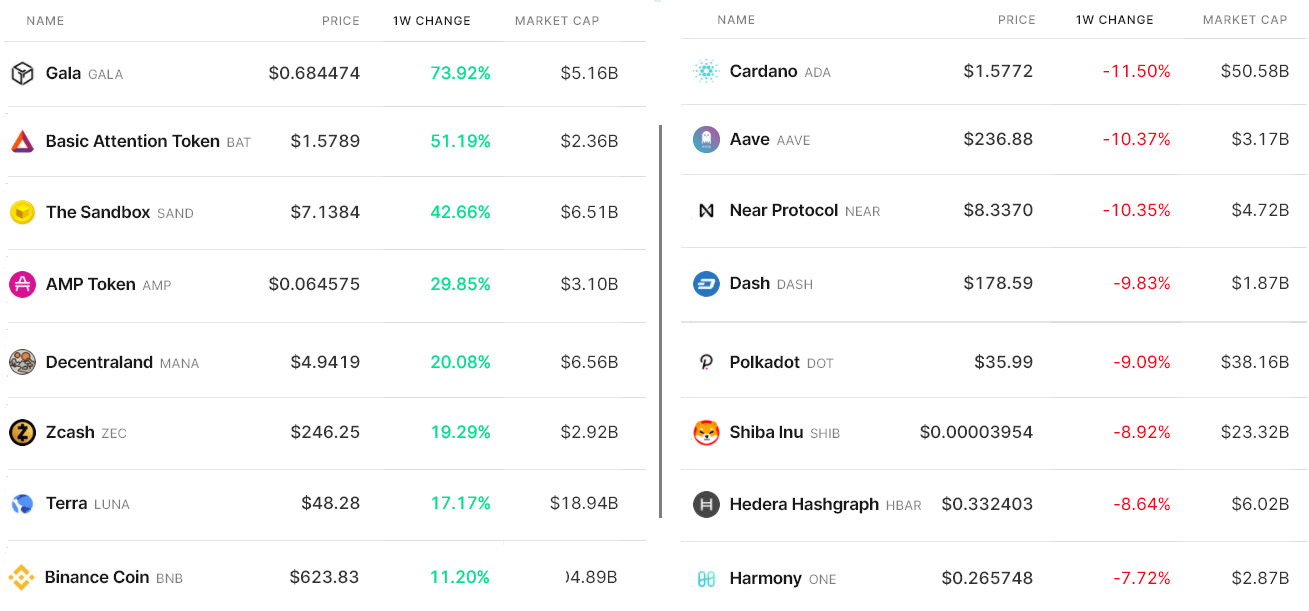

The performance of cryptocurrencies over the last seven days may have seemed uninspiring, all the more so given that the entire market capitalization climbed by „just“ 1.8 percent to $2.7 trillion. Despite the lackluster market movement, some altcoins staged a respectable climb. While Bitcoin (BTC) was down 6% until Nov. 28, it still managed to conclude the week up 1.5 percent following a $3,200 rally that night.

Metaverse tokens are still pushing to new highs

Gala (GALA), The Sandbox (SAND), and Decentraland (MANA) were among the top five gainers in the metaverse sector. While few play-to-earn and metaverse „environments“ are now accessible for genuine participation, significant news and partnerships continue to enhance the prices of various metaverse-related tokens.

As previously reported on Nov. 24, Metaverse Group paid approximately $2.5 million for virtual land in Decentraland. On Nov. 25, a 550 ETH (about $2.5 million) digital land piece in the Axie Infinity game was sold.

Additionally, Sony Pictures and AMC Entertainment announced on Nov. 28 that they will offer up to 86,000 Spider-Man nonfungible tokens (NFTs) to commemorate the release of their new feature film.

Zash (ZEC), a privacy-focused cryptocurrency created in October 2016, surged 20% in 24 hours on Nov. 20 following creators‘ announcement that they would forsake traditional mining in favor of a proof-of-stake network.

