A great deal has improved about the class of the previous twelve months. In addition to the methods that our everyday life have been affected by COVID-19, the money earth has witnessed a lot of modifications.

For fx, COVID has rung in a new era of activity. Like a lot of other areas of the financial globe, buying and selling has found a resurgence in things to do. Waves of new traders came into the place this 12 months. As a end result, business is booming–and brokers have to continue to keep up with the levels of competition.

Seeking Ahead to Assembly You at iFX EXPO Dubai Might 2021 – Creating It Come about!

Finance Magnates not long ago spoke with Albina Zhdanova, main running officer at Equipment For Brokers, about improvements in the foreign exchange field around the earlier yr, as well as how ToolsForBrokers foremost liquidity bridging answer is assisting brokers participate in at the top rated of their game.

https://www.youtube.com/enjoy?v=It5enzkg97M

This is an excerpt that has been edited for clarity and length. To listen to Finance Magnates’ complete webinar with Equipment For Brokers COO Albina Zhdanova, stop by us on SoundCloud or Youtube. To discover much more about Resources For Brokers’ liquidity bridging solution, acknowledged as Trade Processor, click on right here. This is a sponsored piece.

The Foreign exchange business is continuously switching, but it is not likely anywhere whenever before long

“The important thing that we can do to glimpse into the foreseeable future is to comprehend the past,” Albina mentioned. “The simple developments that we have seen in the earlier is that everyone is shifting towards regulation all countries are slowly coming to that place.”

“We also see that the traders on their own are strengthening their buying and selling tactics a lot–they are investing a ton using APIs and automated programs that do elementary analysis. I have observed lots of traders acquire an strategy to diversify their financial investment portfolios to make investments in the foreseeable future and have the forex market place as one particular portion of their total technique.”

“In phrases of the short-term watch of incomes and returns as opposed to extensive-time period ideas, there are numerous points that have alter economy-intelligent,” Albina described.

She recalled “one of the 1st things” that she listened to at a convention when she joined the foreign exchange field a variety of decades ago: “I listened to that this business was likely to die in the upcoming 12 months, or just fade away quickly,” she said. “I’m absolutely sure that there are even now individuals who are declaring this now.”

Could there be any truth to this? Albina doesn’t feel so. “It’s not gonna die,” she mentioned. “It is a younger business, but we will need to bear in mind that this is an important pillar of the world’s monetary system. It is not likely to disappear.”

Even now, simply because the business is so youthful, it is regularly shifting. As these, “to be in a position to catch what’s heading to transpire, I feel that rather of ‘counting down our days,’ persons and corporations must embrace the point that the business is a switching, residing organism,” and adapt swiftly.

Brokers need to have to be completely ready to meet up with trader demand from customers for new belongings with liquidity

What sorts of alterations do business contributors will need to adapt to? “Many don’t forget the binary selections pattern that was a quick up-and-down due to the fact it was banned everywhere you go every person assumed that the identical was going to take place to the cryptocurrency craze that took place after that,” she mentioned.

Of course, “that did not genuinely happen–it wasn’t the exact same situation, and crypto is even now there.” In fact, “we see a ton of institutional clientele investing in crypto as a method of capital preservation, for the reason that the entire financial state condition is pretty unsure.”

Nonetheless, “we just cannot actually predict what will take place in the potential, but what we have to do is to protect and get ready the techniques and qualities in our organizations to be completely ready for whenever that the foreseeable future has for us.”

“In the past two years, we have noticed much more demand for option assets,” Albina ongoing, especially referencing “FX, CFDs, cryptocurrencies, equities, options, and metals.”

For that reason, corporations need to be ready to adapt to buyer demand from customers: for instance, “the potential to include these new property, whichever they will be, need to be adopted pretty promptly,” Albina mentioned. On top of that, companies ought to be prepared to go earlier mentioned and beyond the competitions: “we not too long ago added weekend Fx investing, since we know that it is not made available by many banks or establishments,” she extra.

On the other hand, Albina believes that weekend trading–and an over-all generate towards flexibility in markets–is the way of the long run. “This is what’s heading to transpire,” she claimed. “I feel element of that was influenced by crypto buying and selling, due to the fact you can trade crypto 24/7. Fx and other forms of trading will slowly and gradually transfer towards 24/7 investing as well.”

