Is China softening on BTC? They were just two seemingly innocuous phrases:”investment alternatives.” However, when employed to BTC — the seminal cryptocurrency — with an official from the People’s Bank of China in a recent panel discussionthey reverberated like a firecracker. “A remarkable step for BTC,” Lennix Lai, manager of financial markets in OKEx, calls the statement. Michael Peshkam, executive in residence at European business school INSEAD, clarifies the central banker’s remarks as”a significant shift in the nation’s position” on crypto. […] These are investment alternatives.” CNBC reporter Arjun Kharpal commented:

“Industry insiders called the comments’innovative’ and therefore are watching closely for any regulatory changes produced by the People’s Bank of China.”

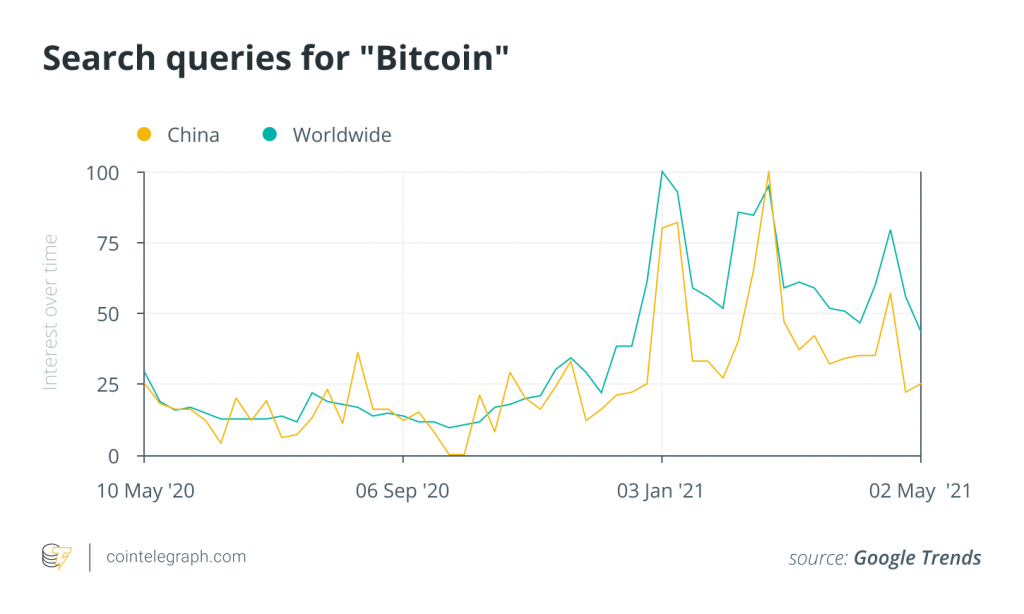

“I still do not find a full embrace of BTC.” “This really is a very important development,” Daniel Lacalle, chief economist in Tressis SV, tells Magazine — one that involves a”significant change of heart” on the part of China’s authorities as it”separates itself from its former financial policy” The government is sayingin effect, it isn’t likely to ban or put the brakes on the growth of BTC along with other cryptocurrencies, that have been an ever-present threat for both China and other authorities, Lacalle suggests. If so, why today? China is close to rolling out among the world’s first major central bank digital monies in scale — sometimes referred to as the Digital Currency Electronic Payment, or even digital yuan. “If it wants a digital yuan that works, it can’t ban crypto,” Lacalle says. Instead, it needs to demonstrate that its DC/EP is as attractive as a crypto alternative. Connecting the dots: BTC and DC/EP Are not they two distinct things — one an emerging international store of value, like gold, and another a domestic payment method? China has long emphasized that if it were to fall these controls, its economy would quickly become”dollarized” — i.e., its citizens would ship bucks away from China into the United States. As matters stand today, the rollout of a digital yuan are an global failure, though it might succeed domestically. Outsiders would presume that the Chinese government wants to control it like it does its conventional yuan. “But if they open the market for crypto in China, they are signalling that capital controls won’t apply to the digital market,” including a digital yuan, Lacalle explains. This is arguably an”smart move” on the portion of the Chinese authorities, which like Russia before it now sees benefits in opening its economy to crypto. In fact, cryptocurrencies can eventually — albeit, in a”distant future” — hurt Western fiat monies, police speculate. However, in the meantime, a new tolerance with regard to BTC can make its digital currency more viable beyond its boundaries. A potential currency? Peshkam tells Magazine that Li’s statement goes beyond recognizing BTC as just another investment asset, which is scarcely an earth-shaking revelation. China now sees crypto”as a potential potential currency in global trade.” Using Google Trends information from 2014 to the present, Peshkam notes that interest in BTC in China — i.e., among its domestic inhabitants — follows a similar pattern as in the U.S., as well as the world at large, as quantified by the number of searches for the phrase”BTC.” Bearing this growing interest on the part of its populace”might not be economically and financially prudent for the country in the long term, thus the shift” in Chinese policy, opines Peshkam.  China’s DC/EP will likely become”the main means of everyday trade from grocery shopping to charge of invoices and bigger ticket items” domestically, Peshkam says. Nonetheless, it’s too early to gauge its global impact, such as whether it will be a danger to the U.S. dollar as the world’s main trading currency. In the event, continues Peshkam, China would like to have BTC available to lower its dependence on the dollar for international commerce. A strong BTC may also likewise weaken the buck’s grip on China’s regional neighbors, which makes them more receptive to using the newest digital yuan. “The shift in China’s position seems to be a strategic movement to safeguard its potential economic dominance should BTC proceed