To test a central bank digital currency (CBDC) in Bhutan, the Royal Monetary Authority of Bhutan has partnered with Ripple to develop a digital currency pilot program.

Ripple Labs announced on Wednesday that Bhutan’s central bank would use the company’s private ledger to issue and administer a digital ngultrum, which is a type of cryptocurrency.

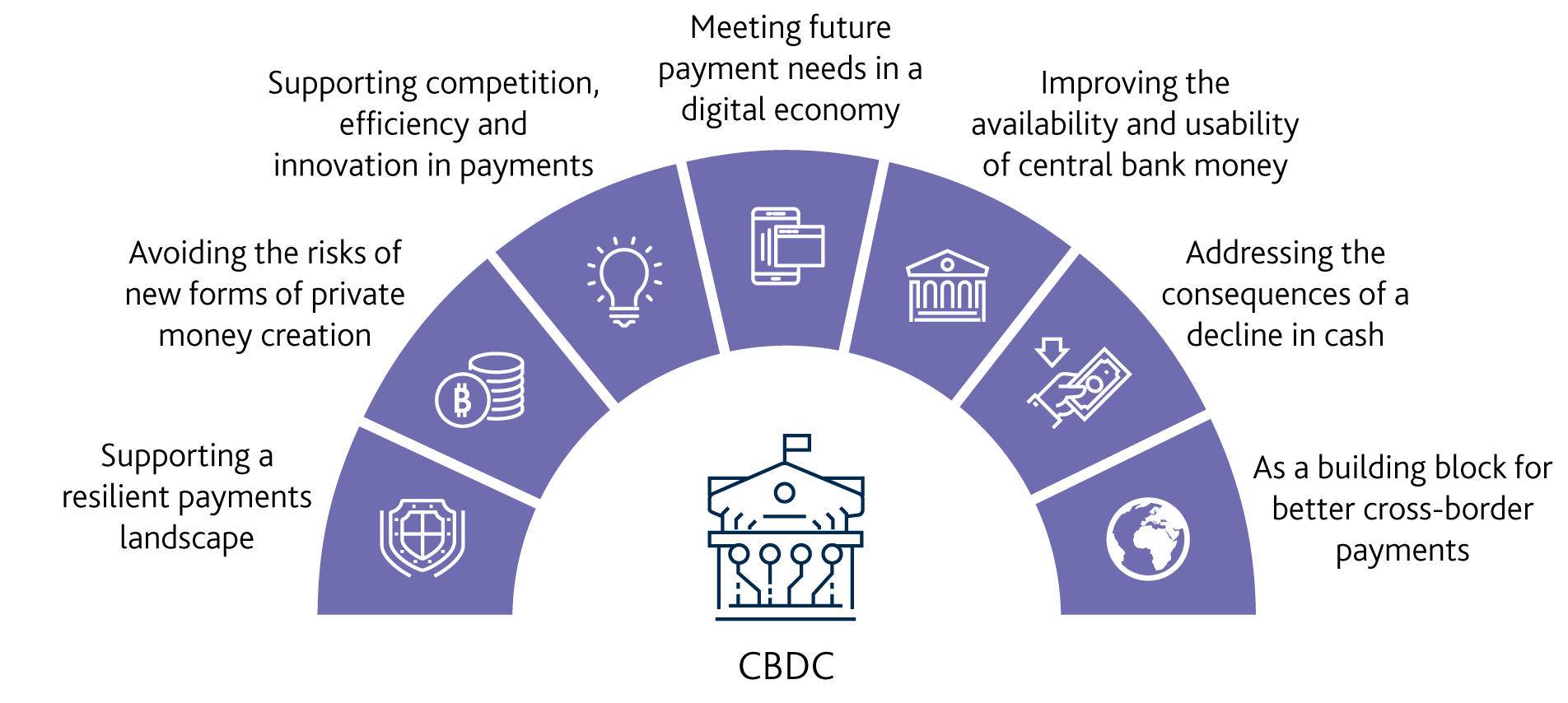

In the words of Ripple, the decision was driven by the Royal Monetary Authority’s (RMA’s) efforts to facilitate cross-border payments, boost financial inclusion for its inhabitants, and „stretch its commitment to sustainability as the only carbon-negative country in the world.“

Bhutan, which has a population of approximately 800,000 people, will have a gross domestic output of $2.5 billion in 2020.

However, despite the fact that hundreds of thousands of Bhutanese citizens have no access to a savings account or a credit card, numerous news agencies focus on the country’s „gross national happiness“ as an alternative to traditional banking.

Financial inclusion is expected to expand by 85 percent in the country by 2023, according to the Reserve Bank of Australia (RMA), which wants to make payments with a central bank digital currency, also known as CBDC, „easier, faster, and more inexpensive.“

Ripple explained that the CBDC solution is custom designed to manage payments at the volume of transactions necessary for a successful retail CBDC, in addition to providing anonymity.