Amp (AMP), the Flexa payment network’s native collateral cryptocurrency, also soared on Nov. 24 following its launch on Binance. Meanwhile, according to Caviar startup founder and crypto investor Jason Wang, Terra (LUNA) benefited from a 5.4 million token burn in four days.

Ethereum-killers limp along

A group of four smart contract platforms attempting to dethrone Ethereum’s dominance, including Cardano (ADA), Near Protocol (NEAR), Polkadot (DOT), and Harmony (HAR), were among the poorest performers (ONE).

To „save costs and to incentivize an ecosystem-wide transition to a rollup-centric Ethereum,“ Vitalik Buterin, the co-founder of Ethereum, proposed a limit on the amount of transaction calldata that can be stored in a block on Nov. 24.

Aave Protocol (AAVE), the collateralized lending and yield platform, is continuing to trade in a decline after its total value of liabilities (TVL) dropped by 30% in three months.

Since July 2018, the number of Dash (DASH) addresses having at least 1,000 tokens has decreased to 5,210, which is the lowest level since July 2018.

Tether and derivatives markets are looking flat

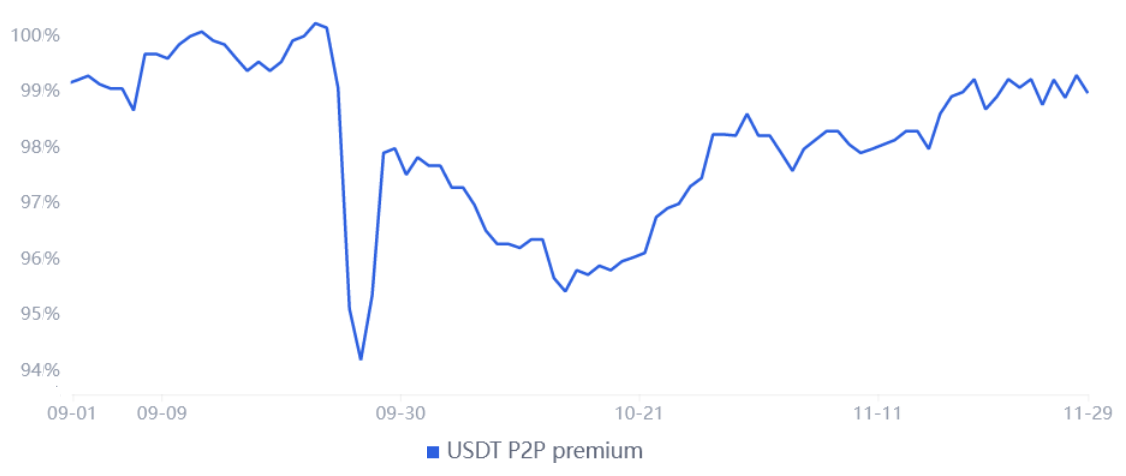

Although the OKEx Tether (USDT) premium has decreased marginally in recent weeks, it remains a useful indicator of the difference between China-based peer-to-peer (P2P) exchanges and the official US dollar currency.

The indicator’s 99 percent reading is neutral to bearish, indicating that cryptocurrency traders have little interest in converting cash into stablecoins. However, this is a significant improvement over the 5 percent discount seen in mid-October.

Furthermore, the total open interest in cryptocurrency futures has remained stable at around $50 billion, which is only a tenth of a percent below the all-time high. It is important to note that a decline in open interest does not necessarily imply a bearish trend; nonetheless, maintaining a particular level is fascinating because more liquidity providers and market makers are entering the market.

When you consider the approximately $2.0 billion in liquidations that took place over the week, the futures‘ open interest is a strong reading. According to CoinMarketCap, the 10 percent decline in global crypto market value to $2.37 trillion on Nov. 25 was responsible for 44 percent of the forced futures contract cancellations.

The data presented above may not appear to be particularly interesting, but considering that Bitcoin (BTC) and Ether (ETH) are both strong on Nov. 29, the rebound from the previous day may imply that the two-week corrective period has come to an end.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)