Can we all take a moment to reflect on how far the world of trading has come since the beginning of time?

Toss out the notion of looking back over the past 100 years.

Understanding the trading environment of just 30 years ago allows you to recognize two significant leaps forward in innovation, as well as the changes in pricing structures that resulted from them.

Three decades ago, the trading and option markets were primarily manual.

Using a full-service broker was the standard practice, and while this meant having a trained professional to assist you with advice and trade execution on your behalf, it also meant paying a fee of approximately 2.5 percent per trade.

Alternatively, some brokers may charge a fee on your managed assets ranging from 0.5 to 1.5 percent of the value of your assets.

In either case, this could become prohibitively expensive, and unless the expertise of the broker was absolutely required, the cost might outweigh the benefit in some cases.

However, as the internet became more widely used, the market for trading and options began to rapidly shift in response.

A swarm of „discount brokers“ wreaked havoc on the pricing power that full service brokers had clung to for so long.

Granted, this resulted in a significant reduction in services, but for traders who conducted their own research and analysis—which was made easier by the internet—they only required a representative to execute their trades and options.

This has resulted in a trade that would have previously cost $250 being done at a cost of only $10.

This was, in many ways, a watershed moment for everyone who was involved.

New brokers joined the team, bringing with them a skill set geared toward high-volume execution.

In the 1980s, a generation of investors emerged who were analytically savvy (to varying degrees), assuming the burden of research in exchange for the benefit of low-cost trades.

Even full-service brokerages were affected, as they were forced to choose between two options in order to survive: either lower their prices in order to be more competitive, or convince their clients that the services they provided were well worth the high fees.

Likewise, high frequency traders (HFTs) were introduced with the advent of the internet, who have been accused of causing sometimes extreme market volatility, while also receiving credit for reducing current bid-address spreads.

In short, the internet has placed a great deal of power in the hands of investors, primarily in the form of information, transparency, and price competition, thereby removing the largely inelastic trade and options fees that existed in the past.

The “ultra” discount brokers, who claim to generate enough interest and other revenue through their services to be able to offer commission-free trades, are at the other end of the spectrum.

A Free Lunch?

If a commission-free trade appears to be too good to be true—especially in an industry that is solely concerned with taking actions that generate revenue—it is possible that there are additional fees hidden beneath the surface.

And the real question is, from where do they come?

Or will the brokerage firm be able to turn a profit that is substantial enough to cover both bull and bear markets while also managing the risk of volatility?

Since these discounting—and sometimes extreme discounting—companies have been in business for a few decades, a number of significant trends have emerged.

First and foremost, it is critical to carefully review the terms and conditions of any type of trade (whether with a discount firm or not), because both standard trades and options may be subject to explicit fees that are labeled as „other services“ in some cases.

The unfortunate reality is that some brokerage firms conceal their money-making strategies from their clients, even if the terms and conditions are clear.

Because of the high volume and instantaneous nature of today’s trades/options, even minor delays in the processing of a market order can be beneficial to the broker while being detrimental to the client’s well-being, creating a significant conflict of interest.

The unseen risks. Photo by Benjamin Davies on Unsplash

The unseen risks. Photo by Benjamin Davies on Unsplash

In order to meet the increasing demand for low or even no fee trading, revenue must be generated somewhere.

Because this is a zero-sum game between the client and the broker, this does not constitute a deceptive practice such as intentionally creating delays in order to benefit from client money.

This instead leads to mistrust and an increasing lack of transparency, which is poisonous in an industry where trust is built on the foundation of openness and transparency.

Is there a more efficient way to reap the benefits of low-cost trading while also maintaining a transparent environment?

The possibility does exist, but it will require a completely different system that ensures transparency and in which the broker’s earnings are transparently disclosed so that clients are not unaware of how much money is being made at their expense.

Crypto Trading and Options

The world of cryptocurrency is the second major innovation to have occurred in the last thirty years, with this one coming into effect only a few years ago.

Trading cryptocurrency, whether in the form of standard investments or options, is already as diverse as purchasing traditional financial instruments.

There is increasing interest and activity in the options market, with Bitcoin options open interest surpassing $13 billion USD in February 2021.

Why has it gained popularity, and can it overcome some of the difficulties associated with traditional broker fees?

