It is fun to discuss nonfungible tokens, or NFTs, because they’re the ideal illustration of how the impact of blockchain technology in people’s lives goes far beyond the financial industry. As we could see in countless headlines in the past few months, they’ve gripped the world’s attention because they’re a new way of interacting with culture, music, sports and the media.

This guide will explain what NFTs are, how they work, how the NFT boom started, and also why blockchain technology has made it feasible for NFTs to make a new economy.

NFTs are such an exciting and enjoyable topic to talk about because almost everyone likes music, arts, games and the internet. The feeds of each social media platform are filled with people who, having shown no previous interest in crypto assets or decentralized fund, eagerly speak about nonfungible tokens. In the first half of 2021, we watched plenty of actors and memes endorsing NFTs.

Jack Dorsey, Twitter’s CEO, sold his first tweet as an NFT for the unbelievable sum of over $2.9 million this past March. Edward Snowden’s NFT, a portrait of Snowden himself, was sold for approximately $5.4 million, or 2,224 Ether (ETH).

The NFT of the Zoë Roth meme, much better known as“Disaster Girl“ because of the 2005 (and beyond) meme of her malicious smile taking a look at the camera while a home is on fire at the background, was sold as an NFT to get 180 ETH, equivalent to almost $500,000.

Furthermore, businesses from the standard marketplace have decided to surf the NFT wave. By way of example, in Brazil, the first group in NFT of Havaianas was auctioned off last month.

