The largest blockchain payment firm, Ripple claims that XRP is 1/10th as volatile as fiat for cross-border transactions. The firm published a detailed blog explaining the math behind this statement.

So far, Ripple has inked partnership deals with various banks and financial institutions – and has been working to boost the use-cases of XRP cryptocurrency among these entities. In fact, the CEO Brad Garlinghouse in his recent interview with Fox Business told how MoneyGram is leveraging the benefit of XRP’s use-cases in the form of speed & cost of transactions alongside leading the competitive market.

Volatility – XRP v/s Fiat

The blog published on October 31 detailed Garlinghouse’s statement who explained how XRP is eliminating pre-funding in today’s correspondent banking network. It elaborated MoneyGram is able to avoid several hundred million dollars every year in “pre-funded Nostro/Vostro accounts using XRP with On-Demand Liquidity on RippleNet”.

However, Garlinghouse explained whether a digital asset was too volatile for fiat payment flows;

“If you multiply 270,000 seconds [just over 3 days] in a low-volatility asset and you compare that to 3 or 4 seconds in a highly volatile asset like XRP, it turns out you are taking less volatility risk with an XRP transaction than you are with fiat.”

Digital assets have an unfounded criticism around volatility—so we crunched the numbers and found that a typical XRP payment actually has 1/10th the volatility exposure of a typical fiat SWIFT payment. #dothemath https://t.co/A7xioZvR2M

— Breanne M. Madigan (@BreMadigan) October 31, 2019

To justify this statement of Garlinghouse, Ripple explained the calculation, naming it “Garlinghouse’s back-of-the-envelope calculations”. SWIFT is the oldest cross-border payment settlement method that helped banks in their remittance service for their customer but since the emergence of Ripple and its blockchain products, several banks are routing to employ Ripple-backed products. In fact, financial entities believe Ripple’s solutions are quicker and affordable than the Swift payment solution.

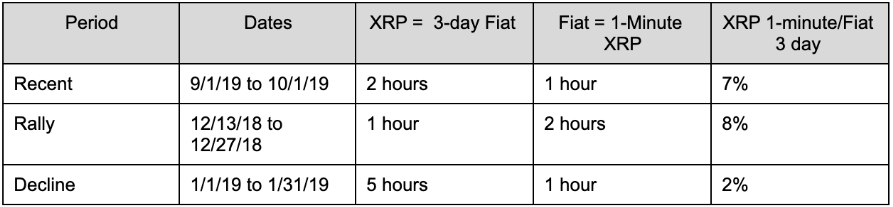

More precisely on volatility, the firm compared XRP and fiat volatility exposures in three different conditions; adding below points;

- The XRP = 3-day Fiat column is how long XRP must be held as the exchange medium before it experiences the same volatility as a fiat-only transaction over three days;

- The Fiat = 1-minute XRP column demonstrates how fast a fiat payment would have to occur to limit its volatility to the same as a 1-minute XRP transaction;

- And the XRP 1-minute/Fiat 3-day column is the fraction of three-day volatility you typically witness in a one-minute XRP transaction.

Speed – XRP v/s Fiat

With that being considered, Ripple’s view is that Fiat’s volatility is nearly one-to-two hours whereas the XRP roughly counts typical one-minute. However, if a crypto enthusiasts aware of the crypto market and its movement, then he must be aware of how crazy the market experience volatility at times – for instance, the market conditions in late 2017. But as for Ripple;

Even during a highly volatile rally period, XRP must still be held for an hour (versus the seconds it’s normally held) to attain the same volatility as a fiat payment.

On the other hand, one can find Ripple’s calculation of XRP worth considering as Ripple ended its point on “speed”. And it has been seen that XRP is widely known for its speed that settles transactions in less than four seconds. Consequently, Ripple concluded by adding;

Ultimately, the speed of an XRP transaction means that transaction partners are in and out of the digital asset so fast, there’s no need to hedge. The resulting risk is much lower with a digital asset and is one of the reasons companies like MoneyGram have been so effusive about the advantages of Ripple and XRP.

Credit: Source link