Bitcoin took a solid dive through Wednesday’s investing session. The asset fell from the $12,075 highs of the working day prior to a nearby small all around $11,200, marking a 7% correction.

The top cryptocurrency stays in close proximity to the lows as buyers have nonetheless to phase in en-masse. There appears to be to be some uncertainty about the medium-term long term of BTC as the cost of gold flags seemingly thanks to the U.S. dollar bouncing.

Traders are responding in sort. Info indicates that BTC miners are liquidating some of their tokens, suggesting that they potentially see a much better move to the downside in the near long term.

It may possibly also be that miners may well have brought on the collapse, as on-chain info demonstrates that there ended up some solid miner outflows prior to the fall from $12,000.

Associated Examining: These 3 Traits Counsel BTC Is Poised to Bounce After $1,000 Fall

Bitcoin Miners Are Marketing Coins, On-Chain Details Reveals

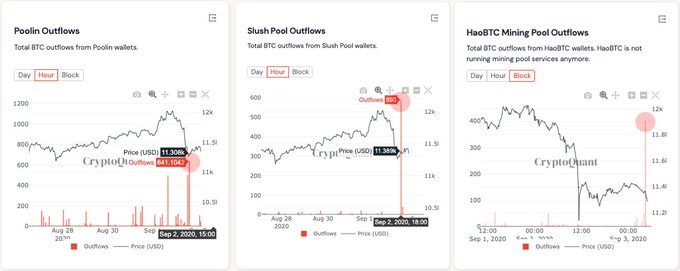

Bitcoin miners are liquidating their coins en-masse in accordance to details shared by CryptoQuant, a blockchain facts startup. The organization documented that ” #Poolin, #Slush, #HaoBTC have taken the bitcoins out of the mining wallets and sent some to the exchange.” The outflows of the past 24 hours collectively total to above 1,500 BTC.

It can be mentioned that in offering these coins, these miners are anticipating a transfer to the draw back.

Chart of BTC's new rate motion with the outflows from miner pools shared by cryptocurrency and blockchain analytics firm CryptoQuant.

This statistic arrives as other on-chain information outlets have described that the quantity of inactive Bitcoin on the blockchain has started to raise.

This means that more time-time period holders are setting up to go their cash, seemingly to start the liquidation of that BTC for fiat or for other cryptocurrencies.

Bitcoin going from “HODLer” wallets is not specifically bearish, although. This exact same craze was witnessed at the start off of the past bull operate that brought BTC from ~$500 to $20,000.

Relevant Examining: Here’s Why This Crypto CEO Thinks BTC Before long Hits $15,000

Extensive-Term Uptrend Remains Intact: Analysts

Even though miners may be liquidating their cash seemingly in anticipation of a transfer to the draw back, analysts continue being optimistic.

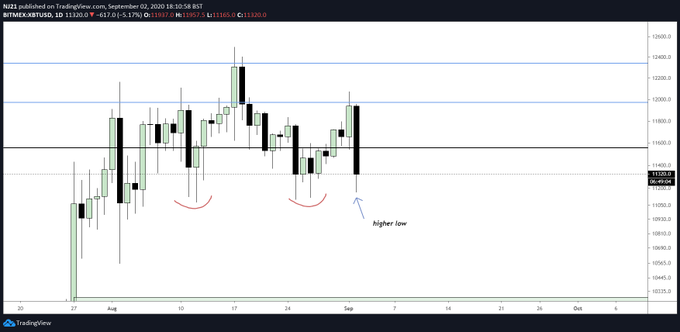

On a limited-phrase time body, sentiment is bullish since Bitcoin’s sector construction technically stays bullish. A person trader shared the chart noticed below, for instance, which displays that the uptrend is intact.

Chart of BTC's cost motion over the earlier couple of weeks with an analysis by crypto trader TraderNJ (@TraderNK1 on Twitter). Chart from TradingView.com

On a for a longer period-time period foundation, quite a few take note that macro fundamentals remain in favor of BTC’s advancement. Raoul Pal, for instance, noted that Jerome Powell’s speech about monetary plan in conditions of the Federal Reserve implies the coin will value 50-100x in the coming a long time.

Photograph by Artur Stanulevich on Unsplash

Price tags: xbtusd, btcusd, btcusdt

Charts from TradingView.com

You can find an "Unconventional" Amount of money of Bitcoin Sellling Pressure From Miners