The U.S. Federal Reserve upgraded their inflation expectations for this season from 2.4percent in March to 3.4percent in their latest meeting that concluded on June 16. To tame inflation, the Fed intends to tackle two rate hikes before the end of 2023.

This news has fostered the U.S. dollar indicator DXY to its best level since mid-April. Gold’s price, which generally has a reverse correlation with the dollar, has dropped into a 6-week low.

The U.S. equity markets have also not been spared. This reveals the short-term opinion has turned bearish and traders’re closing their positions to hoard cash.

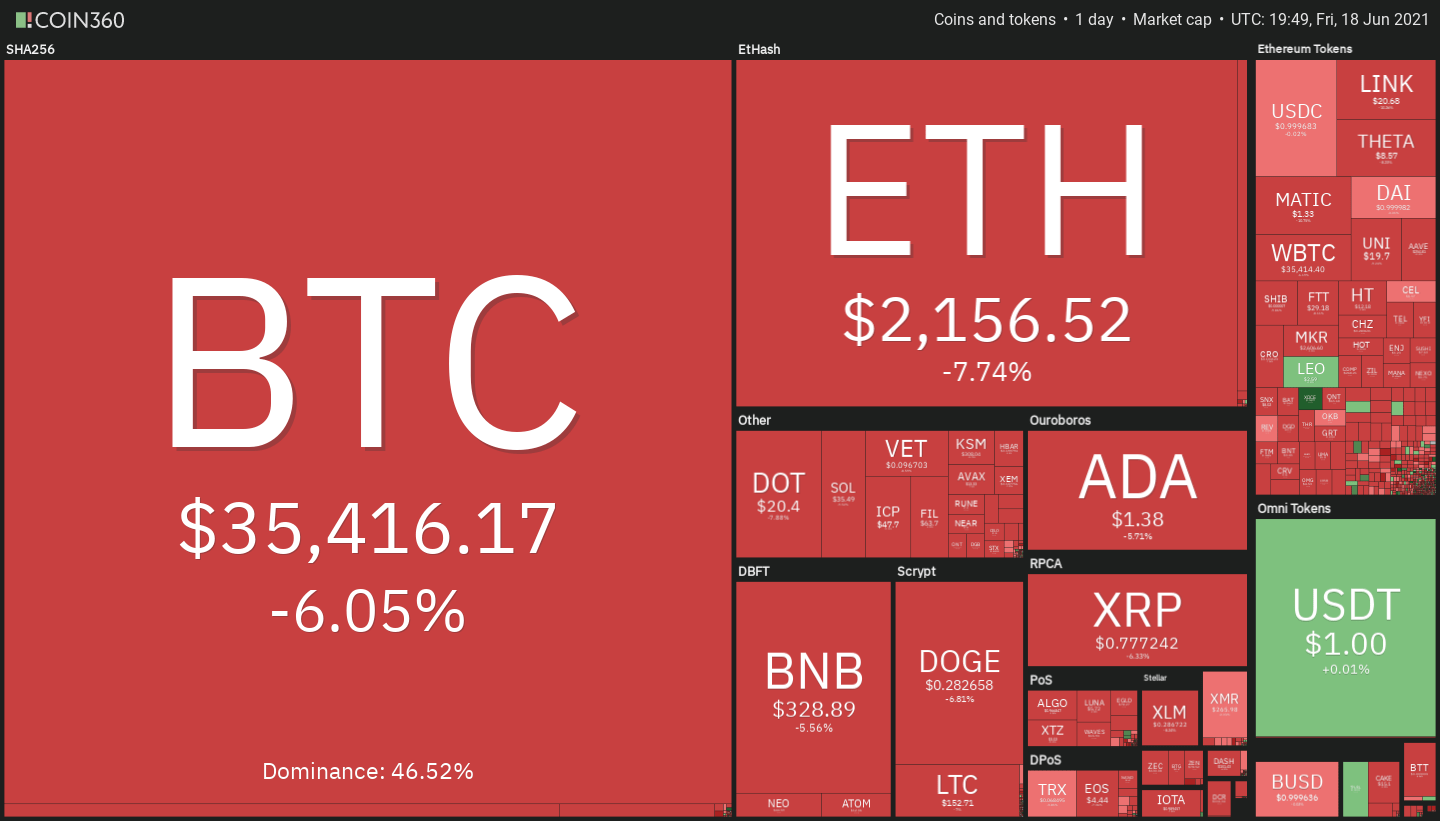

BTC/USDT

This has also put brakes on Bitcoin’s (BTC) recovery. However, Pantera Capital chief executive Dan Morehead stated from the monthly newsletter printed on June 14 which Bitcoin was“that this“cheap“ relative to its trend 20.3percent of the previous 11 decades.“

Santiment data demonstrates that Bitcoin whales, holding between 100 and 10,000 Bitcoin, have been on a buying spree, lapping up about 90,000 Bitcoin previously 25 days. They now hold about 48.7percent of Bitcoin’s supply.

Can the buying from the whales arrest the decline in Bitcoin and will the buying in altcoins resume? Let us examine the charts of this top-10 cryptocurrencies to discover.

This implies the short-term recovery could have finished as well as the bears will now try to sink the price to $34,600.36 and then $31,000.

The relative strength index (RSI) has turned down in the overhead resistance at 55 and fell to the negative territory, indicating the bears have the top hand.

But if the BTC/USDT pair pops off the 31,000 service, then it is going to imply accumulation at lower levels. That may keep the pair range-bound between $31,000 and $42,451.67 for the next few days.

The bulls will need to push and sustain the purchase price above $42,451.67 to signify that the downtrend may have finished. On the flip side, a break below $31,000 will indicate the resumption of the next leg of this downtrend.

ETH/USDT

Ether (ETH) turned down in the 20-day EMA ($2,528) on June 15 and the bears have pulled the price under the service line of the symmetrical triangle now. This implies that supply exceeds demand.

