Bitcoin (BTC) went up and down a lot in 2021. Even though BTC has dropped a lot from its all-time high of $69,000, the digital asset is still up 60% this year.

During the same time, gold has dropped more than 5%.

People may be thinking that Bitcoin is a better way to protect against inflation than gold because it has done better than gold. This is because inflation in the United States and other parts of the world has been going up.

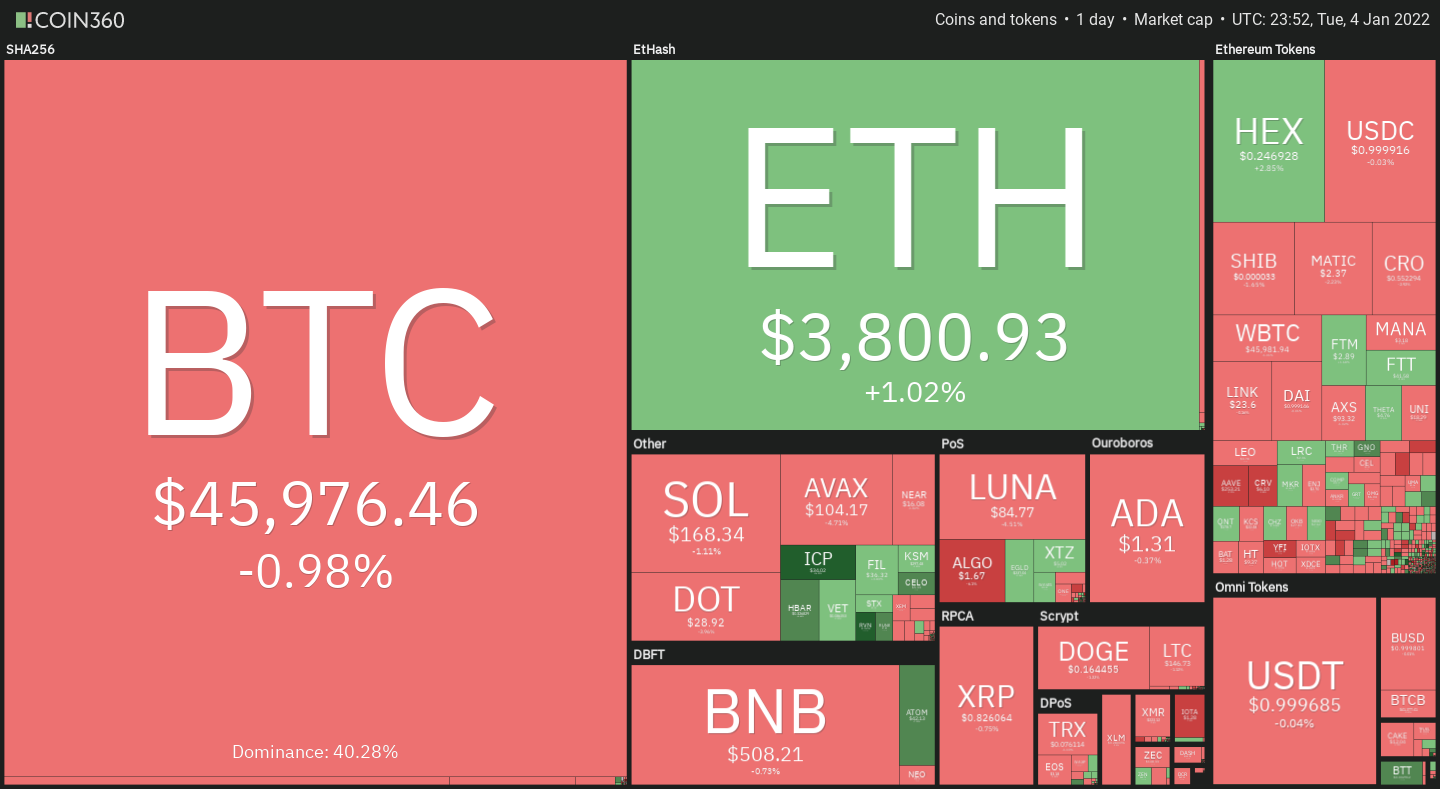

There were a lot more cryptocurrencies this year than there were at the start of the year, but Bitcoin’s share of the market dropped from about 70% to 40%.

This shows that a lot of altcoins have done better than Bitcoin.

As more people use cryptocurrencies, more altcoins are likely to get investors‘ attention. These could make a lot of money for investors in the next year.

Technical analysis has been used to come up with the current list of big-cap cryptocurrencies that could still be in the news in 2022 and benefit from a crypto bull run in the years to come, as shown below.

In 2022, we’ll look at the charts of the top five cryptocurrencies to figure out where they could go and what support levels to look out for in that time.

BTC/USDT

BTC broke and closed above $64,854 in early November. The long wick on the candlestick shows profit-taking at higher levels. During the next week, more people sold, and the price fell below $64,854.

