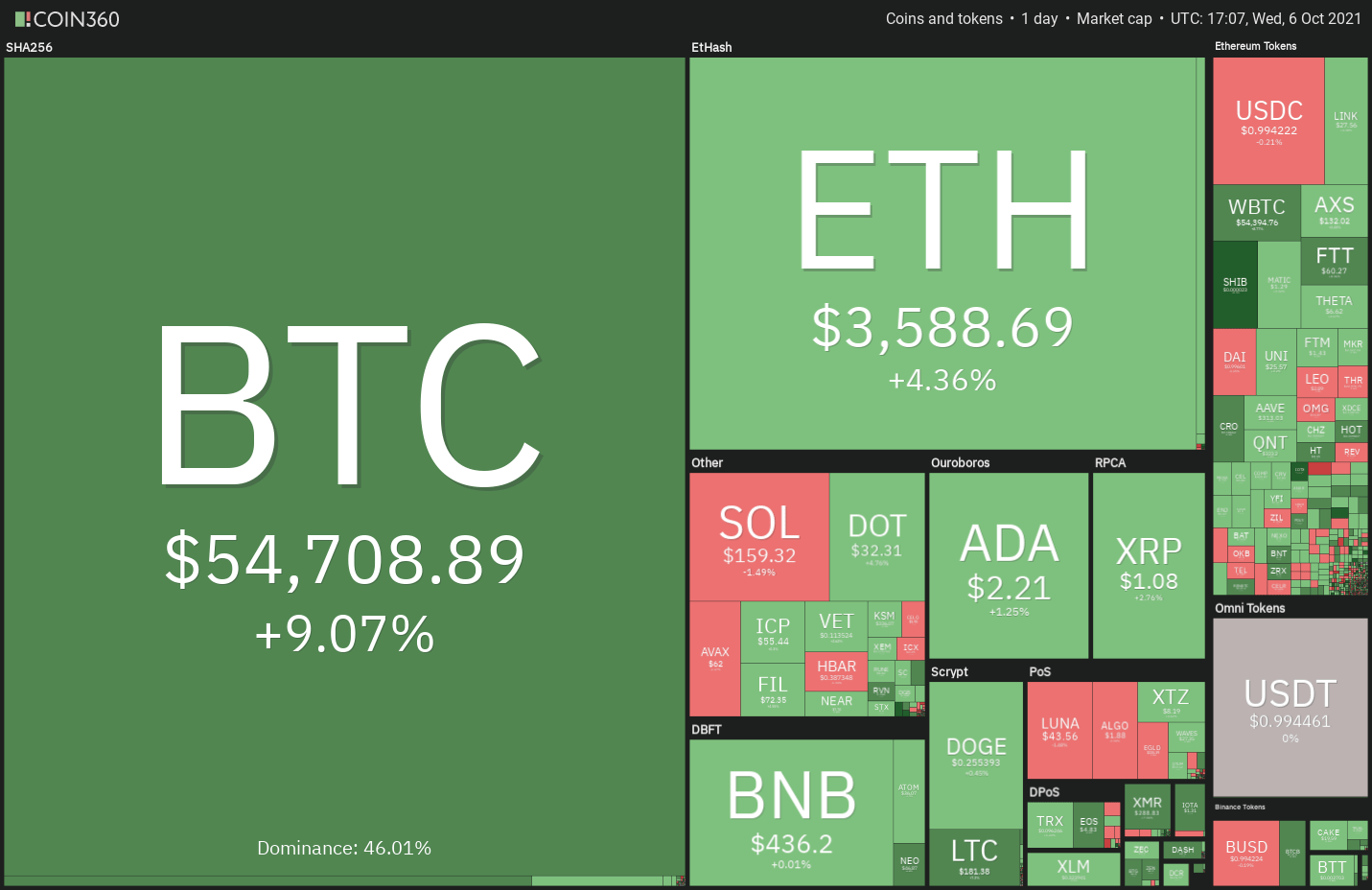

On Oct. 6, Bitcoin (BTC) surpassed the $1 trillion market value, bringing the overall cryptocurrency market worth close to $2.3 trillion. This represents a complete recovery of 100 percent from the June 22 lows, when the overall cryptocurrency market value fell to almost $1.15 trillion.

