The price of Ether (ETH) fell 44% in the last four months, from $4,600 to $3,100.

The growth of decentralized finance (DeFi) applications slowed down, in part because of network congestion and average transaction fees of $30 or more.

The cool-off period can also be blamed on people expecting too much from the fee burn mechanism that was put in place with the London hard fork in August 2021.

Ether became „ultrasound money“ after a lot of people cut back on the amount of money that was given out each day.

The Ethereum network burned more ETH over the last 24 hours than was issued by both the PoW (eth1) and PoS (eth2) networks.

This is the first time this has happened since EIP-1559 went live less than 3 months ago.

ETH is ultra sound money

— sassal.eth (@sassal0x) October 28, 2021

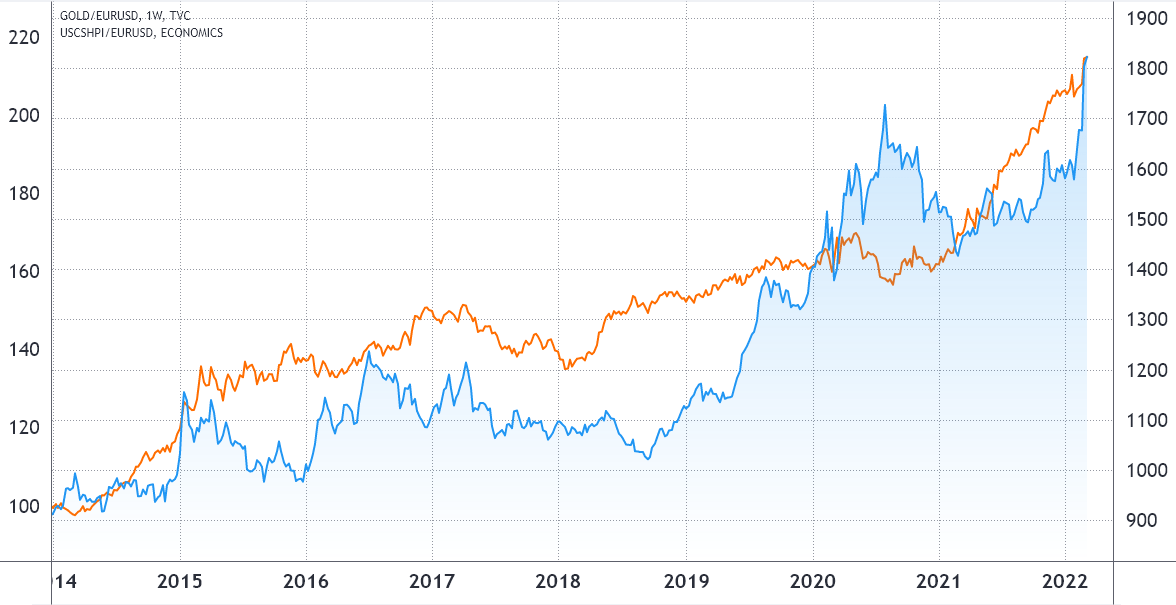

Unfortunately, history shows that „hard money“ needs years of stable monetary policy to become real money.

For example, the euro was made available to the public in 2002, even though it was not used for a long time in 2014 and 2019.

Even so, its purchasing power hasn’t been able to keep up with things like gold or real estate.

One could buy some cheap, ultra-bullish call (bull) options for $4,000 ETH for May for $68. This is because the four-month underperformance has been going on for so long now.

The chances of a 55% rise from $2,570 are slim because there are only 75 days left until the bond is due to expire.

It seems like it would be better to bet on a positive price change, but be more specific about the range you want to bet on.

Professional traders use the „iron condor“ options strategy in the same way that they do.

Reduced losses by limiting the upside

In the deposit contract for Eth2, 10.2 million ETH have been staked, and investors seem to be happy with the move to proof-of-stake (PoS).

Furthermore, fixing the biggest problem with the Ethereum network, scaling, could cause the price of ETH to skyrocket.