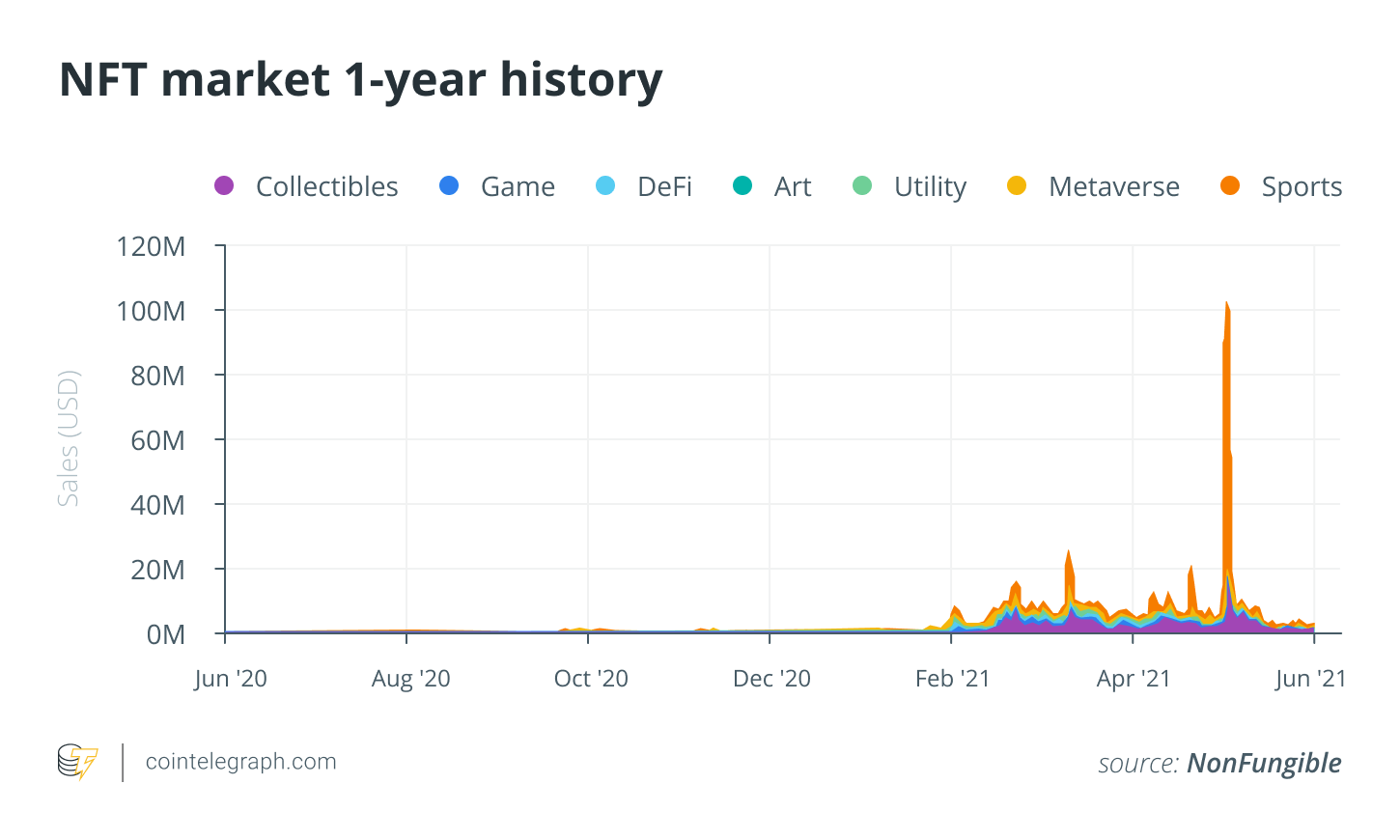

NFT trade volume has multiplied by more than 25 because December 2020, as NFTs have been in people’s daily routines and lives. It might be one of your favorite songs, a cartoon of your favorite superhero or a tool in a game that your children wish to acquire. In the following chart, we can clearly see the gain of NFT trades in the last six months, as well as business volume since the end of the third quarter before the recent pop.

What are NFTs? How do they work?

We can conceptualize an NFT for a piece of software code which verifies that the land of a nonfungible electronic advantage, or the electronic representation of the bodily nonfungible advantage in a digital medium. For those who prefer a more technical view:

„An NFT is a routine of contracts which provides a standardized way of confirming who possesses an NFT, and a standardized means of’shifting‘ nonfungible digital resources .“

In this case, any nonfungible advantage might be the thing of an NFT, be it domains, tickets for an event, electronic coins in matches, and even identifiers in social networks such as Twitter or Facebook. All those nonfungible electronic assets may be NFTs.

An NFT includes a data structure (token) that connects metadata documents which may be fixed within an image or file. That token is carried and altered to accommodate the requirements of blockchain networks like Ethereum, Kusama and Flow, amongst others. The artwork file is uploaded in a blockchain system that creates a metadata file in the information structure of the token.

Your NFT then gains a cryptographic hash (a secret ) — a tamper-proof register with the time and date stamp transported on the blockchain network. Adhering to the valuable data and seeing that it hadn’t been altered at a subsequent date is vital for any artists out there.

Loading your artwork on-chain may give you a better view of when the metadata of the artwork file was tokenized. Since the information of the piece of artwork is uploaded, nobody can recover it or delete it, and also the prospect of your artwork disappearing is practically nonexistent in case your NFT is enrolled on a blockchain.

How has blockchain technology increase the chances of NFTs?

Up till 2008, traditional NFTs did not have a unified representation from the electronic world. Consequently, they were not standardized, and also the NFT markets shut and were confined to the platforms which issued and produced a determinate NFT.

The first NFTs in blockchains started with the advent of coloured coins on BTC’s blockchain. Although originally designed to enable BTC (BTC) transactions, their script terminology stores small quantities of metadata on the blockchain, which may be employed to represent asset management directions.

The fact that the punks“reside“ about the Ethereum system made them interoperable with electronic markets and wallets.

This was a pioneer project for producing a sophisticated system of incentives, determining that NFTs could be used as a promotional tool. This resulted in the fostered interest of market contracts, which lately have become one of the principal mechanisms for pricing and purchasing NFTs.

The fascinating part about employing blockchain technologies to NFTs is that it has substantially amplified their advantages and possibilities. It has caused the standardization of electronic, nonfungible strength representation throughout the ERC-721 standard. Like the ERC-115 as well as the ERC-998 standards, ERC-721 is a pattern of contracts on the Ethereum blockchain which brings a standardized way of confirming who owns an NFT, and a standardized means of“moving“ nonfungible digital assets.

It is worth mentioning that although Ethereum is where the majority of the action now occurs, there are several NFT designs emerging other blockchains. By way of example, dGoods created by Mythical Games focuses on implementing a cross-chain standard utilizing the EOS blockchain. Also, TRON’s first NFT standard, TRC-721, was formally announced in late December 2020.

Ever since that time, an NFT enrolled on a blockchain has truly turned into a“unique“ advantage that cannot be faked, tampered with or spoofed.

