Whilst decentralized finance (DeFi) has witnessed a robust surge in 2020, Maker (MKR), a token strongly tied to DeFi, has underperformed. The cryptocurrency, relative to its opponents, is underperforming where by Aave’s LEND and Synthetix’s Synthetix Network Token surged hundreds of % in this yr by itself, MKR only noticed a 20-30% go higher.

The industry may possibly be transforming its intellect on MKR, however.

The coin is up 7% in the past 24 hours and would seem poised to see additional development as the fundamentals of the fundamental MakerDAO protocol align in favor of development.

Associated Looking through: MicroStrategy’s Inventory Carries on to Soar After Bitcoin Buy

Maker Surges 7% Larger Regardless of Stagnation in Bitcoin & Ethereum Selling prices

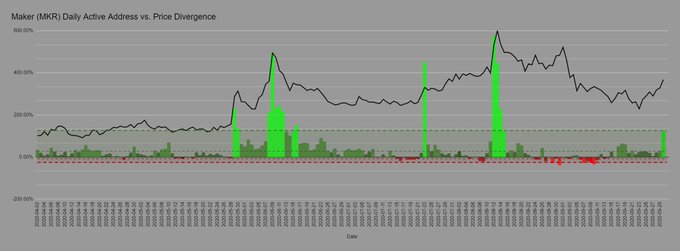

Santiment, a blockchain analytics business, experiences that the cryptocurrency has “the premier bullish divergence concerning everyday active addresses and latest rate (centered on historic indicates) of any best 100 #blockchain we monitor.” This suggests that MKR’s increasing consumer rely is not staying mirrored in selling price action, but might before long be:

“On major of this, from a pure network action perspective, $MKR presently has the largest bullish divergence in between daily lively addresses and present price tag (centered on historic suggests) of any prime 100 #blockchain we observe.”

Chris Burniske, associate at Placeholder Money, has echoed the optimism about Maker. He a short while ago noted that most buyers in the crypto area are currently “sleeping on MKR” in spite of the utility of the protocol “going by the roof” and as extra study is accomplished about how the coin captures worth.

“People largely sleeping on $MKR even though utility goes via the roof, and discussions abound around its value seize model.”

Connected Examining: Critical On-Chain Signal Predicts That Bitcoin’s Upcoming Go Will Be Upward

Adding to this, balance charges ended up just reimplemented into the MakerDAO protocol after a very long interval of % rates. This suggests that MKR may perhaps start to accrue benefit when again as the protocol commences creating expenses, resulting in the buying back and burning of MKR tokens.

Connected Looking through: Ethereum Transaction Charges Surge to All-Time Highs Soon after Uniswap Launch

Highlighted Image from Shutterstock

Cost tags: mkrusd, mkrbtc, mkreth

Charts from TradingView.com

Maker (MKR) Surges 7% as Steadiness Service fees Released, DeFi Regains Footing