Creating a coin from the ground up is not simple. It necessitates considerable understanding of a variety of computer languages, as well as familiarity with blockchain use cases. Rather than doing that effort, folks new to the crypto field who wish to launch their own project go toward tokens.

Tokens are a type of cryptocurrency that exist within an ecosystem, such as an Ethereum-based project. A token might be compatible with all Ethereum-based assets that adhere to the same token standard, but not with cross-chain cryptocurrencies.

Tokens essentially enable anybody to construct their blockchain-based business or idea without having to expend the enormous work required to create a cryptocurrency from scratch. However, developing it introduces its own set of complications, including legality, costs, and smart contract security.

A crypto security standard

With the growth of decentralized financial (DeFi) applications, platforms are experiencing more hacks than ever before. DeFi breaches have cost customers over $1.9 billion so far in 2021, emphasizing the critical nature of token security. Regrettably, such threats do not have an obvious answer.

Certain projects may be unable to afford skilled contract developers, which may spell the end of them before they ever begin. For an industry seeking broad adoption and encouraging developers from diverse backgrounds to launch their own tokenized initiatives, security requires a standard. Otherwise, that $1.9 billion figure is set to skyrocket.

Projects and developers require a more straightforward method of establishing token security. However, there are blockchain projects assisting novice developers – platforms that issue tokens with pre-built security criteria to provide a baseline for developers.

Streamlined token development

Through a Web 3.0 wallet, a token deployment decentralized application (DApp) enables users to mint and distribute their own tokens. The token would adhere to all applicable requirements on their chosen blockchain and would benefit from the blockchain’s security and efficiency.

Naturally, such a project should have pre-audited code, and a deployment DApp would require competent engineers and a strong team.

Lossless is a project that exists in that shape at the moment. It is a multi-chain system that protects against DeFi hacks by integrating specific code into projects. By including the Lossless code in the token, token creators can protect themselves against fraudulent transactions.

A Lossless solution

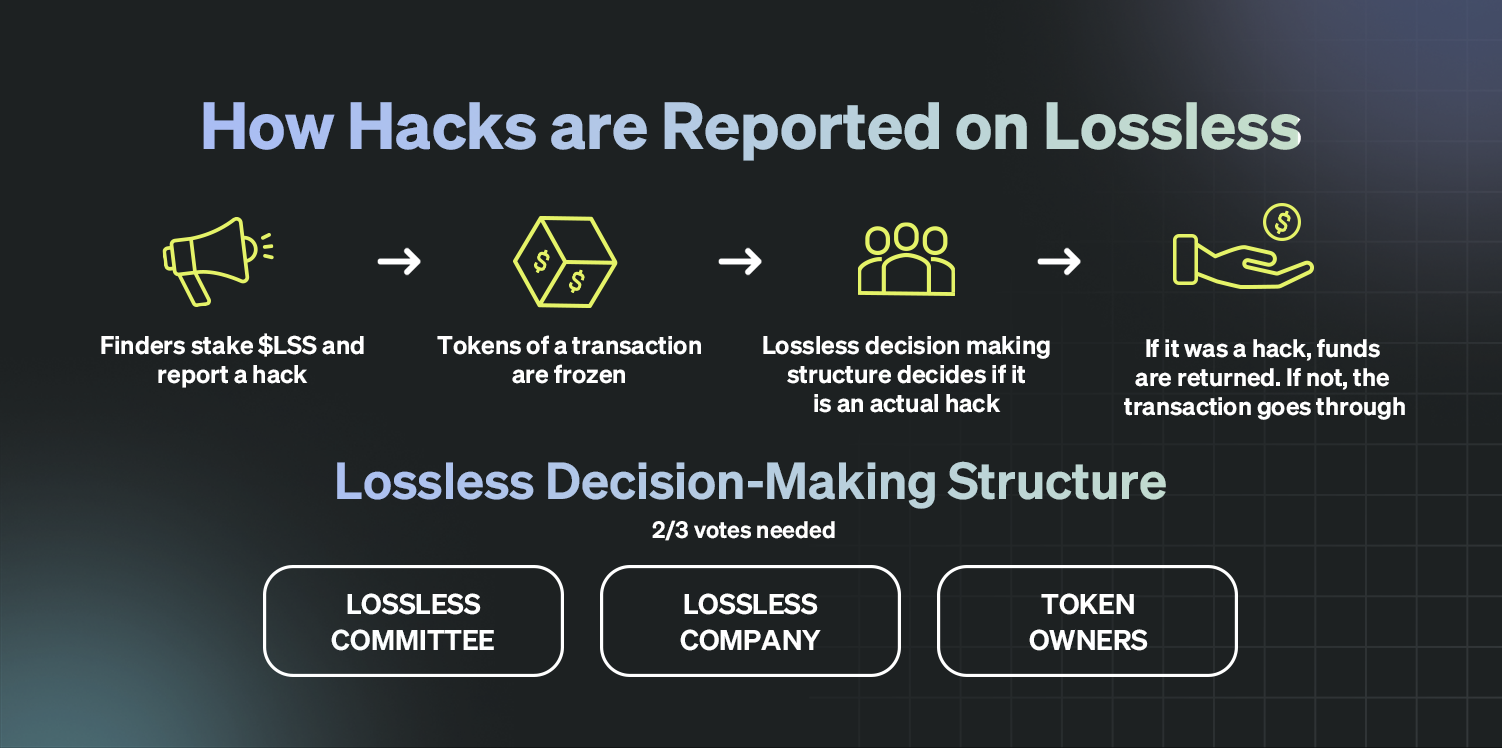

Lossless works by integrating user-created bots that identify questionable transactions and freeze them. Bots are produced by white hat hackers who participate in the network and get rewards when their bot discovers a vulnerability.

Lossless recently introduced a Token Minter tool that enables developers to mint their own token smart contracts on the Ethereum (ETH), Polygon (MATIC), and Binance Smart Chain (BSC) networks. The project’s code has been pre-audited, ensuring that users have a secure environment in which to launch their own token. Additionally, Lossless‘ token minter is free to try, with users paying only the gas charge once for contract installations. Miners have the option of paying for a third-party security audit conducted by cybersecurity firm Hacken.

Tokens created under Lossless have embedded sleeper code that triggers at the protocol’s startup. Naturally, the sleeper code coexists with Lossless‘ other security features.

The Lossless minting tool is intended to be an experimental feature that enables users to evaluate this security on their own. It instantly creates a token, allowing anyone to lay the groundwork for their idea. According to Lossless, the tool is „a free-to-use platform that enables anyone to design and deploy token contracts on ETH, BSC, and Polygon at will.“ You’ll complete your contract in a matter of minutes. Proceed to experiment and play with it.“

Disclaimer. CoinNewsDaily makes no representations on the accuracy or completeness of the information contained on this page.

While we make every effort to provide you with all pertinent information, readers should conduct their own research before taking any action relating to the firm and bear full responsibility for their decisions; this post is not intended to serve as financial advice.