With Satoshi Nakamoto’s pseudonymous developer identity still a mystery, it is difficult to determine his or her true identify. This is despite significant investigation into various aspects of the founder’s influence on Bitcoin. .

A specific focus of interest has been a huge amount of Bitcoin that has remained undisturbed since it was mined by Satoshi Nakamoto in the early days of the blockchain’s existence and which has been linked to him. The presence of this BTC, as well as its dormancy, have been the focus of significant investigation, just like a lost treasure grabs the fancy of treasure hunters.

Over the past few years, anytime Bitcoin (BTC) stored in wallets mined in the years following Bitcoin’s birth is relocated, there has been a great deal of media coverage of the event. The attention has been drawn to a few of these transactions, while others simply do not fall within the timeframe in which Bitcoin’s creator and other early adopters may have been mining.

The amount of study and simulations carried out in an attempt to precisely identify blocks and Bitcoin thought to have been mined by Satoshi Nakamoto has been enormous. Individuals‘ efforts have resulted in a greater understanding of how they went about mining, how many blocks they mined, and how much Bitcoin they earned as a result of their efforts.

Others have improved on this effort to make the image more obvious — but there is still a great deal of curiosity in the legacy bitcoin (BTC) that was mined in the early days of the blockchain’s existence, and whether or not it will ever be relocated or transferred.

The Patoshi Pattern

To understand what happened, let us go back to early 2009, when Satoshi Nakamoto launched Bitcoin by mining the genesis block. As a result, the founder and other early collaborators and adopters began making use of the blockchain in the following months, mining blocks and conducting trading with their Bitcoin wallets.

Given that the Bitcoin mining incentive was set at 50 Bitcoin at the time of the first-ever halving event, a large amount of the capped cryptocurrency was mined in the three years preceding the event. Sergio Demian Lerner, a cryptocurrency security professional, was able to demonstrate through a blockchain research that Satoshi Nakamoto had a big role in the early Bitcoin mining ecosystem, indicating that the founders were in possession of a significant amount of Bitcoin at the time (BTC).

It has since been announced that IOV Labs is employing a chief scientist to assist them in better understanding how Lerner was critical in throwing light on Satoshi Nakamoto’s involvement in the establishment of the Bitcoin network. We’ve reached out to Lerner in order to learn more about his career and his work.

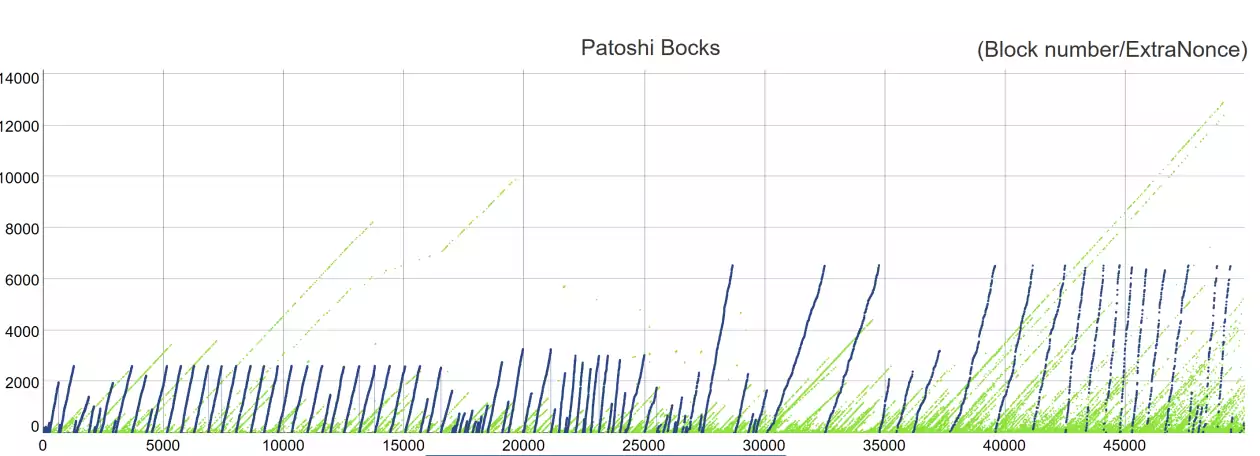

„The Patoshi Mining Machine,“ an article written by Lerner that analyzes the technology utilized by Satoshi Nakamoto to mine bitcoins in the early days of the cryptocurrency’s creation, is a result of Lerner’s simulation-driven investigation. Using the alias „Patoshi,“ Lerner hoped to limit the debate over Bitcoin’s origins to a minimal and concentrate on the technical parts of his job instead.

When explaining how his simulations revealed this trend, the researcher drew a comparison between Bitcoin mining and purchasing a lottery ticket. He said, „The most interesting simulation was the re-mine of Patoshi blocks in search of alternate solutions to the Bitcoin proof of work problem.“

According to him, “each response is represented by a number (known as a nonce), which is akin to the number on a lottery ticket.” Miners are simply „purchasing“ lottery tickets one after another until they strike it rich.” Patrick Patoshi had mined ticket numbers from lotteries, and Lerner used these numbers to compare them to the ticket numbers from the lotteries that he had mined. Using a narrower scope of lottery numbers to focus his inquiry, the researcher concluded that Patoshi had a „clear tendency“ to choose higher lottery numbers.

