A crowd loan is a Polkadot (DOT) crowdsourcing event that enables the community to contribute to project bids in upcoming parachain slot auctions. Users donate DOT, earn project tokens in exchange for their contributions, and receive their DOT back after two years (a standard slot lease duration). This mechanism enables projects to raise significant funding in the form of DOT tokens, which may surpass a few hundred million dollars in nominal value.

The obvious disadvantage for consumers is the requirement to lock their DOT for two years during which they would lose access to their liquidity.

Private firms and initial public offering (IPO) lockup agreements are common in mainstream finance. For a specified amount of time, lockup agreements ban firm insiders — including employees, their friends, family, and venture capitalists — from selling their shares. These shares are „locked up“ to prevent their owners from selling them too soon after the initial public sale.

To circumvent lockup stock regulations, individuals can enter into arrangements that lock up their gains or even get money in advance of the day they can sell their holdings. Corporate counsel began prohibiting these agreements because they would impose undue market pressure and, in certain situations, present the legal dangers intended to be avoided by lockups.

The concept of liquid staking

Fortunately, this examination has nothing to do with the blockchain domain, which is not constrained by private legal considerations. We might very well construct claim rights on the locked assets by the issuance of a specific form of derivative token that represents these claim rights on the underlying primary assets.

Typically, derivative tokens are created in a 1:1 ratio to the locked tokens. They can be issued by a liquid staking provider in exchange for users sending initial assets to their custodian address, or by the target staking protocol in order to simplify accounting. The latter technique is prevalent in Ethereum-based automated market makers (AMMs) and pooled lending protocols that issue liquidity pool tokens, such as AAVE, Compound, or Curve.

In any instance, an obvious arbitrage exists between the market and the eventual custodian. At some point, each user might claim underlying by sending derivative tokens to the staking process. If arbitrage occurs immediately, the ratio of derivative tokens to locked assets approaches one-to-one. Otherwise, it may vary according to the speed with which the underlying can be unlocked.

This concept enables the emergence of a market for numerous decentralized finance (DeFi) initiatives. You may have noticed a number of them already providing liquidity for various sorts of collateral, active interests in proof-of-stake (PoS) protocols, and other non-fluid assets. For instance, Lido has absorbed approximately $6.7 billion in Ethereum 2.0 (ETH) stakes (which is almost 19 percent of all ETH staked in Ethereum 2.0 deposit contract). Marinade Finance was able to secure over $1.6 billion in Solana’s SOL via its Solana protocol.

Liquid staking providers‘ success is greatly dependent on the number of prospective locked assets and the activity of the investors they target.

Liquid staking and crowdloans on Polkadot

Polkadot crowdloans naturally pair well with liquid staking. Crowdloans are expected to lock in up to 20% of DOT supply (which comes to an impressive eight billion U.S. dollars). Second, crowdloan participants are frequently the most active investors, constantly seeking to maximize their returns. Liquid staking appears to be an appealing prospect for them.