In case the ETH/USDT pair breaks under $2,180, the next stop could be $2,079.94 and $1,728.74. The downsloping 20-day EMA and the RSI from the zone imply that the path of least resistance is to the disadvantage.

This negative opinion will invalidate if the purchase price rises from the present level or the service and fractures above the resistance line of the triangle. Such a move will imply that bulls are back in command and a fresh uptrend is likely.

BNB/USDT

Binance Coin (BNB) was trading under the 20-day EMA ($367) for the last few days. This implies the opinion remains negative and traders could be using the rallies to close their extended positions.

The downsloping 20-day EMA and the RSI at 42 indicate the path of least resistance is to the disadvantage. If bears sustain the purchase price under the trendline, the selling could intensify and the BNB/USDT pair could fall to $257.40 and then $211.70.

On the flip side, if bears fail to sustain the purchase price under the trendline, the bulls will try to push the pair above the 20-day EMA. If they succeed, the pair could rally into the overhead resistance at $433.A breakout and close above this resistance will indicate the correction is finished and the pair may start its journey to the 61.8% Fibonacci retracement level at $508.38.

ADA/USDT

Cardano (ADA) turned down in the 50-day SMA ($1.62) on June 15, indicating that the bears are trying to control proceedings. The downsloping 20-day EMA and the RSI from the negative land indicate advantage to the bears.

The sellers will now try to pull the price to the 1.33 support. A break and close below this amount will clean the path for a further fall to the next vital support at $1.

On the contrary, if the purchase price rebounds off 1.33, it is going to imply that buyers are accumulating near this amount. That could keep the ADA/USDT pair range-bound between $1.33 and $1.94 for the next few days.

The bulls will get the upper hand after the price breaks and closes above $1.94. Such a move could push the pair to the all-time high at $2.47.

DOGE/USDT

Dogecoin (DOGE) has failed to rally off the neckline of the head and shoulders pattern in the previous two days, which indicates a lack of demand at current levels. The downsloping 20-day EMA ($0.33) and the RSI under 41 imply that bears have the top hand.

