The Olympic Games are held every four years (usually) and bring the entire world together in a celebration of sport and competition. I

We’ll take a look at countries that deserve gold medals across a variety of spheres in the cryptocurrency and blockchain space in the spirit of Tokyo 2020.

In recent years, the number and variety of sports featured at the Olympics has increased, and the current summer Olympics in Japan will feature a total of 33 different sports. As the global showpiece continues to evolve and incorporate new sports, such as skateboarding and surfing, new and exciting competitions have been added to the Japanese program.

In this regard, the cryptocurrency and blockchain spaces are very similar to one another. A diverse set of working parts results in a vibrant community that is both united and divided by their preferences for cryptocurrencies and blockchain platforms.

Examine which countries and institutions have taken home gold medals in their respective crypto and blockchain competitions.

Bitcoin adoption gold medal goes to… El Salvador

Fans of sports often root for the underdog, and El Salvador has emerged as one of those lesser-known players who will make a splash on the international stage in 2021 by qualifying for the Olympics.

Central American country made headlines this year when it became the first country in the world to recognize Bitcoin as legal tender, making it the first of its kind.

Without getting into the specifics, El Salvador’s congress voted to approve President Nayib Bukele’s Bitcoin Law, which recognizes Bitcoin (BTC) as legal tender alongside the United States dollar. The new legislation received 62 votes out of a total of 84 votes in favor of passing it.

According to Bukele, the law allows citizens to pay for goods and services in Bitcoin, and that the Salvadoran government will guarantee that Bitcoin will be convertible into US dollars at the time of any given transaction.

Later this year, the government intends to distribute $30 worth of Bitcoin to each and every citizen.

Both locally and internationally, there have been critics of the law change, but the overall sentiment appears to be positive for Bitcoin adoption, and a shift in public perception of the world’s most popular cryptocurrency is underway.

Nonetheless, the country faces a few final roadblocks before it can achieve its objectives.

First and foremost, the International Monetary Fund has issued its own warning about the potential drawbacks of adopting Bitcoin in countries with unstable inflation rates, which includes the United States.

Second, some citizens of El Salvador have also expressed their skepticism about the decision to deport the migrants.

A survey conducted at the beginning of July with 1,233 citizens revealed that nearly half of those who responded had no prior knowledge of Bitcoin or other cryptocurrencies.

In the poll, 20 percent of respondents supported the move, highlighting the need for an educational campaign to go hand in hand with the progressive move to make bitcoin cash legal tender.

When it comes to change, there is often apprehension and resistance, but El Salvador wins the gold medal in the first category for its progress and adoption.

Switzerland receives second place in the category, owing to the country’s crypto-friendly laws, which have encouraged the use of cryptocurrencies and the establishment of companies in the space.

A bronze medal is awarded to the United States, thanks to the efforts of Mayor Francis Suarez of Miami, who is a proponent of Bitcoin and has spearheaded a number of initiatives to promote its use.

China is leading the CBDC race, but anti-crypto policies have resulted in the country being disqualified

China has established a dominant presence at the Olympics over the last two decades, with its sporting program producing a distinguished lineage of Olympic weightlifters, gymnasts, divers, shooters, and martial artists. However, things are a little more complicated in the world of cryptocurrencies.

China has previously taken a hard line against cryptocurrencies, which it has maintained in 2021, with the country’s outright prohibition of cryptocurrency mining completely rebalancing the Bitcoin mining ecosystem as a result of the policy.

Unusually for a developing country, the country is far ahead of the rest of the world in terms of developing a fully fledged central bank digital currency, or CBDC. Over the last 18 months, Chinese authorities have conducted extensive testing and piloting of their Digital Currency Electronic Payment, or DCEP, system.

The digital yuan, as it is colloquially referred to, was first tested by citizens via lotteries that awarded a small number of participants in various cities with digital yuan that they could use to pay for goods and services at thousands of participating vendors via a mobile app.

Without a doubt, China has set the bar for developing, testing, and implementing its CBDC. However, the DCEP is a government-controlled program, and the specifics of the technology and systems that underpin the digital yuan are shrouded in secrecy.

However, as a result of China’s recent prohibition of cryptocurrency mining in various regions and its zero-tolerance policy toward cryptocurrency exchanges, the country has been eliminated from contention for a medal, despite having a well-developed CBDC program. The encouraging news is that a number of additional countries have made significant progress toward establishing their own CBDCs.

In sports, fans frequently rally behind underdogs, which is certainly true for the Bahamas and its Sand Dollar CBDC, which is a member of the FIFA World Cup qualifying team. The country made significant strides during the development and testing of its own CBDC, and it will be the first country to implement the technology in October 2020.

A growing number of indigenous banks and financial institutions are joining the Sand Dollar ecosystem, laying the groundwork for widespread CBDC adoption and the establishment of a fully digital payment environment. The Bahamas has earned the gold medal in this category, and they are entirely deserving.

Sweden has begun testing the e-krona CBDC with a small number of local banks and external participants as part of a larger pilot testing program. Sweden earns the silver medal in this category due to the fact that it is currently testing its system with local financial institutions.

