This weekly roundup of news from Mainland China, Taiwan, and Hong Kong attempts to curate the industry’s most important news, including influential projects, changes in the regulatory landscape, and enterprise blockchain integrations.

Victory for the regulators

Chinese authorities have declared victory in their efforts to remove illegal cryptocurrency trading activities in the country, following a tumultuous summer of raids and raids on cryptocurrency exchanges.

The People’s Bank of China’s „China Financial Stability Report 2021,“ which was released on September 3 by the central bank, contained this revelation in the forecast section.

With regard to internet asset management, equity-based crowdfunding, internet insurance, virtual currency trading, online foreign exchange trading, and other areas, the section titled Major Achievements in the Battle to Prevent and Defuse Major Financial Risks highlights that regulatory work in these and other areas has been completed to a large extent.

In spite of the fact that this appears to be a big blow for the company, the majority of projects and enterprises in China are now breathing a sigh of relief in response to the decision. Businesses will be able to operate with a little more freedom and without fear of legal ramifications in the future as a result of the conclusion of the crackdown.

The public blockchain sector in China, or at least what’s left of it, will no longer be compelled to operate in the shadows, as was the case previously. There is also hope that future editions of Shanghai Man’s articles will feature more discussion of growth and innovation, and less discussion of crackdowns and repression, as he has done in the past.

Regulatory actions have primarily harmed the mining industry, but exchanges and brokers are obviously migrating away from China in the long run as a result of these actions. Players such as ByBit and Amber have already declared that they do not allow Chinese users, and if the risks associated with doing business in China do not outweigh the benefits, this might become a trend in the future. For the time being, larger firms like as Binance and FTX are not avoiding onboarding and servicing Chinese consumers, despite the fact that their future decisions will be far more critical.

From Sichuan to San Antonio

Following the cessation of crypto mining operations in China, a large number of prominent mining corporations began looking for greener pastures outside of the country. The announcement by Texas governor Greg Abbot that the state will become „a crypto leader“ prompted numerous bitcoin mining companies to relocate to the Lone Star state in search of more consistent regulatory environments.

It’s happening!

Texas will be the crypto leader.

Cryptocurrency is now coming to Texas grocery stores.

H-E-B is putting cryptocurrency kiosks into some Texas grocery stores.#cryptocurrency @HEB https://t.co/e4CNsSbd0s via @chron

— Greg Abbott (@GregAbbott_TX) June 19, 2021

Bitmain, the world’s largest bitcoin mining equipment manufacturer, has a factory in Rockdale, Texas, where it manufactures bitcoin mining equipment and supplies. Although Rockdale is only a little village of less than 6,000 people, it is a far cry from the 21 million people who reside in Beijing, where the company’s headquarters are located. Additional hardware worth $62 million is being shipped to the state of Georgia by Bitmain Technologies Inc.

As part of its expansion into the United States, BIT Mining (headquartered in Shenzhen) has committed $26 million to the development of a data center in Texas.

A new mining company has joined the ranks of companies like BlockCap, Riot Blockchain, and other mining companies that have already made a name for themselves in the region. In light of the passage of Texas House Bills 4474 and 1576, which legitimize cryptocurrencies under commercial standards, it is predicted that the expansion of all of these businesses, as well as those of others, would accelerate.

Dallas, TX (March 19, 2019) – Texas has joined a growing list of states in the United States that have recognized the legal status of digital assets, offering certainty to investors and businesses that has been sorely lacking in China in recent years. According to the Financial Times, numerous regulatory authorities in China have reversed course on the legal status of cryptocurrencies as recently as this summer. As a result, there is less confidence in the long-term viability of the Chinese market, which should drive even more companies to expand their operations outside.

One country, two regulators

According to a top official at Hong Kong’s Securities and Futures Commission, the recent surge in the number of fraud cases demonstrates the necessity for more strict regulation in the financial industry. FTX and Bitfinex, as well as other Fintech companies have been able to establish themselves in the special administrative zone because of the region’s more lenient position on virtual currencies.

For many years, Hong Kong was considered as a vital link between foreign corporations and the burgeoning Chinese market. However, in recent years, perceptions of the city have begun to change in the opposite direction. In part as a result of harsher rules and increasing uncertainty in Hong Kong, the cryptocurrency business is booming in the city-state of Singapore, with a number of high-profile individuals establishing permanent residence in the city-state.