from’investment choice’ into’trading currency option,”’ says Peshkam. Who is Li? Maybe one is reading too much into a single person’s statement? Li, after all, is just among seven deputy governors of China’s central bank. Might these remarks on the matter of BTC and cryptocurrencies only be one banker’s view? No, Lacalle tells Magazine. “That doesn’t happen in China.” Not in forums like these. “When they wish to alert the world about some new [monetary ] policy, the very first remark is often from an analyst in a state-owned bank” Next, typically, is an announcement with a central banker. And finally, at a later date, the policy is formally declared, clarifies Lacalle. “It is subtle but efficient.” China’s central bank isn’t quite as independent as a number of its Western counterparts, such as the U.S. Federal Reserve, another source, who wished to remain anonymous, tells Magazine:”In his [Li’s] place, it’d be natural to check whether his statement was in accord with the authorities view. Or, instead, he’s been tipped this is the authorities view.” Thus, Li is acting as a government spokesperson? They considered BTC a distinctive asset and said the authorities would bring it under supervision and regulation. Before, the central bank had called BTC a digital commodity. But perhaps an”alternative investment” is just an alternative investment — and nothing more? “It’s hard to be certain, but perhaps PBoC Deputy Governor Li Bo’s intent is simply to state that BTC is a legitimate choice investment,” Darrell Duffie, Dean Witter distinguished professor of finance at Stanford Business School, tells Magazine. “China likely remains against the use of BTC as a payment medium, which is another program.” This would be consistent with Li’s prior remarks, continues Duffie, including:

China’s DC/EP will likely become”the main means of everyday trade from grocery shopping to charge of invoices and bigger ticket items” domestically, Peshkam says. Nonetheless, it’s too early to gauge its global impact, such as whether it will be a danger to the U.S. dollar as the world’s main trading currency. In the event, continues Peshkam, China would like to have BTC available to lower its dependence on the dollar for international commerce. A strong BTC may also likewise weaken the buck’s grip on China’s regional neighbors, which makes them more receptive to using the newest digital yuan. “The shift in China’s position seems to be a strategic movement to safeguard its potential economic dominance should BTC proceed from’investment choice’ into’trading currency option,”’ says Peshkam. Who is Li? Maybe one is reading too much into a single person’s statement? Li, after all, is just among seven deputy governors of China’s central bank. Might these remarks on the matter of BTC and cryptocurrencies only be one banker’s view? No, Lacalle tells Magazine. “That doesn’t happen in China.” Not in forums like these. “When they wish to alert the world about some new [monetary ] policy, the very first remark is often from an analyst in a state-owned bank” Next, typically, is an announcement with a central banker. And finally, at a later date, the policy is formally declared, clarifies Lacalle. “It is subtle but efficient.” China’s central bank isn’t quite as independent as a number of its Western counterparts, such as the U.S. Federal Reserve, another source, who wished to remain anonymous, tells Magazine:”In his [Li’s] place, it’d be natural to check whether his statement was in accord with the authorities view. Or, instead, he’s been tipped this is the authorities view.” Thus, Li is acting as a government spokesperson? They considered BTC a distinctive asset and said the authorities would bring it under supervision and regulation. Before, the central bank had called BTC a digital commodity. But perhaps an”alternative investment” is just an alternative investment — and nothing more? “It’s hard to be certain, but perhaps PBoC Deputy Governor Li Bo’s intent is simply to state that BTC is a legitimate choice investment,” Darrell Duffie, Dean Witter distinguished professor of finance at Stanford Business School, tells Magazine. “China likely remains against the use of BTC as a payment medium, which is another program.” This would be consistent with Li’s prior remarks, continues Duffie, including:

