Due to the rapid advancement of bitcoin and blockchain technology, the race to develop an extremely scalable, user-friendly network that can be adopted on a global scale has become a never-ending marathon in which new competitors are continually entering the race to win.

It is undeniably true that Bitcoin is unquestionably the market leader in terms of network security (as measured by active users), market capitalization value, and market capitalization value, and that Ethereum has thus far established itself as the leading smart contracts platform, the ongoing difficulty in scaling these networks has created an opening for next-generation blockchain protocols to gain a foothold in the market.

However, while Ethereum’s precarious hegemony over the cryptocurrency world has begun to come under increased pressure in recent months, this has been exacerbated by the introduction of incentive schemes designed to attract liquidity and users to the ecosystems of various up and coming Layer One and Layer Two-based protocols, as well as the emergence of new blockchain technologies.

A look at some of the developing layer-one smart contract platforms that are vying to gain a larger share of the bitcoin market’s liquidity is provided below.

Fantom incentivizes developers to migrate

Using a directed acyclic graph architecture to perform its consensus, Fantom is a protocol that is, in theory, infinitely scalable due to the nature of its construction.

Those involved in the cryptocurrency ecosystem have been paying closer attention to the network’s high-speed, low-cost nature in recent months, as the Ethereum network continues to suffer from high transaction costs and delayed confirmation times as a result of network congestion.

Following the launch on August 30 of a 370-million-FTM incentive scheme aimed at rewarding developers who create new protocols for the Fantom network, activity on the network has accelerated significantly.

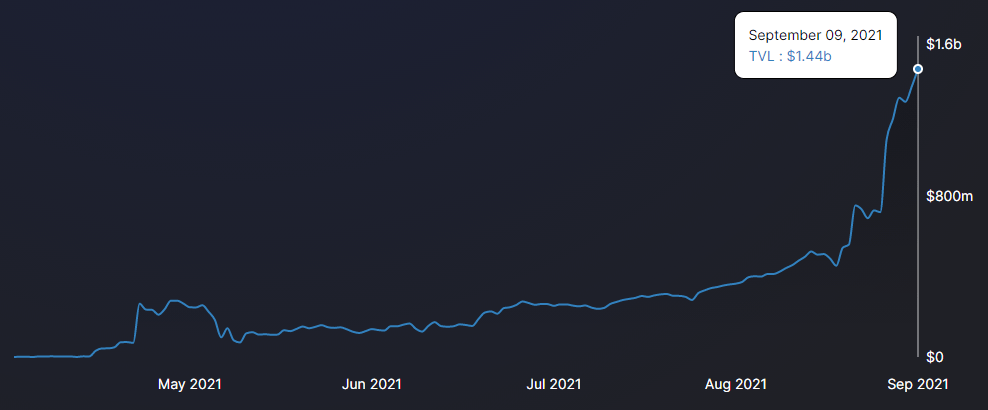

According to data from Defi Llama, the total value locked (TVL) on the Fantom protocol has climbed from $691 million in the time from the commencement of the FTM incentive program to a new all-time high of $1.44 billion on September 9, marking a new record high.

With a market capitalization of $1.44 billion, Fantom, according to the Fantom Foundation is the fourth-largest Ethereum Virtual Machine (EVM)-compatible network on the market, according to the information provided by the foundation. According to the foundation, the network is now adding more than 20,000 new addresses on a daily basis and processing more than 1.5 million transactions on a daily basis.

As more liquidity migrates to the Fantom network, it is likely that this trend will continue to rise, as indicated by the development of a number of new nonfungible token (NFT) and decentralized finance (DeFi) protocols on the Fantom network.

Liquidity “rushes” to Avalanche

The Avalanche network, which is an open, programmable smart contracts platform that has been specifically built for decentralized applications, has also been a cause of liquidity drain on the Ethereum network.

