MicroStrategy CEO Michael Saylor says institutional fascination in Bitcoin is snowballing. He predicts the coming year will see a flood of corporations comply with MicroStrategy’s guide to getting Bitcoin as a treasury strategy.

Much more apparently, Saylor statements make contact with with at least a hundred personal firms that have by now executed this tactic. Even so, supplied the absence of disclosure needs for private companies, they opt for not to reveal this data.

“I assume a good deal of corporations will do this in the coming 12 months, and you’ll start off to see much more announcements. Simply because it is an strategy whose time has appear. I have noticed a whole lot of curiosity, there is a ton of non-public company CEOs who achieve out to me, and they’ve by now performed it, they are just not generating announcements.”

Host Laura Shin pressed for specifics on these personal corporations. Saylor replied by saying they vary in valuation from hundreds of hundreds of thousands to billion-greenback-additionally businesses. Whilst his community is primarily American corporations, he stated this is a pattern mirrored all around Europe, the Middle East, and the Far East.

“sometimes billion greenback moreover. I indicate billion, multi billion, five hundred million, just one hundred million. There is a whole lot of organizations in that sweet place. Normally, everybody talks to most people.”

$1.9 Trillion Stimulus Deal in The Performs, Cue Bitcoin as a Hedge

MicroStrategy grew to become the first community listed firm to acquire substantial holdings of Bitcoin again in August 2020.

Since then, its CEO Michael Saylor has preached tirelessly on the virtues of shopping for Bitcoin. He has spoken thoroughly on the matter, much more so, why he feels it is the play to make through these unsure moments.

One particular quote from an job interview with Anthony Pompliano quickly just after MicroStrategy’s very first acquisition summed up his argument.

“the challenge is I have a good deal of cash and I’m looking at it melt away… [On investors] they’re smarter than I am, I’m not joking, I’m getting really serious, they are smarter than I am. They knew before I realized that money is trash, and you’re a fool to sit on the cash.”

Months later, this is a message that is accumulating steam in people’s attitude from all above the planet. What is more, with no end in sight for money printing procedures, the risk of inflation, economic stagnation, and crippling deficits results in being even much more actual.

Recently elected U.S President Joe Biden arrived at the White Property a 7 days in the past currently with strategies for a new $1.9 trillion stimulus offer. Mainstream retailers, which include the FT, poured scorn over the programs. But what else can they do to continue to keep the method propped up?

“The regular person understands that there is no free of charge lunch. The route to prosperity simply cannot be so quick as to just print and spend. If he relies on minimal rates to fund even more substantial govt expending will increase, Mr Biden will double down on procedures that have magnified the problems he aims to take care of: weak growth, fiscal instability and growing inequality.”

Bitcoin fascination from institutional consumers is an acknowledgment from the corporate entire world that matters may well get busy in the long term. The flood that Saylor talks about demonstrates the extent to which self-preservation is becoming a precedence for these corporations.

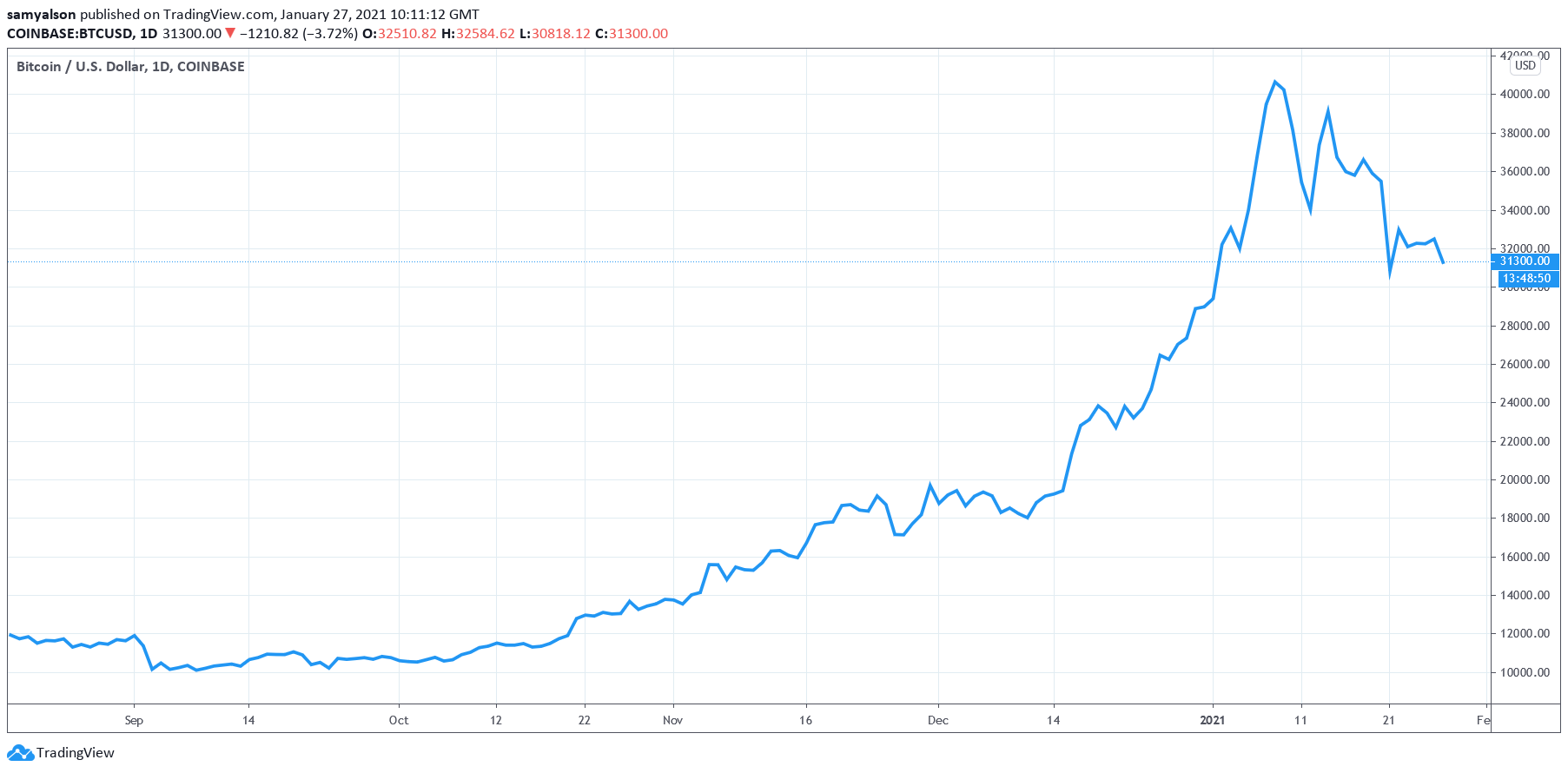

Supply: BTCUSD on TradingView.com