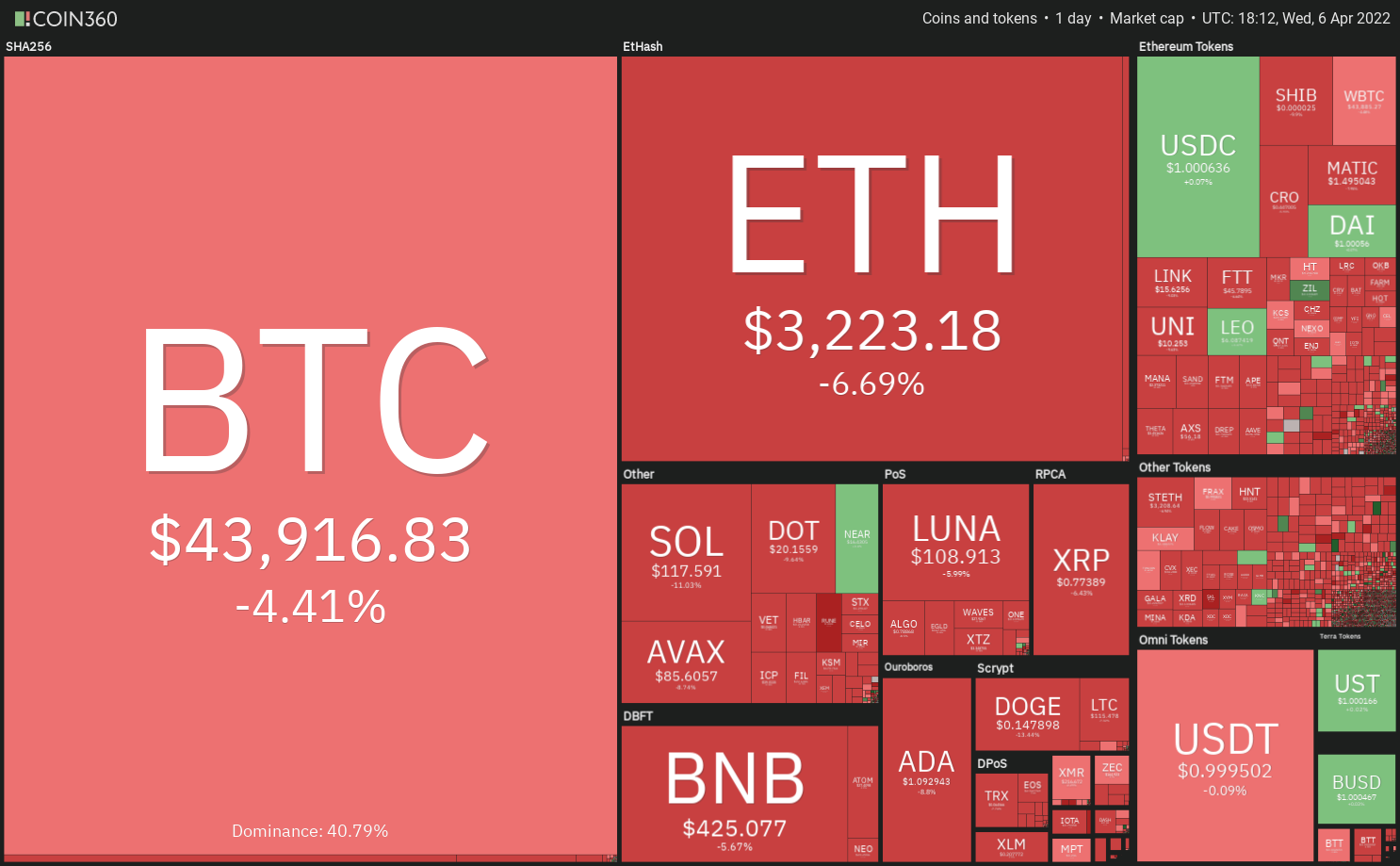

Bitcoin (BTC), the entire crypto sector, and the S&P 500 index are all down on April 6. This shows how closely the two sectors are linked.

People who work for big businesses don’t seem to be stopping their purchases, which means they’re still optimistic about the long run.

There was a dip in the price of Bitcoin. Terra took advantage of it to buy 5,040 more Bitcoin. Terra now owns 35,768 Bitcoin.

In this project, Terra was not the only one.

A subsidiary of MicroStrategy called MacroStrategy added 4,197 Bitcoin to the treasury of MicroStrategy, which has the most Bitcoin.

This means that the business intelligence firm now owns 129,218 Bitcoin.

One more sign that there is a lot of interest in Bitcoin is the amount of money that has been coming into the two Canadian Bitcoin ETFs.

As of January, the funds had 69,052 bitcoin in their portfolios, which is an increase of 6,594 since then.

Could Bitcoin and other cryptocurrencies have a deeper correction, or will lower prices make people want to buy?

To find out, let’s look at the charts of the top 10 cryptocurrencies to see what they look like.

BTC/USDT

It had been stuck in a tight range between the 200-day simple moving average ($48,240) and $45,000 for a few days. Then, the bears made a move and pulled the price below the 20-day exponential moving average ($44,567).

There has been a big drop in the relative strength index (RSI) and the 20-day EMA is flattening out. This means that the market is getting stronger.

There is a good chance that the bullish momentum could be slowing down.

If the price rebounds off the 50-day SMA ($41,752), the bulls will again attempt to push the BTC/USDT pair above the 200-day SMA.

If the price falls below the 50-day SMA, it will show that the pair could stay in the ascending channel for a longer time.

