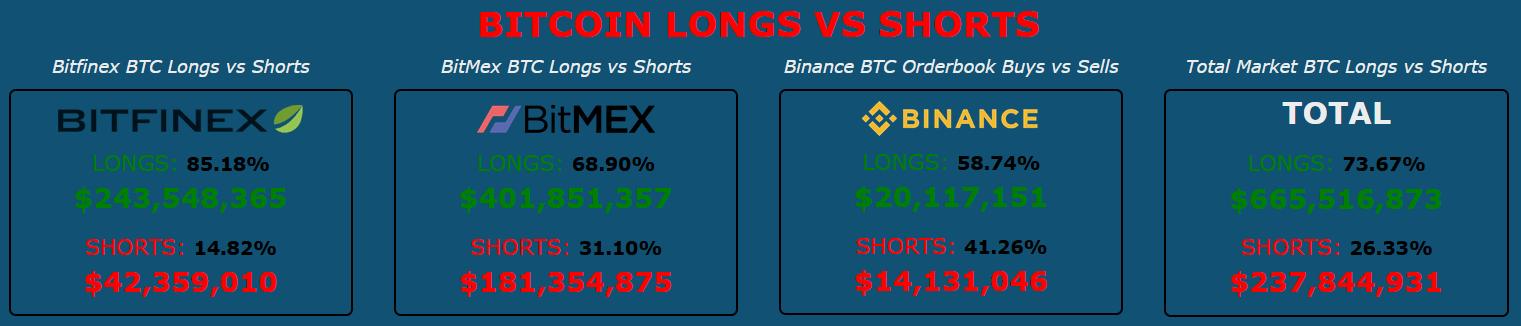

At present, Bitcoin traders are overall internet very long. But chat of a second wave has reminiscences of March’s flash crash contemporary on the intellect.

Source: blockchainwhispers.com

The European Centre for Condition Avoidance and Command has issued a stark discover around the rise in infection fees. As a end result, during Europe, authorities are taking into consideration the chance of a next lockdown.

With that, some analysts and business observers are warning that a sudden marketplace crash could be on the playing cards in the around expression.

Rich Father, Very poor Father creator, Robert Kiyosaki, believes a current market crash is imminent. In a modern tweet, he drew notice to the fundamental dilemma of crippling US financial debt.

In spite of his pessimism, he even now maintains the check out that extended term, the anti-fiats will appear out on leading.

What takes place when vaccine is tested? Gold silver Bitcoin will CRASH. Getting prospect. Genuine difficulty NOT Pandemic. Serious challenge substantial US credit card debt. US Bankrupt. $28 T balance sheet debt. $120 T off equilibrium sheet social obligations. Gold silver Bitcoin very best investments prolonged phrase.