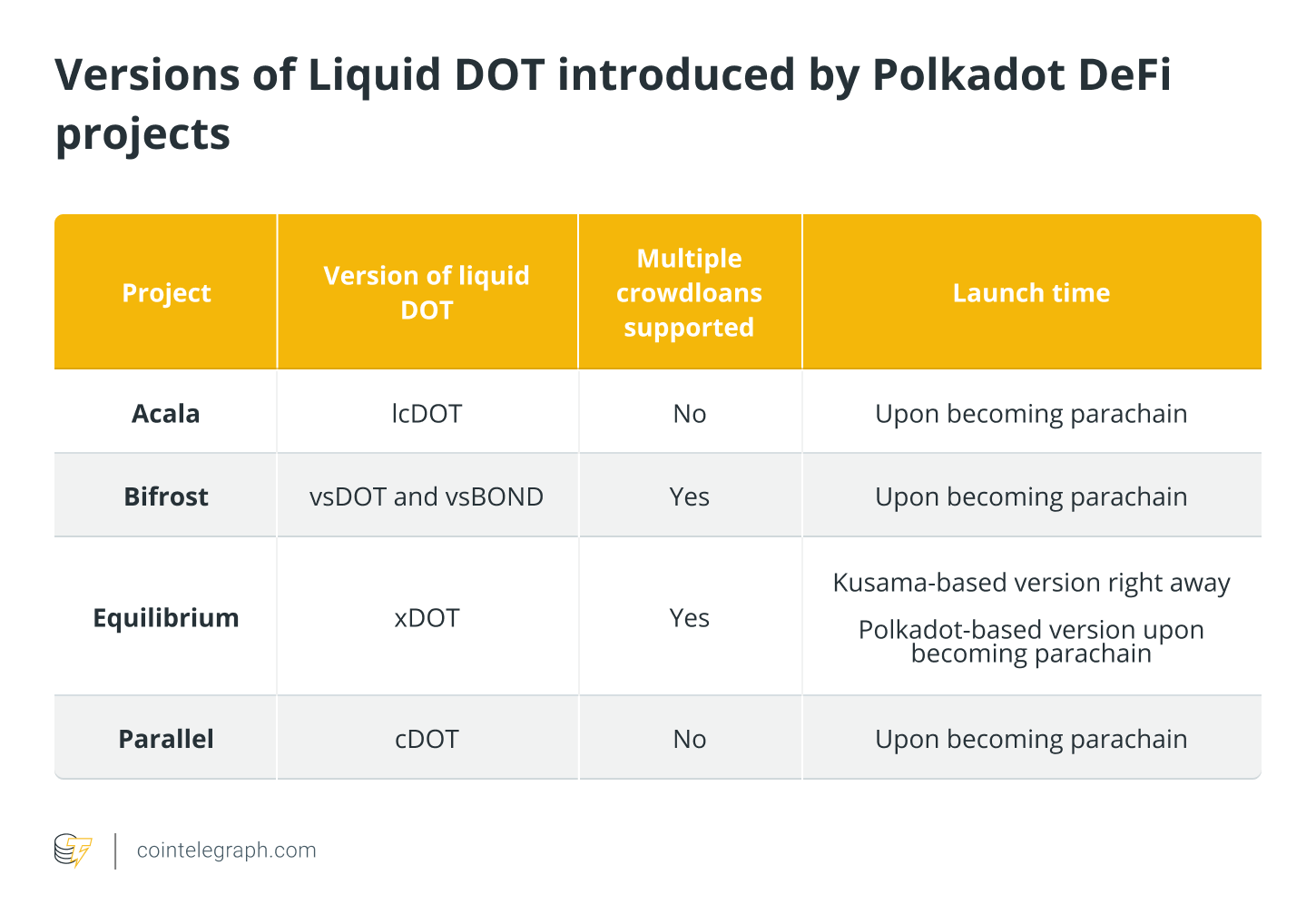

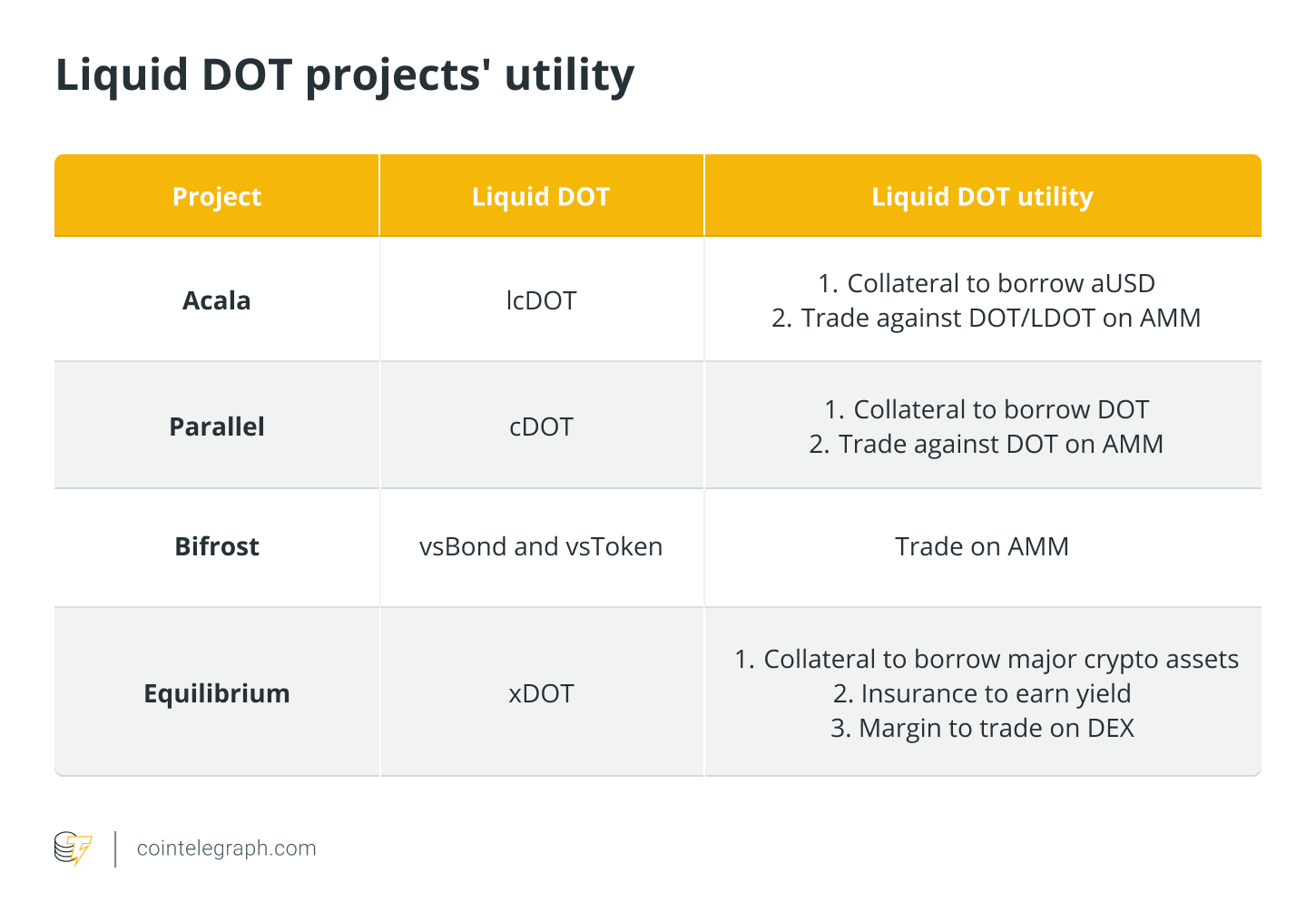

Without a doubt, the most sophisticated Polkadot DeFi teams are already using this use case. Each of them has launched its own liquid DOT that is minted at a 1:1 ratio to the initial DOT locked via their systems. What these projects are currently offering their users is as follows:

Liquid staking is a great opportunity for Polkadot-based DeFi projects to rapidly increase their total value locked (TVL) from the start. Liquid DOT will provide them with liquidity for the duration of the two-year parachain lease.

Major market participants cannot afford to overlook this chance as well. For example, Binance has launched a liquid DOT dubbed BDOT, which the exchange intends to use for both trade and speculating. However, we will evaluate only liquid staking by ecosystem projects today, which means that Binance USD (BUSD) and wrappers on other exchanges will be excluded.

