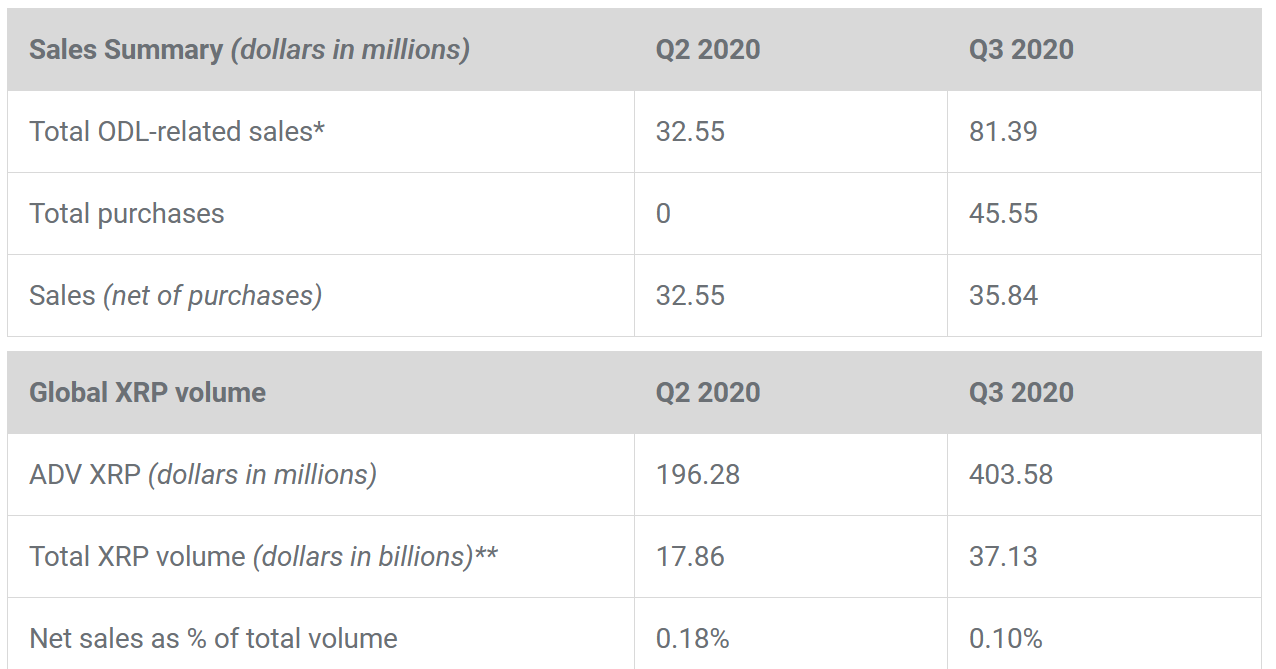

Ripple’s most current Q3 2020 report shows the firm manufactured On-Demand from customers Liquidity (ODL) profits of $81 million this quarter. By contrast, the earlier quarter had ODL profits of $33 million.

In addition, the Normal Everyday Volume (ADV) also confirmed a marked maximize. This quarter’s ADV is up 106% to $404 million bucks, primary to a complete XRP volume in Q3 2020 of $37 billion.

Resource: ripple.com

The reliable quarterly efficiency is satisfied with a new exercise in “total purchases”, which arrived to $46 million this quarter. It refers to Ripple acting as a purchaser of XRP in the secondary industry.

Ripple’s “Line of Credit” Boosts ODL Revenue

Very last quarter observed Ripple start a new beta company known as “Line of Credit”. Primarily, this lets ODL prospects to obtain XRP on credit score directly from Ripple.

The pondering behind “Line of Credit” is to increase XRP use for the needs of cross border payments.

“With Line of Credit history, consumers can purchase XRP from Ripple on credit rating which delivers capital upfront to support accelerate their organization general performance and scale. Line of Credit has been piloted by ODL buyers and the initial opinions is overwhelmingly favourable. Organizations can use the money to further more make investments in their company to enter new markets and get to new customers.”

The ODL payment service, formerly referred to as xRapid, uses XRP as a bridge amongst two fiat currencies. It is beneficial in excess of legacy payment techniques in that ODL consumers can keep cash in their preferred forex. As this sort of, transfers no more time involve fully funded accounts in all of the currencies dealt with.

By including credit to the blend, ODL buyers have additional overall flexibility over capital allocation.

Dependent on the 150% boost in ODL revenue, the “Line of Credit” beta company is a strike with ODL clients.

Ripple Shopping for XRP to Offset Issues of Oversupply

XRP dumping, also acknowledged as programmatic sales, was the subject matter of much stress within the XRP neighborhood. Adhering to a sustained bout of neighborhood strain, this practice ceased in Q4 2019.

The transform.org petition, led by @Crypto_Bitlord achieved its intention, of halting Ripple from dumping XRP, even without having reaching the 5,000 signature rely.

“Ripple continue dumping billions of XRP on us, crashing the selling price! Its incredible this sort of conduct is widely approved in the crypto world. Guaranteed we know that XRP is a sound coin with significant probable but this desires to prevent!”