The pair could then start to fall toward the strong support at $37,000, but it could take a while.

ETH/USDT

The failure of the bulls to keep the price of Ether (ETH) above the 200-day SMA ($3,487) may have caused short-term traders to sell their Ether.

That has brought the price down to the important level of support at the 20-day EMA ($3,223).

In this case, it will show that bulls are buying when the price is low.

The bulls will then try again to push and hold the price above the 200-day SMA.

If they do well, the ETH/USDT pair could start moving north toward $4,150, where the bears are expected to put up a strong fight.

If the price falls below the 20-day EMA, the selling could pick up speed and the pair could fall to the 50-day SMA ($2,907). This is not true.

BNB/USDT

On April 5, BNB again didn’t break above the 200-day SMA ($468).

Long wick on the day’s candlestick shows that the bears are defending the 200-day SMA with everything they have.

The BNB/USDT pair has dipped to the 20-day EMA ($424). The bears will now try to keep the price below the 20-day EMA.

If they do well, the pair could fall to the 50-day SMA ($398).

As long as this level is breached, the pair is likely to stay in a range between the 200-day and 50-day SMAs.

If the price rises above the 20-day EMA, the bulls will try to push the pair above the 200-day SMA and try to break through $500.

SOL/USDT

When Solana (SOL) started to get better on April 2, it came to a halt. The price has now dropped below the $122 level where it broke out.

The bulls are going to fight hard to keep the 20-day EMA ($113) in their corner.

A strong bounce off of the 20-day EMA will show that people are still optimistic and that traders are buying on dips.

The bulls will then try to push the price above the 200-day SMA ($149).

If, on the other hand, the 20-day EMA breaks and closes below the 20-day EMA, that means that the bullish momentum has slowed down.

They could then fall to the 50-day SMA ($96).

After a strong rebound off this level, the pair could be stuck between the 50-day and 200-day SMAs.

XRP/USDT

Ripple (XRP) turned down and fell below the 20-day EMA ($0.81) on April 5.

Today, the price fell below the 50-day SMA ($0.78), which is where it has been for a while.

As of this writing, the 20-day EMA has started to go down, which means that bears have a small lead.

If the price doesn’t go back above the 50-day SMA, the XRP/USDT pair could fall to $0.70.

Bulls need to protect this level because if it falls, the decline could go all the way to $0.60.

On the other hand, if the price rises above the 20-day EMA, the bulls will try to push the pair above the 200-day SMA ($0.89).

ADA/USDT

The failure of the bears to push Cardano (ADA) above the $1.26 level may have made short-term traders want to take profits.

A lot of people aren’t happy about that. The price has dropped below the 20-day EMA ($1.09).

Price could fall to the 50-day SMA if it breaks below the 20-day EMA.

In this case, the bulls are likely to fight hard for this level. If the bears win, the ADA/USDT pair could fall to the strong support level of $0.74.

A strong rebound from this level will show that the pair may stay between $0.74 and $1.26 for a while.

Bulls will try again to push the price above this level if the price goes up from where it is now.

If they do well, the ADA/USDT pair could rise to the 200-day SMA ($1.47) if they do well.

LUNA/USDT

Terra’s LUNA token had been on a strong uptrend, but the Doji candlestick pattern on April 5 warned that the bullish momentum might be fading. This is what happened.

It also looked like the bulls were losing their grip on the RSI.

On April 6, the Doji candlestick pattern came to an end to the downside.

As soon as the bears see the price hit the 20-day EMA ($102), they’ll try to push it there.

Because the bulls need to keep this level safe, a strong rebound from it will show that traders are still buying when the market is down.

People might sell more quickly if the price falls below the 20-day EMA, so they rush to get out.

You can see how that could bring the LUNA/USDT pair down to the 50-day SMA at about $86.

AVAX/USDT

The bulls bought the dip to the 20-day EMA ($89) on April 4, but they couldn’t get Avalanche (AVAX) above $98.

This shows that bears are still fighting hard to keep the overhead resistance.

If the 20-day EMA is flattening out, it means that the bears have a slight advantage.

It could fall to $65 if the AVAX/USDT pair breaks below the 50-day SMA if the price falls below that.

A rise above this level will mean that the pair may stay in a range between $65 and $98 for a few more days.

This means that if prices go up again, bulls will try again to climb above the area between $98 and $100.

DOT/USDT

Dot (DOT) bounced off the 20-day EMA ($21) on April 4, but the bulls couldn’t get past the $23 barrier.

This may have made short-term traders want to cash in their gains.

On April 6, the DOT/USDT pair fell below the 20-day EMA and the RSI went down.

People who see this might think that the bulls have lost their grip.

It could be the 50-day SMA ($19).

They are likely to fight hard to keep this level. If the support breaks, it could go down to $16.

Alternatively, if the 50-day SMA is broken, the pair could stay between $19 and $23 for a few days.

A new uptrend could start if the bulls can push and keep the price above $23.

DOGE/USDT

When Dogecoin (DOGE) hit a high of $0.17 on April 5, the bulls could not get past the 200-day SMA ($0.18).

This may have led to short-term bulls and aggressive bears selling and taking profits, which led to the sharp reversal on April 6.

There is a good chance that the DOGE/USDT pair will go back to the 20-day EMA ($0.14).

This means that if the price rises above this level, it will mean that bulls will keep buying when the market is down.

People who want to buy will then try to get over the 200-day SMA again.

If the price keeps going down and breaks below the 20-day EMA, this positive view will be invalidated.

It might be possible for the price to fall to $0.12.

They could stay stuck between $0.10 and $0.18 for a while.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.