In addition to having an adaptive tactic towards advancement, Albina also endorses that corporations need to have to spouse with corporations that have a “startup attitude.” In other words and phrases, these lover companies must share this adaptive solution.

“They should be in a position to transform points promptly, to carry out new functionalities, to quickly adapt new issues from regulators and traders, and from the threat administration crew as well,” she said.

What are the main obstacles that retail brokers are currently facing?

On the other hand, in get to be able to adapt swiftly, investing companies will have to be outfitted with the good technological innovation.

Certainly, Albina described that one of the biggest obstructions that businesses deal with is “trying to use previous tricks in a new natural environment.”

Advised content articles

How are Different Technologies Impacting the Life of Traders & Brokers?Go to article >>

“The complains that the foreign exchange industry is ‘going to die’ are often coming from folks who believe that regular methods are not going to function, which is why change is so significant,” Albina said.

Even though companies that have been running in the currency trading industry for a extended time have the knowledge of practical experience, they may not generally be in touch with the cutting-edge buying and selling engineering that is obtainable for brokers right now.

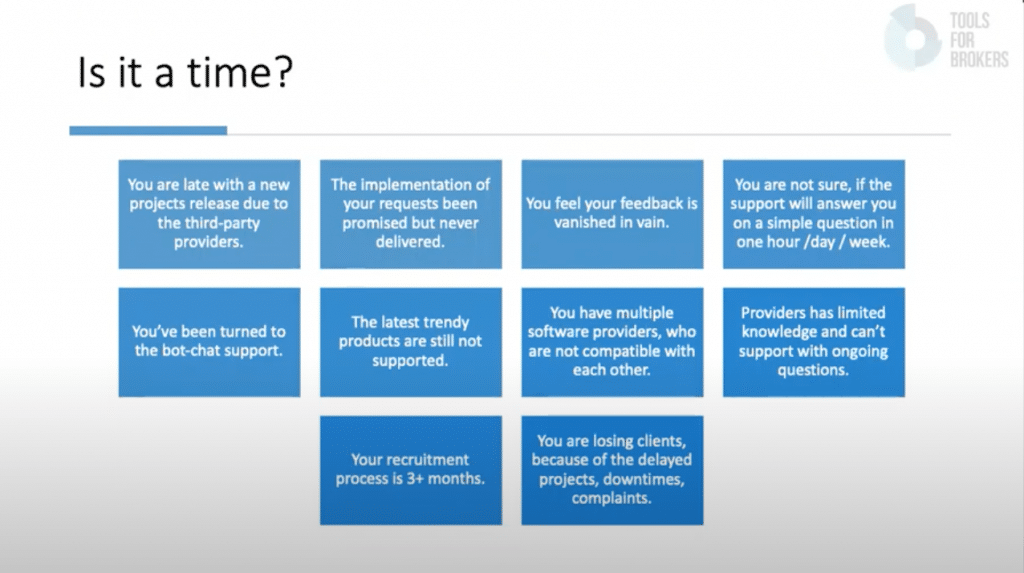

If you are nevertheless clinging to the previous, “there are apparent indicators that are telling you that the time has appear to make modifications,” Albina explained.

What are these signals? “The explanation that we made a decision to construct the liquidity bridge in the 1st spot is that when we have shared our expertise with our clients, we have observed that there are so lots of simple, compact matters that can be sorted, and would not have cause massive difficulties that occurred because they weren’t addressed.”

Albina claimed that “we aimed to kind the motive of the problems that were being occurring.”

This is what led to the development of Equipment For Brokers’ liquidity bridge, regarded as Trade Processor. “We just decided to do the total factor by ourselves, for the reason that we know how to steer clear of these important problems from the commencing,” she said.

“It’s important to examine your business and the partnerships that you have right now, and to see if now it’s possible is the time to make variations.”

What forms of issues does the liquidity bridge support to tackle?

Albina stated that the most widespread challenge is time-to-market: when “the partners that you’ve chosen–or your inner enhancement team–is holding you again from launching your new solution.”

“It could not seem like a large issue, for the reason that your solution will get launched eventually,” Albina said. “But if you think of the reality that somebody else may have introduced their products before you, or that somebody else doesn’t have troubles that reduce them from launching…this is the expense of launching later.”

