Wall Avenue has been all over Bitcoin more than the earlier couple months thanks to the expansion in the need for an inflation hedge and a relative stagnation in the selling price of gold relative to other asset courses. This much was verified just not long ago when a Wall Road veteran and previous White Household staffer introduced a BTC fund with his possess $25 million financial investment, displaying that there is demand from customers for the main crypto asset.

Associated Reading through: Here’s Why Ethereum’s DeFi Industry Could Be Close to A Base

Scaramucci Kickstarts Bitcoin Fund

In accordance to Yahoo Finance, Anthony Scaramucci, the founder of $9.2 billion fund-of-cash SkyBridge Capital, has launched a Bitcoin fund to empower registered investment decision advisors (RIAs) to invest in BTC.

SKyBridge, which will be running the fund, recently submitted a Sort D with the Securities and Trade Commission for this new fund.

To kickstart the fund and demonstrate that he has faith in it, founder Scaramucci has put $25 million of his own capital into the fund.

He thinks that this fund will allow for a broader variety of traders to get publicity to BTC. The situation is that quite a few institutional players or even retail traders obtain it difficult to spend in BTC.

Associated Studying: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

Wall Avenue Assistance Swells

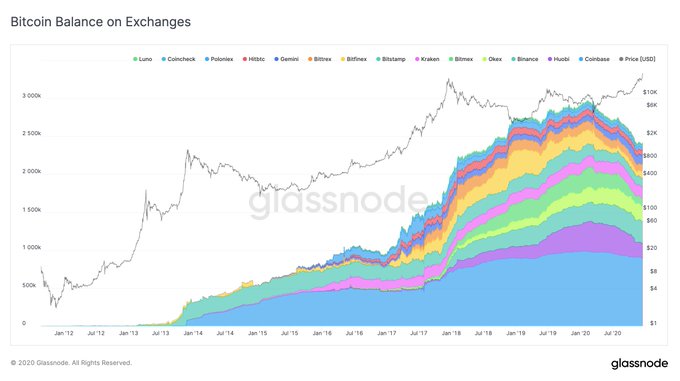

In a indicator of ongoing Wall Avenue assist of Bitcoin, the amount of cash on exchanges has been in a steep decrease. Referencing the chart viewed underneath, Rafael Schultze Kraft, CTO of Glassnode, not long ago said:

“#Bitcoin is in a supply and liquidity disaster. This is incredibly bullish! And extremely underrated. I imagine we will see this significantly mirrored in Bitcoin’s value in the future months. Let’s consider a look at the information.”

Chart of BTC's value motion in excess of the previous decade with an on-chain evaluation of btc on exchanges from Rafael Schutlze Kraft, CTO of Glassnode Chart from Glassnode, a crypto details supply

#Bitcoin is in a source and liquidity disaster.

This is extremely bullish! And really underrated.

I imagine we will see this substantially mirrored in Bitcoin’s cost in the upcoming months.

Let’s get a glimpse at the knowledge.

A thread ???????????? pic.twitter.com/vx6rJmiloE

— Rafael Schultze-Kraft (@n3ocortex) December 21, 2020

A massive customer of these cash is MicroStrategy. The American enterprise products and services firm wrote in a push release released before this 7 days that it has obtained $650,000,000 well worth of BTC:

“TYSONS CORNER, Va.–(Company WIRE)–Dec. 21, 2020– MicroStrategy® Integrated (Nasdaq: MSTR) (the “Company”), the most significant independent publicly-traded business intelligence firm, currently announced that it experienced bought an more roughly 29,646 bitcoins for about $650. million in hard cash in accordance with its Treasury Reserve Policy, at an ordinary selling price of close to $21,925 for each bitcoin, inclusive of charges and expenditures.”

The corporation believes that BTC will respect above time to outpace the development in the price of its financial debt, as it procured these coins with credit card debt generated by the sale of senior convertible notes.

Connected Studying: 3 Bitcoin On-Chain Traits Show a Macro Bull Market Is Brewing

Featured Impression from Shutterstock Value tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Wall Avenue Veteran Kickstarts Have BTC Fund With $25m Financial investment