Everyone’s pinning their hopes on this new year to bring very good fortune, and for Bitcoin traders, it could not be a far better beginning. January saw BTC soar to dizzying new heights of up to $40,000 for every coin. When the marketplace has seen some rate exercise due to the fact then, it appears to be like BTC will keep the high floor. Just after the financial turmoil of 2020 and greater adoption of Bitcoin by mainstream monetary establishments, the first cryptocurrency is shut to living up to its nickname of ‘digital gold’.

How did we get listed here?

Bitcoin’s triumphant volatility may possibly have shocked some market place followers that noticed Satoshi’s creation dip as very low as $4,000 in the spring. But, as the global financial state continued to undergo due to the COVID-19 pandemic, large-scale stimulus packages from condition actors meant that common fiat currency was at possibility of devaluation. On major of that, the 2020 halving event slice down benefits from miners, making the asset’s presently minimal supply even extra scarce.

Buyers took note, and the cryptocurrency became a lot more and far more desirable for speculators on the lookout for a hedge against inflation, with Goldman Sachs pinpointing Bitcoin as ‘digital gold’ and Paul Tudor Jones endorsing it, as properly. Grayscale, Fidelity, MassMutual and Microstrategy have all acquired publicity to Bitcoin a short while ago.

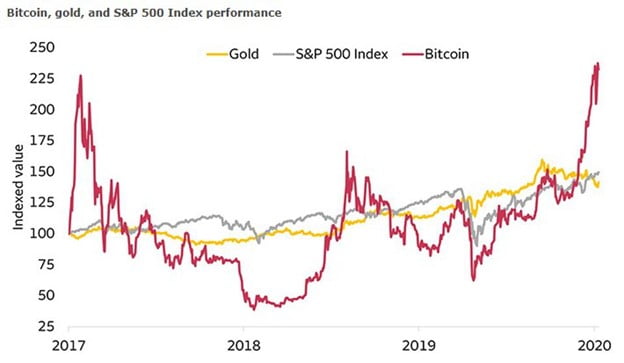

BTC outperformed gold and the S&P 500 in modern decades, but with bigger volatility. / Wells Fargo.

The institutional expenditure in BTC is nonetheless a relatively modest proportion of the current market, but personal traders have benefited from mainstream fascination by way of better value for their holdings. Square ($50 million invested in Bitcoin) and PayPal — which a short while ago added BTC and other cryptocurrencies to its company — are delving into the Bitcoin environment. As much more platforms discover BTC, its price as a electronic asset will be sure to replicate its use situations outside of that of a speculative asset.

The put together worth of Bitcoin and the relaxation of the cryptocurrency industry surged to more than $1 trillion as charges rose across the board. But BTC’s modern climb could not very last forever.

BTC industry right now

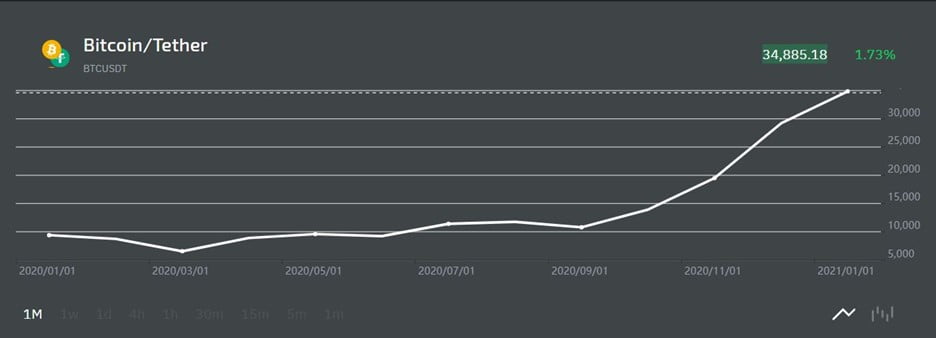

At the time of crafting, Bitcoin (BTC) price slipped for the fourth day in a row. Nonetheless, at $35,000, it bounced back from a modern drop to $30,000 and is still much over 2020’s minimal of $3,800. Savvy analysts have pointed out that equally BTC’s investing volume and lively tackle are at a new all-time significant. In the meantime, numerous firms have reported a extraordinary rise in Bitcoin futures contracts, and on the net crypto exchanges have pointed out an influx of new consumers, with the StormGain crypto buying and selling platform reporting a investing quantity of $7.43 billion over the past month.

BTC’s modern general performance: starting off 2021 on a superior note. / StormGain

More BTC is altering palms than at any time, a sign of a nutritious, liquid industry. Bitcoin’ whales’, or accounts with far more than 1,000 BTC, are also on the increase, potentially gobbling up the smallest retail investors (a lot less than .1 BTC) who panicked and sold during the dip.

Outlook for Bitcoin in 2021: Should you invest?

Lots of analysts, institutional investors and crypto professionals alike forecast sunny outlooks for Bitcoin in excess of the subsequent year. A leaked report from a senior Citibank’s analyst projected that Bitcoin could perhaps hit a large of $318,000 by December 2021, calling it “21st-century gold”.

Strategists at JPMorgan have reported that if Bitcoin beats its volatility, the original cryptocurrency could surge as high as $146,000 in the long-term as it overtakes gold as a protected-haven asset. Guggenheim’s predictions are even increased at $400,000.

Alex Althausen, CEO of crypto trade StormGain, explained on Wednesday that “BTC could very easily hit $100,000 by the end of 2021. We have observed curiosity from new traders in Bitcoin like never ever prior to, which is also boosting the other cryptocurrencies on our system.”

Bitcoin surely presents opportunities for investors in 2021, but the possibility for retail traders is that whales can suck up even much more of an increasingly scarce asset and cost smaller sized traders out. To maximise their earnings, interested events need to search for a reputable crypto system that features the greatest returns on their investment decision and incentives for buying and selling. Amid the Bitcoin feeding frenzy, other cryptocurrencies should not be neglected, as BTC’s fortunes have historically lifted up other digital tokens, primarily those people which existing fascinating use scenarios for finance platforms.

How to acquire BTC

Cryptocurrency is progressively aspect of the mainstream, but expert crypto platforms nonetheless supply the finest circumstances for traders. A very good online trade will give buying and selling options for BTC, XRP, ETH, and other coins that can be ordered with a standard financial institution card. The finest crypto platforms also offer extra advanced solutions, these kinds of as crypto indices and DeFi tokens.

When thinking about a crypto exchange for investment decision, be certain to research the fee rates and bonuses for the ideal deal, as perfectly as unique perks from numerous platforms. For case in point, StormGain, one particular of the dependable crypto exchanges pointed out for its reduced commissions, also presents up to 12% APR curiosity on crypto holdings, which is particularly appealing for long-time period traders. The system also features free of charge cloud mining program that can passively get paid BTC for the person. What ever exchange you pick, really do not miss your prospect to stake your declare on the initial cryptocurrency, as the momentum of electronic property can only speed up.

About the Author: Anurag Gautam is an avid reader and Crypto Trader with a enthusiasm for innovative crafting for the previous several years. By creating, he intends to enable individuals flourish synchronously with parts of his knowledge. His niche largely includes blockchain, startups and organization &engineering. He has been doing the job with startups, leaders, business owners and innovators.