Other blockchains are being added to the growing decentralized finance (DeFi) market, which is currently dominated by Ethereum (ETH). What may come as a surprise to some is that Bitcoin (BTC) is included in this list.

Please continue reading to find out more about the developing Bitcoin DeFi ecosystem and the kind of returns you may anticipate to earn on your Bitcoin holdings.

DeFi on Bitcoin

Bitcoin-native DeFi apps are emerging that are powered by Bitcoin Layer 2 (L2) smart contract protocols, such as RootStock (RSK) or Stacks, and are secured by Bitcoin. Bitcoin-native DeFi apps aspire to provide next-generation financial services that are built on Bitcoin.

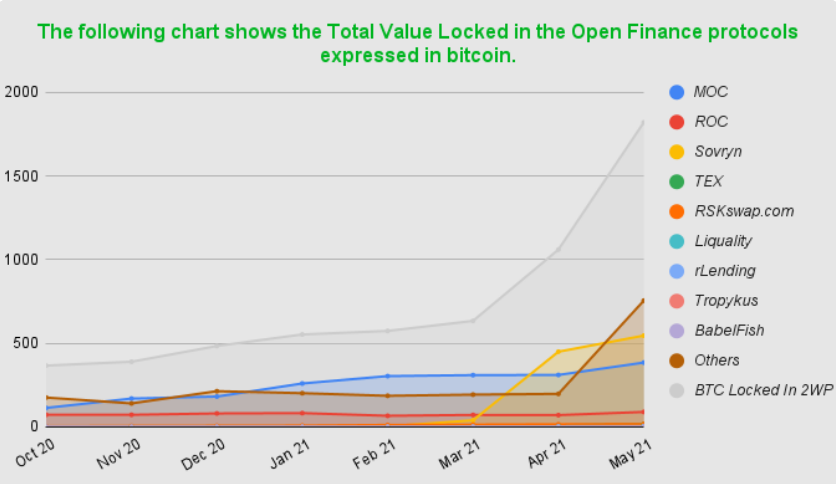

The market for decentralized Bitcoin-native yielding goods is growing, despite the fact that the Bitcoin-native DeFi market is still modest compared to what’s offered on Ethereum, Binance Smart Chain, and other major DeFi destinations.

Current prominent use cases in the Bitcoin DeFi market include lending, trading, stakeholding, and stablecoins, which are all based on the Bitcoin blockchain.

Bitcoin-native DeFi apps to check out

Consider some of the main Bitcoin DeFi platforms, as well as the decentralized products and services that they are currently offering, before continuing on.

Sovryn

Sovryn is a decentralized bitcoin trading and lending platform that operates on the Ethereum blockchain. Sovryn is a permissionless, non-custodial platform that makes use of smart contracts to provide Bitcoin borrowing, lending, yield farming, and margin trading.

A variety of advantages over tokenized Bitcoin on Ethereum, such as improved storage handling and data structure, as well as lower transaction fees, are provided by Sovryn, which is constructed on top of RSK.

Sovryn allows you to earn money by lending bitcoins to borrowers and margin traders, and you can utilize it to do so. Furthermore, it is possible to trade bitcoin for USD stablecoins as well. Other features available on Sovryn include automated market maker (AMM) pools, yield farming, and a variety of other options.

Money on Chain

It provides a bitcoin-collateralized stablecoin, an interest-bearing digital asset for BTC token holders, and a decentralized leverage exchange, all of which are powered by blockchain technology.

Money on Chain aims to address the issue of bitcoin volatility while also reducing the counterparty risks associated with other stablecoins, such as those that rely on traditional bank accounts or less developed decentralized networks. Money on Chain is currently in beta testing.

Money On Chain leverages Bitcoin as collateral for the stablecoin in order to achieve this goal. RSK smart contracts secure the collateral, which is not stored in a third-party bank account but is instead provided as a token that is 1:1 in value to bitcoin.

In order to operate, Money On Chain requires the use of four tokens: Dollar on Chain (DOC), a stablecoin with a USD price pegged to it, the BitPro token (BPro), a token that allows Bitcoin holders to earn interest on their bitcoin while also gaining free leverage and the BTCx, which represents a leveraged long bitcoin position. The system also includes the Money on Chain (MOC) token, which serves as the governance token for the platform.

Atomic Finance

Using a covered call strategy driven by DLCs, Atomic Finance allows bitcoin holders to create yield on their bitcoin while maintaining custody of their bitcoin (Discreet Log Contracts). A covered call is a strategy in which you retain a token while concurrently selling a call position on the token, with the option premium serving as your yield generator.

Discreet Log Contracts enable non-custodial speculation to take place directly on top of the Bitcoin network through the use of a private key. Because it combines the security of Bitcoin with the greater flexibility of smart contracts, the system is able to deliver non-custodial yields through financial derivatives such as call and put options.

The protocol is now in beta testing, with additional improvements scheduled for release in the near future.

AlexGo

AlexGo is a decentralized finance protocol based on Bitcoin that operates on the Stacks blockchain. It is open-source and free to use. By connecting to Bitcoin, Stacks makes it possible for smart contracts and digital assets to benefit from the security, capital, and network capabilities of the cryptocurrency.

To borrow bitcoin at variable rates, lend your bitcoin and earn interest, maximize earnings with long Bitcoin holdings, and manage risk with short Bitcoin positions, you should be able to use AlexGo.

Remember that AlexGo is still developing their testnet, which is vital to keep in mind.

DeFiChain

A decentralized system, DeFiChain, which is powered by the Bitcoin network, provides financial services to its users. The system is based on a hybrid proof-of-stake (PoS)/proof-of-work (PoW) mechanism, and it is tethered to the Bitcoin blockchain through the Merkle root, which provides an additional layer of security to the network.

Furthermore, you can borrow and lend using the platform’s native token, DFI, through collateralized systems, wrap tokens, tokenize assets, swap on their decentralized exchange, and perform a variety of other functions.

At the time of writing, DeFiChain had more than USD 800 million in smart contracts locked away.

Tropykus Finance

Tropykus Finance is a decentralized finance protocol that aims to connect Bitcoin (BTC) investors with decentralized finance (DeFi) opportunities in emerging areas, including Latin America.

The protocol makes use of RSK smart contracts to provide decentralized lending and credit products that you can profit from by earning interest on your loan or credit.

Other Bitcoin-native DeFi apps you can check out include Defiant and rLending.

What are the yields like in Bitcoin DeFi?

Bitcoin hodlers can earn above-average yields on both CeFi (centralized finance) and DeFi lending platforms, which are operating at a time when traditional lenders are paying historically low interest rates to customers.

Take, for example, Gemini Earn, which operates on the lower end of the yield spectrum and lets you to earn up to 1.49 percent APY (annual percentage yield) on your Bitcoin. Bitcoin deposits made through BlockFi, on the other hand, earn up to 5 percent annual percentage yield (APY).

As far as Bitcoin DeFi is concerned, the following are some predicted returns derived from the websites of the dapps at the time of publication.

| Tropykus Finance

|

|

| Sovryn

|

|

| Money on Chain

|

|

Securing decentralized finance protocols using Bitcoin may result in a more stable decentralized finance landscape, which has been plagued by insecure infrastructure for a long time now.

It remains to be seen whether the „DeFi degens,“ who are overwhelmingly Ethereum supporters, will make the switch to Bitcoin.

Perhaps if the yields are sufficient to justify the investment.