“Central banks like as the RMA will benefit from this since it gives them with the security, control, and flexibility they require to implement a CBDC without jeopardizing financial stability or monetary policy objectives.”

The announcement comes more than six months after Ripple said that it would be piloting a private version of the XRP Ledger in order to give central banks with a solution to create a central bank digital currency (CBDC).

In fact, Bhutan is one of the first countries to take advantage of this opportunity.

Other CBDC (central bank digital currency) trials are continuing around the world, with Indian officials hinting that they will begin rolling out a digital rupee in December and Nigeria’s central bank announcing plans to establish a digital currency by the end of the decade.

China, on the other hand, appears to be the leader of the pack, having begun trials of its digital yuan in April 2020.

CBDC – Central Bank Digital Currency?

Is CBDC a Cryptocurrency?

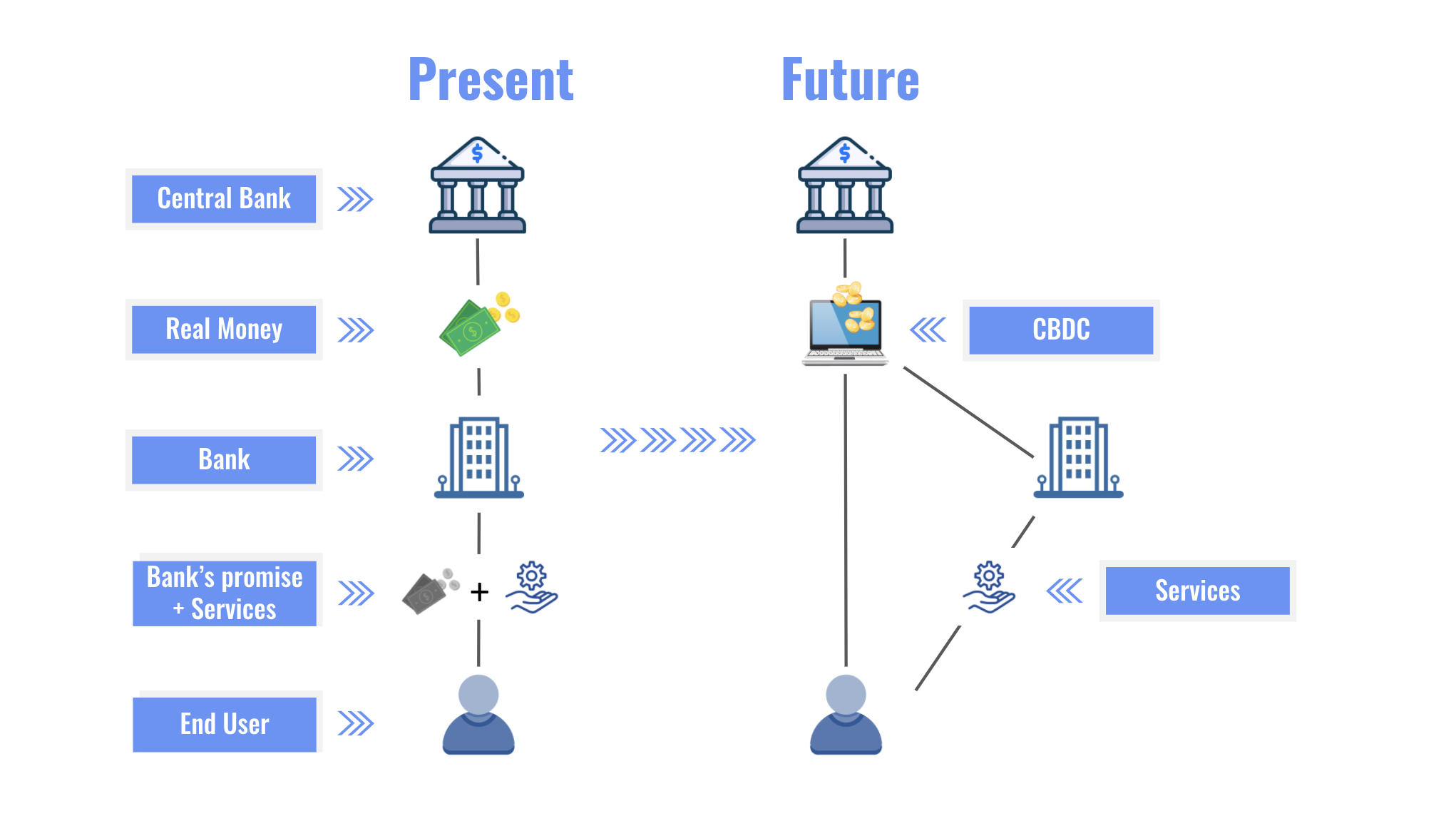

As cryptocurrencies and stablecoins have grown in popularity, the world’s central banks have realized that they must provide an alternative or risk missing out on the future of money.

What is digital currency and how does it work?

It can be converted into physical currency in some instances, for example, by withdrawing cash from an ATM.