Non-fungible trends

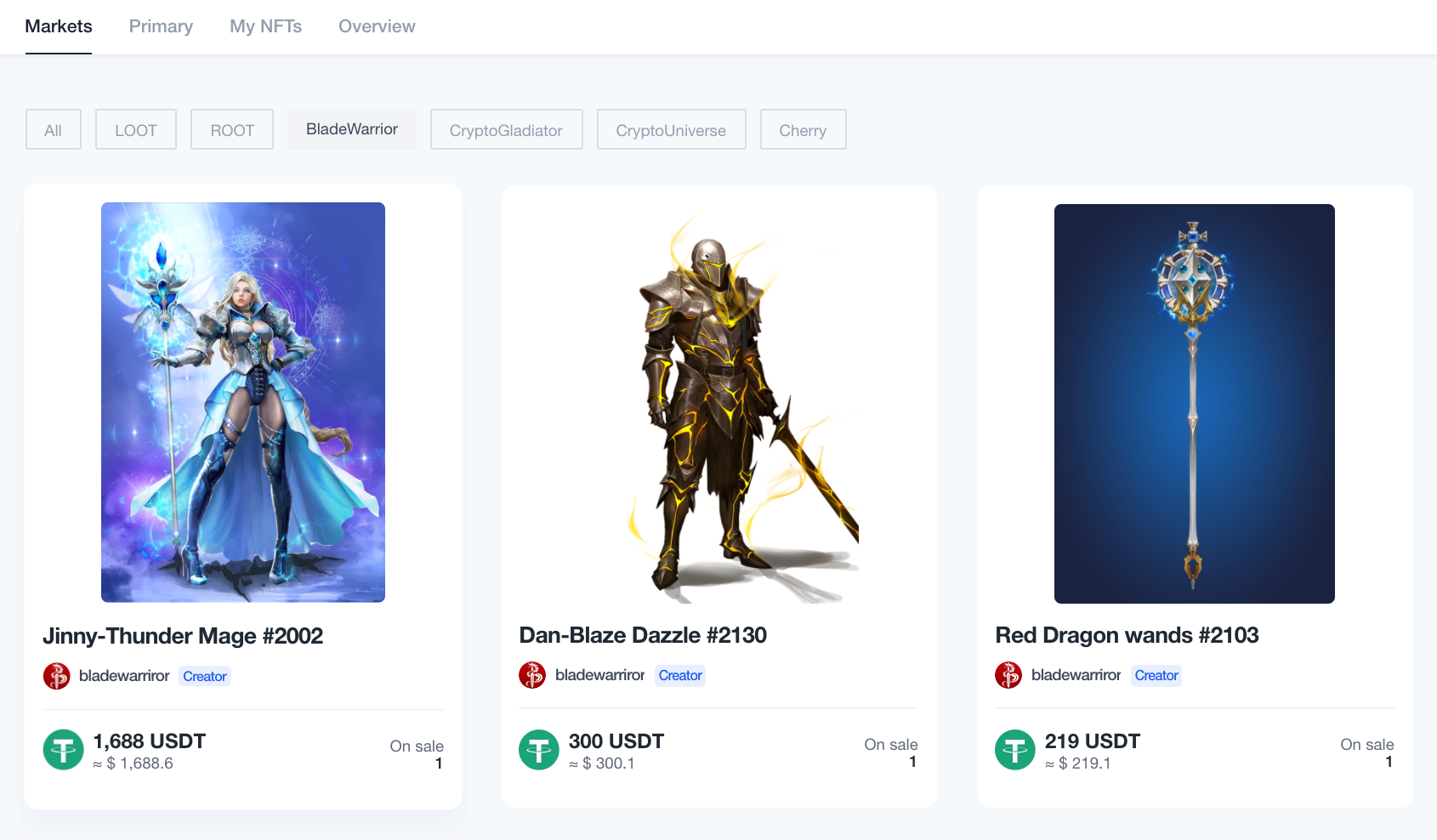

It is still possible to find non-fossil fuel products on the Chinese market, as long as the general trend toward them is maintained. On September 2, OKExChain announced the debut of its OKExNFT marketplace, joining the ranks of other cryptocurrency exchanges such as Binance and FTX, who have already created platforms of a similar design.

The fact that it hosts a large number of NFTs that look like Loot and are branded as Root suggests that it is attempting to capture the NFT and GameFi sectors. While it may not have the most innovative naming team. The fact that China’s gaming and trading markets have historically been extremely active indicates that this is a logical move on their behalf in this regard. It remains to be seen whether OKExChain will be able to match the level of success achieved by other exchange sidechains.

When Steph Curry announced his choice to become an ambassador for FTX, it was met with mixed emotions, with some suggesting that the NBA star, who is well-known in China for his humorous demeanor, had matured and become a successful businessman.