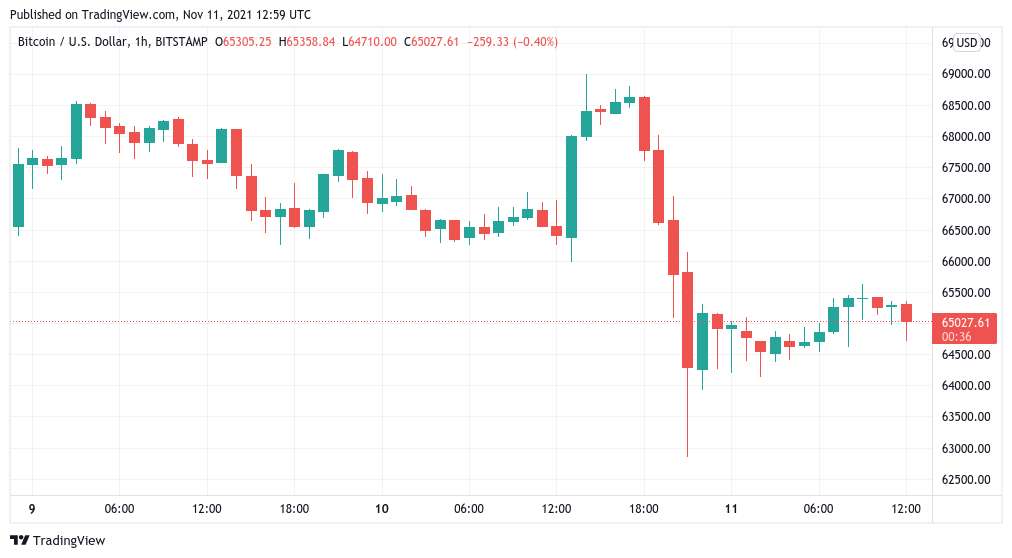

In the early hours of Nov. 11, Bitcoin (BTC) was trading just below $65,000, after an overnight slump erased the previous day’s gains.

“No free lunch” for speculators

According to data from Cointelegraph Markets Pro and TradingView, the bitcoin to dollar exchange rate has recovered after temporarily falling below $63,000 in the wake of new turbulence.

The pair had risen quickly as a result of inflation in the United States reaching its highest level in 30 years, which combined with derivatives market movements to produce a period of uncertain price action.

With the stock market having reached an all-time high of $69,000, some investors were terrified, while others took advantage of the occasion to make fun of the weak hands.

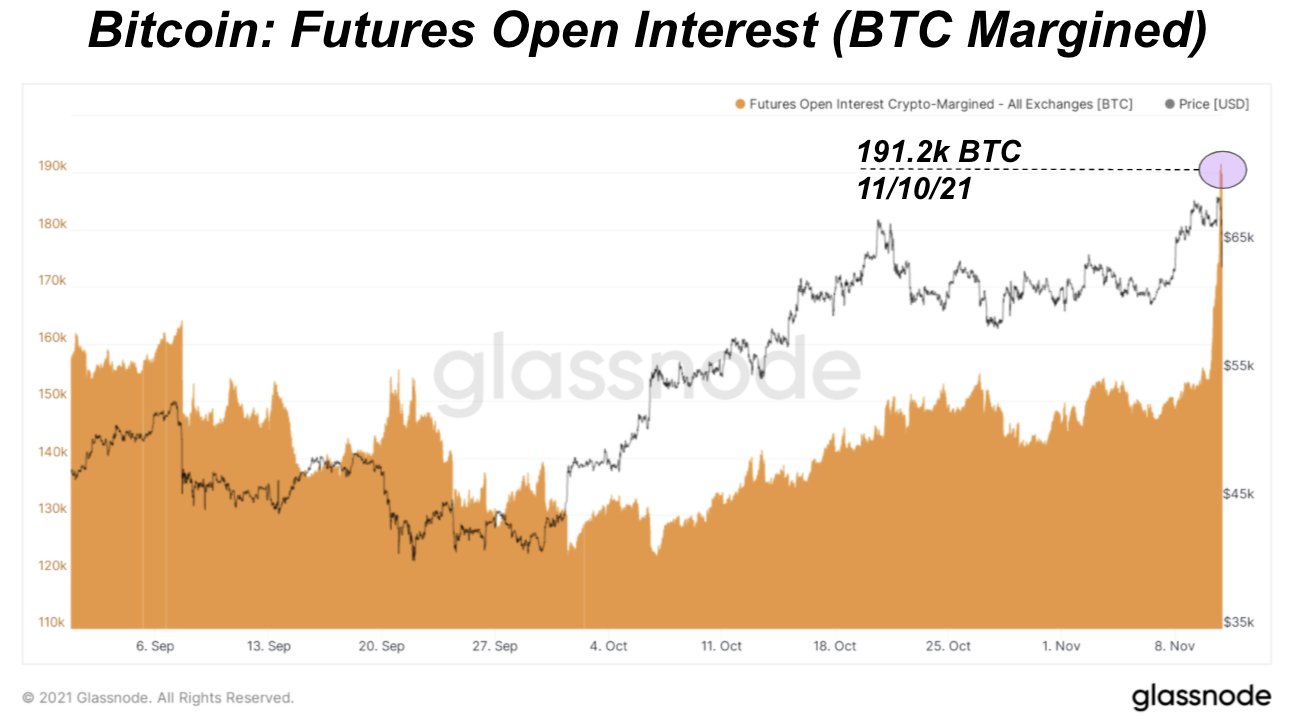

„What is the reason for the BTC’s retreat from 68k? Today’s enormous surge in BTC margined futures open interest (traders going long BTC with BTC as collateral) was described by analyst Dylan LeClair, who displayed a chart from Glassnode to illustrate his point.

“No free lunch — these traders are in the process of being shaken out.”

Fellow analyst William Clemente cited the imminent Taproot soft fork as a compelling cause to be bullish and to disregard short-term price movements in the cryptocurrency market.

Several protocol enhancements will be brought to Bitcoin by Taproot, which will be incomparably more significant than any other updates that have occurred since the introduction of Segregated Witness (SegWit) transaction technology.

We’re days away from Bitcoin’s first major upgrade (Taproot) since Segwit in 2017 and people are panicking.

— Will Clemente (@WClementeIII) November 10, 2021

While this was happening, derivatives financing rates served as evidence that a shake-out had definitely occurred, returning solidly to the neutral region of 0.01 percent across all exchanges.

Ether avoids deeper altcoin retracement

Altcoins felt the heat when Bitcoin’s price reversed, wiping away any gains that had previously surpassed BTC/USD. This was typical Bitcoin behavior.

Ether (ETH) was the most resilient cryptocurrency on the day, falling only 0.6 percent and remaining within striking distance of all-time highs.

Others fared slightly worse, with daily losses of up to 4 percent not uncommon among the top ten cryptocurrencies by market capitalization among the top ten cryptocurrencies.

„Bitcoin is quite important at the time,“ Michael van de Poppe stated in his most recent YouTube update.

“Where are we going to break through? If we break through that area around $67,000, I think we’re going to continue the bull cycle, and we’re ready for new all-time highs to be hit.”