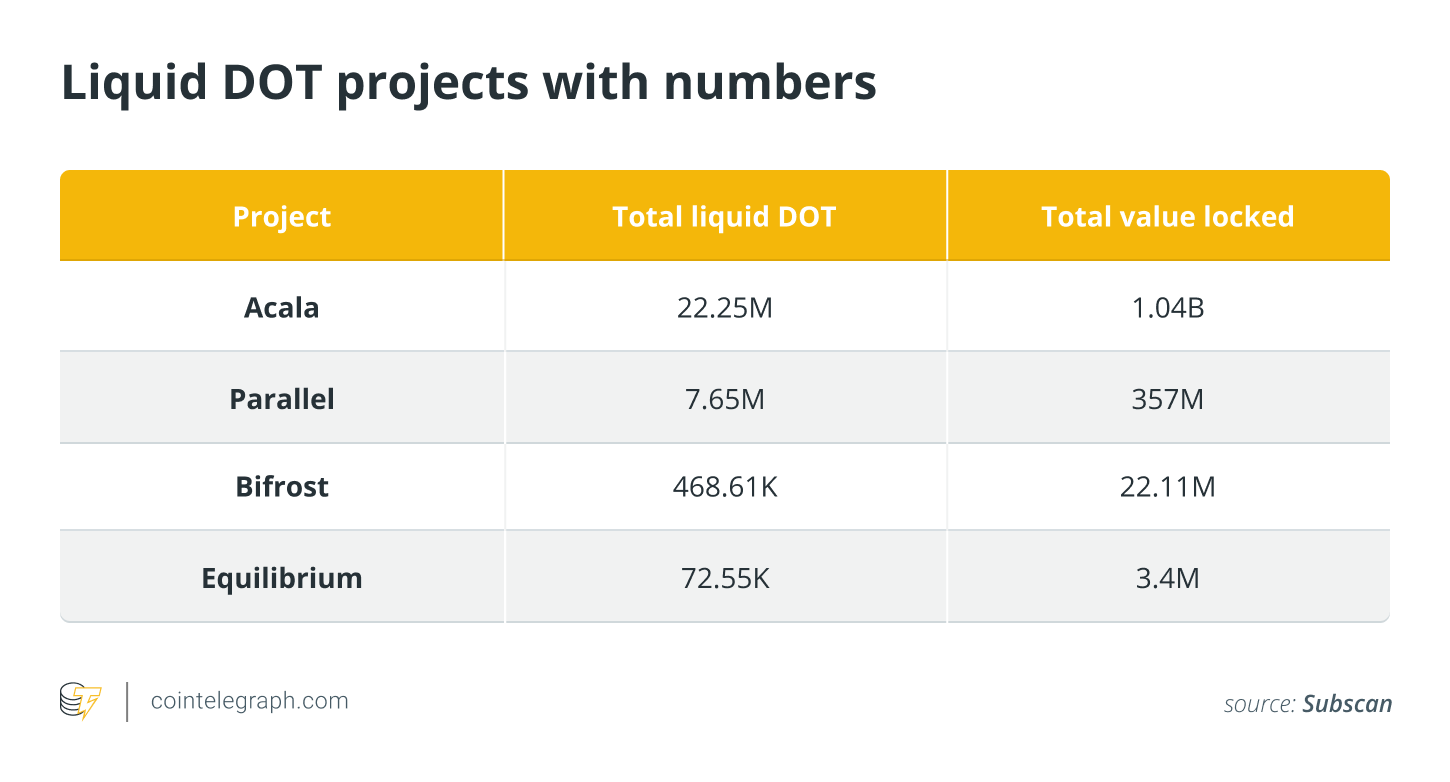

Liquid DOT’s traction so far

Before we go into the mechanics of each arrangement, examine the following statistics in the mid of November-

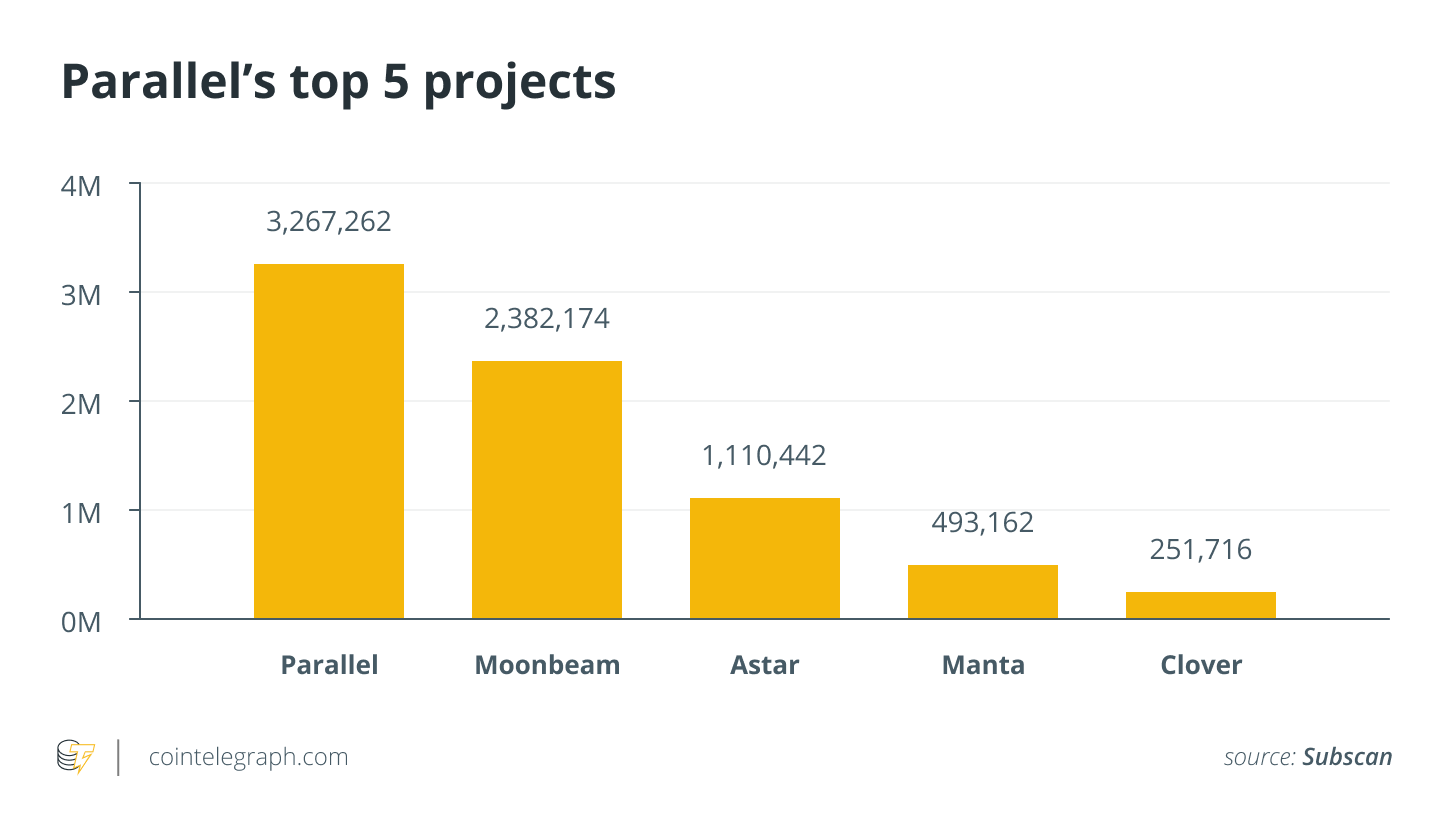

As can be seen, Parallel and Acala are clear leaders here. Acala is able to manage this enormous volume because to its primary position as the ecosystem’s top project. Parallel gained an early advantage by offering DOT contributors benefits in Parallel’s native token PARA, in addition to extra bonuses from partnered projects.

