the viability of faulty ideas long after they should have died. Con artists thrive in the open, and the average person frequently loses money. Given that the crypto sector is 95% bullsh*t by volume, it’s reasonable that some people believe it must be 100% bullsh*t.

However, mostly bullsh*t is not synonymous with absolutely bullsh*t. Criticizing cryptocurrency due to its prevalence of frauds is akin to dismissing Twitter because to its average tweet quality. The issue is not that Twitter (or cryptocurrency) has nothing to offer; the issue is that it takes time and effort to learn how to sift through the nonsense and uncover truly fascinating ideas.

Rejecting cryptocurrencies totally is more simpler and appears to provide significant moral clarity — but it raises a lingering question: If cryptocurrency is so obviously evil, why doesn’t it just die?

Bitcoin is not going away

A fascinating aspect of Bitcoin is that nearly no one believes in it immediately. Bitcoin’s design is so unattractive and illogical that almost everyone initially dismisses it as impossible. Between the time I first heard about Bitcoin and the time I began to actually research it, it was approximately three years. In graduate school, I studied game theory and mechanism design, and thus understood precisely why Bitcoin could not work. I couldn’t fathom why it was still there.

In theory, I was certain that Bitcoin could not exist… but it did in actuality. And when theory contradicts seen reality, theory must be altered. I became skeptical of my skepticism. I read the white paper. I changed my mind.

More than anything I can write or say, the history of Bitcoin’s operation demonstrates that it operates as claimed.

The longer Bitcoin exists, the more serious it should be taken.

The Lindy effect — the idea that the longer something has survived, the longer you should expect it to continue — is the academic term for this. We could all decide tomorrow that gold is no longer valuable, and we could all decide to continue listening to today’s hit singles indefinitely. But we’re not going to.

Gold has been valuable for a long time, and it will most likely continue to be valuable in the future. Today’s top songs are mostly new, implying that tomorrow’s top songs will also be mostly new. Something’s continued existence is proof that it will continue to exist. That’s what the Lindy effect is.

As a result, governments all over the world have stopped ignoring Bitcoin and have begun to develop formal policies to outlaw, regulate, or adopt it. Ignoring Bitcoin and assuming it will go away on its own is no longer a viable strategy. If Bitcoin was going to die on its own, it would have done so by now.

Bitcoin has value because it is useful

One common criticism leveled at Bitcoin is that because it is not backed by anything, it must be worthless. Because it lacks intrinsic utility, it must be a greater fool’s game in which the only goal is to sell your worthless bags at a higher price to an even greater fool than you. It’s true that the only use for Bitcoin is to send it to someone else, but that doesn’t mean it’s worthless. Transferring value is an important service. That is why banking is so profitable.

„Imagine a base metal as scarce as gold that has the following properties: – boring grey in color – not a good conductor of electricity – not particularly strong, but not ductile or easily malleable either – not useful for any practical or ornamental purpose and one special, magical property: – can be transported over a communications channel. If it gained any value for whatever reason, anyone wishing to transfer wealth over a long distance could purchase some, transmit it, and have the recipient sell it.“

Satoshi Nakamoto

Money is a technology that allows value to be transported across space and time. Bitcoin is a value vehicle that does not require physical distance and cannot be diluted, seized, or censored. The value of that service is what „backs“ Bitcoin’s value.

„I think there’s no capacity to kill bitcoin“ says @PatrickMcHenry #btc pic.twitter.com/DY70tx2TvV

— Squawk Box (@SquawkCNBC) July 17, 2019

Bitcoin will not be stopped

Because Bitcoin lacks a central point of control, the only way to „stop“ it is to individually stop each person on the Bitcoin network. Even shutting down the internet would be ineffective because you can connect to the Bitcoin network via radio or satellite. By any reasonable standard, the network cannot be shut down.

