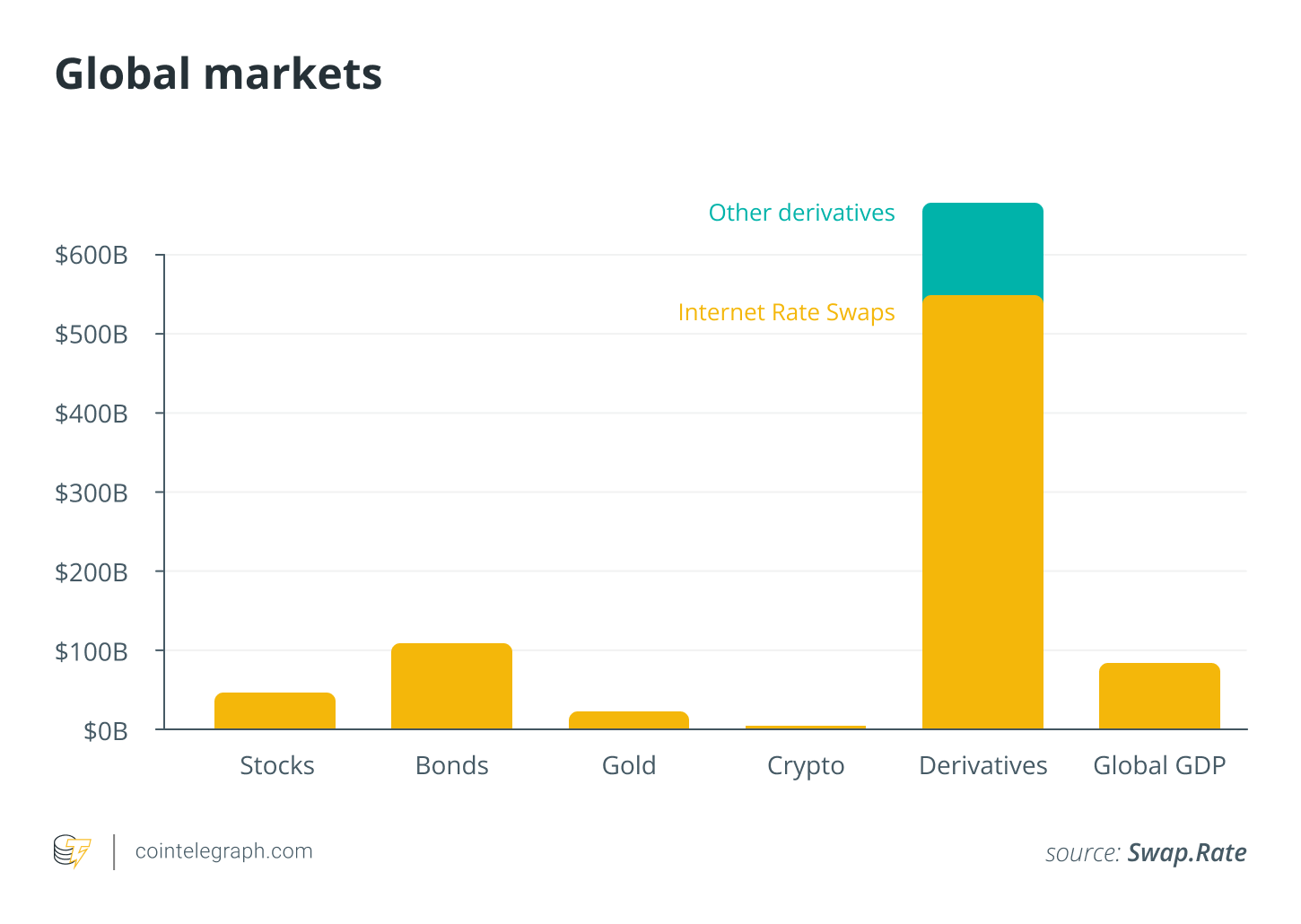

With more people trading derivatives and more people using decentralized exchanges (DEXs) because of regulations in the United States and China, there has been a rise in people using derivatives DEXs, with Bitcoin (BTC) whales moving into derivatives and more people interested in buying derivatives.