Equilibrium has also announced further EQ benefits on all DOTs locked via its xDOT platform. Apart from perks, the project has created a referral scheme via which users can earn EQ for each stake to xDOT made via referral links.

As such, crowd loan investors can take use of an exclusive option to earn regular crowd loan returns while maintaining a liquid DOT and earning additional rewards from liquid staking. These nice additional perks appear to be growing in popularity as competition amongst liquid staking suppliers heats up.

Now that we’ve examined the environment, let’s take a closer look at each project.

Acala

Users will donate DOT through Acala’s Liquid Crowdloan DOT (lcDOT) option in the crowd loan marketplace. Contributions are made to the Acala Foundation’s proxy account. Each user receives 1 lcDOT for each DOT that is locked. Cardano (ACA) will also be distributed to users, albeit it is unclear if this will be distributed to original DOT contributors or lcDOT holders. For the time being, lcDOT will accept contributions for only one project, Acala.

lcDOT may be used as collateral for the decentralized stablecoin Acala dollar (aUSD). Additionally, it will almost certainly be featured on their Uniswap-style AMM for pairs containing DOT and Liquid DOT (LDOT).

Acala will first collect DOT on a proxy account controlled by the Acala Foundation’s multisignature wallet. When the Acala parachain becomes operational, ownership of the proxy account will be moved from the multisig to the Acala parachain account, which will be completely trustless and subject to Acala’s on-chain governance.