Governments can, of course, outlaw cryptocurrency (and several have), but making Bitcoin transactions illegal is similar to making drug use illegal — it does not eliminate it, but rather drives it underground. China is a powerful authoritarian state that has repeatedly banned Bitcoin, but Bitcoin cannot be banned from China because Bitcoin has no concept of China. China’s only option is to disconnect from the network.

But what if governments go even further and attack the network? They could steal or seize mining rigs and use them to mine empty blocks, slowing the network and reducing revenue for honest miners. They could market-sell the mining rewards and open short positions to drive down the price of Bitcoin, reducing miner revenue and market confidence even further. As miners stopped defending the network, attackers took over more of it, resulting in a feedback loop and death spiral.

Attacks like this are easiest to imagine in the context of an abstract, monolithic global government. It is less clear how they would function in the context of current world governments. In practice, the two most obvious governments that could launch such an attack are the United States and China. China has been working diligently to remove all mining rigs from its borders, so it isn’t exactly preparing to launch a mining-based attack on the network.

China’s $1 Trillion mistake, #Bitcoin miners being shipped away. pic.twitter.com/wxoO9BMDUy

— Documenting Bitcoin ? (@DocumentingBTC) June 27, 2021

Additionally, the United States appears to be an unlikely contender to conduct an attack on the network. The seizure of private property such as mining rigs outside of the setting of a conventional battle would set an uncommon and politically volatile precedent. In a more practical sense, cryptocurrency has developed into a powerful lobbying organization. Members of Congress from both parties who are currently in office own Bitcoin and have made support for cryptocurrencies a part of their political platforms. The issue has become so popular that several have made it their hallmark issue.

A Bipartisan group of U.S. Senators just wrote a letter to Treasury Secretary Janet Yellen informing her that she hasn’t done her homework on #Bitcoin. pic.twitter.com/St4KkMMITj

— Dennis Porter (@Dennis_Porter_) December 14, 2021

A sufficiently powerful, politically motivated attack on the Bitcoin network may bring the network to a halt, although such an attack would be prohibitively expensive to maintain and would not prevent the network from returning to regular operation once the attack was ended. Insights into the game theory of what happens when determined attackers and defense teams struggle over a blockchain are difficult to come by, and rational people can disagree about what it might mean. In contrast, the two most powerful countries on the planet today are either embracing Bitcoin or systematically disarming their own populations.

THREAD:

Many things set #Bitcoin apart from any altcoin. But keep it simple, no technical metrics needed.

Three elements to consider:

– Digital scarcity is a one-time phenomenon

– Schelling points

– Money is the mother of all network effects & tends to one pic.twitter.com/yBcso6Z66p— Croesus ? (@Croesus_BTC) March 29, 2021

Bitcoin will not be replaced

Bitcoin is a relatively limited system (by design). It is mostly used to send and receive Bitcoin. It is extremely resistant to change (also by design), and as a result, it embraces new technology slowly, if at all. This may appear primitive and sluggish to outsiders, but resistance to change is key to Bitcoin’s value proposition. You cannot improve Bitcoin by making it easier to change.

Bitcoin is more of a social revolution than a technology breakthrough. No new cryptocurrency will ever attain the same level of success as Bitcoin, given the societal context in which it was established has ceased to exist. Bitcoin was practically free for the first year and a half of its existence – there was a website called Bitcoin Faucet that gave users 5 BTC for completing a CAPTCHA. Satoshi vanished before the initiative gained widespread attention, and they never received any special founder’s rewards for their contributions. Even if a new project could reproduce similar conditions, it would not be able to recreate the history of demonstrated operation that has occurred since.

Other cryptocurrency initiatives may continue to be useful and important — but not at the expense of Bitcoin’s position as the finest money. If they succeed, it will be because they have been tuned for a specific use case.

They will coexist with Bitcoin rather than replace it.

In a nutshell, Bitcoin functions exactly as described.

