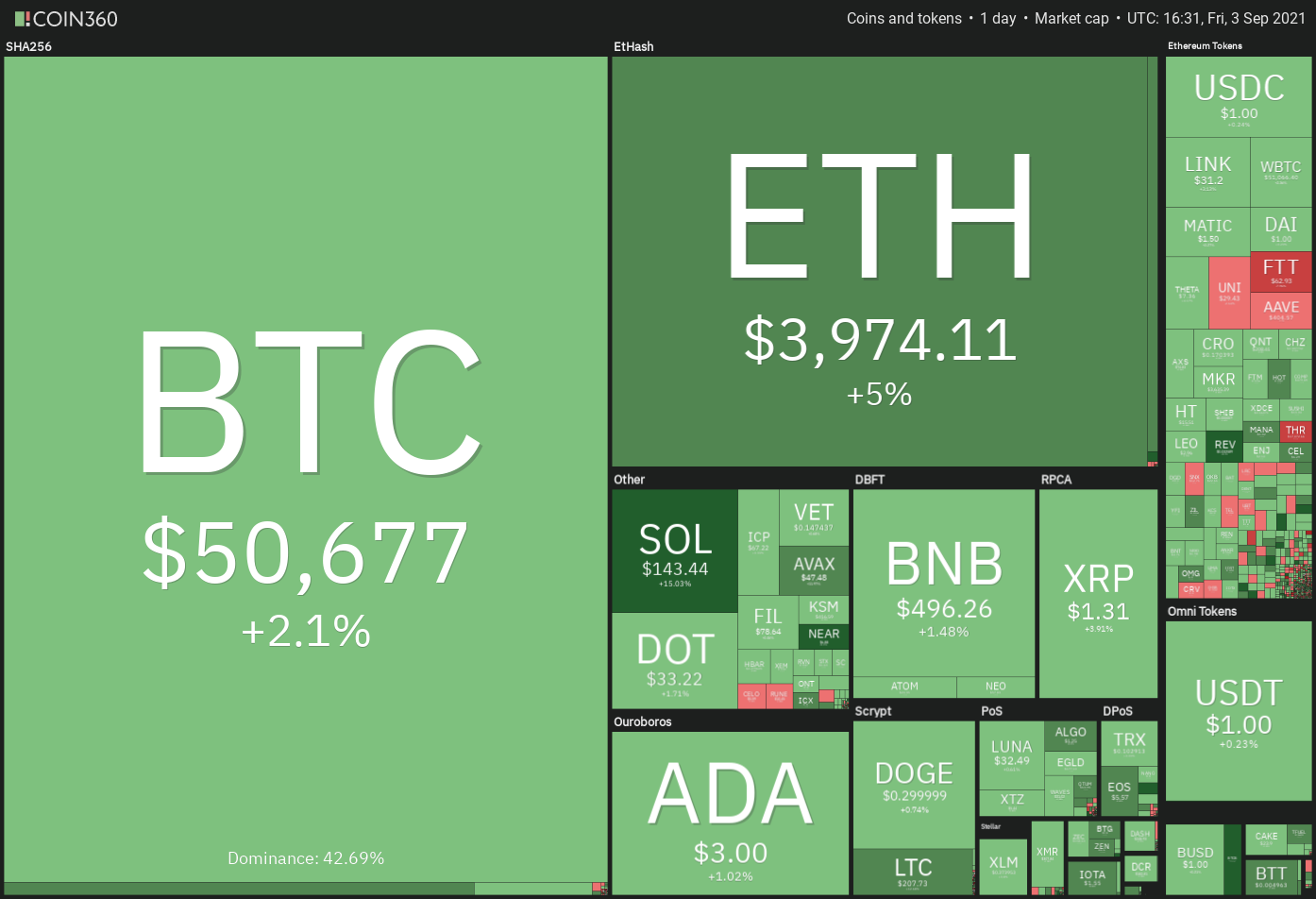

Bitcoin (BTC) has finally surpassed the $50,500 resistance level, while Ether (ETH) has surpassed the $4,000 mark. This indicates that interest in cryptocurrencies is growing, and numerous legacy financial institutions are taking steps to capitalize on this growing demand.

