There’s been a fight between buyers and sellers for the last two days, which shows that they’re both trying to get the upper hand on the trend.

Glassnode, an on-chain analytics firm, said that 100,000 Bitcoin left exchanges in March.

There have been only two times in the history of Bitcoin when large amounts of money were withdrawn. The largest was in March 2020.

However, this does not mean that the price will rise right away.

This happened in 2020, but it didn’t get going for another three months until the fourth quarter.

Analysts are split on what will happen to Bitcoin in the near future. Some think it will fall to $44,800 or even $43,000, while others think it will rise to $50,000.

As the crypto markets grow older, they keep getting new investors.

A report by Gemini, a crypto exchange, said that the number of people who bought their first cryptocurrency in 2021 rose by more than 50% in India, Brazil, and Hong Kong, among other places.

Even in Latin America, Asia Pacific, the United States, and Europe, there were more people who started investing in 2021 than there were people who started investing in 2017.

Could Bitcoin and other cryptocurrencies get off their support and keep going up?

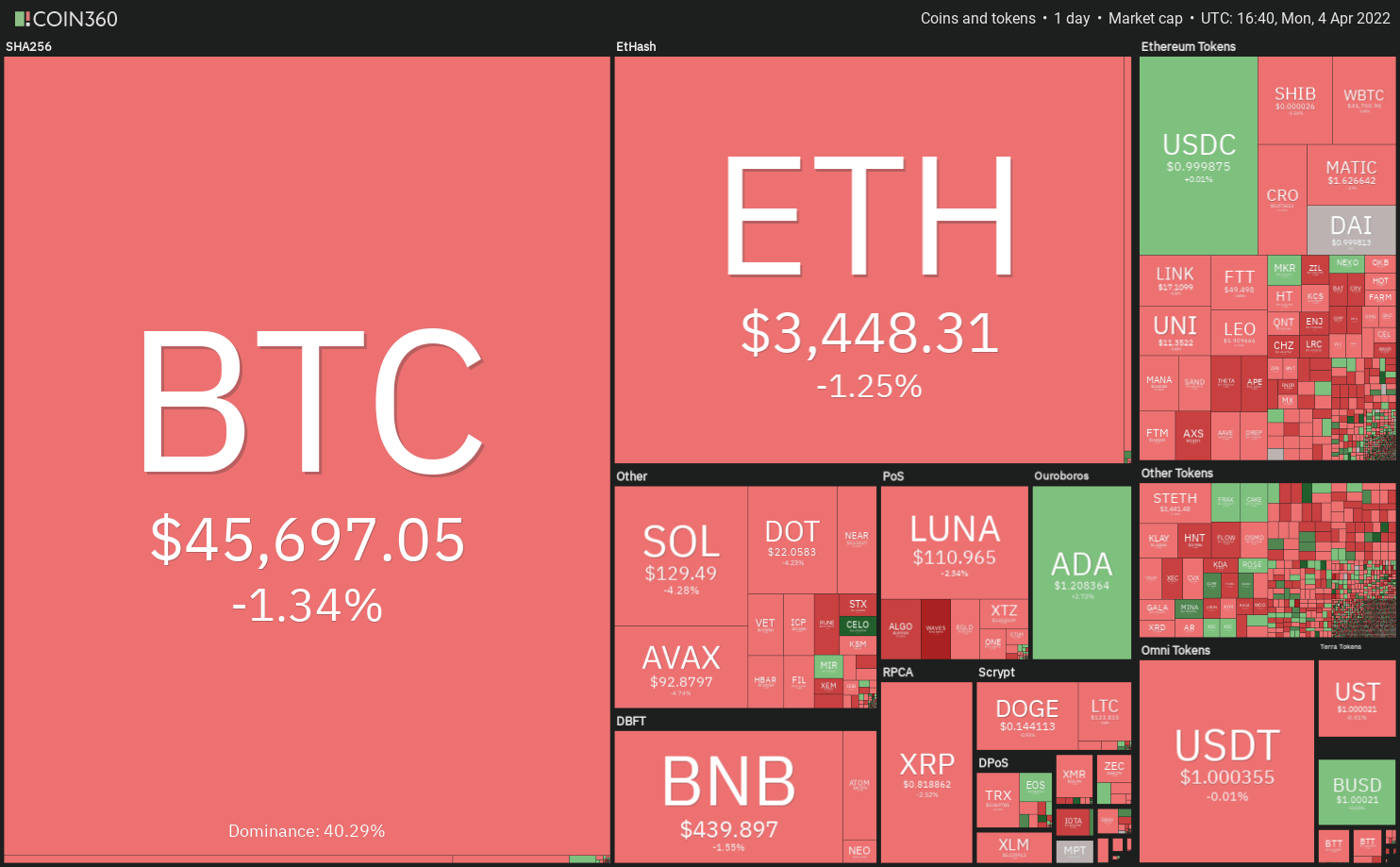

To find out, let’s look at the charts of the top 10 cryptocurrencies to see what they look like.

BTC/USDT

The long wick on the candlestick of the past two days suggests that bears are selling near the 200-day simple moving average (SMA) ($48,266), which is where the price is now.

Bulls haven’t let Bitcoin break below important support at $45,400, which is a small good.

However, this kind of trading isn’t going to last very long.

BTC/USDT could fall to the 50-day SMA if the price breaks below the 20-day EMA ($44,467).

The short-term bullish setup could be thrown out by such a move.

People should keep buying on dips if the price rises from where it is now or from the 20-day EMA.

That could make it more likely that the 200-day SMA will be broken.

If that happens, the price of the pair could rise to $52,000.

ETH/USDT

On April 3, Ether (ETH) broke and closed above the 200-day SMA ($3,487), but the bulls could not keep the price above that level.