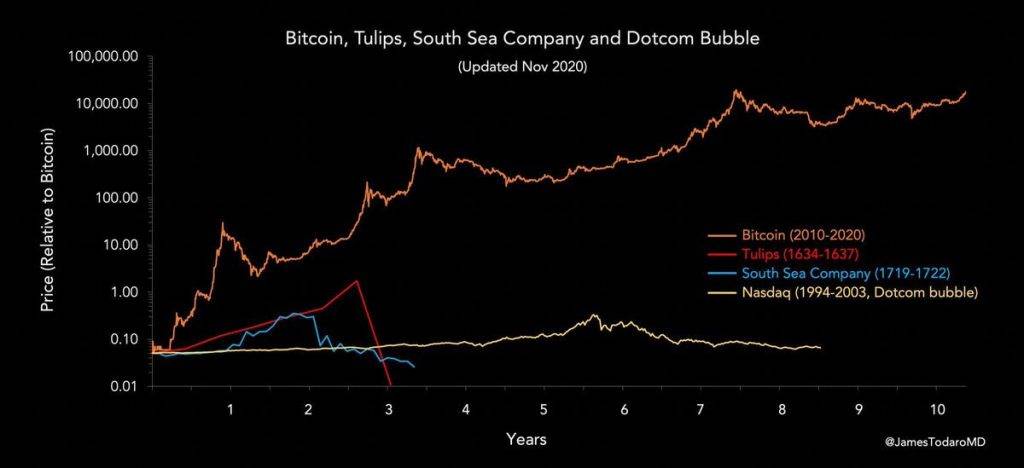

Bitcoin has been operating constantly and independently of anyone’s control for more than 12 years now – this fact alone should compel even the most skeptic of observers to pay close attention. It has not been hacked, banned, stopped, or otherwise restricted. It has endured bubbles and crashes, as well as attempts to takeover it, prohibit it, or render it obsolete, among other things. A increasing collection of circumstantial evidence indicates that Bitcoin is, in fact, what it claims to be: a perfectly scarce, sovereign asset with a long history of successful operation.

Because there is a growing amount of evidence that Bitcoin is real, responsible individuals should begin making preparations for the potential that it will exist. What does the existence of a perfectly scarce asset that is universally available signify for the rest of the world?

Bitcoin is good for people

Bitcoin is frequently accused of being primarily useful to criminals, however this is not entirely accurate. Criminal activity on the Bitcoin network peaked above 2% in 2019 and then decreased to 0.34 percent in 2020. Bitcoin transactions are recorded in a permanent public ledger. The majority of criminals would want to conduct business in US dollars. In fact, Bitcoin is primarily used for saving.