Outside of delays in time-to-industry, “another large thing we see is complex assistance,” Albina said. “With buying and selling know-how, there is normally anything happening–and if you want to know the respond to about why this happens and what the logic was,” you need to have assistance.

Albina clarified that she “wasn’t referring to software bugs, due to the fact all liquidity bridge companies have very superior techniques.”

Nevertheless, “when you want to comprehend how items perform, and it normally takes you a total week of pinging them just to realize what is happening–I assume this is component of what’s holding brokers in the previous.”

“It’s important to examine your business enterprise and the partnerships that you have right now, and to see if now possibly is the time to make improvements.”

Tools For Brokers’ liquidity solution allows brokers to be ready for everything.

How can Applications For Broker’s liquidity bridging solution assist brokers?

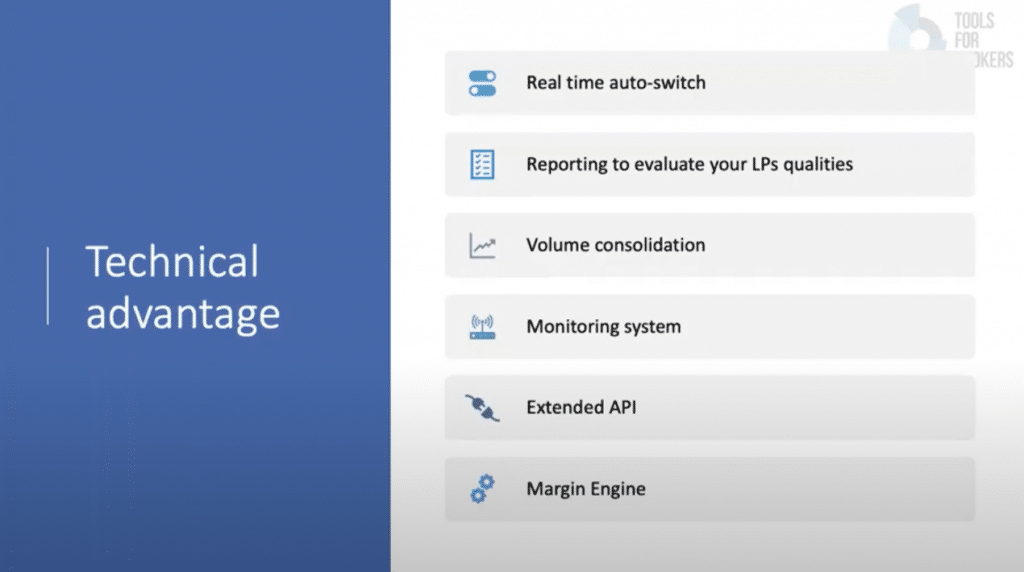

“We have determined to consider a totally diverse technique with an impartial system at the centre of it,” Albina reported. “This generates a non-public aggregation pool for each and every broker.”

“This offers a great deal of rewards for your organization,” Albina spelled out. “It implies that you nevertheless have the prospect to hook up with about 50 liquidity companies and exchanges that we have appropriate now, and the relationship will materialize specifically to your pool–you are not sharing the link with many others.”

“Another aspect is that we have built the aggregation system using modular code,” Albina spelled out. “What this signifies in ‘plain English’ is that the code can be simply modified dependent on the clients’ wishes. If you want to modify 1 perform, it will not impact the other elements.”

This permits Tools For Brokers to build personalized merchandise rapidly and competently. “We can launch new versions of the solution just about every couple months with new attributes,” she mentioned. “This may possibly be based on laws, new varieties of assets, new connections, new formulas, new filtration policies, just about anything.”

“Because this is a non-public, independent process, it can also be used on the weekend,” Albina additional. “If you are section of a centralized program, you are not in a position to handle it–if it is off on the weekend, it is off for all people if it is failing, it is failing for every person.”

Nevertheless, “if it is your private system,” there is significantly extra flexibility. “If you want it to perform on the weekend, it will function on the weekend. If you want to update it, you do that in just your performance. If someone’s technique is down, your program is unaffected.”

This is an excerpt that has been edited for clarity and duration. To listen to Finance Magnates’ entire webinar with Resources For Brokers COO Albina Zhdanova, visit us on SoundCloud or Youtube. To master additional about Tools For Brokers’ liquidity bridging resolution, recognised as Trade Processor, simply click below. This is a sponsored piece.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)