Between July 2020 and June 2021, the Central and Southern Asia and Oceania region saw a 706 percent increase in crypto transactions, according to Chainalysis. The entire transaction value was $572.5 billion, or 14% of the global total.

On Oct. 4, BofA Securities, a division of Bank of America Corporation (BoA), published a research predicting a bullish long-term outlook for cryptocurrencies. According to the analysis, about 221 million users would have traded cryptocurrencies or used a blockchain application by June 2021, a significant rise from 66 million users in May 2020.

According to the BofA analysis, the crypto sector was „too huge to ignore“ and encompassed „so much more“ than Bitcoin.

Is Bitcoin capable of regaining momentum and challenging the all-time high? Will this increase interest in alternative currencies? To learn more, let’s examine the charts of the top ten cryptocurrencies.

BTC/USDT

On October 4, bitcoin broke through and closed over $48,843.20, which was the first indication that the downturn might be coming to an end. Bears may have been enticed to cover their short positions as a result, culminating in a rally on October 5 and 6.

The bulls have pushed the price over $52,920, therefore invalidating the head and shoulders (H&S) pattern on the chart. A bullish crossover of the 20-day exponential moving average ($46,947) and the relative strength index (RSI) is near to the overbought zone, indicating that bulls are in command.

If bulls can keep the price above $52,920 for an extended period of time, the BTC/USDT pair could gain momentum and climb to $60,000. However, if this level is breached, the pair might threaten the all-time high of $64,854, which is currently at $64,854.

In contrast to this notion, if the price fails to maintain a sustained level above $52,920, it will indicate that demand at higher levels has dwindled. The pair’s value might then rise to $48,843.20.

ETH/USDT

On October 4, the cryptocurrency Ether (ETH) bounced off the 50-day simple moving average (SMA) ($3,317), and the bulls were able to prolong the comeback on October 5. On October 6, however, the bears attempted to block the recovery by pulling the price down to the 50-day simple moving average (SMA).

The extended tail on the day’s candlestick indicates that heavy purchasing has taken place near the 50-day simple moving average. The rising 20-day exponential moving average ($3,262.50) and the relative strength index (RSI) in the positive zone imply that bulls are in command.

If buyers are able to push the price above $3,676.28, the ETH/USDT pair might reach $4,027.88 in the near future. The bears will have to drag and hold the price below the 20-day exponential moving average in order to open the doors to a possible slide to $3,000 and subsequently to the 100-day simple moving average ($2,871).

BNB/USDT

Binance Coin (BNB) broke through and closed above the overhead resistance level of $433, but the bulls have been unable to capitalize on their gains thus far.

However, as can be seen from the long tail on the day’s candlestick, bulls eagerly bought the dip, which is a positive indication. The bears were successful in bringing the price down below $433 on October 6.

The 20-day exponential moving average ($404) is sloping upward, and the relative strength index (RSI) is in the positive region, indicating that buyers have the upper hand. If bulls are able to push the price above $444 and keep it there, the BNB/USDT pair might rise as high as $518.90.

This level may act as a stout obstacle once more, but if bulls are able to conquer it, the market’s momentum may begin to pick up. According to this premise, if price declines from its current level and falls below the 20-day exponential moving average, the next halt might be the 100-day simple moving average (SMA) ($377).

ADA/USDT

The bulls have been unable to overcome the overhead resistance at the 20-day exponential moving average ($2.25) in recent days, signaling that selling may be imminent at higher levels. According to the length of the tail on today’s candlestick, bulls are accumulating Cardano (ADA) at lower prices.

The 20-day exponential moving average is flattening out, and the relative strength index (RSI) is just below the midpoint, indicating a balance between supply and demand. If bulls are able to push the price over the 20-day exponential moving average, the ADA/USDT pair might surge to $2.47.

Alternatively, if the price continues to decline from the 20-day moving average, the bears will attempt to drive the pair down to $1.94. If the price breaks and closes below this support level, it may open the door for a further slide to $1.60.

