Bitcoin has sustained a strong fall above the earlier several times as legacy marketplaces have undergone a powerful correction immediately after a document rally. The primary cryptocurrency traded about $9,800 on Friday morning as bears sent the cryptocurrency reduce.

This is a stark correction from the $12,000 nearby highs witnessed just times ago and the $12,500 found in August.

Bitcoin remains bullish on a macro scale, while, as analysts notice that the asset’s extensive-phrase chart and fundamentals keep on being skewed to appreciation.

Similar Studying: These 3 Trends Advise BTC Is Poised to Bounce Right after $1,000 Drop

Bitcoin Remains Bullish on a Macro Time Frame: Analyst

Bitcoin continues to be bullish on a macro scale irrespective of the recent drop, a person analyst pointed out in the wake of the correction.

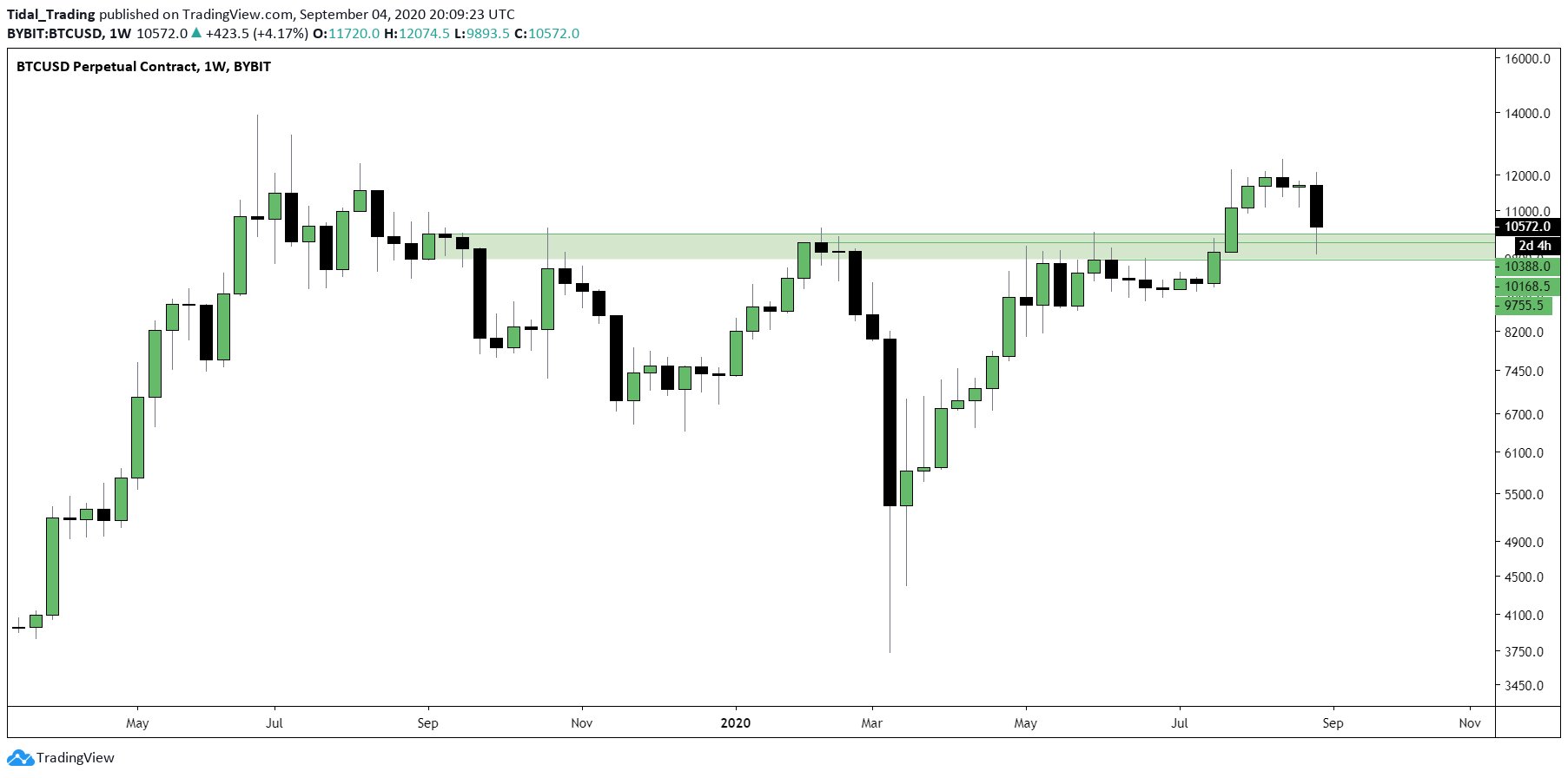

He shared this chart under, which demonstrates BTC printing a distinct bounce off a pivotal macro amount, suggesting it has turned into support. Not to point out, BTC is currently in a macro bullish market place construction due to the split previously mentioned $10,500 just months ago.

Also talking about how Bitcoin’s funding price on BitMEX and quality crashed as investors marketed the cryptocurrency in mass quantites, the

“$BTC funding and premium index reached the least expensive it had been since March 19th yesterday… Except this time we’re retesting a multi-calendar year S/R amount with a confirmed bullish break in MS all the way up to the regular chart…”

Chart of BTC's macro cost action with examination by crypto trader HornHairs (@CryptoHornHairs on Twitter). Chart from TradingView.com

Including to this, Bitcoin’s relative strength index, a measure of the severity of rate action, reached notable lows in the course of the fall on Friday. The normally-utilized indicator strike the lowest worth considering that the March capitulation.

Right after March’s crash, BTC underwent a potent bounce that introduced it back again to pre-crash concentrations in just 3 months.

Related Looking at: There’s an “Unusual” Sum of Bitcoin Sellling Force From Miners

Not the Only One That Thinks So

This trader is not the only 1 that thinks Bitcoin is even now positioned to appreciate in the for a longer time run. Raoul Pal, CEO of Real Eyesight, commented last week on feedback from the Federal Reserve’s Jerome Powell on long run inflation:

“Most people today really don’t realize the latter but is simply just set, Powell has shown that there is ZERO tolerance for deflation so they will do Anything at all to prevent it, and that is fantastic for the two most difficult belongings – Gold and Bitcoin. Powell Would like inflation. I do not think he will get genuine desire drive inflation but he will get fiat devaluation, in conjunction with the other central banking companies all on the same mission.”

Other individuals that have shared bullish extended-term sentiments involve Arthur Hayes of BitMEX, Mike Novogratz, and Pantera’s Dan Morehead.

Relevant Studying: Here’s Why This Crypto CEO Thinks BTC Before long Hits $15,000

Highlighted Impression from Shutterstock

Price tags: xbtusd, btcusd, btcusdt

Charts TradingView.com

This Straightforward Chart Displays Why Bitcoin Stays Bullish on a Macro Scale