Ethereum could bounce towards $500 right after dropping from its $480 highs. The major cryptocurrency now trades for $380, obtaining been pressured lower by Bitcoin dropping, which by itself was catalyzed by weak point in legacy markets.

Related Reading: These 3 Traits Advise BTC Is Poised to Bounce Following $1,000 Fall

Ethereum Could Quickly Jump to $500

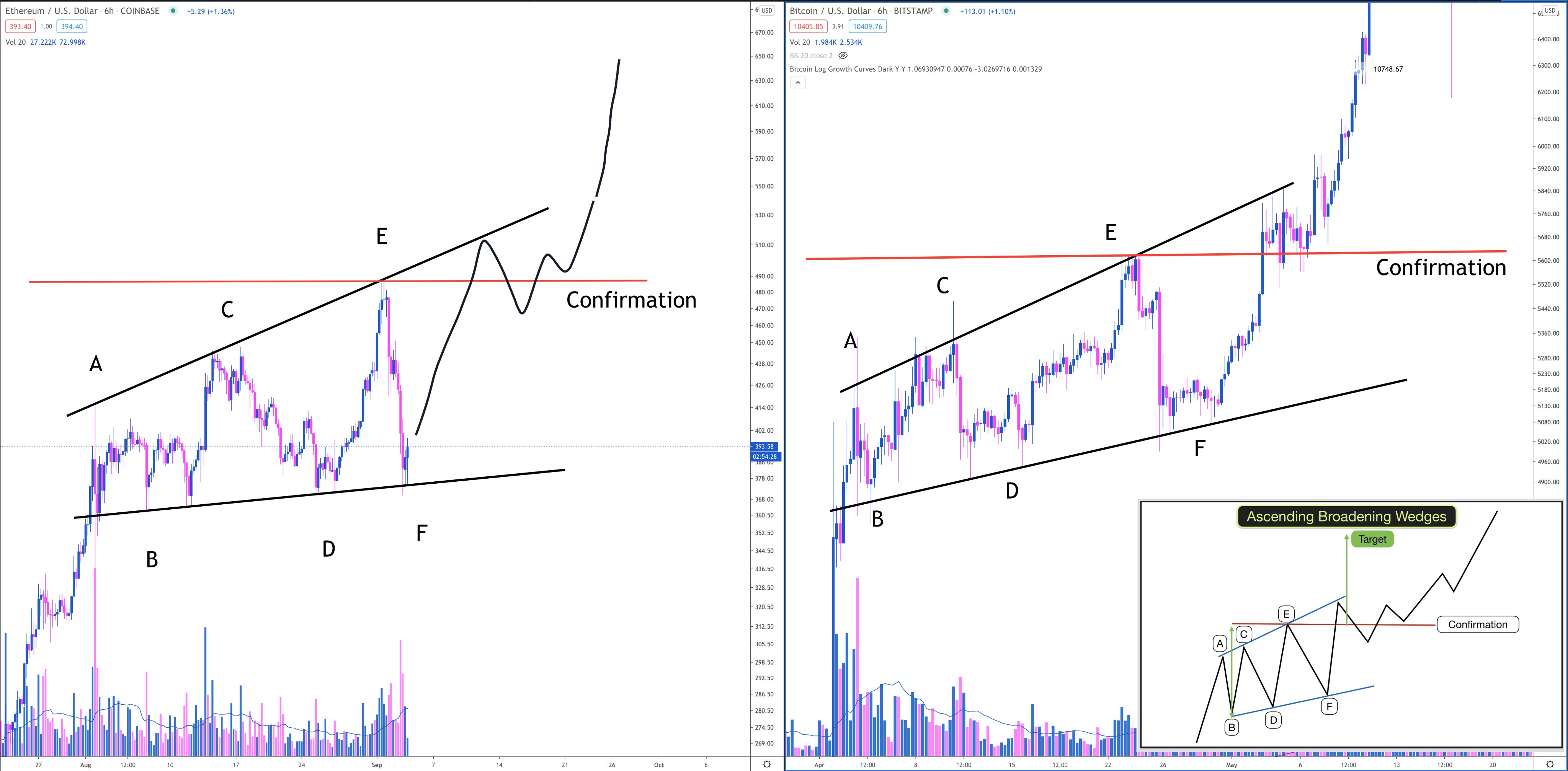

Just one trader thinks that Ethereum is currently trading in a textbook broadening wedge, which are generally bullish designs when they are ascending.

He shared the two charts below, which demonstrate that Ethereum is trading in a broadening wedge as Bitcoin did through the rally in April 2019. This fractal predicts that ETH will quickly bounce from its regional lows to the nearby highs, then to refreshing calendar year-to-date highs higher than $500.

Chart of ETH's cost motion over the previous couple of weeks when compared to Bitcoin's cost action in 2019 by crypto trader Polar Hhnt. Chart from TradingView.com

This sentiment is significantly diverse than that shared by just one traditionally precise trader who predicted Bitcoin’s 2018 lows six months in progress. This trader indicated that a fall in the direction of $300 might soon be experienced.

Connected Examining: There’s an “Unusual” Amount of Bitcoin Sellling Pressure From Miners

Elementary Danger in Substantial Transaction Costs

Ethereum may possibly confront a elementary threat to its rally, however: higher transaction expenses. Owing to rigorous congestion on the blockchain prompted by an uptick in decentralized finance adoption, the price tag of sending ETH and interacting with the blockchain in other techniques has achieved excessive ranges.

Simon Dedic of Blockfyre current commented on the matter:

“I spent like 800 USD in transactions fees for couple of trades right now. Moreover, I lost all-around 10k USD when trying to sell today, mainly because a tx with reduced nonce did not go via for 3h. $ETH 2. has to occur ASAP, otherwise I experience gloomy about its potential..”

There are remedies on their way, although.

Vitalik Buterin, the founder of Ethereum, recently commented that there are answers such as rollups or ETH2’s sharding technology:

“In a rollup-hefty ecosystem, on-chain gasoline expenses would continue being the similar, and 465 gwei may perhaps even develop into the norm, but most transactions would be going on inside rollups, where by true charges compensated by consumers would be hundreds of instances lower. The only remedy to high tx costs is scaling. Tether, Gitcoin and other applications are carrying out the proper thing by migrating to ZK rollups right now. I’m energized about the shortly-forthcoming optimistic rollups that will generalize rollup scaling to comprehensive EVM contracts.”

A quick thread on offer and demand from customers economics, and why particular „naive“ options to substantial gas prices is not going to do the job. pic.twitter.com/lmmyx0x8vL

— vitalik.eth (@VitalikButerin) September 2, 2020

Whether or not these remedies will occur in time to avert an Ethereum correction, nevertheless, continues to be to be found.

Connected Examining: Here’s Why This Crypto CEO Thinks BTC Quickly Hits $15,000

Highlighted Picture from Shutterstock Cost tags: ethusd, ethbtc Charts from TradingView.com This Eerie Fractal Predicts Ethereum Will Before long Trade At $500