Cambodia and Ukraine have been recognized for their respective CBDC development programs, with the two countries sharing the bronze medal in this category, according to a recent report from PricewaterhouseCoopers.

North America in the race for gold in Bitcoin mining

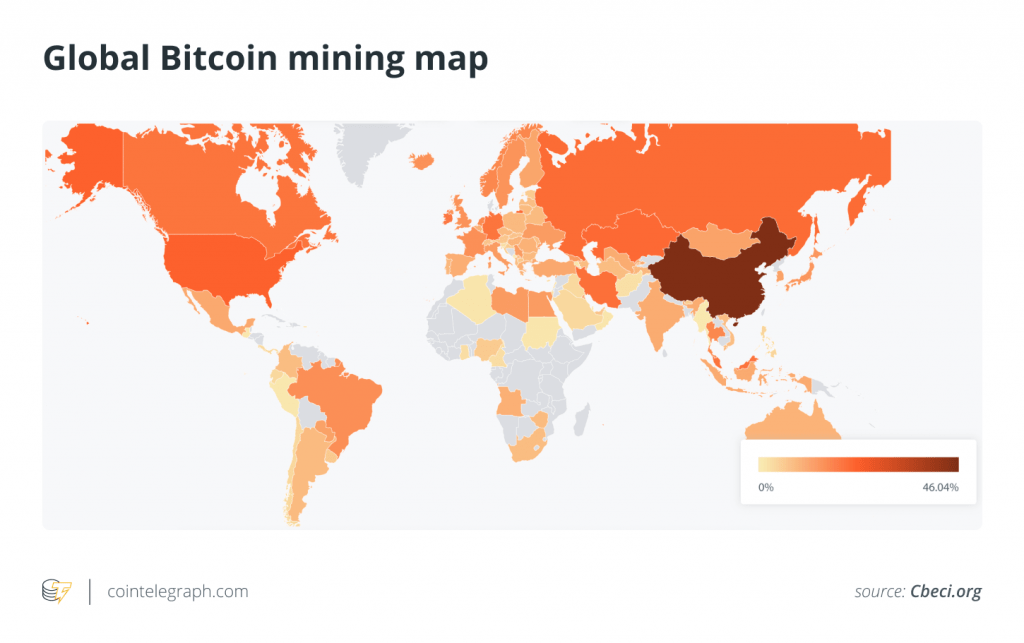

China was unquestionably the gold medalist in Bitcoin mining in 2016, but this is rapidly changing in 2021.

According to recent estimates, China accounted for more than 70% of the global hash rate prior to the closure of various mining operations in June.

Those businesses that could quickly relocate to greener pastures would appreciate their mining equipment.

While various countries in Asia are the most convenient locations to relocate to, North America is rapidly emerging as the new cryptocurrency mining hub.

According to research conducted by the Cambridge Centre for Alternative Finance, the hash rate of American-based miners has been steadily increasing over the last year, and China’s recent regulatory move has only accelerated that trend.

The Cambridge Bitcoin Electricity Consumption Index world map does not yet fully reflect data from China’s regional mining bans in June, which is necessary to gain a better understanding of how the Bitcoin mining hash rate’s geo-distribution has changed. The most recent map depicts the distribution in March 2021.

Nonetheless, from August 2019 to March 2021, the US increased its contribution to the global hash rate from 4% to 16%, placing it second only to China.

This is largely due to a concerted effort by major mining operators in America during this period to steadily increase their hash rate through the acquisition of new equipment.

Kazakhstan has also opened its doors to Bitcoin miners fleeing China, increasing its share of the global Bitcoin hash rate to around 8%, according to a recent report from Cambridge.

China’s share of the global hash rate has dwindled to less than 50%, while the United States‘ share has increased.

However, this picture does not yet include the significant relocation of mining operations out of China.

While it may be premature to award the United States the gold medal for Bitcoin mining, the country appears to be on track to take over the leaderboards if current trends continue.

As a result of China’s mining crackdown, the United States becomes the new gold medalist in this category.

Kazakhstan takes silver with an 8% share of the global hash rate, while Iran takes bronze with a 4.6 percent share.

Canada and Malaysia come up just short of a podium finish in this category.

The regulatory race goes down to a photo finish

Several countries are competing for the cryptocurrency gold medal in terms of progressive regulation that is driving cryptocurrency adoption and use. These countries can boast of having developed regulatory parameters that are assisting the industry to thrive in their respective jurisdictions.

Malta has been positioning itself as the blockchain island for a number of years now, and as a result, it has attracted a number of the world’s largest cryptocurrency exchanges and other cryptocurrency service providers to the country.

Due to the attractiveness of the country’s regulatory package, crypto holders do not have to pay capital gains, wealth, or inheritance taxes on their holdings; however, cryptocurrency trading is subject to income tax.

In addition to the United States, Singapore has enacted comprehensive legislation that makes it clear what cryptocurrency firms and service providers must do in order to be permitted to conduct business in the country.

Singapore is also one of only a handful of countries that does not impose a capital gains tax on cryptocurrency income earned in the country.