“This strongly implies that Patoshi scanned the numbers downwards when looking for the winning lottery ticket. Even if we don’t know if he started with a high or low number, he always did it by decrementing the ticket number until some time had elapsed or he won the Bitcoin block lottery. The fact that in each separate range he searched there is a tendency to pick higher numbers, but combining all ranges there is not such a tendency implies that he was scanning the numbers simultaneously with five different machines (or threads), each on a certain range.”

Through the discovery and identification of a pattern in the nonce value of the coin base transaction of specific blocks mined in the first three years of Bitcoin’s existence and subsequent identification of the pattern, Lerner was able to shine a light on blocks and bitcoins that were unquestionably mined by Satoshi Nakamoto.

According to Lerner, the audience was also made aware of the fact that „The Patoshi Pattern“ is crucially similar to the nonce pattern found in almost all of the Bitcoin blocks mined in the first 14 days of the blockchain’s existence, and that this is the case in almost all of the Bitcoin blocks mined in the first 14 days of the blockchain’s existence. As a result, the identification of Patoshi-mined blocks and BTC in coin base transactions that were later determined to be the property of Satoshi Nakamoto was aided by the data-backed link that was established.

Satoshi’s largely untouched fortune

Lerner’s research serves as the foundation for an educated guess as to the quantity of Bitcoin that Patoshi and his associates had amassed through their early Bitcoin mining efforts. He claims that Patoshi obtained approximately 1.1 million Bitcoin as a reward for mining approximately 22,000 blocks.

He emphasized some key characteristics that made this pattern stand out in terms of assisting in the identification of Patoshi blocks and coins, while also acknowledging that other bodies of research have come to lower estimates of Satoshi Nakamoto’s Bitcoin hoard, which has been estimated to be around 750,000 bitcoins. He goes on to say:

“The fact that the nonce space scanned is smaller than the space scanned in the rest, the fact that those blocks were never mined very close to other blocks, the fact that they are mined at a very specific and high rate (the extranonce is incremented much faster than in other blocks), the fact that the nonce is scanned backwards instead of forward, the fact that the nonce is scanned in parallel in five threads or machines, instead of sequentially, the fact that the timestamp was updated less frequently when mining those blocks, and finally, the fact that 99.9% of those blocks have not been spent, while the remaining blocks have been mostly spent, there is no doubt those blocks are different from the rest.”

Despite the fact that the majority of Patoshi’s assets have remained undiscovered, the Bitcoin they did transfer has been traced down and identified thanks to the work of researchers such as Lerner and other Bitcoin aficionados, among others. Lerner believes that this provides enough data to make some valid judgements about Patoshi’s BTC, which he believes is sufficient.

Apart from the fact that Satoshi Nakamoto was the first Bitcoin miner, according to Lerner, „persons other than myself have established a relationship between certain of the Patoshi blocks and payments made by Satoshi that early Bitcoiners have revealed over the years.“

In the course of investigating Satoshi’s payments, it was discovered that several of them, including those sent to Dustin Trammell, Nicholas Bohm, and Mike Hearn, were traceable back to him. When the exact quantities of the payments were established, as well as the approximate timeframes during which those transactions occurred, and the transaction identification was checked, it was revealed that they were all linked back to Satoshi.

As an added point, Lerner points out that he is more accustomed to mathematical proofs than to circumstantial evidence, and that the fact that Patoshi was the first miner, as well as these public conversations, do not prove that Patoshi is Satoshi. Nonetheless, according to the principle of Occam’s razor, the most straightforward solution, namely that Patoshi is in fact Satoshi, has the greatest possibility of being correct.”

Lerner asserted in his statement that he had discovered 16 payments made by Patoshi that utilised no more than 16 coin base incentives. It is known as a coin base transaction because it represents the amount of bitcoins that were awarded to a successful miner at the moment the transaction was made, which was 50 bitcoins. According to Lerner, the possibility of Patoshi moving approximately 800 BTC was strong, even if the value of these currencies was low at the time of the transaction.

“It doesn’t change much if the amount he spent is 10 Bitcoins or 800 Bitcoins, over a total of 22,000 blocks that he mined. At the time he spent them, even considering the first valuation that was established one year later, the value of 800 Bitcoins would be less than one dollar. In dollar terms, we can say he spent almost zero.”

Nonetheless, this also implies that Satoshi Nakamoto did not spend the vast bulk of the Bitcoin he earned from the network’s upkeep and maintenance.

Estimating BTC held in virgin wallets is still difficult

Given that about 1 million Bitcoins linked to Satoshi Nakamoto remain dormant, every transfer of Bitcoin from wallets that have been inactive for a lengthy period of time attracts attention and makes news in the cryptocurrency community. Blockchain analysts maintain a tight check on major Bitcoin transactions that originate from ancient wallets if there is even the slightest indication that the BTC in question could be belonging to Bitcoin’s inventor. For example, the movement of 50 BTC in May 2020, which had been mined in February 2009, was a notable event.