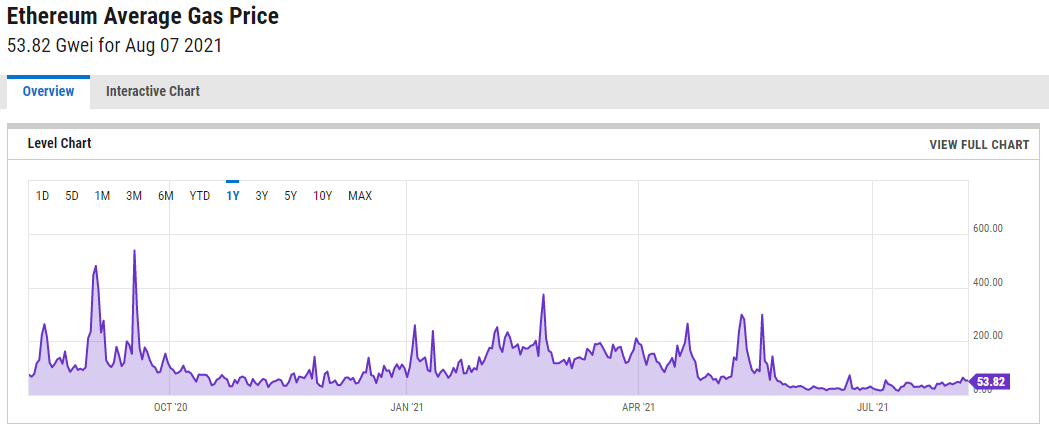

One of the most important fees that is discussed in the world of cryptocurrency are the “gas fees,” which are the transaction fees that are charged when an order is executed on an exchange.

Ethereum gas fees are well-known for being high, and they have prompted even more innovation for the market from other chains wishing to break through the cost/transaction bottleneck that Ethereum is currently experiencing.

While there are advantages to trading on Ethereum, the Binance Smart Chain (BSC) allows traders to trade their supported tokens at lower fees than they would otherwise be able to.

Image source: ycharts.com

Additionally, the fact that the future of cryptocurrency is a LOT more uncertain than the future of traditional stocks makes options trading with cryptocurrency an interesting proposition.

This can be extremely dangerous if done incorrectly, but it can also yield significant rewards for those who are fortunate enough to do so.

Additionally, for others, it means that trading in cryptocurrency options is a necessary part of their risk mitigation strategy, as traditional pricing calculations such as Black Scholes do not hold up to scrutiny as well as they should.

One innovation that is attracting attention is the platform developed by the team at Premia, which addresses both traditional limitations as well as the risks associated with cryptocurrency.

In order to match buyers and sellers, they’ve developed an advanced pricing model that incorporates massive amounts of market information in order to provide fair and transparent pricing to both parties involved.

In contrast to traditional models, the Premia algorithm continuously updates and learns based on market behavior, assisting in informing its model and ensuring that it does not suffer from the uncertainty associated with the market.

Even tokens that are less liquid can be handled by the platform, allowing for faster convergence to a fair market price.

Premia, like other cryptocurrency platforms, creates value by utilizing its token as a base for facilitating the provision of liquidity.

As more options traders join in, the platform’s liquidity increases as a result of the increased participation.

Premia token holders, in contrast to traditional trading exchanges, can actually stake their tokens and participate in both the liquidity and the yields generated as a result of this.

This is an excellent illustration of why the cryptocurrency markets are gaining in popularity at such a rapid pace:

With blockchain immutability and transparency, more advanced algorithms to connect buyers and sellers, a clear business model that demonstrates where revenue comes from, and the opportunity for token holders to participate in yield generation, they have taken the best of internet innovation (power to the people) and taken it a number of steps further.

Conclusion

Therefore, what is the catch?

Is this an offer that is too good to be true?

No, because, as with any market, options trading entails inherent risk that must be mitigated through extensive research and analysis, as well as a certain amount of luck.

However, the world of crypto options, particularly for those earning additional yield by holding and staking tokens on platforms such as Premia, stands to benefit significantly more than previous generations of internet and traditional investors.

With increased transparency, empowered control, and a better understanding of the business model of a platform, now is an excellent time to be in the trading and options game!

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)