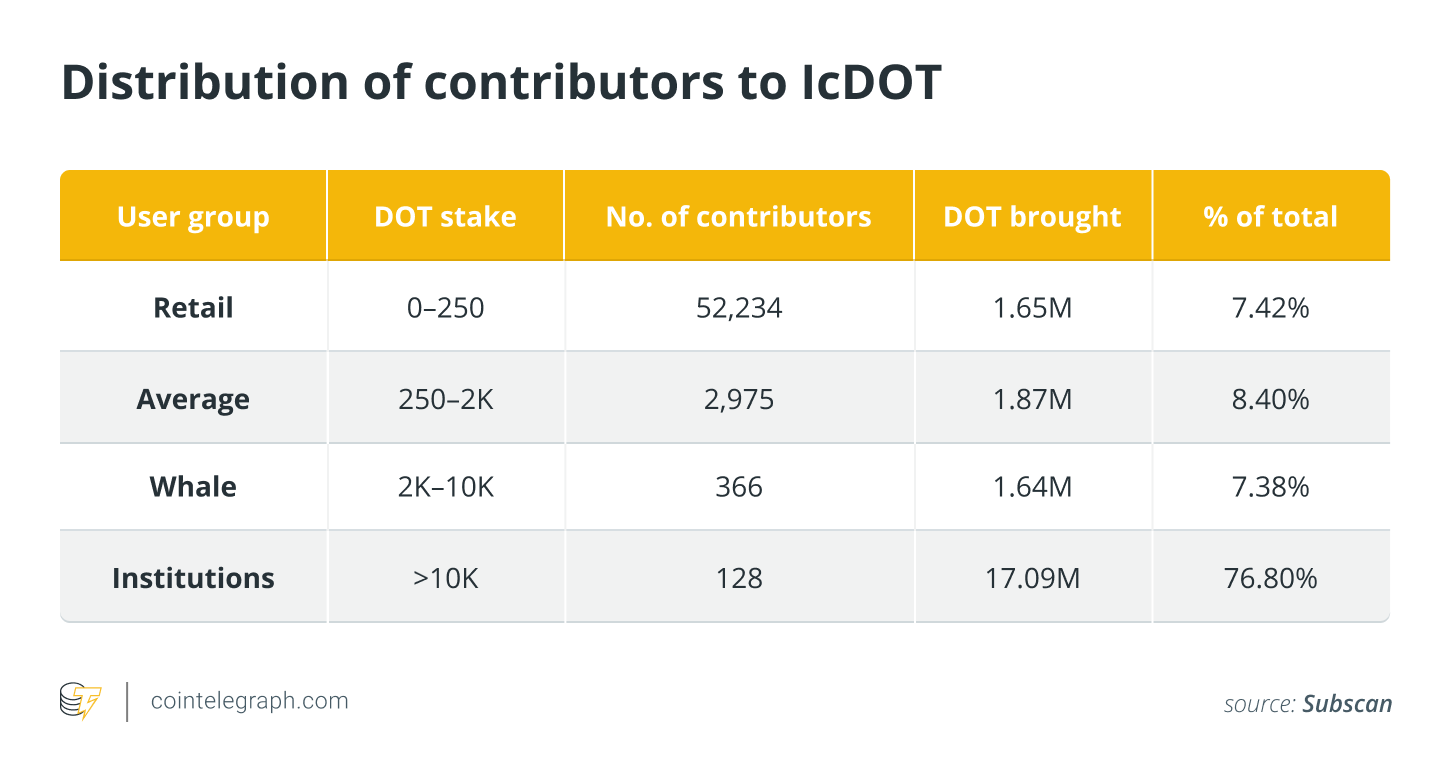

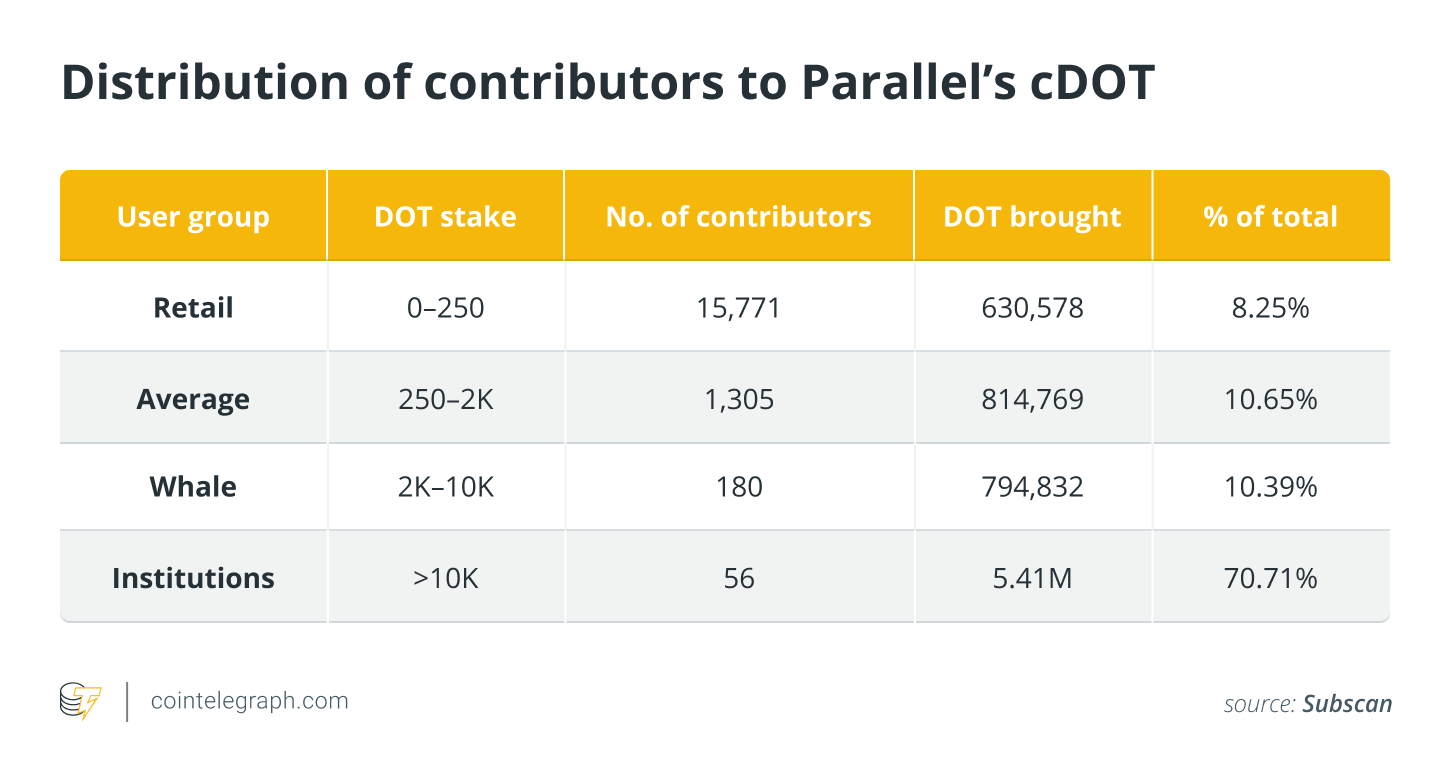

Despite a substantial 80 percent+ share of whales and institutions, which once again validates the Pareto principle, we witness an outstanding quantity of contributions from retail customers. Additionally, there is no other way to contribute to Alcala’s crowd financing on the municipality’s website other than through lcDOT. Given the DOT’s ridiculous 27 million crowd loan, this retail behavior is quite predictable.

Parallel

Parallel’s cDOT mechanics will be used to provide DOT. Parallel supports various projects and provides additional benefits to users participating in crowdloans via cDOT, both in PARA tokens and from their „partner“ initiatives.

Parallel’s cDOT tokens will be issued upon the acquisition of a parachain space by Parallel. These tokens will be used as collateral for loans or as a lending asset on Parallel’s compound-like money market network.

The technical arrangement is similar to that described above, with the exception that user contributions will initially be held in a multisignature repository that will collectively vote for other projects. At the time of writing, there is no publicly available information about the multisig players.

It’s unsurprising that the majority of DOT is staked for Parallel. Their website does not provide any other means of participation in their crowdloan except through cDOT.

Parallel’s technical support for the Moonbeam crowdloan remains unknown, as Moonbeam’s parachain currently lacks a multisignature pallet. It may even be impossible to disburse Moonbeam’s crowdloan payouts in GIMR, the Moonbeam native token, which will arrive at Parallel’s multisignature-protected address. Despite this, they accumulated an astounding amount of DOT for Moonbeam.

Surprisingly, the image bears a striking resemblance to Acala’s. Parallel has received a single mega-donation of 1.5 million DOT from a single address that committed DOT for Astar, Clover, Moonbeam, and Parallel.

Bifrost

Users will submit DOT via the SALP protocol developed by Bifrost. SALP supports a number of projects that are theoretically capable of processing multisignature transactions. Bifrost provides two sorts of tokens to its users: vsBond and vsToken. vsBonds are associated with certain projects and enable the collection of crowd loan incentives.

They are tradeable on the pending orders exchange for „buy-in-price“ orders. vsTokens, on the other hand, are not tied to any one project and, when combined with equivalent vsBonds, enable users to redeem DOT at the end of the lease time. At maturity, vsTokens trade in a Bancor and 1-to-1 peg pool. Additionally, vsBond and vsTokens can be used within Bifrost’s DeFi ecosystem.

Technically, the solution is comparable to that of Acala. They will first utilize a multisig address controlled by Bifrost until Bifrost is no longer a parachain. After the project is awarded a parachain slot, control of the multisignature will be transferred to the parachain account. A necessary condition is the faultless operation of Polkadot’s XCM protocol.

