Desire for LEND has surged significantly more than the last 7 days as the token undergoes a rebranding.

Aave, the non-custodial “DeFi” protocol, earlier released its Aave Enhancement Proposal (AIP1) to allow group consent over the migration from its governance token LEND to its rebranded avatar AAVE. In retrospect, the switchover tried to take people’s opinions on the new variations proposed to Aave’s protocol existing financial model.

Aave Governance is officially on mainnet, offering the decisional ability to the community! Now it is time to vote on the pretty initially Aave Advancement Proposal (AIP) for the token migration from $LEND to $AAVE.

Thread on how to vote⬇️

Site put up for information: https://t.co/Z09ajBmb2Y

— Aave (@AaveAave) September 25, 2020

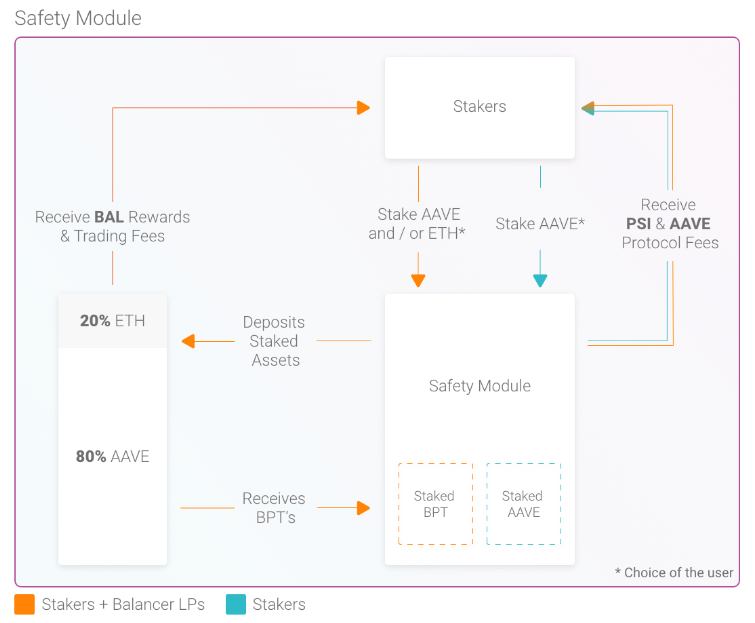

The modification released new Protection Incentives that would allow customers to earn revenue by staking AAVE tokens in a reserve by using “Safety Module.” For that, customers would require to give up their LEND holdings. They will obtain AAVE tokens rather at an exchange charge of 100 LEND for every AAVE.

Aave Basic safety Module flowchart

The proposal also promised an more 400 AAVE in rewards each and every working day when taking the 100 LEND > 1 AAVE swap into account.

“AAVE holders will be incentivized to backstop the protocol from shortfall by staking to the Protection Module,” defined Matt Kaye, the taking care of lover at Blockhead Capital in California. “The SM incorporates a builtin backstop system to reduce the excess flow of AAVE into the open up marketplace as not to increase AAVE offer strain.”

The AIP1 went through unharmed on Thursday with the vast majority “YAE.” The group introduced that it would release far more facts about the migration on Friday.

The voting period of time for AIP1 to migrate from $LEND ➡️ $AAVE has finished, with an mind-boggling ‚YAE‘

You can observe the countdown to the migration commence here: https://t.co/noc4D7wzmG

We will release guidance for migration and staking on Friday, and we are here to assistance you! https://t.co/xizn3JcPB6 pic.twitter.com/gwrsu3V6lX

— Aave (@AaveAave) October 1, 2020

LEND Surges

In the meantime, the LEND/USD trade rate jumped by 8.79 per cent in the final 24 hours thanks to the migration hype. That introduced the pair’s full rebound up by virtually 20 %, with a session large around $.6.

LEND overall performance amid the protocol up grade buzz. Source: TradingView.com

The surge appeared to have come from traders’ inclination to hold AAVE. At 1st, it has to do with the rewards. At the identical time, AIP1’s dedication to incorporate adds a 3M token Aave Reserve to a neighborhood governed treasury further more enhanced the attractiveness of LEND among really serious stakers.

LEND could surge in direction of its 50-day shifting common (pink) as it retains up with the token migration hoopla. A productive breakout, on the other hand, would validate $.65 as its up coming upside goal.

“A consolidation stage,” explained an analyst, “will deliver several solid entry opportunities in the coming weeks, probably months, just before LEND receives heading on its future leg up.”

He reported the LEND/USD could surge another 20,000 again on Aave’s believability as an rising decentralized finance job.