As a result, the coin base transaction took place less than a month after the Bitcoin mainnet became online, raising the likelihood that the coins were moved by Satoshi Nakamoto or one of the early cypherpunks who had been experimenting with mining and transacting in the blockchain’s early days.

Perhaps even more intriguing is the potential impact that these awakenings may have on the broader cryptocurrency markets in the future. In May 2020, an unknown someone shifted bitcoins that Craig Wright claimed to control in addition to his highly disputed claims to be the founder of Bitcoin. Wright’s claims have been severely contested.

However, while Wright never proved or denied that he had relocated the coins, Wright’s allegation that the real Satoshi had done so in order to establish Wright was not the genuine Satoshi caused concern in the cryptocurrency markets. As a result of the uncertainty, traders sold off their Bitcoin holdings, causing the market capitalization to decrease by $6.5 billion dollars.

One of the most recent dormant BTC transfers occurred in June 2021 and was discovered by WhaleAlert on Twitter, who alerted the public. A total of 791 BTC was transferred from a wallet that has not been used since 2012. Kirill Kretov is a blockchain researcher, developer, and cryptocurrency trader who has been keeping a close eye on several “virgin” wallets, which are wallets that have only ever held their original Bitcoin mining reward and have never moved these coins.

The relocation of these coins drew the attention of some in the crypto world, who speculated that Satoshi was relocating old coins in order to avoid detection. However, Kretov argues that the transaction did not merit the attention it received: “My parsers only look at ‘virgin‘ wallets, which are those that have received funds but have never performed an outgoing transfer,” says the author. Consequently, until they produce it, we cannot be certain when the private key for it will be discovered or whether the wallet will remain dormant indefinitely.”

The author goes on to say that once an outward transaction has been made, he is no longer interested in that wallet due to the fact that ownership has already been confirmed in the chain. It is not of interest to me because the wallet in the story was already awoken in 2012,” says the author.

Through his investigation, Kretov was able to construct a comprehensive list of these virgin wallets, which provides a ballpark estimate of the number of wallets that were created during this time period. In 2009, an estimated 21,500 wallets were made, 12,400 in 2010, 3,600 in 2011, and around 2,200 in 2012. In 2012, an estimated 2,200 wallets were created. His explanation is as follows: „Since the day I released the first version of my parser in the autumn of 2018, I have discovered approximately 5,500 awakenings, however this includes all Bitfinex-hack addresses as well as all virgins between 2009 and August 2017.“

It is true, according to Kretov, that providing an accurate estimate of how many dormant coins exist is a challenging task, mostly due to the large number of different wallets that were established between the launch of Bitcoin in 2009 and the first reward halving three years later.

“A very rough estimate would be 2 million BTC of virgin Bitcoins created between 2009 and 2012. A more precise current figure would require me conducting a lot of lengthy calculations. And while I would be doing those, things may already change.”

Satoshi’s altruism

The sheer volume of Bitcoin that has lain dormant for years will, in the end, continue to capture the attention of the cryptocurrency community, even as its value continues to progressively climb over time. This unmoved Bitcoin represents a major portion of the market supply, and as more individuals begin to acquire Bitcoin and the market supply shrinks, this unmoved Bitcoin will become increasingly valuable.

Many people are skeptical that Satoshi Nakamoto will ever use their bitcoins, given that their total holdings amount to approximately 1.1 million bitcoins.

Satoshi’s holdings were valued at about $70 billion at one point, despite the fact that the value of a single Bitcoin has reached a maximum of $63,500 thus far.

Even if Satoshi were to reawaken all of their coins, take them to exchanges, and sell them all at once, there would likely be a significant market drop caused by supply and demand fundamentals.

While it is impossible to predict whether or not Satoshi will ever relocate their coins, Lerner’s study led him to conclude that such a move would be out of character for Bitcoin’s originator. Despite eight years of blockchain forensics study, nothing frightening was discovered; on the contrary, all evidence points to Patoshi acting with great charity in mining Bitcoin. He continues, saying:

“He refrained from mining when others did, not to hoard too many coins, and to keep the difficulty low longer so more people could earn coins when joining the network. Patoshi mined to protect the network from early double-spend attacks when the network was more fragile, and not for selfish reasons.”

Furthermore, Lerner emphasized that his research was motivated by his desire to find an answer to what he refers to as a „deep logic mystery.“ His investigations not only revealed how many Bitcoins were owned by Satoshi Nakamoto, but they also provided a better understanding of the compassion demonstrated by Patoshi and the efforts they made to foster the early Bitcoin network. “Personally, my research was never about Satoshi the individual or organization; rather, it began as an investigation of Bitcoin wealth concentration and the possibility of market manipulation.” He made the following statement:

“Before I learned about Patoshi, it was an ethical dilemma for me to work in Bitcoin. What if a few early adopters had the majority of coins? What if Bitcoin’s new financial system ended up having much higher wealth concentration than the current one.”