The value of Bitcoin dips underneath $40k, triggering bearish sentiment. BTC is now down 40% from its highs, generating this in line with the worst drops of 2017. Presently, Bitcoin is keeping the 200-working day going regular, owning wicked below it briefly during the early hours.

Supply: BTCUSD on TradingView.com

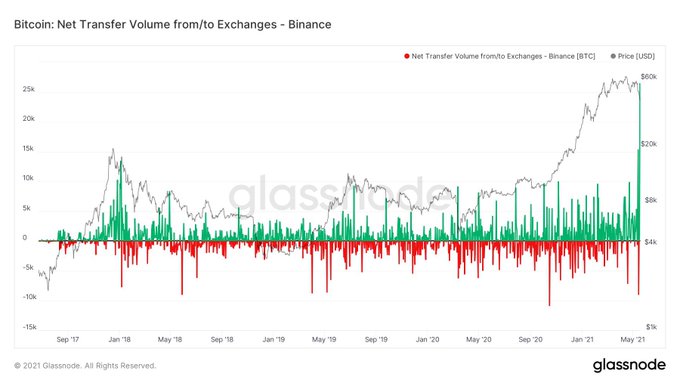

William Clemente III famous that Bitcoin inflows into Binance have hardly ever been greater, at close to 27k models. This would propose sellers are keen to liquidate their holdings, introducing to the bear case and denting the narrative all-around Bitcoin as an institutional-grade retail store of price.

Resource: @WClementeIII on Twitter.com

Bitcoin Haters Sharpen Their Knives

Gold-bug Peter Schiff took the prospect to weigh in on the Bitcoin selloff, targeting businesses that bought BTC as an inflationary hedge. Schiff termed out the “asinine advice” specified by MicroStrategy’s Michael Saylor, expressing Bitcoin losses now considerably exceed the envisioned once-a-year inflation amount.

He signed off by saying now is the time to soar ship.

“CEO’s who adopted@michael_saylor‘s asinine assistance to plug their harmony sheets into #Bitcoin to hedge versus an anticipated once-a-year #inflation amount of 2% are now down as a great deal as 34% on their “hedge” in 1 thirty day period. Which is 17 several years of expected inflation losses. Time to pull the plug!”

In reaction, Saylor posted a screenshot exhibiting gold’s return vs. Bitcoin about the previous 12 months at -77%. This was triggered a frenzied outburst from Schiff. He named Saylor a coward for not wanting to discussion him on the gold vs. Bitcoin argument.

“Also, instead of just posting irrelevent [sic] replies to my tweets, why do not you agree to debate me? So considerably you have turned down every single option to do so. It’s clear to me that you are afraid to truly confront me and protect your absurd sights, so you consider the coward’s way out.”

Saylor countered by expressing the basis for the discussion is unclear as Schiff has a vast scope of tips, not just gold. Introducing that his caveat of purchasing “just not also much” of almost everything fails to give any definitive solutions.

MicroStrategy Provides To Its Holdings All over again

Undeterred by the bearishness, Saylor declared yet another Bitcoin shopping for spree for MicroStrategy – the second because the Elon-FUD of past week.

In a tweet, the MicroStrategy boss mentioned the company spent $10 million to purchase an extra 229 BTC.

“MicroStrategy has obtained an supplemental 229 bitcoins for $10. million in hard cash at an average cost of ~$43,663 for each #bitcoin. As of 5/18/2021, we #hodl ~92,079 bitcoins acquired for ~$2.251 billion at an normal price of ~24,450 per bitcoin.”

Bitcoin is at a significant juncture. Time will inform if Saylor’s confidence in it is justified.