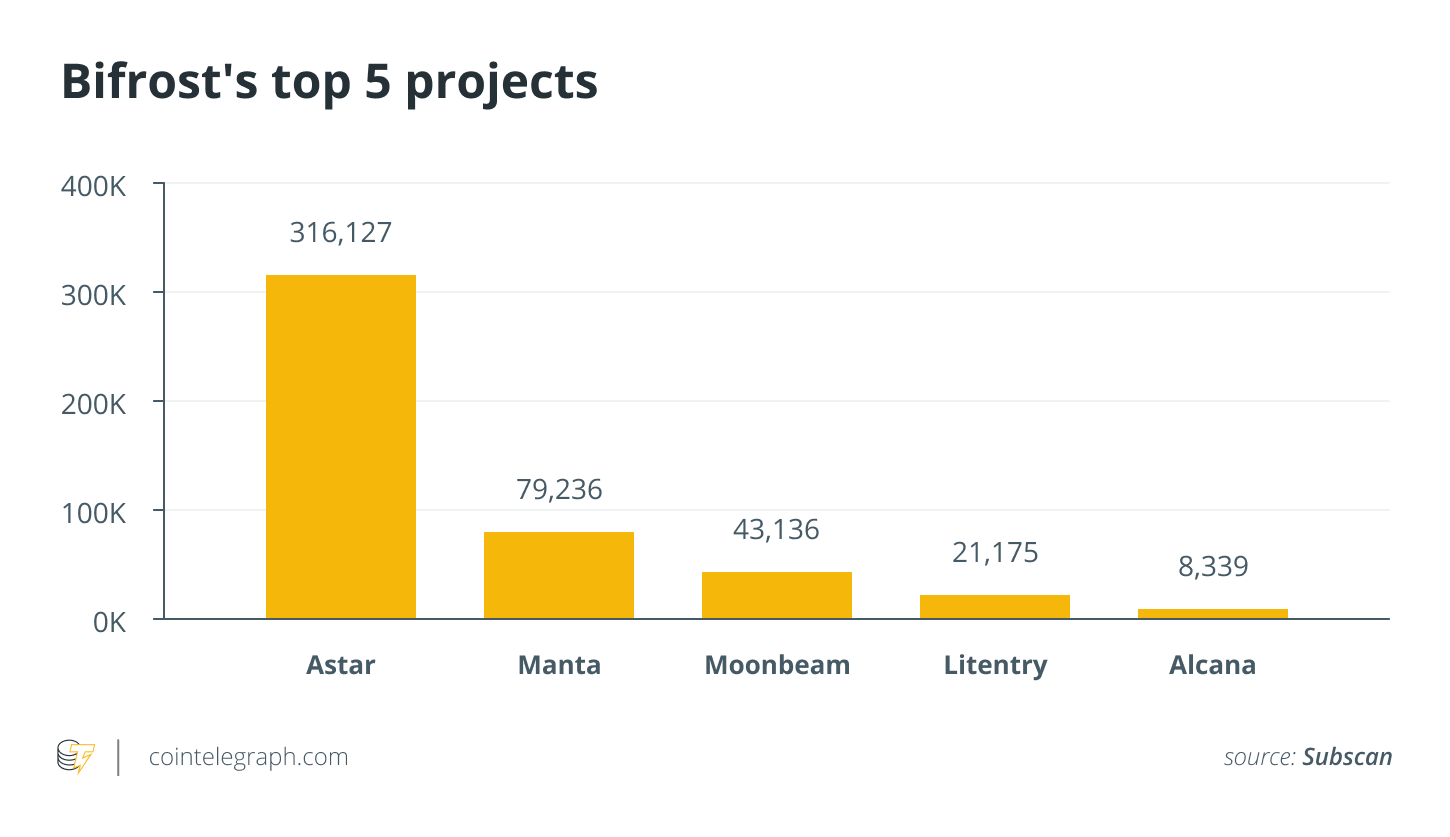

Astar is clearly the beneficiary here, owing to the one large holding of 300,000 DOT. This funding comes from DFG, a venture capital (VC) business that participated in Astar’s crowd loan through Bifrost’s liquid DOT solution.

