It is been a risky earlier several months for Bitcoin.

Final week, the cryptocurrency traded within a $2,000 assortment, rallying as higher as $10,400 ahead of plunging to $8,600 in a large liquidation party that wiped out around $100 million worthy of of positions.

On a more compact scale, Bitcoin has found quick $100-300 swings many situations a day around the past two weeks.

Analysts have had mixed feelings about this selling price action.

Some argue that given that BTC was rejected at $10,400, the cryptocurrency is poised to drop reduced. $10,500 has been a pivotal level for Bitcoin over the past yr, acting as a reversal stage for two vital rallies, just one in Oct and one particular in February.

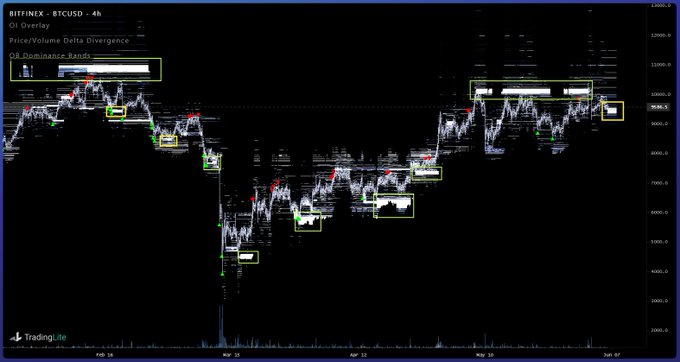

Still analysts say that the selling price action more than the earlier couple months seems to be eerily equivalent to Bitcoin in March 2019, prior to a vertical breakout that introduced the asset to $14,000.

Linked Reading through: Crypto Tidbits: $200M of Bitcoin Liquidated, Ethereum DeFi Adoption Limited, Bloomberg Is Bullish

Bitcoin Is Poised to Erupt Bigger, Fractal Investigation Reveals

Bitcoin’s latest price action, which include the $10,400 rejection, seems to be eerily similar to the selling price motion observed in February and March of 2019. What followed March of 2019 was a rally that took the asset approximately 250% greater in a few months.

“I assume I have witnessed this ahead of,” an analyst remarked in reference to the two charts prior to. This fractal investigation predicts that BTC will hit $12,000 by the end of the thirty day period.

A further analyst echoed the assertion that Bitcoin’s latest price tag motion appears to be very similar to the sample pre-breakout in March 2019. He remarked on the subject:

“This is turning in the Actual exact as March 2019, a Incredibly sluggish grind up, non risky, every person switching bias in excess of 50$ moves, industry seems dead But in the conclude, the nukes get weaker and weaker, and the pressure will increase. “

Traders Are Expecting Upside

Traders in the crypto house are expecting a move to the upside.

As reported by NewsBTC earlier, Bitfinex’s buy reserve confirmed previous 7 days that there is a apparent confluence of buying pressure in the $9,500 assortment.

This is vital as the past time there was such get help on Bitfinex was when Bitcoin was trading in the $7,000s. Purchase book facts also identified as quite a few trend tops around the earlier 4 months.

Other signals display that the typical crypto trader is positioning for upside.

Crypto derivatives publication Ecoinometrics pointed out that there is now $300 million value of open curiosity in the CME’s Bitcoin call options industry.

Phone selections are derivatives that permit the customer of the deal to obtain an asset at a precise selling price through a specified time span. Contact options are normally utilised by investors that want to fiscally obtain from an asset appreciation in benefit.

Linked Studying: In excess of a Dozen Prime Crypto Assets Are Up About 10% Currently: Here’s Why

Featured Picture from Shutterstock Price tags: xbtusd, btcusd, btcusdt Title: Previous Time Bitcoin Had This Marketplace Composition, It Rallied 250% in Three Months