User experience has been a longstanding dilemma in cryptocurrency. Early adopters have approved a lot of issues that just don’t exist in standard economical markets, which includes friction with onboarding, slow block confirmation situations, and trade outages.

Having said that, potentially a person of the most significant UX concerns for cryptocurrency traders and investors is liquidity. The cryptocurrency markets are seriously fragmented, with every exchange functioning as a virtual silo, unconnected to the others. It can even be the scenario that if you want to trade a unique altcoin, you have to have to go resources amongst numerous exchanges just to obtain the token you want.

Now, we’re in a new period of adoption, with establishments in search of to acquire publicity to the fast expanding electronic asset marketplaces. From an institutional standpoint, liquidity is an even more considerable obstacle. In a fragmented exchange landscape, the liquidity of a well known trading pair like BTC-USD or ETH-USD is only as deep as the quantity on the biggest exchange.

Additionally, there are frequently non-negligible cost differences concerning exchanges and no easy way for a trader to be absolutely sure that they are generally getting the very best price tag. Trackers providers like CoinGecko or CoinMarketCap may perhaps offer averages and market overviews. But with the fast pace of actions in the crypto markets, people chance slippage if they’re jumping close to concerning distinctive interfaces and providers.

For that reason, with BTC on a seemingly hardly ever-ending tear and institutional and retail newcomers flocking to the room, there’s by no means been a superior time to resolve the liquidity challenge at the time and for all.

Enter OpenOcean.

What is OpenOcean?

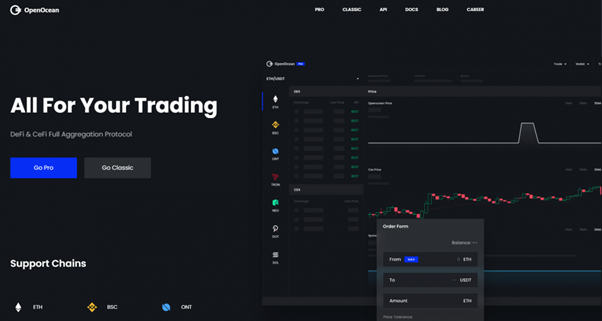

OpenOcean is the only complete sector aggregator that presents customers a single interface to accessibility liquidity throughout centralized and decentralized exchanges. It uses an smart routing algorithm to come across the very best price tag for any asset throughout all exchanges, with the cheapest danger of slippage.

The algorithm is an optimized version of Dijkstra’s algorithm designed to locate the shortest route amongst details on a graph. OpenOcean applies its edition of the algorithm, termed D-star, to uncover the very best charges with decreased slippage and then splits routing among various protocols for better transaction costs. The net outcome for end users is the most effective price tag with the least expensive slippage in genuine-time throughout an lively trade.

Traders have the solution of applying either the “Classic” interface, with is a easy box making it possible for people to entry token swaps, or the “Pro” interface, which presents whole sector visibility across all CEXs and DEXs. Professional traders can also plug into the protocol utilizing the API.

There are no charges for utilizing the protocol. Even so, institutional buyers wishing to choose advantage of custom UIs and investment approach execution are charged for setup.

Roadmap and Milestones

At the time of creating, OpenOcean has integrated 4 blockchains: Ethereum, Binance Smart Chain, Ontology, and TRON. As a result, it aggregates liquidity from all DEXs running on those platforms. It also plans to integrate the Polkadot, Solana, and NEO blockchains.

Binance is the initial centralized exchange to develop into integrated, with plans for Coinbase and Deribit to stick to.

The roadmap for OpenOcean is break up into 4 phases, dubbed Antarctic Ocean, Indian Ocean, Atlantic Ocean, and Pacific Ocean.

Antarctic Ocean associated aggregating DEXs managing on Ethereum, BSC, and Ontology. This stage is already concluded. Indian Ocean ongoing with cross-chain aggregation of swaps, aggregated location solutions on CEXs, and the issuance of the OOE governance token. Indian Ocean done at the close of March 2021.

The latest period, Atlantic Ocean, is longer and will run until eventually the finish of the to start with 50 % of 2022. It will provide in multiple updates, together with introducing CeFi futures products and solutions, aggregating DeFi derivatives, and cross-chain mixed margin pools. We can also anticipate to see extra centralized exchanges and blockchain platforms join OpenOcean as the roadmap progresses.

The last stage, Pacific Ocean, will run from July 2022 till 2023. The greatest target is to start OpenOcean as a complete smart asset management platform covering the whole spectrum of centralized and decentralized economical methods.

In early March, OpenOcean done a strategic fundraising round led by Binance. A couple months later, the enterprise confirmed that it experienced made a private placement of shares to a picked group of traders, including Altonomy and LD Money, equally of which participated in the funding round.

OOE Token

The OOE token presents various utilities, in addition to its purpose as a protocol governance token. In future, OOE holders will reward from gasoline and slippage subsidies, resulting in negligible investing fees. Holding OOE also confers CEX VIP membership, which includes advantages these types of as fee premiums and lessened buying and selling expenses and token withdrawals.

As OpenOcean provides on its roadmap milestones of integrating derivatives products, OOE holders will be capable to deploy their tokens as margin in put together margin items, enabling a single-quit derivatives investing throughout exchanges. Tokens can also be utilised as collateral for lending.

The task is currently engaged in an airdrop of 1% of its OOE tokens to early customers. 34% of the complete OOE source is allocated to the distribution of liquidity mining benefits more than the upcoming 5 years. OpenOcean will operate swimming pools on DEXs in numerous community chains it aggregates on the protocol, like Ethereum, Binance Intelligent Chain, Ontology, and Tron. OOE swimming pools will contain pairs with DAI, ETH, USDT, BNB, and many others.

Group

OpenOcean was started by Leo Xue and Cindy Wu. Leo Xue provides working experience from Intel and the China Monetary Futures Exchange, exactly where he led the crew creating the investing system. He started off looking into cryptocurrency protocols in 2015.

Cindy Wu was formerly a strategy supervisor at RBS, and M&A supervisor at the 3M corporation. She also labored at a personal equity fund as a senior investment director. She holds a Masters in State-of-the-art Finance from the IE Company Faculty.

Conclusion

Liquidity in cryptocurrency is a genuine dilemma, and OpenOcean is the only aggregator of its form looking for to pool liquidity from throughout the whole cryptocurrency markets. Thus, it has an clear price proposition that will enchantment to cryptocurrency users across the spectrum. If the challenge delivers on its bold roadmap, it will occupy an useful placement in the sector – one particular that other people will without doubt try to replicate.