Trying to find a way to make up to $3,600 by May 27 seems like a good idea.

However, hedging for a negative 7 percent return is also a good idea because there is a lot of uncertainty about what President Joe Biden will do with crypto regulations.

Even though the executive order signed on March 9 didn’t say anything about restrictions, it’s likely that it set the stage for more federal oversight.

„Iron Condor“ options are a great way to make money when the market is a little bit up.

This is how the Iron Condor works: It sells both call and put options at the same price and date.

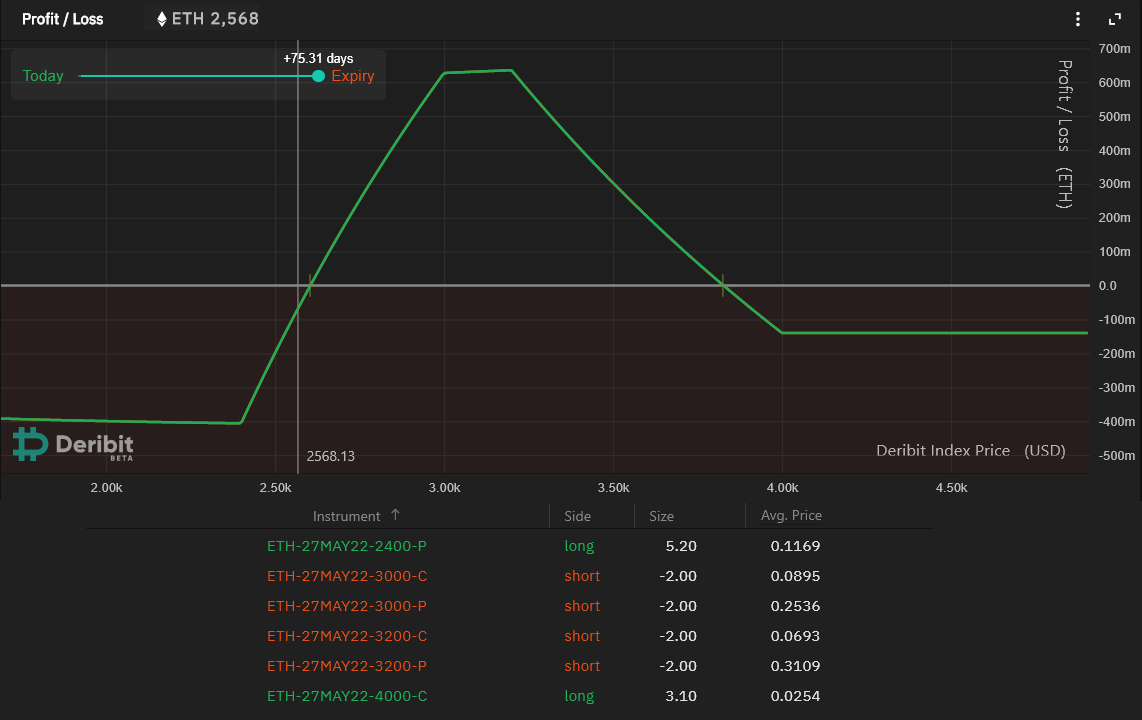

ETH May 27 options have been used to set up the example above.

ETH profit zone is between $2,600 and $3,800

Investors should short (sell) two contracts of the $3,000 call and put options to start the trade.

It then needs to be done again for the $3,200 options.

A protective put at $2,400 has been used to protect against big price changes.

According to the price, 5.20 contracts will need to be made.

As a last step, if the price of Ether goes above $4,000, the buyer will need to buy 2.10 call option contracts to keep the strategy from losing money.

Number of contracts: This example wants to make as much money as possible, but it also wants to lose as much money as possible.

It makes money if the price of Ether is between $2,600 and $3,820 on May 27.

Investors can make money if the price of Ether rises less than 49% by the time the Iron Condor expires.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.