“As a payment moderate, BTC makes it more difficult for the government, in any country, to track payments for compliance with regulations and laws, for example anti-money laundering. When utilized as a payment medium, BTC makes it a bit easier to skip China’s capital controls, which China would not want to see.”

Li may have been stating that BTC is right as a store of value i.e., as gold 2.0 — but maybe not as a payments platform. James Barth, finance professor in Auburn University, tells Magazine”BTC, like gold, might be viewed and allowed as an investment with the ability to serve as an inflation hedge.” […] This still allows China to impose restrictions by excluding monetary institutions within its boundaries from easing transactions involving cryptocurrencies.” The banker may have only been describing the current reality. It doesn’t necessarily imply anything about whether those alternatives would be accessible to Chinese investors.” Unlike what some think, Werbach says that China has never tried to thwart BTC and blockchain actions. “China has never been uniformly hostile to cryptocurrencies,” he says, adding:”Chinese government shut down initial coin offerings and renminbi-to-crypto exchanges in 2017 because they were worried about excessive speculation, fraud, and capital flight. There’s not been any indication of the view changing.” Meanwhile, China has tolerated a massive crypto mining business within its boundaries and has actively encouraged blockchain technology”as part of its’brand new infrastructure’ agenda,” adds Werbach. “A lot of the world’s biggest crypto exchanges, for example Binance, Huobi, and OKcoin, have major ties to China, even though formally they are headquartered elsewhere” In Conclusion, Werbach tells Magazine:

That would be quite consistent with China’s strategy. I feel the crypto community required the wrong message out of his remarks.

Others, however, continue to discern a policy shift supporting the lien’s announcement. For instance, OKEx’s Lai tells Magazine:”The new statement from the PBOC banker gave a very clear position to the market that BTC would be considered as an alternative investment instrument. We think it’s a remarkable step for BTC and we’ll probably see BTC regulated with a similar frame as those for other alternative investments.” Others were quick to see ulterior motives on China’s part. But BTC may be getting too large to ignore, even for China, suggests Agnese — particularly considering it’s a market cap that recently surpassed the $1 trillion mark. “China will still attempt to ride the crypto wave just to undermine the power of the USD in global trade transactions” — that accounts for approximately 60 percent of foreign exchange reserves –“as there’s a trade war still going strong” As for China’s own CBDC project, Agnese comments:

“Cryptos in large, and BTC particularly, have just come to challenge the monetary status quo, not only by introducing much needed competition, but also by exposing its long-standing weaknesses.”

Yu Xiong, associate dean global at Surrey University and seat of business analytics in Surrey Business School, tells Magazine the statement by Li only meant that China was starting to pay more attention to cryptocurrencies — with the goal of regulating them. “This won’t mean China will play a softer place toward cryptocurrencies. China will just become soft when the authorities really can track the trades and cash flows. […] This won’t happen in the foreseeable future.” An”asset class that should be regulated” “This is very significant for both domestic institutional investors and high net-worth people” looking to invest in”alternative assets like BTC in the future,” Zuckerman tells Magazine. Lai adds:”After years of evolution, I feel all major authorities and governments” — today such as China –“have acknowledged BTC as a viable asset class that needs to be regulated rather than a complete ban.” There is an increasing understanding in China the nation could benefit from a rising crypto sector. The electricity that powers crypto mining, after all, is mostly based in China. The Chinese have a bet, also, in many blockchain-based enterprises. And the nation has an ambitious digital currency project underway, therefore some softening with respect to BTC may also be tied, as Lacalle posits,”to its own desire to have a [worldwide ] working digital yuan.”