Participation in the DeFi and staking ecosystems has observed explosive progress about the very last 12 months, with the blended sectors at the moment accounting for around $50 billion in worth.

DeFi growth was predominantly fueled by the breakthrough good results of Ethereum-primarily based assignments these kinds of as Aave, Compound, and Uniswap, using ERC20 stablecoins like USDC and Dai to deliver produce. Electronic assets staked on other networks ended up still left at the rear of, not able to participate in the rising DeFi ecosystem.

If those stakers required to access DeFi devoid of introducing new money, they desired to unstake and sell their investments to enter the current market. That intended supplying up on prospective capital gains and staking rewards from individuals property.

Singapore startup RAMP DeFi is now groundbreaking an choice resolution, opening up participation in the Ethereum-centered DeFi ecosystem – with out giving up the upcoming added benefits of other staked electronic belongings. It has captivated investment decision from Alameda Exploration, IOST, and Blockwater Capital, amid other people.

A Cross-Chain Liquidity On/Off Ramp

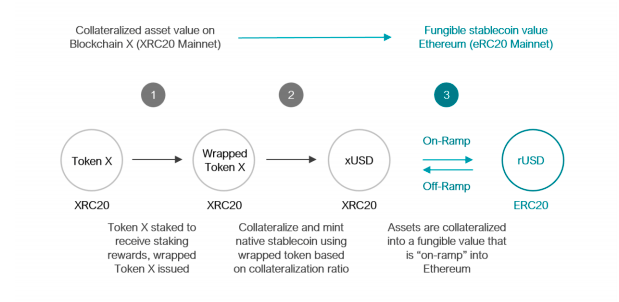

RAMP DeFi’s revolutionary decentralized protocol answer proposes that funds staked on non-Ethereum blockchains can be collateralized into a new stablecoin “rUSD” issued on Ethereum, performing as a bridge amongst non-ERC20 tokens and the Ethereum chain.

By lending/borrowing, bootstrapping stablecoin liquidity, and integrating with other DeFi answers, rUSD holders can either deploy rUSD into larger yield building alternatives or swap into USDT/USDC. This creates a seamless on/off ramp for customers with staked capital on other chains to entry DeFi devoid of supplying up long term likely gains or rewards from the collateralized digital property.

How Does It Work?

For every blockchain “X” integrated, a RAMP staking node and sensible deal on blockchain X are set up to regulate the assets. Token X is staked in the RAMP ecosystem to proceed to receive blockchain X staking benefits.

A Wrapped Token X is then issued and made use of to collateralize and mint a blockchain X native stablecoin, xUSD. xUSD is based on a collateralization ratio equivalent to MakerDAO.

xUSD can then be swapped into the ERC20 rUSD stablecoin, using the on/off ramp cross-chain bridge. From there, rUSD can be deployed into produce farming options or swapped instantly for other stablecoins employing decentralized liquidity swimming pools.

A Broadening Ecosystem That’s Attaining Traction

RAMP DeFi’s liquid staking answer opens up an ecosystem of products and services, belongings, and options that is presently beginning to get traction:

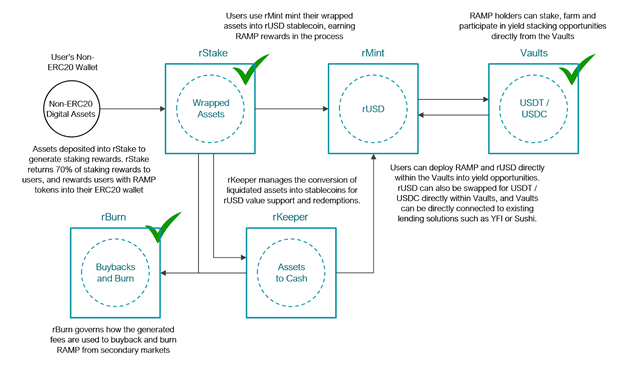

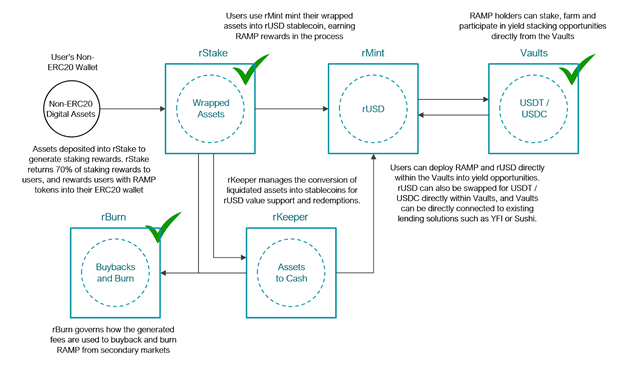

rStake

rStake is the section of the ecosystem where non-ERC20 tokens are staked and wrapped tokens are issued to represent the ownership of the fundamental belongings. It is an aggregator of staking nodes on the participating blockchains, returning 70% of the staking benefits to the user, incentivizing participation by way of added RAMP governance token benefits. The remaining staking rewards crank out service fees for the RAMP ecosystem to enable with steadiness.

rStake has previously launched integrations for the IOST, TomoChain, and Tezos blockchains.

rMint

rMint works by using the wrapped tokens issued by rStake as collateral to mint a stablecoin for the respective X blockchain (xUSD). xUSD is then swapped into ERC20 rUSD to use in the Ethereum DeFi ecosystem, earning RAMP rewards in the system.

Early adopters involve Elrond, NULS, and Solana for cross-chain DeFi farming.

Vaults

The Vaults utility system for RAMP and rUSD enables holders to stake, farm, and take part in produce stacking prospects.

rUSD can also be swapped for USDT/USDC straight, and Vaults can hook up to current solutions these as YFI, Uniswap, or Sushi.

rKeeper

rKeeper manages the conversion of liquidated property into stablecoins for rUSD exactly where needed for worth help or redemptions. rKeeper converts the value of liquidated property into USDT/USDC at the equivalent rUSD at first minted.

The repurchase of rUSD by rKeeper only takes spot when rUSD is significantly less than 1:1 with USDT/USDC, building balance for rUSD utility.

rBurn

The charges produced by rStake are utilised to invest in back again and burn off RAMP, eradicating tokens from circulation. rBurn is created as a “smart burn” system that yet again allows supply steadiness for rUSD as an different secure coin and bridge to the Ethereum-based DeFi network.

Opening Up Defi To Non-ERC20 Tokens

RAMP DeFi introduces a remedy with the prospective to unlock around $30 billion in a beforehand illiquid staked electronic asset sector, set to broaden fourfold with the changeover to Ethereum 2. by itself.

The RAMP ecosystem represents fascinating development possible for DeFi, harnessing current good results when opening up additional prospects for ERC20 and non-ERC20 tokens to acquire obtain to extra generate creating products and services. It frictionlessly connects a array of electronic belongings to the decentralized finance marketplace, throughout an significantly interoperable place, boosting DeFi adoption as a result.

Image by WorldSpectrum from Pixabay