Traders use a variety of technical analysis tools to find new trends and make money when they trade in that direction.

The price channel is a common trend-detection pattern that many traders use to figure out what is going on.

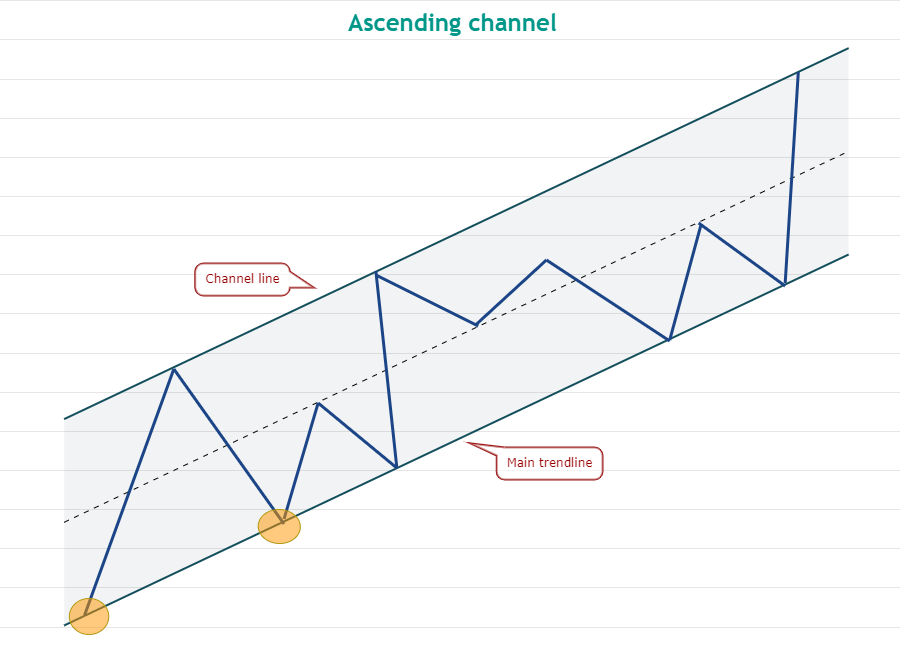

To make a „ascending channel“ or a „bullish price channel,“ you draw parallel lines between the support and resistance points that an asset moves between on candlestick charts.

Ascending channel basics

An ascending channel is formed when the price action can fit inside two lines that are both going up.

First, the main trendline is drawn by putting together the two lows that the market has had.

Then, a line is drawn that connects two points where people have had a lot of reactions.

Channel: This line is called the Channel Line, and it goes through the middle of everything.

The main trendline is the area where the price comes back up, and the channel line is the area where the price goes down.

In most cases, the price moves between these two lines.

As the price keeps going up inside the channel, the ascending channel is seen as a good thing.

Reaction lows (ellipses) in the chart above can be joined together to make one big trend line.

Channel lines should have two points. For a quick way to figure out which direction the channel is going, a parallel line with just one reaction high can also be drawn.

As you can see, the price bounces off the main trendline and turns down from the channel line in the above picture.

The main trend line is where traders buy and sell.

There is no set pattern to the price action inside the channel, so it could be random and not follow any rules.

People can see this because the price keeps going up inside the channel. This shows that the market is going up.

Traders use corrections to the main trendline to buy because it’s a low-risk way to get in.

Breaking out of the channel means that there will be more bullish momentum. Breaking below the channel means that there could be a change in the trend.

A break below the channel doesn’t always lead to a downtrend because sometimes the price stays in a range for a few days and then goes back up again.

Ascending channel breakouts

To make the main trendline, the chart shows that it was drawn by joining the two lows that happened after FTX Token (FTT).

Lines from the reaction highs were used to draw a line that goes through the middle.

As shown in the chart above, the price mostly stayed in the same place from December 2019 to mid-December 2020.

Corrections near or to the main trendline could have been used as a low-risk buying opportunity if a close stop-loss was kept in mind when making the trade.

Sometimes, a breakout of the channel is seen as a sign that the bullish momentum has sped up. In this case, two of the breaks turned out to be bull traps on both occasions.

There was a first close above the channel line on Aug. 30, 2020. It came back inside the channel on Sept. 3, 2020.

There was another close above the channel on Nov. 30, 2020, but it didn’t get any buyers at higher levels, and on Dec. 1, 2020, the price came back down to the channel level.

There is no way to know for sure what will happen in trading, so traders should always use stop-losses to protect their positions.

Finally, on the third try, the price broke out of the channel on December 16, 2020, and the bulls fought back when the price tried to come back to the level where it broke out.

There had been a lot of resistance that was now support, and the bullish momentum was about to get even more strong.

There is more momentum when a breakout from an ascending channel lasts for a long time.

That usually leads to a bigger rally.

The goal can be found by adding the height of the channel to the breakout level.

There is a $1.15 price for the height of the channel in this case.

Add that to the breakout level at $4.70, and you get a goal of $5.85.

When it turned vertical and quickly reached $10.10 on January 7, 2021, the rally quickly went up to $10.10.

This shows that the target goal should only be used as a guide. Before closing the position, other indicators should be looked at to see if they are strong enough.

Ascending channel breakdowns

For the second time, the FTT/USDT pair formed a rising channel, and the price rose from about $20 to $63.10 inside the channel.

Price went up a lot after the sharp rise. It broke below the channel on May 17.

This is what happened on May 18. The bulls tried to push up the price, but they didn’t work.

This caused a lot of people to want to sell, and the pair started going down.

The depth of the channel is $14.90, and it broke down at $50.56.

To figure out how much money to make, subtract the depth of the channel from the level at which the market broke down. This gives a target goal of $35.66.

There was still a drop in prices, but on June 26, the pair hit $21.89.

People who trade should be careful when the price breaks out of a range, which is what this shows.

Not all breakdowns result in a prolonged downtrend

There was a rise in the price of Bitcoin (BTC) from April 2020 to early-June, 2020.

It happened on June 11, 2020, but the BTC/USDT pair did not start going down.

Instead, the price stayed in a range for a few days and then kept going up.

This shows how a break below the channel doesn’t always mean that the market is going down.

Traders should look at other indicators and the price action before they decide to be bearish.

Key takeaways

People can buy on dips to the main trendline when the ascending channel lines up with the main trend line.

Breaking out of the channel usually means that there is more momentum, which leads to a quick rise in prices.

Usually, it’s better to wait until the breakout level has been successfully retested before you start making new trades. Sometimes, a breakout turns out to be a bull trap.

In this case, the uptrend has come to an end, but it doesn’t always mean that the price will go down.

Often, after the price breaks below a channel, it stays in a range for a while. As the volume picks up, the asset starts moving up again.

Traders should use the ascending channel and other technical tools together to get more information about whether to buy or sell a stock or other thing.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.