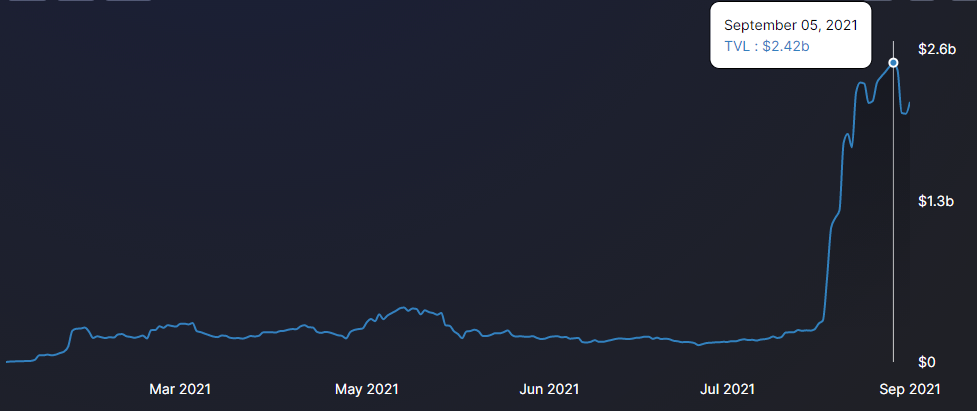

As a result of the launch of the Avalanche Rush DeFi Incentive Program on Aug. 18, which committed $180 million to DeFi protocols and liquidity to the Avalanche ecosystem, the protocol experienced a large surge in activity, which has continued to grow.

Initally, the program included only Curve and Aave, two of the most prominent decentralized financial infrastructure protocols on the Ethereum network, but it has since grown to incorporate more protocols such as SushiSwap, Benqi Finance, YAY Games, the Kyber Network, and ParaSwap.

In response to the launch of the incentive program on Sept. 5, the total value locked on the Avalanche protocol increased from $311.5 million on Aug. 18 to an all-time high of $2.42 billion on Sept. 5, according to data from Defi Llama, before a market-wide pullback reduced its value to $2.11 billion within a few days.

New DeFi and NFT protocols have also been introduced on the Avalanche network, including a collaboration with the collectible and trading card manufacturer Topps, which debuted its “2021 Topps Major League Baseball Inception NFT Collection” on the Avalanche network.

As previously stated, the Avalanche Bridge, which launched in June, makes it feasible for users to transfer any asset on the Ethereum network to Avalanche at a fraction of the cost that was previously necessary through the bridge.

A competitive field gets even more crowded

Among the most recent emerging stars in the layer-one game who have been siphoning users away from the Ethereum network are Fantom and Avalanche, but they are by no means alone.

The Binance Smart Chain and Polygon are two other EVM-compatible networks that made significant progress earlier in the year.

In both cases, customers are able to keep their assets on the Ethereum network while avoiding the exorbitant costs associated with the Ethereum base layer.

The most serious danger to Ethereum posed by a non-EVM-compatible chain comes from Solana, which has seen the greatest increase in TVL over the last seven days, followed by the stablecoin-focused protocol Terra, which has seen the greatest increase in TVL over the past seven days.

Lastly, the self-amending blockchain technology Tezos as well as the pure proof-of-stake protocol Algorand need to be mentioned as standouts.

Each network’s TVL increased by 207 percent and 71 percent, respectively, over the past seven days, according to data from Defi Llama. Their token prices spiked close to all-time highs as a result of protocol upgrades and, in the case of Algorand, the government of El Salvador’s adoption of the network.

As previously stated and seen in the TVL figure above, the Ethereum network is the dominant smart contract blockchain in terms of users, protocols, and TVL; yet, due to the network’s existing constraints, it has left the door open for competitors to chip away at its market share.

In the meantime, it remains to be seen whether Ethereum 2.0 will be able to resolve the issues that have arisen, or if a next-generation protocol will emerge and provide the most optimal solution to the blockchain trilemma of providing decentralization while also providing security and scalability on a single, simple to use platform.