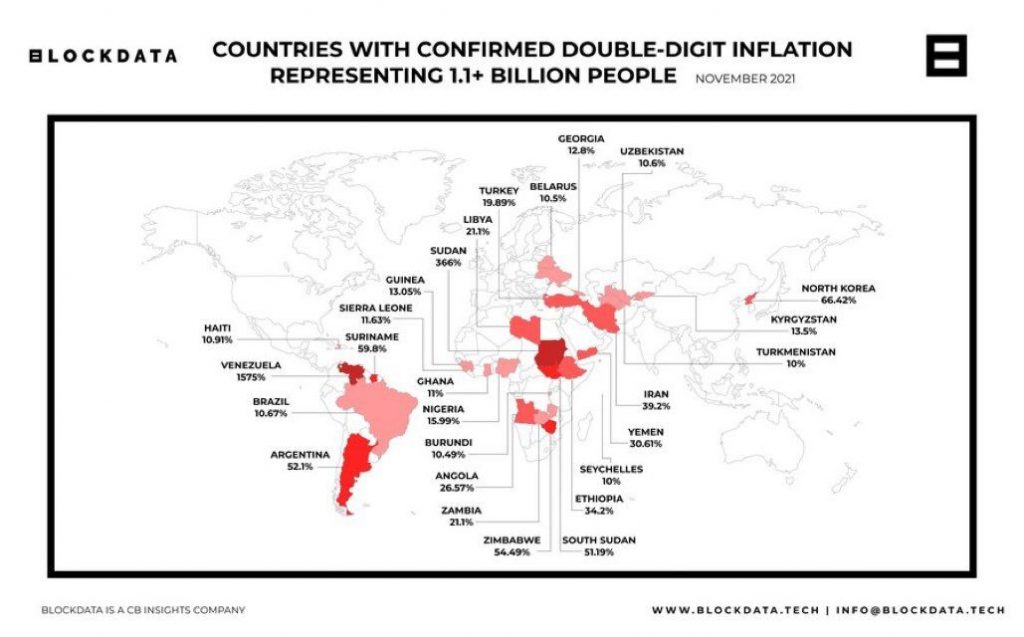

Bitcoin benefits the poor since inflation disproportionately affects them. If the majority of your net worth is in cash and future cash-denominated wages, inflation depletes your wealth. If the majority of your net worth is made up of investments and real estate, inflation just alters the numbers next to your accounts – it costs you nothing. Bitcoin is a shelter for the underprivileged in countries experiencing rampant inflation.

Bitcoin is also beneficial to activists such as Nigerian feminist protests, Russian dissident politicians such as Alexei Navalny, and marginalized populations like as Afghanistan’s unbanked women. According to Alex Gladstein of the Human Rights Foundation, it is a „critical weapon for defending liberty.“

Why Bitcoin matters for human rights, in two minutes. pic.twitter.com/7whCGZKEXi

— Alex Gladstein ? ⚡ (@gladstein) June 24, 2020

Bitcoin is good for the planet

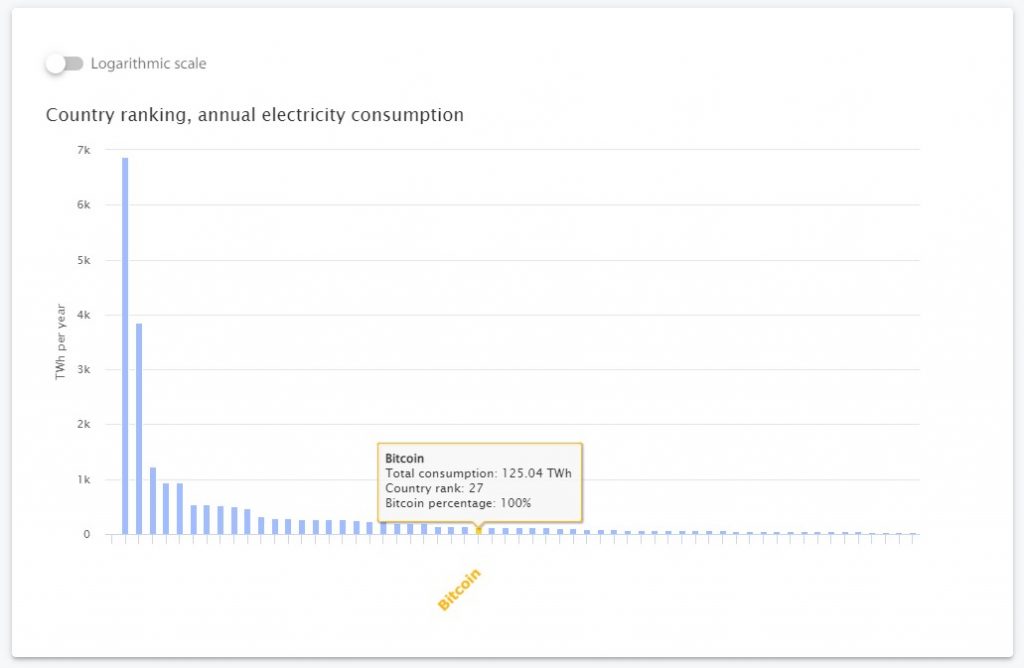

Despite its sometimes negative image in the mainstream media, Bitcoin is actually beneficial to the environment. Bitcoin consumes a significant amount of energy, but it is a scavenger that feeds on low-cost waste energy. Because energy is much easier to produce than it is to store or transport, a lot of energy is wasted.