— therealkiyosaki (@theRealKiyosaki) September 15, 2020

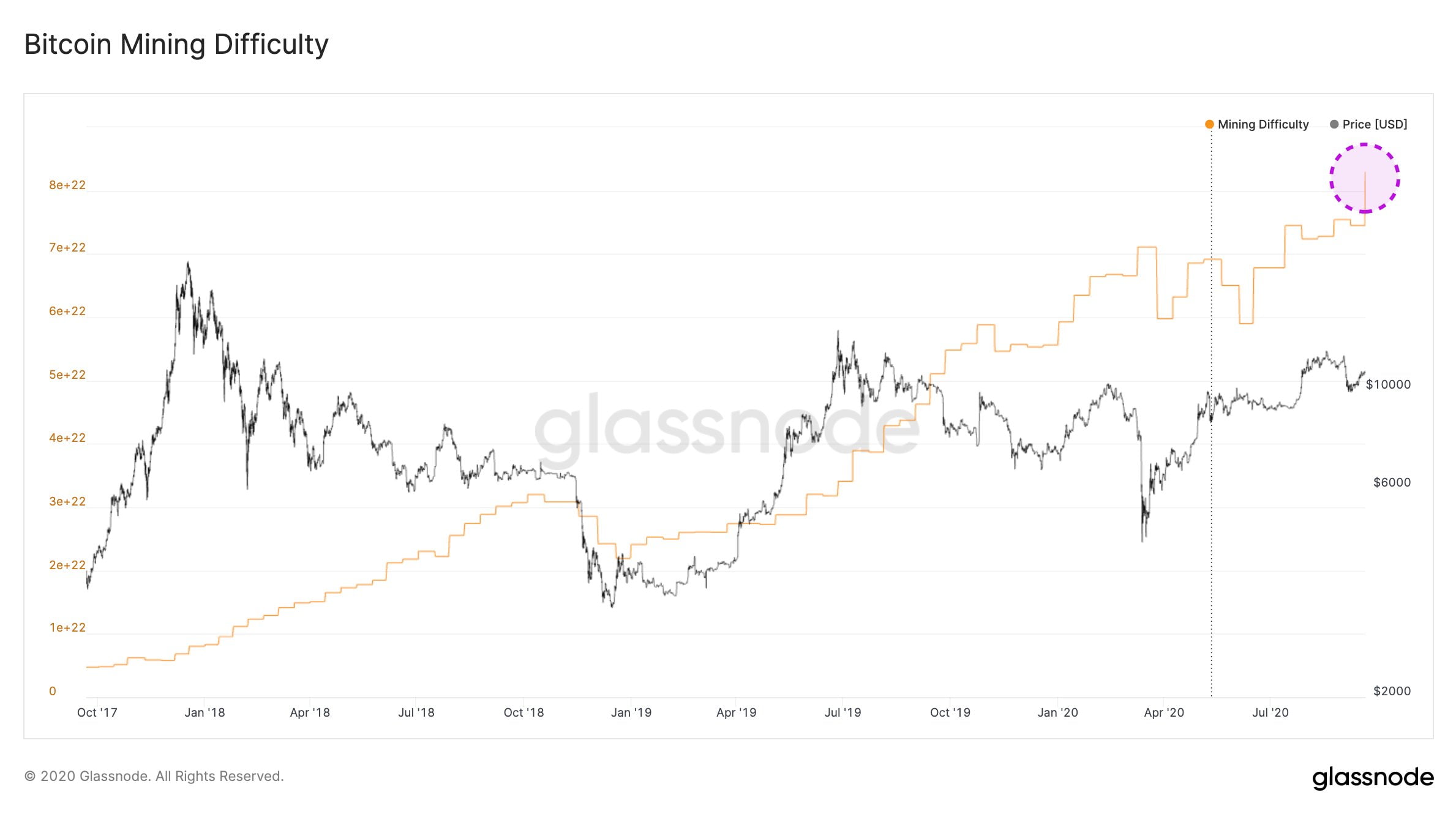

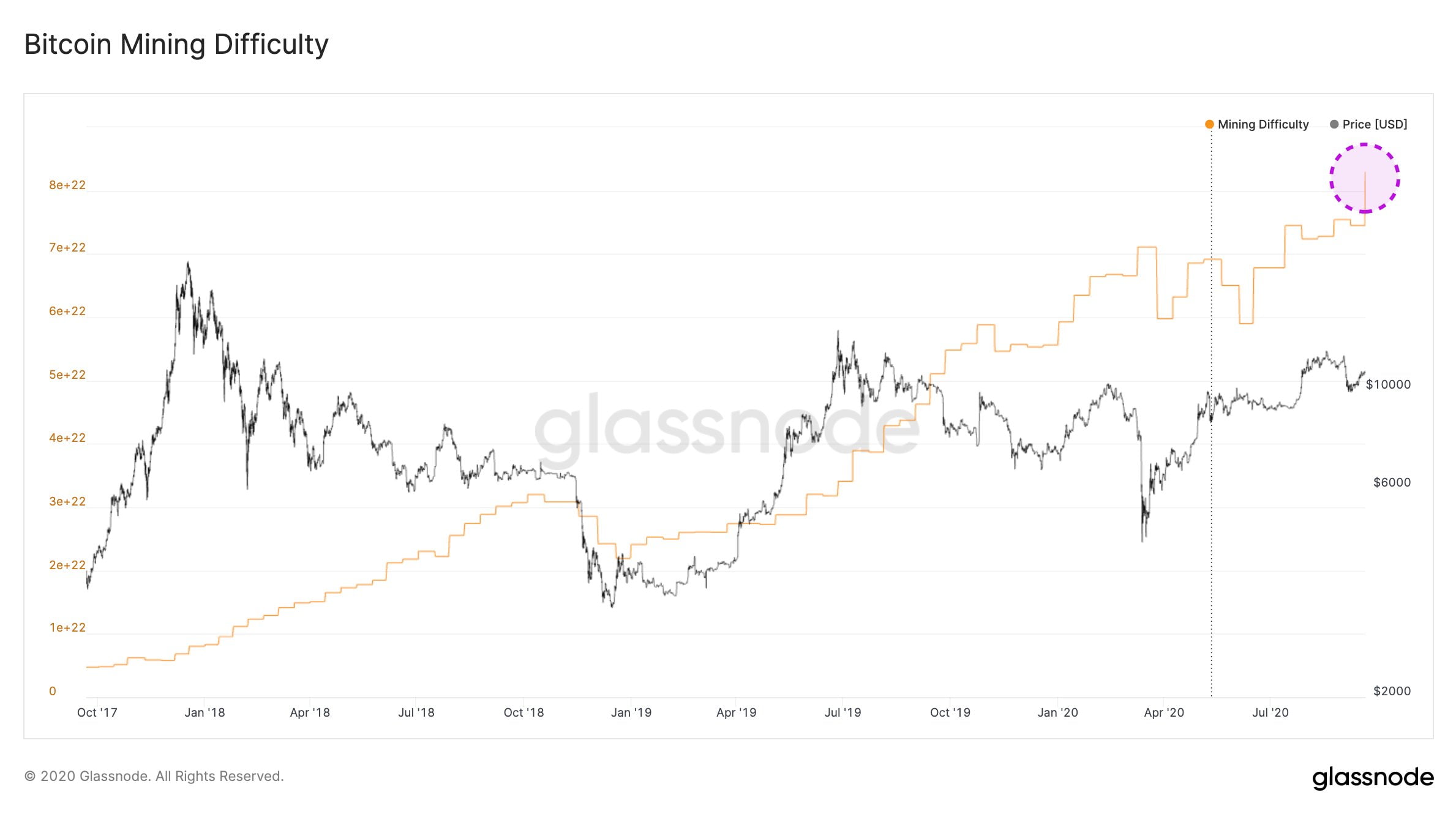

This is a perspective shared by Bitcoin miners. Irrespective of the uncertain macro image, it has never ever been as complicated, as it is now, to mine Bitcoin.

The latest details exhibits Bitcoin mining problem attained a new all-time significant yesterday. This signifies a 47% maximize since the start of the calendar year.

Supply: twitter.com

As these, in spite of Bitcoin’s failure to shut higher than $11k, miners show up unfazed by possibly close to phrase rate action or talk of a second wave.

Bitcoin daily chart with volume. (Source: BTCUSDT on tradingview.com)

Bitcoin Mining Issue Enhance Indicates Bullish Sentiment

Despite the fact that May’s halving looks like a very long time in the past, the speedy impact of it observed mining problem drop as scores of miners have been not able to sustain lucrative operations.

Chopping rewards in half was adequate to travel modest miners, with inefficient devices and/or superior costs, out of the mining activity.

Some believed the mining exodus would set off a loss of life spiral for the price of Bitcoin. At the time, Zach Resnick, Partner at VC business Unbound Funds, painted a photo of woe from the drop off in mining problems. He summarized it as follows:

“As the halving cuts the block reward, a significant amount of miners will go away the community. As the network hash amount drops, the block time increases, the community results in being congested. This, in change, tends to make Bitcoin a lot less beautiful, as individuals do not want to wait endlessly to have their transactions processed. This leads to the Bitcoin rate slipping, which pushes more miners off the grid. This course of action repeats alone till the network dies.”

With yesterday’s bounce in mining trouble, more miners than at any time right before are doing work to protected the Bitcoin community. This decisively places paid out to any idea of a mining death spiral as a outcome of the halving.

What is more, historical information exhibits there is a diploma of positive correlation involving Bitcoin mining issue/hash amount and the BTC rate.

On the other hand, irrespective of miner’s optimism, the bigger photo can’t be dismissed fully. As this kind of, the longs really should carry on with warning.