This has led to a surge in the amount of money traded on derivatives protocols every day, which has allowed them to briefly take over centralized finance platforms like Coinbase. This has sparked interest in decentralized finance from retail investors who want to trade derivatives in the future (DeFi).

It’s possible that new investors will leave DeFi right away if they don’t learn about derivatives in a proper way first.

5 years ago I left @coinbase and eventually founded dYdX

Today, for the first time, @dydxprotocol is doing more trade volume than Coinbase pic.twitter.com/QzoKAUpH29

— Antonio | dYdX (, ) (@AntonioMJuliano) September 26, 2021

But is this the case in the current DeFi sector?

Derivatives in DEXs: Are they worth the risk?

Derivatives in DeFi bring the benefits of traditional finance, but they leave behind the inefficiencies that come with that.

It’s also very difficult to trade DEXs, which are complicated because retail investors have to learn how to make the trades on their own.

When these people start trading derivatives for the first time, they need help with both DeFi and how to use the platform.

If you used DeFi applications in 2020, you might think that the user experience is outdated compared to the centralized exchange counterparts that DeFi apps are compared to now.

Users who used to use centralized exchanges now have to be simple and easy to use in order to get more people to use them.

A protocol is used to help new users get used to the program, which makes them more likely to stay with it and use it more.

DeFi might not be a good place to trade derivatives if users who had bad experiences with derivatives leave a bad taste in the mouth of future traders.

From a user’s point of view, derivatives could be just a way to get more money or protect your current position.

What we can do as derivative protocol developers is explain the user interface and the risks of trading derivatives in a way that is easy for people to understand.

To help new users understand how to use the application site, we could give them „tool tips.“ We could also hold weekly „onboarding calls“ to show new users how to use the platform and answer any questions they have.

Other than that, having a testnet where people can practice trading before investing real money can help them get used to the platform and trading experience.

The DeFi protocol itself should not be a problem for people who want to trade derivatives if they know what they’re getting into and are well-educated about the risks of them.

DeFi redefining derivatives trading

Most new investors don’t know much about DeFi derivatives, so protocols are going out of their way to make sure that these new investors can handle the torque in derivatives.

There is more information about derivatives trading now, whether it’s on Twitter, YouTube, Medium, or Discord, and it’s all good.

You can learn more about derivatives trading now than you can during the summer of 2020.

In addition, DeFi protocols are being used in the same way that traditional finance is used to drive growth.

It can be easier to trade options with fintech apps, like Robinhood, because they can figure out what strategy a user might want to use and let them do a one-tap thing to do that strategy.

Similar strategies have been used in the field of DeFi.

In fact, there are more and more protocols that offer structured products with derivatives, like Ribbon Finance and Stake DAO, which make it easy for newcomers to enjoy the benefits of derivatives.

Experience more adoption by creating more experiences

Protocols are looking into different ways to make their protocols more usable.

Cryptocurrency has a big problem on its way to becoming more popular: it’s not easy to use.

By making things easier for people to use and giving them a simple and clear interface, derivatives trading can be adopted more quickly.

Today, most derivatives protocols are very easy to use, which makes it easy for new investors to jump in and start trading right away without any problems.

However, not all protocols are making user experience their top priority. This means that many investors can’t accurately assess the value and risks of their derivatives products, which leads the government to make more regulations on derivatives.

Without a good user experience for people who want to trade derivatives, this could make them think of them in a bad way.

Retail investors can expect derivatives trading to become more common in the future, which will make it easier for anyone with a decentralized wallet to get in on trading.

To keep up with the demand, derivatives protocols need to pay more attention to the experiences that they give their users to keep up.

A lot of people are using derivatives trading in DeFi, which means there will be more competition between protocols to make better products that end up benefiting the people who use them. This will lead to a healthier ecosystem where decentralized derivatives trading can really take off in the future.