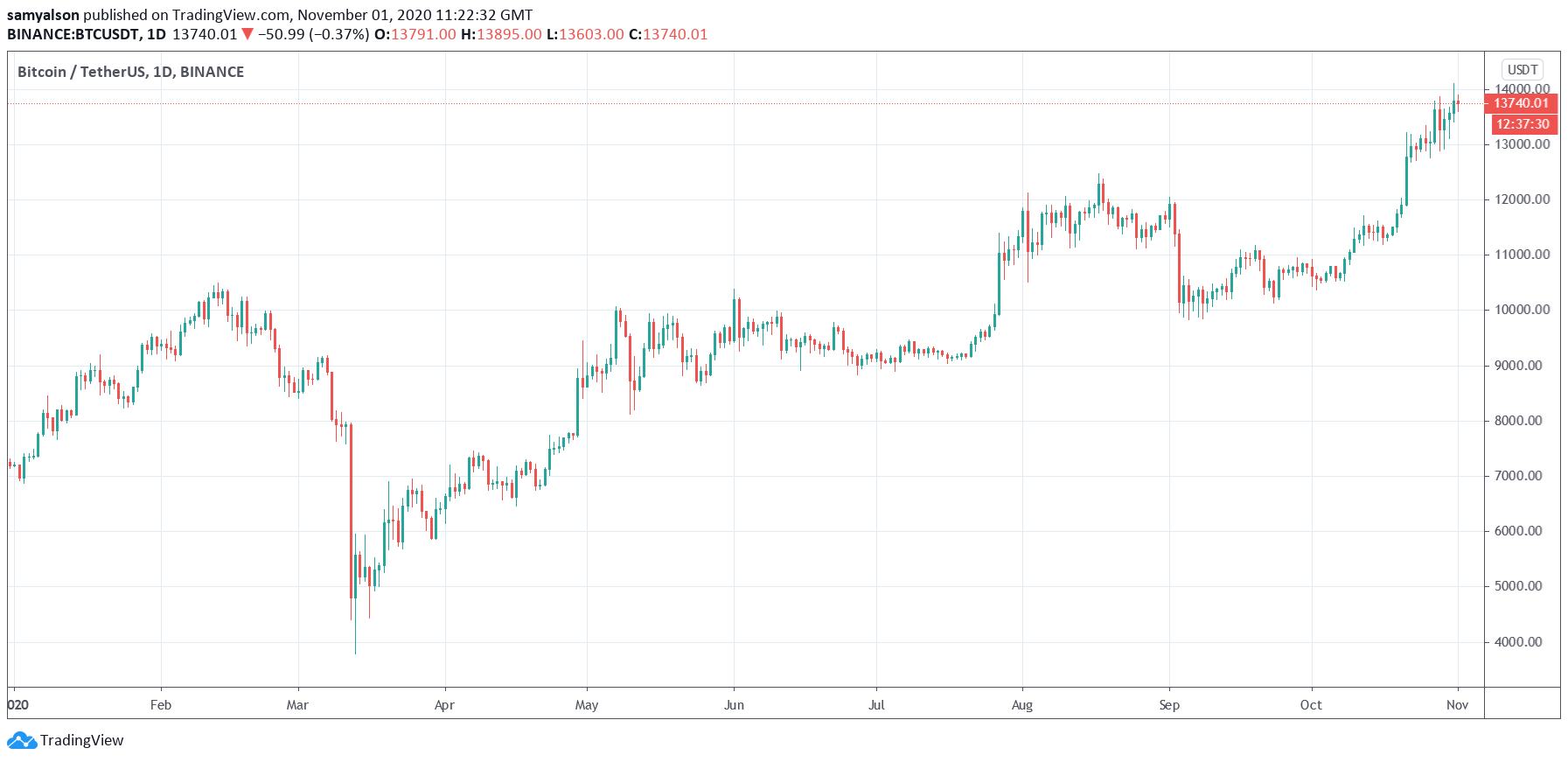

What an Oct it was for Bitcoin. The quantity a single cryptocurrency by sector cap has found a 30% increase in its rate above the very last 4 months, making a 17-month substantial in the process.

Even a lot more spectacular is how Bitcoin managed to shrug deteriorating macro-components to achieve this.

Resource: BTCUSDT on TradingView.com

This is typically many thanks to a glut of constructive sentiment coming from corporate America, who it appears to be, is starting off to warm to the plan of a decentralized retailer of price community.

MicroStrategy was the 1st to stamp their approval on Bitcoin. What adopted was a sequence of u-turns from industry-major corporations, some of which, in the earlier, have been openly vocal about their hatred of Bitcoin.

The most popular illustration getting JP Morgan, whose CEO, Jamie Dimon, blasted Bitcoin as a fraud. Even heading as considerably as expressing Bitcoiners are stupid.

“It’s worse than tulip bulbs. It will not finish effectively. Another person is likely to get killed. It is just not a authentic matter, ultimately it will be closed.”

Though Dimon has due to the fact expressed his regret in indicating that, the fact is, Bitcoin and the banking institutions have normally experienced an uneasy marriage.

Bankers Hate Bitcoin

Banking scandals are so commonplace that the public has come to be apathetic to the challenge. The most current shame, the FINCEN leak, showed various central banks complicate in facilitating cash laundering.

Paperwork demonstrate Deutsche Lender, JP Morgan, Normal Chartered, HSBC, Barclays, BNY Mellon, and Societe Generale unsuccessful to report suspicious banking activity. There has been a widespread denial of any acutely aware wrongdoing on the portion of the banking companies.

Even so, Rachel Woolley, Director of Economical Criminal offense at Fenergo, said the incident highlighted systemic failures throughout the overall financial field.

But, somewhat than criminalize the perpetrators, regulators selected to punish the banking companies by issuing fines. The authentic kicker is that money penalties are just one more expense of business for the banking institutions.

What the FINCEN scandal reveals is that banking companies are a central part of the criminal network. What’s additional, judging by the punishments doled out, one particular that is untouchable as well.

When it will come to Bitcoin and the financial institutions, crypto fanatic Michael Kern summed it up nicely by declaring banking institutions detest anything at all that interferes with their monopoly on abuse.

“Some of the world’s greatest economical institutions want to ban bitcoin to defend modern society from revenue laundering and legal action, but probably what they truly want is to shield their own monopoly on regulatory and consumer abuse.”

Taking into consideration that, is it any marvel so many banks have been vocal in panning Bitcoin in the past?

Bankings Creating U-Change on Cryptocurrency

The typical emotion is that banking institutions finding on board with Bitcoin is a fantastic factor. But, ought to we as libertarians and seekers of monetary democracy be apprehensive?

As Kern alluded to, the financial institutions have experienced it their way for so lengthy. And so it is complicated to visualize they also want economic democracy.

The most possible motive powering the u-turn is not since they see the positive aspects of transacting peer to peer. Fairly, they see the failure to get on board will depart them wholly irrelevant.

Banking companies have manipulated and corrupted every single sector they’ve been involved with. Just question any valuable steel investor. As this kind of, banks turning bullish on Bitcoin requirements looking at for what it is, a ploy to sustain fiscal authority.