Bitcoin is exhibiting signs of continuing its bullish momentum regardless of a recent sell-off that it expert immediately after soaring in direction of $18,500.

The flagship cryptocurrency’s hottest draw back correction has fulfilled with an equal resistive buying sentiment around nearby lows. As a end result, its selling price towards the dollar has rebounded on numerous breakdown makes an attempt, developing a framework that seems like a Bull Pennant.

Bitcoin types an upside continuation sample. Source: BTCUSD on TradingView.com

The Bullish Construction

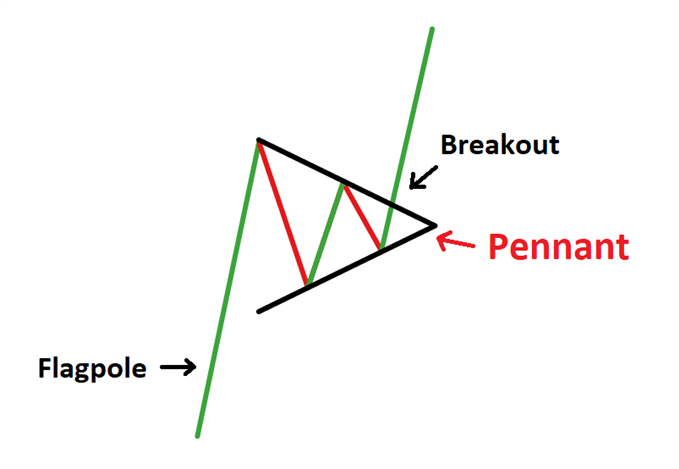

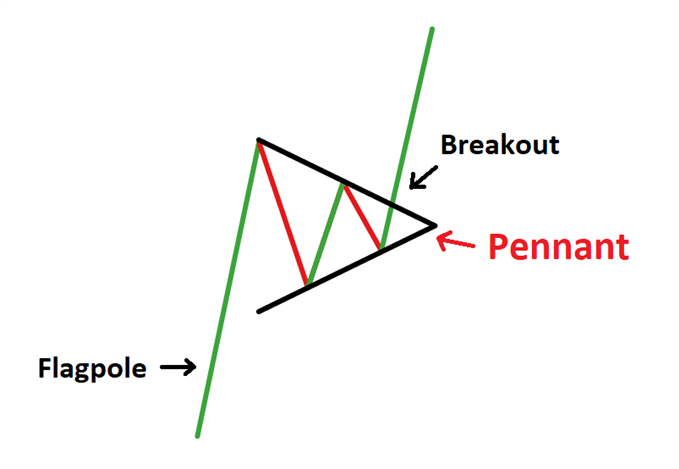

In retrospect, a Bull Pennant is a bullish continuation signal that kinds through an asset’s uptrend. It exhibits traders with a limited-phrase risk appetite liquidate their positions for an interim revenue. In the meantime, all those with a prolonged-expression appetite prepares to reload their positions at area support levels.

That minimizes the bid for the asset, total, leading to a correction. But as the selling price consolidates, forming reduced highs and higher lows, it represents higher accumulation sentiment from the long-time period traders. As a end result, the asset generally breaks out above the vary, with an upside rate focus on as substantial as the rally’s height prior to the consolidation started.

Bull Pennant Instance. Resource: DailyFX

Bitcoin fits the criteria of the mentioned Bull Pennant Construction. The cryptocurrency rallied by $1,898 and is now consolidating sideways inside of a converging trendline construction. All it wants to verify the Pennant fully is to crack out and increase by as significantly as $1,898.

That places Bitcoin en route to hitting $20,000 (or ranges $100-150 shy of it).

Bitcoin Fundamentals

The potential clients of hitting $20,000 maximize further because of supportive fundamentals. Bitcoin this thirty day period obtained attention from worldwide media, with the likes of Economical Periods, the Wall Road Journal, and CNN covering the cryptocurrency just after it rallied by far more than 150 per cent in 2020.

Even Sport of Thrones actor Maisie Williams became a “BITCOINER,” incorporating more acceptance to the earlier referred to as “a rat poison” by legendary trader Warren Buffett.

But this time is diverse, as Monetary Instances documented. Other famous investors like Paul Tudor Jones and Stan Druckenmiller acquired the cryptocurrency, stating that they see it as a hedge towards inflation. The “rat poison” is emerging as nectar as global banking institutions prints additional funds to help their economies through COVID-led recession.

“Bitcoin is coiling above the craze line to a new ATH by 12 months-end,” stated Jason Williams, co-founder of Morgan Creek Digital Property. “The constant development is like a great bait in the water for a fisherman. The satisfies see the charts and can’t assist on their own. Hooked and in the boat. Bitcoin is familiar with what it’s executing.”

As of now, Bitcoin is just $2,000 away from hitting its record peak.