According to LinkedIn job ads, Franklin Templeton, one of the world’s largest independent asset managers, has received new job applications for mid- to senior-level roles in crypto trading and research.

Meanwhile, SBI Holdings, a Japanese banking conglomerate, plans to launch one of the country’s first crypto funds by the end of November. SBI’s director and senior managing executive officer, Tomoya Asakura, stated that a second fund will be considered based on the success of the first.

While cryptocurrency traders applaud the recent rally in various altcoins, JPMorgan analysts have warned their customers that the altcoin rally and nonfungible tokens (NFT) are becoming frothy.

According to researchers, altcoins‘ share of crypto market trade increased from 22% in early August to 33%, which is a record high by historical norms. They feel the rationale is due to „froth and retail investor’mania,‘ rather than a structural rise.“

Could Bitcoin sustain a price above $50,500 and resume its upward trend, or will altcoins continue to take center stage? To learn more, let’s examine the charts of the top ten cryptocurrencies.

BTC/USDT

On Sep. 2, the bears successfully defended the $50,500 barrier but were unable to knock the price down below the downtrend line. This could have swayed bulls, who have pushed Bitcoin beyond $50,500 today.

If purchasers are able to keep the price over $50,500, the BTC/USDT pair might reach $60,000. This level may act as a tough resistance once again, but if bulls can push the pair over it, the pair may target the all-time high at $64,854.

If bulls push the relative strength index (RSI) above the downtrend line, the negative divergence will be invalidated. This, together with the upward 20-day exponential moving average ($47,584), indicates that the path of least resistance is upward.

This bullish view will become worthless if the price falls below the 200-day simple moving average ($46,083). This could result in a price reduction to $42,451.67.

ETH/USDT

Ether gained momentum today after breaking through the $3,377.89 barrier. If bulls can keep the price above this psychological level, the largest altcoin may threaten the all-time high of $4,372.72 per coin.

The upsloping 20-day EMA ($3,344) and the RSI in the overbought zone suggest that bulls are in control. If buyers push the price above $4,372.72, the ETH/USDT pair could start its journey toward the critical level at $5,000.

This may not be easy as bears are likely to have other plans. They are likely to mount a stiff resistance in the $4,000 to $4,372.72 zone. If the price turns down from this zone and breaks below $3,700, the pair may drop to the 20-day EMA.

A strong rebound off this support will suggest that the sentiment remains bullish. The buyers will then try to resume the up-move. Conversely, a break and close below the 20-day EMA will be the first sign that bulls may be losing their grip.

ADA/USDT

Cardano (ADA) broke above the $3 mark on Sep. 2 but the bulls could not sustain the higher levels as seen from the long wick on the day’s candlestick. Although the price dipped back below $2.97 today, the bulls bought the dip and are again trying to drive the price above $3.

A breakout and close above $3.10 will signal the resumption of the uptrend. The ADA/USDT pair could then rally to $3.50. The 20-day EMA ($2.58) favors the bulls but the negative divergence on the RSI indicates that the bullish momentum may be weakening.

If bulls fail to drive the price above the overhead resistance, the pair may drop to the 20-day EMA. This is an important level for the bulls to defend. A strong rebound off it will suggest that the sentiment remains positive.

Conversely, a break below the 20-day EMA may pull the price to the breakout level at $2.47. A break below this support could start a deeper correction.

BNB/USDT

Binance Coin (BNB) has been trading between the 20-day EMA ($456) and the overhead resistance at $518.90. The long wick on the Sep. 2 candlestick suggests that bears are selling above $500 but the positive sign is that bulls are not giving up much ground.

The buyers will again try to push and sustain the price above $518.90. If they manage to do that, the BNB/USDT pair could pick up momentum and rally to $600. This psychological level may act as a resistance but if bulls clear this hurdle, the rally may extend to $680.

Conversely, if the price turns down from the overhead resistance and dips below the 20-day EMA, the pair may slide to $433. A break below this level will suggest that bears have overpowered the bulls. The pair may then decline to the 200-day SMA ($375).

XRP/USDT

The bulls pushed XRP above the downtrend line on Sep. 2, invalidating the developing bearish descending triangle pattern. The bears tried to pull and sustain the price below the downtrend line today but failed.