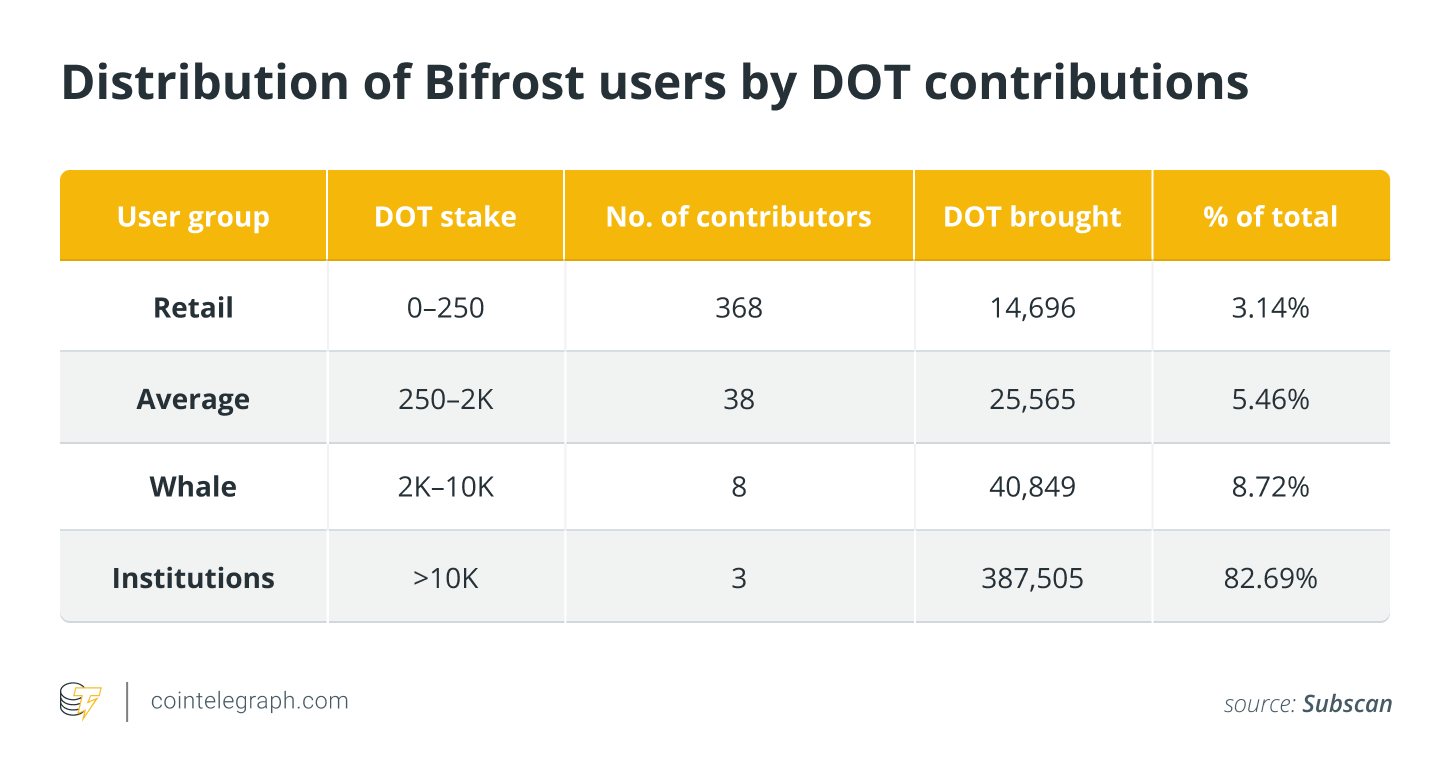

As with Acala and Parallel, the Pareto principle applies nicely here as well, as institutions own almost 80% of the entire DOT stake. Though, in comparison to the first two initiatives, whales far outnumber retail and typical investors in the Bifrost example.

Equilibrium

Users donate DOT through Equilibrium’s xDOT. Equilibrium supports multisignature projects that are technically capable of managing them. Equilibrium is also said to support the Ledger for users that contribute to Equilibrium via the xDOT platform.

There will be a single xDOT token for all projects, and Equilibrium will manage both xDOT and project tokens separately. Equilibrium will price xDOT using a special-purpose AMM and commits to issuing these tokens in Genshiro first (their Kusama-based canary network). After obtaining a parchain position on Polkadot, xDOT will be deployed in Equilibrium. Borrowing, lending, and utilizing xDOT as margin to trade are all examples of xDOT use cases on Genshiro.

Equilibrium’s technical approach, likewise, makes use of a multisignature wallet. It’s worth noting that the multisignature keys are held by well-known venture capital firms, including Signum Capital, DFG, Genesis Block Ventures, and PNYX.

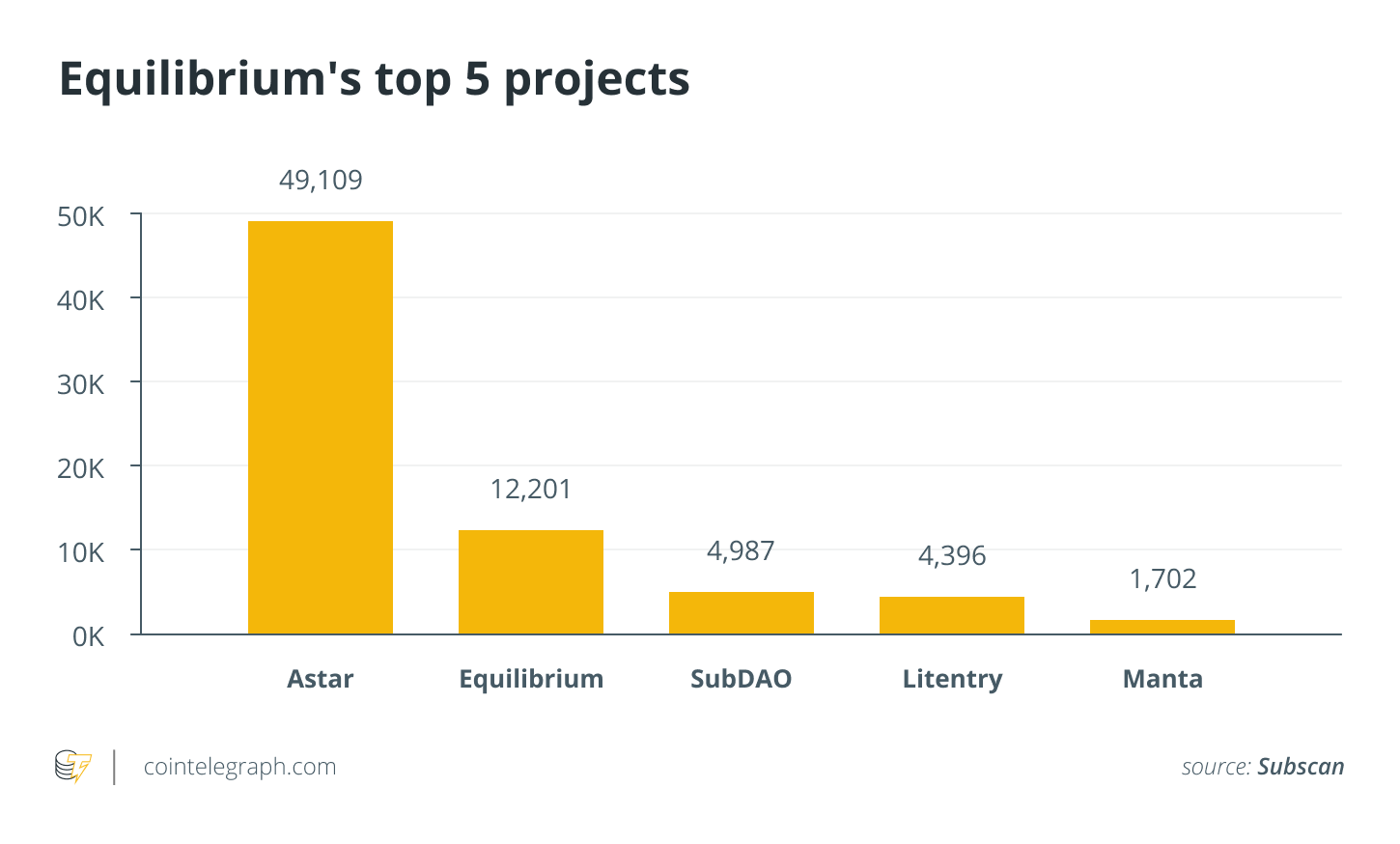

It is quite possible that Equilibrium’s stake as an xDOT creator will surpass that of the majority of others. As with Bifrost, Astar maintains a commanding lead, which most likely reflects the effectiveness of Astar’s business development activities and partnership bonuses.

