Because of its demonstration of the use of cryptocurrency in monetary transfers, Ripple has established itself as a reliable partner for traditional financial institutions looking to modernize their cross-border payment services. Ripple has established itself as a trusted partner for traditional financial institutions looking to modernize their cross-border payment services.

A new partnership between Ripple and Japan’s SBI Remit Co., Ltd to transform remittance payments from Japan to the Philippines has been announced, which will help to realize this vision even more fully.

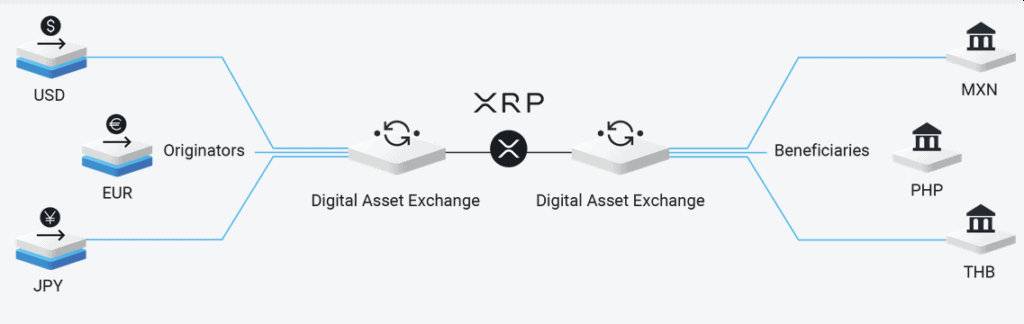

Ripple has entered into a partnership with mobile payments service Coins.ph and digital asset exchange platform SBI VC Trade, both of which will be involved in the latest partnership, in order to provide a more affordable remittance option to its customers.

As a result of the use of XRP, there will be no need for upfront funding expenses.

Official statements claim that Japan’s first on-demand liquidity (ODL) service implementation will help Ripple accelerate the adoption of crypto-enabled services by serving as a catalyst for the growth of the industry.

Earlier this month, Nobuo Ando, representative director of SBI Remit, issued the following statement:

“The launch of ODL in Japan is just the start, and we look forward to continuing to push into the next frontier of financial innovation, beyond real-time payments in just the Philippines, but to other parts of the region as well.”

This announcement stays in line with Ripple’s intent to expand its services for the Asia-Pacific (APAC) markets as it continues to see transactions growing 130% year-over-year. A recent report also showed that Ripple’s XRP sales shot up 97% in Q1 due to the rising demand for its ODL service.

Despite Ripple’s conflict with SEC authorities against the XRP securities lawsuit, Ripple frontman Brad Garlinghouse informed that the company had not suffered any setbacks in the APAC region.

“We have been able to continue to grow the business in Asia and Japan because we’ve had regulatory clarity in those markets,” Garlinghouse said.

Ripple recently appointed a new managing director to plan out its roadmap to dominance in the Southeast Asian region.

By involving former Uber executive Brooks Entwistle, Ripple’s Southeast Asia wing doubled down on its expansion plans against the market’s “fairly complex, country-specific schemes.”