Bitcoin has continued to flatline for the umpteenth week in a row. As of this article’s creating, the primary cryptocurrency trades just a handful of foundation details beneath $9,200. Even with the unpredictability of this market place, a cryptocurrency trader continues to be selected that a move larger is probable.

Related Examining: Crypto Tidbits: Twitter’s “Bitcoin Rip-off,” Elon Musk & Dogecoin, Institutions Want BTC & ETH

4 Symptoms Display Bitcoin Could Soon See a Move Better

According to a July 17th evaluation of the total current market capitalization of the crypto marketplace by trader Michaël van de Poppe, there are four indicators signaling upside:

- The evaluate is at this time buying and selling over the 100-day and 200-day simple shifting averages.

- The crypto market’s quantity, which is considerably representative of Bitcoin’s quantity, has witnessed “insane accumulation.”

- Quantity has not too long ago started to lower, suggesting a “big move” is coming up.

- We “took all the lows” as the crypto market has found restricted volatility more than recent weeks, meaning an “upwards break is additional most likely.”

Assessment of the full current market capitalization of the crypto market by trader Michaël van de Poppe (@CryptoMichnl on Twitter). Chart from TradingView.com

Van de Poppe is not the only a single that thinks Bitcoin will shortly shift increased.

Senior commodity analyst at Bloomberg Intelligence, Mike McGlone, a short while ago shared the next tweet, crafting:

Volatility really should proceed declining as Bitcoin extends its transition to the crypto equivalent of gold from a highly speculative asset, still we hope new compression to be settled by using increased charges.

#Bitcoin Blahs? Benchmark #Crypto Looked Related Right before Previous Gains —

Volatility really should keep on declining as Bitcoin extends its changeover to the crypto equal of gold from a hugely speculative asset, but we assume recent compression to be solved by way of bigger costs. pic.twitter.com/XbIMv5AYAf— Mike McGlone (@mikemcglone11) July 2, 2020

He added in a different analysis that Bitcoin should trade above $12,000 because of to a strengthening on-chain situation.

Investors Are Accumulating

Investors are seemingly responding to the expectations of upside by accumulating.

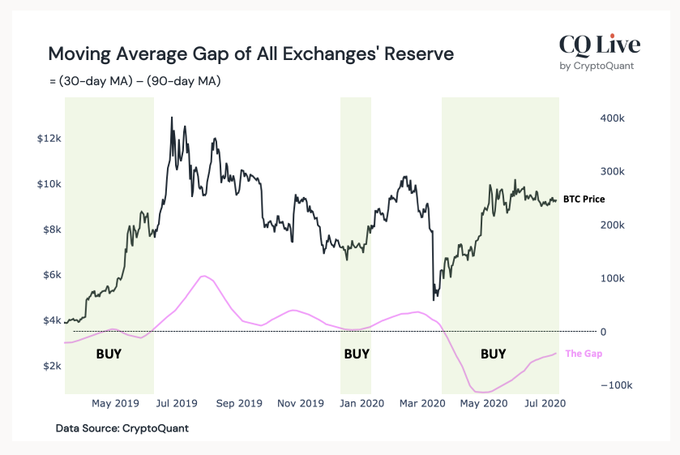

As claimed by NewsBTC formerly, exchange reserve info shared by Crypto Quant implies that Bitcoin is in a macro accumulation selection. As the data company’s CEO stated in regards to the chart down below:

“We are in the #BTC accumulation section. The 30- and 90-working day relocating common gap of all exchanges’ reserve signifies the downside danger. It strike a document reduced in May perhaps this 12 months and is continue to below zero… Hunting at the history of Bitcoin given that 2015, we can see that whenever it touches zero or going damaging, the downside Risk decreases, this means the accumulation period.”

Chart of Bitcoin’s price tag motion furthermore the “gap of all exchanges’ reserve” from the CEO of CryptoQuant, Ki Younger Ju.

The existence of a solid accumulation mindset been corroborated by poll stats shared by the analyst “PlanB.” The analyst shared final 7 days that close to 3-quarters of Crypto Twitter is both HODLing or shopping for Bitcoin, even though only 13% are promoting.

Not to mention, facts suggests that the selection of addresses keeping at least a single BTC is frequently achieving new all-time highs. This arrives in spite of the March shakeout and the ongoing consolidation.

Related Examining: BTC Just Verified a Signal That Preceded Historic 5,000% Rallies

Highlighted Impression from Shutterstock Selling price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com These 4 Symptoms Recommend Bitcoin Is on the Verge of a Enormous Shift Better