XRP/USDT

For the previous few days, Ripple (XRP) has been trapped between the 20-day exponential moving average ($1.02) and the 50-day simple moving average ($1.10). This demonstrates that bulls are buying near the 20-day exponential moving average (EMA), while bears are defending the 50-day simple moving average (SMA).

The 20-day exponential moving average (EMA) has begun to rise, and the relative strength index (RSI) has moved into positive territory, indicating that bulls may have a minor advantage. If buyers are able to push and hold the price above the 50-day simple moving average, the XRP/USDT pair might begin its upward march toward $1.41.

On the other side, if the price continues to decrease from its current level and breaks below the 20-day exponential moving average, the decline could extend to the 100-day simple moving average ($0.91). Dropping below $0.70 is possible if the price breaks through and closes below this level.

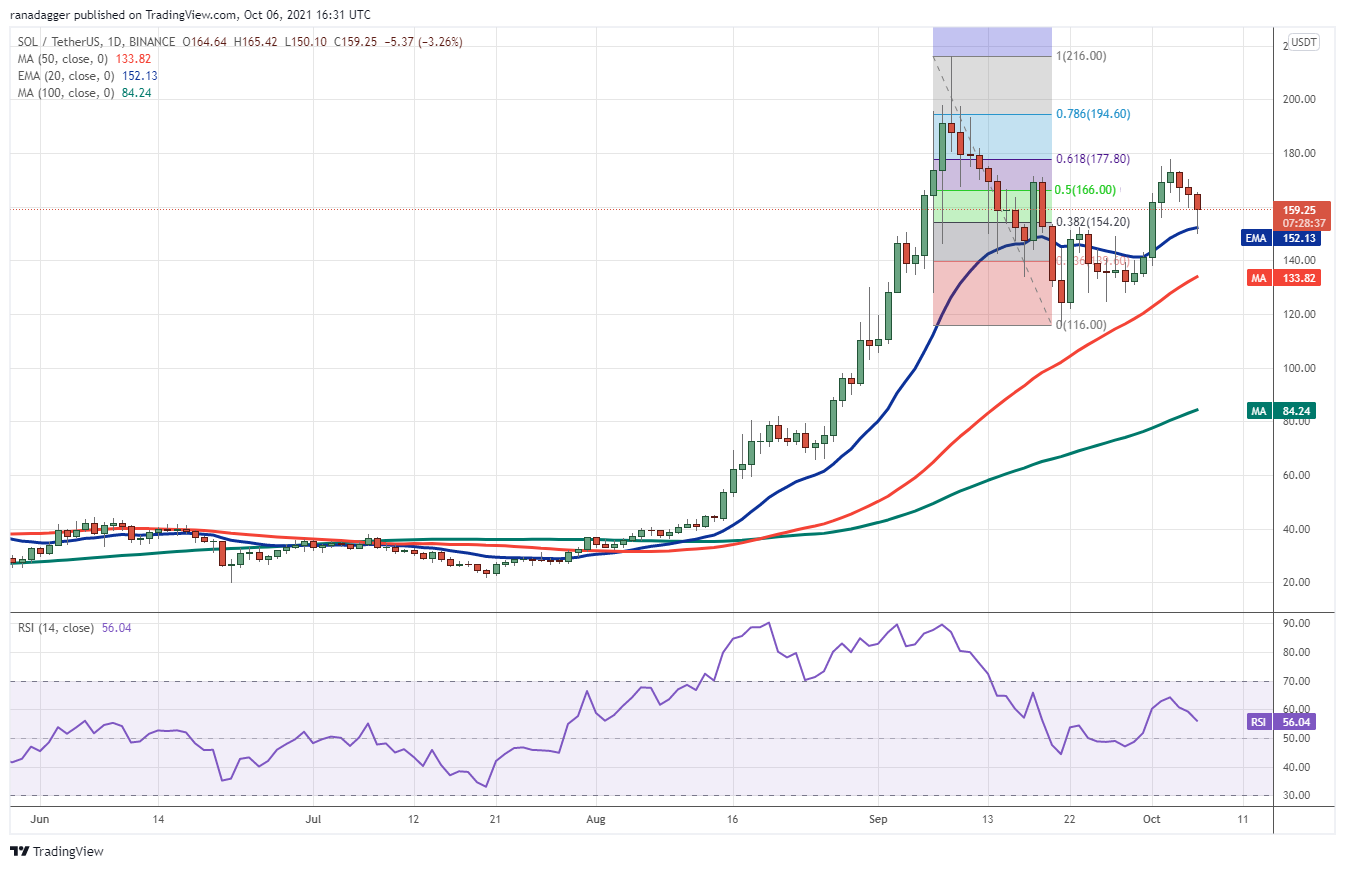

SOL/USDT

Earlier this month, Solana (SOL) fell below the 61.8 percent Fibonacci retracement level at $177.80 and sank to the 20-day exponential moving average ($152) on Oct. 6. The bulls are currently seeking to hold onto the 20-day exponential moving average.

If the price climbs from its current position, the bulls will attempt to take the SOL/USDT pair above $177.80, according to the market. If they are successful in doing so, the pair may rise above $200 and then retest the all-time high of $216, which would be a significant gain.

Alternatively, if bears manage to push the market below the 20-day EMA, the pair may drop to the 50-day simple moving average ($133) and then to the important support level of $116. If this level is breached, the selling might get more intense, and the pair could plummet to the 100-day simple moving average ($84).

DOGE/USDT

On Oct. 4, Dogecoin (DOGE) surged over the 20-day exponential moving average ($0.22), indicating that bulls are attempting a return. On Oct. 5, buyers successfully moved the price above the 50-day simple moving average ($0.25), but the bears were able to hold onto the downtrend line.

On October 6, another attempt by the bulls to force the price above the downtrend line was met with heavy resistance, but the positive indicator is that the bulls are not giving up much ground at this point. The 20-day exponential moving average has progressively risen, and the relative strength index (RSI) is in the positive zone, indicating that the path of least resistance is to the higher.

In a bullish scenario, the DOGE/USDT pair might rally to $0.32 and then to $0.35 if bulls can drive the price above the downtrend line and keep it there. Alternatively, if the price continues to fall and falls below the 20-day exponential moving average, the pair might fall to the $0.21 to $0.19 support zone.