If the purchase price sustains beneath the neckline, the DOGE/USDT pair could fall to $0.21. Even the bulls may defend this service aggressively but if this amount cracks, the selling could intensify and the pair could decrease to $0.10.

Contrary to this assumption, if the purchase price rebounds off $0.21, the bulls will try to propel the purchase price above the 20-day EMA. If they do that, the pair could climb to the 50-day easy moving average ($0.40) and then to $0.45.

XRP/USDT

XRP continues to trade under the 20-day EMA ($0.91), suggesting a lack of need at higher levels. The bears will now try to pull the purchase price under the crucial service at $0.75 while the bulls will try to defend the service.

If the purchase price rebounds off $0.75, the XRP/USDT pair could move until the 20-day EMA. A breakout of this resistance could keep the pair range-bound between $0.75 and $1.07 for the next few days.

However, the downsloping moving averages and the RSI under 39 signify advantage to the bears. In case the pair slides under $0.75, the next stop is likely to be 0.65. Whether this support cracks, then the selling may intensify and the pair could fall to $0.56 and then to $0.43.

DOT/USDT

Polkadot (DOT) turned down in the resistance line of the symmetrical triangle on June 15 and broke under the 20-day EMA ($23.57) on June 16. The altcoin has now dropped into the service line of the triangle.

If the purchase price rebounds off the service line, the DOT/USDT pair may continue to combine within the triangle to get a couple more days. However, the downsloping moving averages and the RSI from the negative land indicate advantage to the bears.

If bears sink and sustain the purchase price under the triangle, it is going to indicate the resumption of the downtrend. The first support on the downside is $15. A break below this amount could open the doors to get a further drop to $8.

The bulls will be back into the game after they push and sustain the purchase price above the triangle. Such a move will signal that the correction may be over.

UNI/USDT

Uniswap (UNI) turned down in the 20-day EMA ($24.16) on June 15, indicating selling on rallies. The bulls defended the 21.50 service on June 17 however, the collapse of these buyers to construct upon the recovery indicates too little demand at higher levels.

If bears sink the purchase price under $20, the selling may intensify and the UNI/USDT pair could fall to $16.49 and then to $13.04. Such a move will indicate that traders offered their positions from the current restoration to $30.

On the contrary, if the pair pops off the $20 service, it is going to imply that bulls are accumulating on drops. The buyers will then try to drive the purchase price above the 20-day EMA. If they succeed, the pair may rise to $30.

LTC/USDT

The bulls attempted to defend the service line on June 17 but they could not push Litecoin’s (LTC) price above the 20-day EMA ($176). This implies that bears are safeguarding the 20-day EMA aggressively.

Even the downsloping moving averages and the RSI from the negative zone signify benefit to the bears. If vendors sustain the purchase price under the service line, the LTC/USDT pair could start its journey ahead of the May 23 reduced at $118.03. Whether this support also gives way, the selling may intensify and the pair could plummet to $70.

This negative opinion will invalidate if the purchase price rebounds off the present level and climbs above the 20-day EMA. Such a move is going to be the first sign of strength. The pair could then rally into the 50-day SMA ($230). A break above this amount will imply that the downtrend may be over.

BCH/USDT

Bitcoin Cash (BCH) turned down in the 20-day EMA ($648) on June 15, indicating that bears are selling on every small rally. The price action of the last few days has shaped a descending triangle pattern which will complete to a breakdown and close below $538.11.

The downsloping moving averages and the RSI under 39 indicate the path of least resistance is to the disadvantage. If bears sink and sustain the purchase price under $538.11, the BCH/USDT pair could resume its down move. The pair could then fall to $400 and after to $370.

Contrary to this assumption, if the purchase price turns up from the present level or 538.11 and breaks above the 20-day EMA, it is going to indicate strong buying by the bulls. The pair could then rally to $800 and then to the 50-day SMA ($872).

The perspectives and opinions expressed here are only those of the writer and don’t necessarily reflect the views of Cointelegraph. Every single investment and trading move involves risk. You need to conduct your own research when making a decision.

Market information is provided by HitBTC exchange.