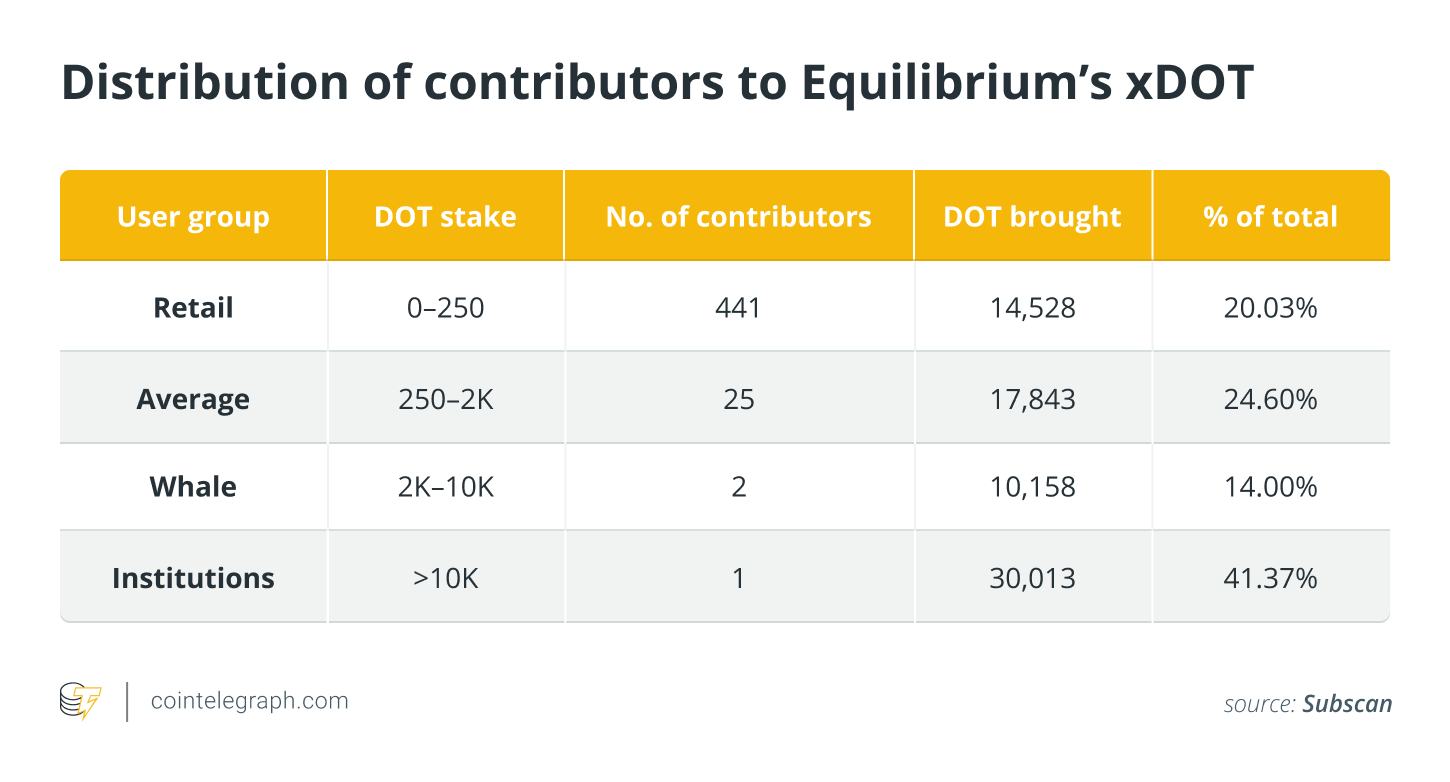

In contrast to Bifrost, retail customers‘ participation in xDOT outpaces that of other investor groups. According to the figures above, the project has not yet enrolled as many institutions. However, Equilibrium’s bonus program, which rewards major stakeholders with additional EQ tokens for DOT provided via xDOT, may become highly appealing to large stakeholders.

Is liquid DOT staking bulletproof?

After delving deeper into each project, we may wish to explain a few additional points. The first logical question is what extra utility projects are available on their liquid DOT, as consumers may essentially wish to use their liquidity for something.

Otherwise, what is the point?

This is highly dependent on the underlying projects‘ feature set. Another factor to consider is how quickly they will be able to connect with other projects that may be interested in supporting those tokens. From the information gathered above, we can assess early use cases on a project-by-project basis.

There appear to be potential applications for liquid DOT, and its future adoption across the ecosystem will be contingent on the success of business development activities. In the long term, whomever succeeds in convincing other ecosystem players to use their liquid DOT will benefit the most.

The following question concerns bonus redistribution. Will users that contribute via liquid DOT mechanics be eligible for the benefits offered by projects for „traditional“ trustless contributions?

There is little information available at the moment, but from what we do know, Acala will offer all of the advantages now available to its regular members.

Parallel has discussed offering additional crowd loan bonuses with at least two projects, while Equilibrium and Bifrost will almost certainly be able to handle the standard crowd loan bonus structure. This could change dramatically in the future, as nothing precludes Equilibrium or Bifrost from striking similar deals with campaigns.

Finally, but certainly not least, how secure is the technical configuration? Given the prevalence of DeFi hacks, this question becomes critical.

The technique is same across the board: a custodian address for DOT is initially handled via multisignature permissions. And it’s a reasonable option, given that multisignature has established itself as the gold standard for secure asset storage. Once the project responsible for issuing liquid DOT is converted to a parachain, the configuration becomes completely trustless.

The bottom line

Liquid DOT is an elegant approach for unlocking the liquidity of locked-up DOT that has piqued the interest of numerous initiatives in the ecosystem.

Nevertheless, they all provide somewhat similar technical solutions.

The extent to which these various liquid DOT variants (lcDOT, cDOT, vsBond, or xDOT) mature successfully is highly dependent on the business strategies employed by these projects and the usefulness provided by their DOT derivatives.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.