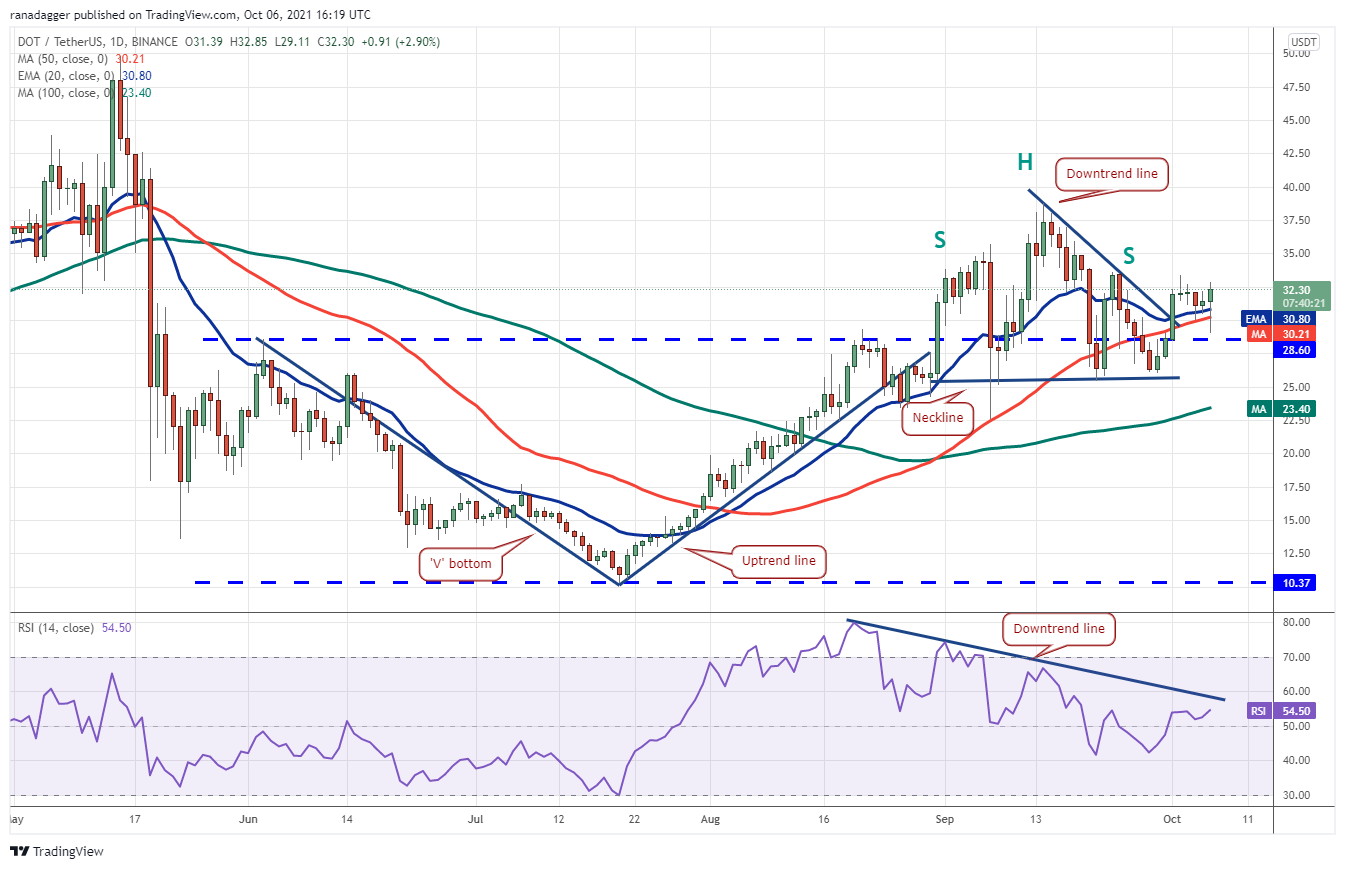

DOT/USDT

Polkadot (DOT) rallied off the 50-day simple moving average ($30.21) on October 4, but the bulls were unable to maintain the higher levels. The bears were able to push the price back below the 50-day simple moving average (SMA) today, but the lengthy tail on the day’s candlestick indicates aggressive buying near the $28.60 level.

The bulls will now attempt to push the price over the overhead resistance level of $33.60 in the near future. If this occurs, the DOT/USDT pair might rise as high as $38.77 per dollar. This level may operate as a resistance level in the future, but if the bulls are able to surpass it, the pair may begin its ascent toward $49.78 again.

Alternatively, if the price continues to fall from its present level of $33.60, the bears will attempt to push the price below the neckline for a second time. This move will complete the H&S pattern, which has a target objective of $12.23 and a target price of $12.23.

LUNA/USDT

While the Terra protocol’s LUNA token reached a new all-time high on Oct. 4, the lengthy wick on the day’s candlestick indicated that investors were taking profits near the psychological level of $50 at the time. On Oct. 5, the token formed an inside-day candlestick pattern, indicating that bulls and bears were unsure whether to buy or sell.

On October 6, this ambiguity was resolved in the negative direction, and the LUNA/USDT pair fell to $40.38. According to the long tail on today’s candlestick, lower levels attracted strong purchasing, whilst higher levels did not.

It is expected that the bulls will make one more try to push the price above $50 and re-establish the upward trend. The bears, on the other hand, will attempt to stop the recovery by pulling the price below the 20-day moving average ($38.57). If this occurs, the pair is likely to fall below the key support level of $32.50.

UNI/USDT

As evidenced by the lengthy wick on the candlestick over the past two days, the bulls are actively buying on dips to the 20-day exponential moving average ($24.33). On October 6, bears dragged Uniswap (UNI) below the 20-day exponential moving average (EMA), but bulls held onto the 100-day simple moving average ($23.47).

With the 20-day exponential moving average steadily increasing and the RSI in the positive region, buyers have a slight advantage. If bulls are able to drive the price above the neckline and close the trade above it, the inverse H&S pattern will be completed. This profitable setup has a target objective of $36.98 as its target price.

The price falling from its current level or from its neckline and breaking below $22 will indicate that demand has dried up at higher levels, which is in opposition to this premise. After that, the UNI/USDT pair might fall to $18.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.