Quite a few in the local community observed a direct correlation amongst Ripple “dumping” its month to month escrow produced XRP and the stagnant XRP selling price. The oversupply of XRP on exchanges was considered to be a contributing variable to very poor selling price general performance during that time period.

With the “Line of Credit” beta service, a identical problem, to do with oversupply, raises its head. On the other hand, this quarter has noticed Ripple actively intervening in the secondary market place, by acquiring XRP at marketplace prices, to lessen supply.

Q3 2020 demonstrates Ripple procured 46 million pounds really worth of XRP to “support nutritious markets”. While Q3 2020 report mentions this is to offset “Line of Credit” oversupply, it is also doable that Ripple is purchasing XRP to counter the legacy results of “XRP dumping”.

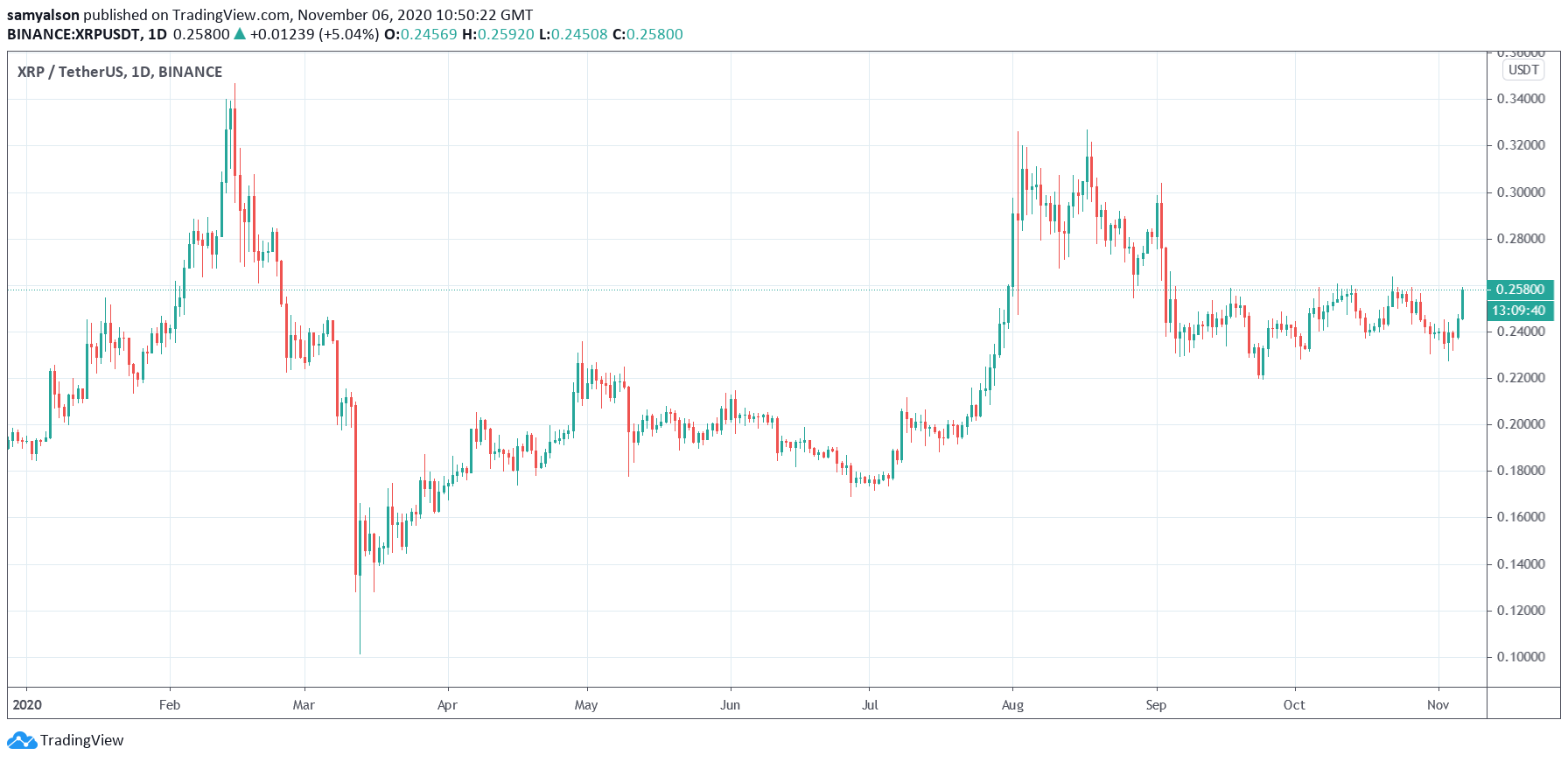

It’s been almost a year due to the fact Ripple stopped dumping its indigenous token, but the selling price of XRP carries on to stagnate relative to the general performance of key rivals.

Owning reported that, the past seven times has observed a 10% raise to $.2580.

Source: XRPUSDT on TradingView.com