This means that the bears are trying to make the price go down so that the bulls can’t get away.

If the price falls below $3,411, the bears will try to push the ETH/USDT pair to the 20-day EMA ($3,197). This is where the pair has been for the last few weeks.

To keep the bulls‘ momentum going, they need to keep this level safe.

In this case, the buyers will try to push and hold the price above its 200-day SMA again.

If they do that, the pair could rise to $4,000.

Another thing that could happen is that if the 20-day EMA support breaks down, the selling could get worse. The pair might fall to its 50-day SMA ($2,895).

BNB/USDT

This week, the price of BNB has been near $445.

The bulls tried to push the price above this level again and again, but they couldn’t keep it there and try to break the 200-day SMA ($467).

This means that there is less demand at higher levels.

Keep an eye on the 20-day EMA, which is where the price should stay.

People will try again if the price rises above this level. If the BNB/USDT pair breaks through this level, they’ll try to push it to $500.

Instead, if the price falls below the 20-day EMA, it could mean that short-term traders are taking profits.

To get the price to the 50-day SMA, that could make it go there.

It will be a sign that the break above $445 may have been a bull trap if the price drops below this level.

SOL/USDT

When Solana’s (SOL) recovery came to a stop just below the 200-day SMA ($150), it came to a halt.

This means that the bears are selling at higher levels.

They will now try to push the price up to $122.

As long as the price doesn’t fall below $122, the bulls will try again to clear the 200-day SMA.

If they do well, the SOL/USDT pair could rise to the $200 level.

The rising 20-day EMA ($111) and the relative strength index (RSI) near the overbought zone show that buyers have a good chance of getting in.

If the price drops below $122, the pair could fall to the 20-day EMA. This isn’t true, though.

This is an important level to keep an eye on because a break below it could send the price down to the 50-day SMA ($96).

XRP/USDT

The bulls tried to push Ripple (XRP) above the level of $0.86, but the bears didn’t move.

The price may fall to the 50-day SMA ($0.78) if it doesn’t rise above $0.86. Short-term traders may want to sell their gains, which could push the price down to that level.

As long as the price doesn’t go back down to the 50-day SMA again, it will show that bulls want to buy when the price is low.

For a few days, the XRP/USDT pair could be stuck between the 50-day SMA and the 200-day SMA at $0.89.

The flattish 20-day EMA ($0.82) and the RSI near the middle point also suggest that the market will be stable in the near term.

It could fall to $0.70 if the price falls below its 50-day SMA.

This is another possibility: If more people buy than sell and push prices above the 200-day SMA, then the pair could rise to the $1 level.

ADA/USDT

On April 1, Cardano (ADA) started going up. It has hit the overhead resistance at $1.26, where the bulls are likely to face strong resistance from the bears, so it’s not going to go any further.

People who look at the 20-day EMA ($1.08) and RSI near the overbought zone say that the path of least resistance is going up.

If the price goes above $1.26, the ADA/USDT pair could rise to the 200-day SMA ($1.48) and then $1.63.

If, on the other hand, the price turns down from the overhead resistance, the pair could fall to the 20-day EMA.

A break and close below this support could send the price down to the $1 level.

LUNA/USDT

LUNA broke through the $111 barrier on April 2 and hit a new all-time high of $118 the next day, setting a new record.

This shows that the bulls are in charge.

However, the negative divergence on the RSI tells us that the bullish momentum may be slowing down, and the LUNA/USDT pair might have a small correction or rest.

Price could fall below the 20-day EMA if traders who bought at low prices could make money.

That could bring the price down to the 50-day SMA, which is $84.

In the opposite case, if the price bounces back off the 20-day EMA, it will show that the bulls are still fighting hard to keep the level.

Then, the buyers will try to push the pair above $118, but it will be hard.

If they do well, the pair could rise to $125 and then move on to $150.

AVAX/USDT

Avalanche (AVAX) kept breaking above the $98 level over the last few days, but the bulls couldn’t hold on to the gains.

This shows that the bears are fighting hard to keep the level.

They will now try to get the price down to the 20-day EMA ($89).

Watch out for this important level because a strong rebound from it will show that the market is still going up and that people are buying when it drops.

That could make it more likely that the price will break and close above the $98 to $100 level.

This could make the AVAX/USDT pair go up to $120 if that happens.

If the price keeps going down and breaks below the 20-day EMA, the 50-day SMA ($82) could be the next target.

The two could then keep their range-bound work going for a few more days.

DOT/USDT

Polkadot (DOT) broke and closed above the $23 level on April 3, but the bulls could not hold on to the gains.

Bears haven’t yet given up, and they sell on every rise in the price.

Keep the price below $23 so that the aggressive bulls who may have gone long on a breakout above the resistance can’t get out of the way of the bears.

On the upside, the 20-day EMA ($21) is the most important thing to look for.

Because of this, the DOT/USDT pair could fall to $19.

It could take a few days for the DOT/USDT pair to get back above this level. If it doesn’t, the price could stay between $19 and $23.

If, on the other hand, the price rises from its current level and breaks above $24, the pair could rise to the 200-day SMA ($29).

DOGE/USDT

On April 3, Dogecoin (DOGE) bounced back from the 20-day EMA ($0.13), which means that the bulls are still fighting hard to keep this level.

The 20-day EMA is rising and the RSI is in the „good“ area, which means that buyers have an advantage.

As of April 4, there was still a lot of buying going on. The long wick on the candlestick suggests that bears are selling at higher levels because the price hasn’t hit $0.17 yet.

If the price keeps going down and breaks below the 20-day EMA, it will mean that the DOGE/USDT pair could stay in a range between $0.10 and $0.17 for a while longer.

The bulls will have to push and hold the price above the 200-day SMA to show that there could be a new trend.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.