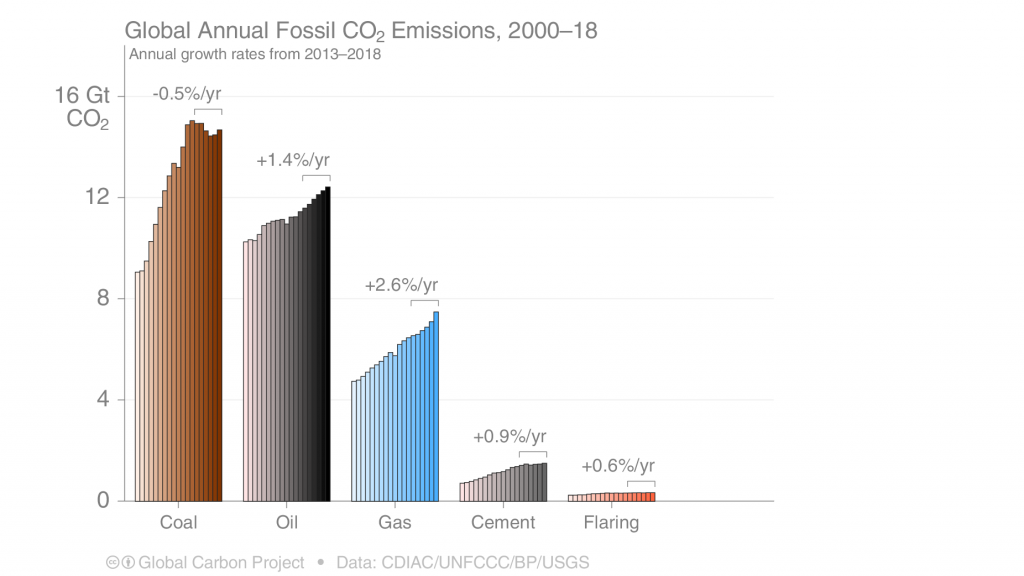

For example, natural gas is frequently produced as a byproduct of oil mining. When it is convenient, oil companies will sell that natural gas; however, because oil is often mined in remote locations, bringing that gas to market is neither easy nor cheap. Instead, oil companies simply vent that gas into the air and set it ablaze, a practice known as flaring. The Cambridge Bitcoin Electricity Consumption Index estimates that enough gas is flared globally to power the Bitcoin network nearly six times over. Here is how significant flaring is in comparison to other sources of carbon dioxide emissions:

Several companies are developing portable Bitcoin mining rigs that can go to the vents and mine Bitcoin using natural gas on-site. This increases Bitcoin’s energy consumption, but it actually has a positive impact on the environment because using natural gas is preferable to flaring it. Both flaring and using natural gas emit CO2, but flaring, which is frequently inefficient and incomplete, can also emit methane and NOx into the atmosphere. The ozone layer is harmed by methane, and NOx contributes to acid rain. The graph of Bitcoin’s energy consumption as a proxy for its environmental impact is deceptive.

Bitcoin mining is also beneficial to renewable energy because much renewable energy is generated during off-peak hours when it is less valuable. The Bitcoin network acts as a „last resort buyer“ for energy producers, making renewable energy more economically viable. By creating a market for its excess power, Bitcoin effectively subsidizes the development of more renewable energy. As a result, renewable energy companies are beginning to incorporate Bitcoin mining into their operations.

Many anti-Bitcoin critics cite environmentalism as a concern, but not as many environmentalists cite Bitcoin as a concern, because it is fairly obvious that Bitcoin is a footnote if you sincerely care about the environment.