What are the main benefits blockchains bring to NFTs?

As explained above, the primary benefit of NFTs backed by blockchain technologies is standardization. Aside from the standardization of the most important attributes of NFTs — for example property, transport and access control — blockchain technology makes it possible for NFTs to incorporate extra features, such as specifications about how to obtain an NFT, for example. We’ll explain each one by one.

The NFT patterns make interoperability viable so that the NFTs can proceed more readily among many ecosystems. In a new job, nonfungible tokens might be visualized immediately in dozens of distinct pocket suppliers, negotiable in many markets and also the ability to be acquired in many digital worlds. That interoperability is only possible because of the open patterns permitted by blockchain technologies that offer a clean, consistent, dependable application programming interface, and also with the authorization to read and record information.

Interoperability, consequently, has amplified the marketability of NFTs by enabling free trade in open markets. NFTs based on blockchains allow users to transfer their nonfungible assets outside of their original environments. They have the advantage of complex negotiation tools, like stocks and auctions, as well as the ability to transact in any currency, from cryptocurrencies such as BTC and Ether into stablecoins and particular digital currencies from a determined application.

The instant marketability of NFTs based on blockchains brings greater liquidity to niches which may serve a greater variety of people, enabling substantial exposure of nonfungible assets into a wider group of buyers.

This is only because the wise contracts allow programmers to set severe limits within an NFT’s supply and inflict long-lasting properties that cannot be altered after a token was issued. Therefore, an individual can ensure that the particular qualities of an NFT won’t change with time, since they’re codified in the blockchain. This is especially intriguing for the physical artwork marketplace that is contingent on the proven scarcity of an original piece.

An intriguing trajectory within this fresh NFT world based on blockchain appeared because of recent trends and new markets, such as design artwork — which makes it possible for collectors to interfere from the first design of the art piece.

In the marketplace of NFT-represented artwork, immutability and scarcity are crucial. From the electronic artwork market, the advantage of programmability may be something to take into account. We can find examples of programmability at Async Art, a stage to negotiate and make NFTs that empowers the owners to modify their images whenever they wish. Another case of the programmability feature is the ability to get a tune to modify its composition. Meaning that the audio may seem different every time you listen . These two examples are possible by dividing a piece into separate layers called stems. Each stem has a lot of versions for its new owner to select from. That way, a single path of Async Music could contain many exclusive mixtures of noises.

Takeaway

Many people have yet to know the dimension of the NFT boom and how blockchain is revolutionizing how we have the arts. Maybe the topic deserves a broader conversation.

However, the hole-in-one of NFTs is that the programmability of smart contracts on the blockchain, which always assures a reward to the content founder whenever their job is negotiated.

Suppose a determined content (music, art, domain name, photograph of a target from Pelé, etc.) is transacted countless occasions. If that’s the circumstance, the content creator will receive a commission.

This may completely change the dynamics of copyright and intellectual property because if a“division of earnings“ is programmed to the NTF’s smart contract’s code, the content creators will no more need to worry about the legal property of their artwork.

Indeed, nonfungible tokens and blockchain technology niches still need to embark on a long journey to resolve scalability, advertising infrastructure and also the applicable authority in NFTs with decentralized storage. But we shall not lose sight of the chance to codify the rights of the determined digital advantage behind the trade of an NFT. This permits the appearance of new businesses and new markets governed not only by associations or traditional validators of hope but by those who make the content valued in the social and effective hubs.

The views, ideas and opinions expressed here are the author’s alone and do not necessarily represent or reflect the views and views of CoinNewsDaily.

Tatiana Revoredo is a founding member of the Oxford Blockchain Foundation and is a strategist at blockchain at Said Business School at the University of Oxford. Furthermore, she’s an authority in blockchain business software at the Massachusetts Institute of Technology and is the chief strategy officer of The Global Strategy. Tatiana was encouraged by the European Parliament into the Intercontinental Blockchain Conference and was encouraged by the Brazilian parliament into the public hearing on Bill 2303/2015. She is the author of 2 books: Blockchain: Tudo O Que Você Precisa Saber and Cryptocurrencies from the Global Scenario: What Is the Position of Central Banks, Governments and Authorities About Cryptocurrencies?

Nonfungible tokens present a new way of interacting with the arts, music, sports and the press — and much more.