The bulls tried to keep the 20-week exponential moving average (EMA) ($51,999) in their corner, but they couldn’t keep the rebound going. There was more of a rush to sell, and the price fell below the 50-week simple moving average ($47,681).

The bulls bought the dip, but they couldn’t keep the recovery going above the 20-week EMA. Here, we might see a shift in sentiment from buying on dips to selling when the market goes up. The bears are trying to get and keep the price below the 50-week SMA for a second time.

If they do well, the BTC/USDT pair could fall to the strong support at $39,600 if they do well. There has been a change in the 20-week EMA and the relative strength index (RSI), which means that the bears are in the lead.

People who break and close below $39,600 could see the market fall even deeper to $28,805. Such a big drop could put off the start of the next rise.

It will also try again to rise above the 20-week EMA if the bulls hold the 100-week SMA. They’ll try to get to the top of the range at $64,854 to $69,006.

People who buy or sell bitcoins can make money when they break and close above this level. This could start the next leg of the uptrend, which could push it to the $100,000 price point.

ETH/USDT

In a strong uptrend, Ether (ETH) is going back down. Both moving averages are going up, and the RSI is in the positive zone, which means that the bulls have the upper hand.

Although bears have been trying to get the price below the 20-week EMA ($3,745), bulls have been buying very quickly at low prices. This is shown by the long tail on the candlesticks of the past few weeks.

In the next few days, the bulls will try to break through an important psychological level at $5,000. There is a good chance that if they do well, they will be able to start a new uptrend. The first target is the 100% Fibonacci extension level at $5,719.68.

Keep an eye out for the 138.2% Fibonacci extension level at $6,566.19 and the 161.8% extension level at $7,089.17 if the price moves above this level.

This isn’t true. If the price drops below the 20-week EMA, it will show that people are selling when the market goes up, not buying. That could make it possible for the price of gold to fall to the strong support level of $2,652.

Because if the pair breaks below this level, it could fall to $1,700.

BNB/USDT

Bears are fighting hard to keep the all-time high at $691.80. Binance Coin (BNB) fell from $669.30. It’s still good that bulls are buying the dips to the 20-week EMA ($500), though.

Buyers have the upper hand because moving averages are rising and the RSI is in the „good“ zone.

BNB/USDT could rise to the level of $669.30 to $691.80 if the price rises above the level where it’s now at. The bulls will have to break through this barrier to show that the uptrend is going to start again.

If that happens, the pair could start the next leg of the up-move to $848.30 and then try to get to $1,171.90 after that.

This isn’t the only thing that could happen. The price could bounce off the 20-week EMA but then turn back from the overhead resistance. So, they might stay in that range for a while.

This is a good thing because it shows that traders aren’t rushing to get out of the market. That makes it more likely that the up-move will keep going.

In the opposite case, if bears sink and keep the price below the 20-week EMA, it will show that there is more supply than demand. That could make the 50-week SMA ($379) go down. A break and close below this level could make the bullish assumption false.

AVAX/USDT

When Avalanche (AVAX) rose quickly to a new all-time high of $147, it sent the RSI close to the 85 level, which means that the short-term up move was too high.

This may have led to short-term traders taking profits.

The bears pulled the price below $81 for three consecutive weeks but they could not sustain the lower levels as seen from the long tail on the candlesticks.

In this case, it means that bulls have turned the previous resistance point at $81 into support for them.

The strong rebound off the 20-EMA ($73) indicates that sentiment remains bullish and traders are buying on dips. After the bulls push the price to $147, they will try to get it there.

A break and a close above this level could start the next part of the uptrend. The AVAX/USDT pair could then rise to $213.17 and if the momentum sustains, the rally could even extend to $260.

This bullish view will invalidate if the price turns down from the current level or the overhead resistance and breaks below $75.50. Such a move will show that the mood has changed and people are selling when the market goes up.

There is a lot of support at $50. Then, the pair could fall to that level, which is very strong. Such a deep fall is likely to delay the start of the next leg of the up-move.

MATIC/USDT

Polygon’s MATIC has been on the rise. The bulls tried to push the price above the all-time high of $2.70, but they didn’t. This suggests that bears are fighting back hard against the overhead resistance.

There is, however, a good sign that bulls are buying the dips to the 20-week EMA ($1.62). This shows that people are still feeling good about the stock market, and people are buying when it drops.

It looks like the path of least resistance is to the upside, because the moving averages are rising and the RSI is close to the overbought zone. One more time, the bulls will try to push the MATIC/USDT pair above $2.70 to make it to that level.

If they can do that, the pair could start the next leg of the uptrend, which could reach $3.28, if they keep going. A break and close above this level could lead to a rise to $4 and then to $4.77.

According to this assumption, if the price drops below the 20-week EMA, it will show that there is more supply than demand. This is not true. Keep going below 20-week EMA, and selling could pick up speed. The pair could fall to 50-week SMA ($1.04).

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.