South Korea has long been known as a country with a large cryptocurrency user base, and the country frequently sees Bitcoin trading at prices that are significantly higher than those seen elsewhere in the world.

It has since developed strict regulatory frameworks, but it has also been at the forefront of a number of initiatives to promote a variety of services that are based on blockchain technology.

Due to its progressive attitude toward cryptocurrency and blockchain technology, Switzerland is another strong contender in this category.

Residents of the Canton of Zug will be able to pay their taxes in bitcoin and ether starting in early 2021, according to the Canton (ETH).

Canada is a prominent participant in this race because it was the first country to approve the establishment of a Bitcoin exchange-traded fund (ETF).

The launch of the first Bitcoin exchange-traded fund (ETF) in February 2021 was a rousing success, with the Purpose Bitcoin ETF on the Toronto Stock Exchange seeing nearly $100 million in trade volume on its first day.

Overall, Canada has been commended for creating a progressive regulatory environment for the use of cryptocurrencies.

In the United States, cryptocurrency is classified as a commodity, and its use for the exchange of goods or services is treated as a barter transaction.

So these five countries come in second, third, and fourth, respectively, in the crypto and blockchain regulatory race, which is difficult to call.

As we bring up the slow-motion replay, we can see that Canada is the clear winner in this category, with a wide range of crypto-friendly regulations ranging from exchange-traded funds (ETFs) to transparent tax laws and favorable mining tariffs.

Malta receives a silver medal, despite the fact that its reputation as the „Blockchain Island“ has waned somewhat as a result of a change in the governmental leadership that had initially championed the cause of cryptocurrency.

In this category, Singapore and South Korea are tied for third place.

The United States wins the gold medal in institutional adoption

As a capitalist society, the modern-day United States is optimized, and the disruptive nature of cryptocurrency has spurred some forward-thinking individuals, businesses, and institutions into action in order to capitalize on the potential of cryptocurrencies and blockchain technology.

Among those who have done so is MicroStrategy, a global leader in business intelligence services, which in 2020 became the first organization to convert its fiat-based treasury holdings to Bitcoin.

The company’s CEO, Michael Saylor, is a staunch supporter of Bitcoin, and the company has been aggressively accumulating Bitcoin since making the decision to place its bets on the world’s most valuable cryptocurrency in August of last year.

According to popular belief, MicroStrategy’s decision to invest in Bitcoin influenced electric vehicle manufacturer Tesla and its founder Elon Musk to make the decision to begin investing in the cryptocurrency and, at one point, to accept Bitcoin as a form of payment for its vehicles.

A disruptive force in the payments industry, cryptocurrency has been heralded as such, and American firm PayPal sought to gain a competitive advantage by announcing that it would roll out cryptocurrency custody and payment services on its widely used platform.

Additionally, American investment firms have blazed a trail in providing a variety of ways for a broader audience to gain exposure to cryptocurrencies.

Nobody does this better than Grayscale Investments, which manages a number of cryptocurrency trusts that are currently worth more than $33 billion in total.

Its flagship Bitcoin Trust, for example, is currently valued at more than $24 billion.

In the race for institutional adoption, these factors are more than sufficient to award the United States of America yet another gold medal at the Crypto Olympics.

Canada takes second place in this category as a result of its crypto-friendly regulatory environment and progressive ETF laws, which have allowed it to surpass its North American neighbor in this regard.

Siam Commercial Bank, Thailand’s oldest banking institution, has committed $110 million to invest in the decentralized finance sector through its venture capital arm SCB 10X, earning the country a bronze medal in this competition.

DNFs

A number of countries have been disqualified from the competition due to their divergent views on cryptocurrency and blockchain technology. Nigerians were taken aback in February 2021 when their central bank effectively prohibited local banks from providing services to cryptocurrency exchanges, a move that stunned the world. The move drew widespread condemnation both domestically and internationally, particularly in a country that remains number one in Google’s search for Bitcoin. Nigeria’s Securities and Exchange Commission was developing crypto regulatory plans prior to the suspension, which were subsequently put on hold.

India, like the United States and the United Kingdom, has a checkered history when it comes to cryptocurrency. It has been a long time since the country’s government threatened to outright ban Bitcoin use, but that is slowly changing with talk of asset classification, which would establish proper regulatory frameworks and oversight for the burgeoning industry.

India’s banking sector appears to remain opposed to the cryptocurrency movement, with several of the country’s largest financial institutions warning customers against acquiring and using cryptocurrencies. Clearly, the Indian government and central bank have sent mixed signals in recent years, creating a great deal of uncertainty about the sector that can only be alleviated through proper education.

China’s recent ban on cryptocurrency mining in various regions of the country also falls under this disqualification category, as the move wreaked havoc on the mining ecosystem, forcing operators to shut down operations and seek greener pastures in other parts of the world.

Additionally, the Chinese government has issued directives to domestic banks prohibiting them from providing services to businesses engaged in the cryptocurrency industry. By severing the country’s ties to the traditional financial sector, its citizens will be unable to access and utilize cryptocurrencies to their full potential.