As the DeFi ecosystem begins to gain pace and catch the interest of an ever-increasing amount of traders and investors, it’s the aggregator platforms that are winning a lot of the plaudits and consumers.

We have seen jobs including Autofarm, Beefy Finance, and Pancake Bunny welcome countless dollars in complete Worth Locked (TVL), thanks to the manner in which they’ve forged partnerships with different DeFi farms, like Venus, Belt, and BZX.

With these endeavors paving the way and generating a prosperous early space for information aggregation platforms, the opportunity is ripe for a single platform to overshadow all of them and create a ship that nobody will want to jump from. Introducing TheForce.Trade, who are also developing cross-functional services between DeFi and NFTs. The current rise of NFTs and DeFi has occurred simultaneously, so there’s some logic for this synergy.

So, how exactly do we intend to innovate and cement their place in this emerging business?

Firstly, what is the platform planning to perform?

- Aggregate yield farming and NFT information to a large scale

- Leverage customisable smart contracts to simplify DeFi and NFT investing

- Gather and gather information on different mining pools and investments

- Current information in an easily digestible way

What’s TheForce.Trade necessary right now?

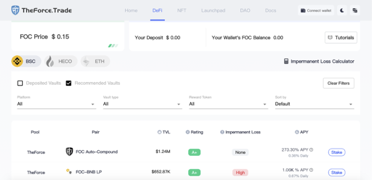

- DeFi investors may find themselves in countless pools and jobs across many different platforms and discover that it’s challenging or time-consuming to simultaneously track their yields, coin prices, APRs and more

- Automation brings all of this data into a centralised platform, providing real-time Details on yield farming and NFTs, whilst also presenting information to help mitigate risk

What will TheForce.Trade do that their competitors don’t?

- Break into the NFT area to provide NFT drops, NFT farming, and NFT monitoring

- Give out puzzle prizes and open up the platform for lending as well as yield farming

- Create non-financial incentives to hold the FOC governance token

- Operate main market financing and construct funding pools to prosper as an independent ecosystem that can encourage other startups

- Offer zero-fee auto-compounding for yield farmers — the sole platform to do so

- It will not be required to lock in the FOC token to use the DeFi tools and solutions

- The FOC token will be used to Buy NFTs and in-game items

- TheForce.Trade will also leverage the talents and tools from countless strategic partners, including:

- AutoFarm.Network — Merely a BSC yield farming aggregator with no NFT services. Offers yield farming using very reduced costs and auto-compounding, with fees already included in the offered APRs and APYs. There is also a DeFi swap feature

- Beefy Finance — Very like AutoFarm, however with less functionality and transparency (no data crashes ) without a swap attributes

- Bunny — Backed from Pancakeswap, where most DeFi swaps are taking place, Bunny gets the benefit of auto-compounding profits straight into a CAKE pool having maximized yields and greater levels of security. They are also developing an innovative BSC-ETH cross-chain. Currently the largest yield farming aggregator and rival

Despite the fast growth and noteworthy achievement of these platforms, they have not quite captured as much interest as they had hoped. TheForce.Trade, after being chosen by CoinMarketCap for an airdrop scheme and as a promising pick for the long run, has already gathered over 57,000 Telegram followers (and over 60,000 on Twitter) prior to the platform has formally launched. The interest and excitement are overpowering. But why?

Working with all the DeFi community to cultivate a fascination with aggregation tools.

Aggregation offers a Enormous opportunity in this emerging market

Insurance comparison sites use the technology to offer the best deals to their visitors. News agencies take action to make broader coverage of tales. Banks and financial institutions take action to be as competitive as possible. Amazon does it to offer more products than anybody else.

In the emerging DeFi area, aggregation is going to be powerful, as well as, no information aggregator has really solidified its standing as the number one alternative, keeping the marketplace innovative and competitive, but also massively volatile, with opportunistic novices doing carpet pulls and conducting scams. Over the next year or so, many expect to see a Binance Smart Chain aggregator really push out in the front of this pack, but as of yet, it’s not obvious which endeavor that will be. This feeling of chance can be a great incentive for jobs such as TheForce.Trade and other up-and-coming aggregator platforms.

A Exceptional platform for a Vast Array of users

TheForce.Trade aims to catch a wider part of the market than its competitors by enabling various yield farming approaches on the same platform. Where many of their competitors ask for 4% or 5 percent deposit charges, TheForce.Trade won’t. Where other platforms incentivise pool-hopping, TheForce.Trade will incentivise consumers to remain on the platform.

TheForce.Trade aims to construct a one-click subscription system, various portfolio viewing management tools, and auto-reinvestment Smart Contracts, all of which are targeted at yield farmers.

For NFT collectors and collectors, an NFT auction system and NFT staking will offer intriguing new chances in the DeFi ecosystem. On the other hand, TheForce.Trade will allow creators to tokenise their artwork, generate NFTs, and sell them. It seems that this platform may offer something for everybody.

It isn’t offered or intended to be used as tax, legal, investment, financial, or other information.