Whilst legacy marketplaces and Bitcoin have rejected from community highs, Ethereum has been keeping up very well. Considering that the launch of Uniswap’s UNI token, the value of the top cryptocurrency has surged all-around 6-7%.

From the lows set previously this month, the coin is up in surplus of 20%, shocking some commentators who thought this market place was on the verge of a bear trend.

Ethereum is primed to shift even larger in the days ahead.

Linked Reading: Here’s Why This Crypto CEO Thinks BTC Before long Hits $15,000

Ethereum Could Shortly Shift Even Greater Following Bounce From Lows

Ethereum is primed to continue on its ascent in the times ahead as on-chain studies favor bulls, blockchain analytics company Santiment claimed on September 17th.

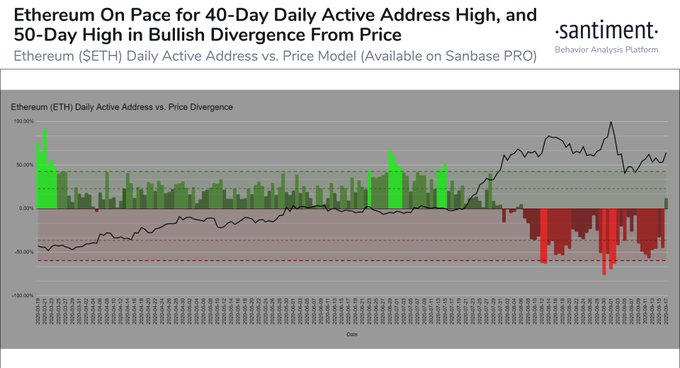

In accordance to their data, there is a divergence forming in between ETH’s rate action and the daily energetic handle count on the Ethereum network. The past time this sort of a divergence was viewed was prior to a powerful 20% uptrend in August/Early-September. This is also the first positive divergence considering that August, suggesting that bulls could before long reassert regulate above ETH’s value motion:

“$ETH has divided from $BTC on a bullish Thursday, as our DAA Divergence Product signifies it has space for additional development on a refreshing +7% selling price surge. On the working day, #Ethereum is on rate for 456k lively addresses, which would be its best output considering the fact that 8/8.”

Chart of ETH's rate motion more than the earlier few months with evaluation of Ethereum's each day energetic addresses (and its divergence to price) by crypto and blockchain details organization Santiment (@SantimentFeed on Twitter).

Associated Reading through: This European Crypto Exchange Was Just Hacked for $5 Million

Fundamentals Still Good for the Coin

ETH’s extended-expression fundamentals keep on being in a good state regardless of the latest price motion.

Chris Burniske, a partner at Placeholder Funds, not too long ago commented on Ethereum’s prospective buyers in this industry cycle:

“Meanwhile, to the mainstream $ETH will be the new kid on the block — be expecting a frenzy to go with that realization. Provided $ETH’s outperformance of $BTC about its life time (chart under again), not to mention smaller network value and solid on-chain economies, I see each and every motive for $ETHBTC to surpass ATHs.”

This was echoed by Joseph Todaro of Blocktown Cash.

He mentioned that DeFi will do extra to drive Ethereum bigger than ICOs very last cycle:

“In 2017 ICOs aided in relocating ETH beyond $100 billion marketcap. In this future cycle, Defi will possible assist press ETH to $1 trillion marketcap.”

Ethereum may operate into shorter-time period issues, even though, with transaction expenses hitting noteworthy highs.

Related Studying: It’s “Logical” for Ethereum To Reject At Current Prices: Here’s Why

Highlighted Image from Shutterstock

Cost tags: ethusd, ethbtc

Charts from TradingView.com

The Vital Rationale Why Ethereum Could Go Even Increased Soon after 20% Bounce