The amount of energy consumed can be surprising. Bitcoin uses more energy than Argentina, but less energy than Christmas lights in the United States. Neither of these comparisons is particularly informative. Instead of comparing the energy consumption of the entire legacy banking system, it would be more appropriate to compare it to the environmental impact of the oil dollar. When viewed in its appropriate context, Bitcoin’s energy consumption isn’t nearly as significant as it is simple to quantify.

USD full node pic.twitter.com/4qs2bDVpMp

— Gabor Gurbacs (@gaborgurbacs) May 29, 2021

Bitcoin is an alternative to war

The history of warfare is the history of the defense of one’s territory and the accumulation of wealth. The existence of a physical location for that riches implies the necessity of defending physical territory, which implies the use of violence. With the migration of wealth from physical systems to non-physical systems such as Bitcoin, it is possible to defend it by non-violent means — such as Bitcoin mining. The greater the amount of wealth that is removed from tangible objects, the less wealth is required for physical defense.

Few understand…#Bitcoin pic.twitter.com/PEt8M1vRtz

— Jason Lowery (@JasonPLowery) November 1, 2021

Hyperinflating the currency, as is done by governments to prolong a lost war by spending their citizens‘ money, makes it more difficult for governments to do so. Because people are more aware of the consequences of direct taxation than of the production of new money, it is considerably easier to support a war through the creation of new money than through direct taxes. As a result, the gold standard had to be abandoned by the vast majority of the countries involved in World War I. If the people realized how much money the war was costing them, they would put an end to it far earlier.

None of this is intended to indicate that Bitcoin heralds the end of war; power plants and population centers will continue to be targets of conflict indefinitely.

Governments will always find cause for contention with their neighbors.

However, to the extent that Bitcoin develops traction, it reduces the means and incentives for violent conflict significantly.

You should own some Bitcoin either way

Even after considering all of the points presented above, you may remain unconvinced of Bitcoin’s value — but you should probably still possess a small amount of Bitcoin nevertheless. That is because, if Bitcoin succeeds in becoming the optimal method of storing value, it will capture the majority of the wealth currently stored in alternative methods. Not only will the price of Bitcoin increase; the value of everything else will decrease.

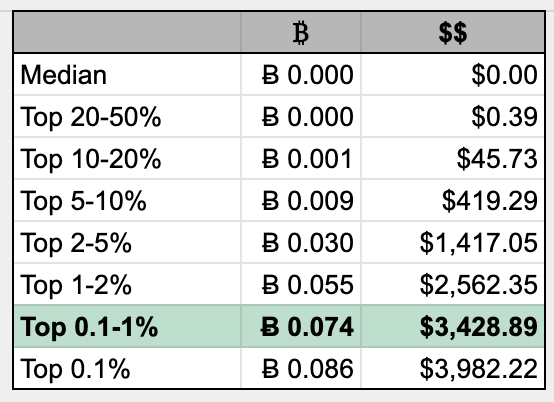

That is why, regardless of whether you support Bitcoin or not, everyone should consider how they would safeguard themselves against the potential that Bitcoin is genuine. Possessing a little quantity of Bitcoin is one method to mitigate that risk — and you likely require less than you believe. If everyone wants Bitcoin, there won’t be much left to go around – having 0.074 BTC (about $3,500 at the time of writing) will almost certainly be enough to place someone in the top 1% of Bitcoin wealth.

This estimate is based on global wealth inequality as it exists today. Additionally, I created a spreadsheet where you may review and adjust assumptions independently.

Given the little amount of Bitcoin required to hedge against a Bitcoin futures contract, having no Bitcoin at all is an exceedingly confident position. While being skeptical of Bitcoin’s chances of success is quite acceptable, being certain that it will fail is excessive. Intelligent skeptics are skeptical of their skepticism.

Keep your mind open

Regardless of your feelings towards Bitcoin, I encourage you to maintain an open mind. Since 2014, I’ve been immersed in space, and I’m continually learning new things and changing my thinking on a daily basis.