If bulls are able to keep the price above the downtrend line, the XRP/USDT pair may climb to $1.35. This level may operate as a barrier, and if the market breaks through it, the pair may trade between $1.05 and $1.35 for a few days.

The 20-day exponential moving average ($1.15) has turned upward and the RSI has surged over 64, indicating that bulls are in control. A close over $1.35 might pave the way for a run to $1.66. The bears must push the market below $1.05 in order to signify a reversal.

SOL/USDT

At $130, the bears attempted to halt Solana’s (SOL) advance, but the bulls were unfazed. The buyers prevented the price from falling below the psychological support level of $100.

On Sep. 2, buying resumed, and bulls have pushed the SOL/USDT pair to a new all-time high today. Vertical rallies are rarely sustained and frequently end in precipitous drops. Additionally, an RSI value greater than 88 implies that the pair is overextended in the immediate term.

If the price falls below the current level of $150, the first support level is at the 38.2% Fibonacci retracement level of $115.75.

A significant recovery from this level indicates strength and increases the likelihood of a break above $150. The next upside goal is $166.97. On the other hand, a break below $115.75 might trigger a decline to the 50% retracement level at $106.29.

DOGE/USDT

On Sept. 1, Dogecoin (DOGE) broke over the 20-day exponential moving average ($0.28), and bulls pushed the price above the falling wedge pattern’s downtrend line on Sept. 2. The extended wick on the day’s candlestick, on the other hand, indicated that bears were selling at higher levels.

The DOGE/USDT pair has recovered from the 20-day exponential moving average (EMA) and bulls have pushed the price above the wedge. If buyers are able to keep the price over $0.31, the pair may climb to $0.35. This level is expected to operate as a significant barrier.

If the price reverses from $0.35, the pair may once again fall to the 20-day exponential moving average. A significant recovery from it indicates that sentiment is good. A break and close above $0.35 may pave the way for an uptrend to $0.45.

On the other hand, if the price reverses and breaks below the 20-day exponential moving average, the pair may fall below the wedge’s support line.

DOT/USDT

Polkadot (DOT) has maintained a three-day high above the breakout level of $28.60, suggesting the start of a new uptrend. The rising moving averages and an overbought RSI point to a buyer’s advantage.

If bulls can push the price over $33.84, the DOT/USDT pair may begin its ascent above $41.40 and then toward the pattern target at $46.83.

On the other hand, if the price reverses from its current level, it may retest the $28.60 breakout level. If bulls convert this level to support, it might serve as a springboard for the next leg of the uptrend.

A break and closing below the 20-day exponential moving average ($27.12) will be the first indication that the latest breakout was a bull trap.

Related: How to prepare for the end of the bull run, Part 1: Timing

UNI/USDT

Uniswap’s (UNI) upward movement slowed from $31.41 on Sept. 2, indicating that the bears have not yet given up. The recent price action has created a negative divergence on the RSI, indicating that the bullish momentum may be waning.

If the price bounces off the 20-day exponential moving average ($27.91), bulls will make one final try to push the UNI/USDT pair over the overhead resistance level of $31.41. If they succeed, the pair’s journey to $37.52 and subsequently to $42.25, may begin.

Alternatively, if bears can push the price below the moving averages, the pair might fall under $25 and remain range-bound for a few more days. A break and close below the $25 to $23.45 support zone will indicate that bears have reintroduced themselves to the game.

LINK/USDT

Chainlink (LINK) had been trading in a narrow range between $24 and $30 for some days. On Sept. 2, bulls pushed the price over the overhead resistance but were unable to sustain the gains.

Today, the bulls purchased the dip and accelerated the price above the overhead barrier. If buyers maintain the price above $30, the LINK/USDT pair may advance to $36 and, if that barrier is breached, the pair may rally to $43.50, the intraday high set on May 19.

The 20-day exponential moving average ($26.99) has begun to rise, and the RSI has moved into positive territory, indicating that buyers have the upper hand. In contrast to this notion, if the price declines and breaks below $30, this indicates that range-bound behavior may persist for a few more days.

The author’s views and opinions are entirely his or her own and do not necessarily reflect those of Cointelegraph. Each investing and trading decision entails some level of risk. When making a decision, you should perform your own research.

Market data is provided by HitBTC exchange.